Get the free Nomination of Beneficiary Form

Get, Create, Make and Sign nomination of beneficiary form

How to edit nomination of beneficiary form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nomination of beneficiary form

How to fill out nomination of beneficiary form

Who needs nomination of beneficiary form?

