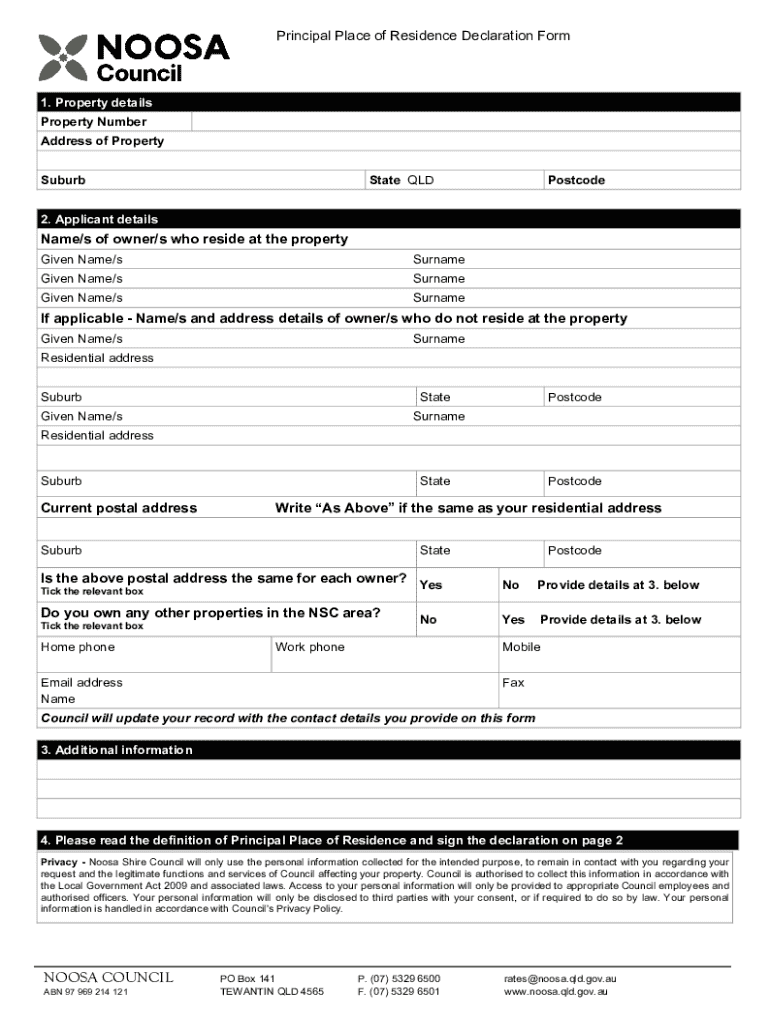

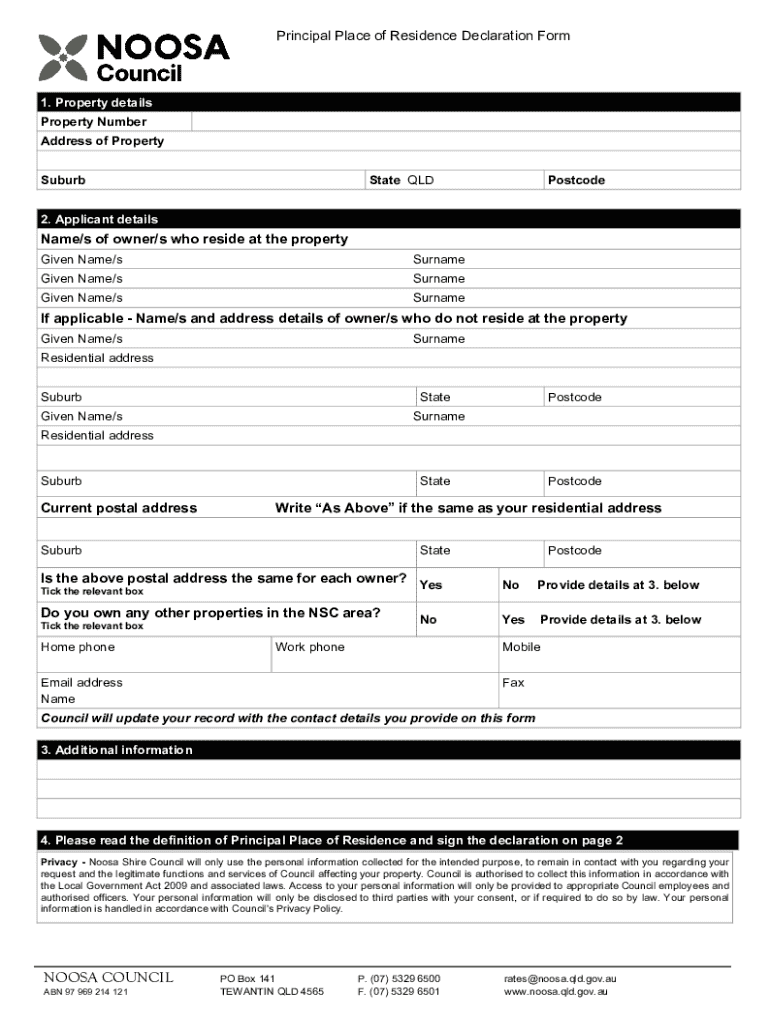

Get the free Principal Place of Residence Declaration Form

Get, Create, Make and Sign principal place of residence

Editing principal place of residence online

Uncompromising security for your PDF editing and eSignature needs

How to fill out principal place of residence

How to fill out principal place of residence

Who needs principal place of residence?

A comprehensive guide to the principal place of residence form

Understanding the principal place of residence form

The Principal Place of Residence form, commonly referred to as the PPR form, serves a vital function in property taxation. It enables homeowners and tenants to declare their primary residence, potentially qualifying for various land tax exemptions. Understanding its significance helps property owners optimize their financial obligations while ensuring compliance with local regulations.

The purpose of the PPR form extends beyond mere documentation; it plays a crucial role in determining land tax obligations. In many jurisdictions, a primary residence is exempted from certain taxes, allowing homeowners to alleviate their financial burden. This differentiation is essential when compared to other forms of residency documentation, which may not provide the same tax reliefs and benefits.

Who needs to complete the principal place of residence form?

Several individuals and scenarios warrant the completion of the Principal Place of Residence form. Homeowners, especially those purchasing their first property, are typically the primary applicants. It's vital for individuals wishing to claim land tax exemptions, ensuring their main residence is registered correctly with local authorities.

In addition to individuals, certain teams or organizations may also need to ensure proper documentation of residential properties for various purposes. Special circumstances may further influence eligibility; for example, retirees often face unique considerations due to fixed incomes, while families with children may also have different eligibility criteria tied to property.

Key benefits of filing a principal place of residence form

Filing the Principal Place of Residence form can yield significant financial benefits, primarily through land tax exemptions. This can lead to substantial savings for homeowners, allowing them to allocate funds toward home improvements or savings instead of taxes. Moreover, there are broader implications for homeowners concerning capital gains tax; when a property is recognized as a primary residence, gains from its sale might be exempt from taxation.

Beyond financial aspects, homeowners and tenants also experience enhanced peace of mind. Knowing that one is recognized officially as living in their primary residence shields them from potential tax liabilities and offers security concerning their legal standings in property ownership.

Requirements for filling out the principal place of residence form

Completing the Principal Place of Residence form necessitates specific personal information and documentation. Essential data required typically includes your name, address, and date of birth, ensuring that the form accurately reflects your residency.

Proof of residence is vital; acceptable forms often include utility bills, bank statements, or lease agreements that confirm occupancy. Furthermore, certain durations of residence may be stipulated—generally, a minimum primary residence duration is required to qualify for exemptions. Joint owners and cohabiting couples must also keep an eye on special considerations regarding documentation and residency validation.

Step-by-step guide to completing the principal place of residence form

Completing the Principal Place of Residence form can be straightforward if you follow a structured approach. Start by gathering all required information. This includes necessary documents such as photo IDs, proof of ownership, and utility bills that affirm your residency.

With your documents at hand, proceed to fill out the form. Each section requires attention; ensure your details are accurate to avoid common mistakes such as miswriting your address or leaving fields incomplete. After filling out the form, you can submit it through various methods; online submissions are often quicker, but mailing a hard copy remains an option for those preferring traditional methods.

Frequently asked questions

Individuals frequently inquire about the implications of claiming multiple properties as their Principal Place of Residence. Generally, tax laws stipulate that only one property can be designated as your primary residence at any given time. Ownership changes or alterations in occupancy can also affect your eligibility for land tax exemptions, making it crucial to report these changes promptly.

What happens if you move out temporarily? Life events, such as traveling for work or hospitalization, can lead to questions about your status. It’s essential to communicate any temporary absences to the relevant tax authority to maintain compliance without losing potential exemptions.

Special circumstances affecting the principal place of residence exemption

Certain unique circumstances may affect your Principal Place of Residence exemption. For example, if you use part of your property for business, you might qualify for a partial exemption based on the actual residence portion. Temporary absences due to reasons like travel or hospitalization usually do not disqualify you from maintaining your exemption but should be reported correctly.

Moreover, special situations, such as those involving family matters, domestic violence incidents, or personal hardship, can significantly impact tax responsibilities and entitlement to exemptions. Navigating these matters adeptly may require professional input to ensure that you’re capitalizing on any available relief.

Updates and changes to PPR regulations

Staying informed about recent regulatory changes concerning the Principal Place of Residence exemption is crucial. Legislative updates may shift eligibility criteria or introduce new documents required for application. Recognizing notable changes can prevent unintended exposure to higher taxes.

Make note of important dates and deadlines for submissions to avoid regrets and possible financial penalties. Engaging with local tax authority websites regularly ensures you are up-to-date on the latest regulations and policies affecting your principal place of residence.

Tools and resources for managing your PPR form

Utilizing interactive tools such as pdfFiller can significantly enhance your experience when managing the Principal Place of Residence form. Their features facilitate an efficient completion process, allowing for easy editing and electronic signing of necessary documentation.

These tools not only streamline your efforts but also ensure that all your forms and submissions remain organized, reducing stress throughout the process.

Specific case studies and examples

Illustrating the successful exemption of properties through the Principal Place of Residence form demonstrates the application of its rules in action. Consider a scenario where a married couple applies for the exemption on their family home. They collect all requisite documentation, submit their PPR form, and within a few weeks, they receive confirmation that their application has been approved.

In a contrasting case, a property owner who erroneously labeled a rental property as their primary residence faced hefty penalties after failing to provide accurate information. This serves as a reminder to ensure clarity while filling out the form, emphasizing how different situations and submissions can lead to distinct outcomes.

The role of pdfFiller in simplifying document management

pdfFiller offers powerful features designed to simplify the management of the Principal Place of Residence form. The platform enhances productivity by enabling users to edit, eSign, and collaborate efficiently, all within a single cloud-based location.

Collaboration tools especially benefit teams managing multiple submissions, allowing them to function cohesively. Secure cloud document management also fortifies the safeguarding of sensitive personal metadata, which is crucial when dealing with personal residence details.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send principal place of residence for eSignature?

Can I create an electronic signature for the principal place of residence in Chrome?

How do I fill out principal place of residence on an Android device?

What is principal place of residence?

Who is required to file principal place of residence?

How to fill out principal place of residence?

What is the purpose of principal place of residence?

What information must be reported on principal place of residence?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.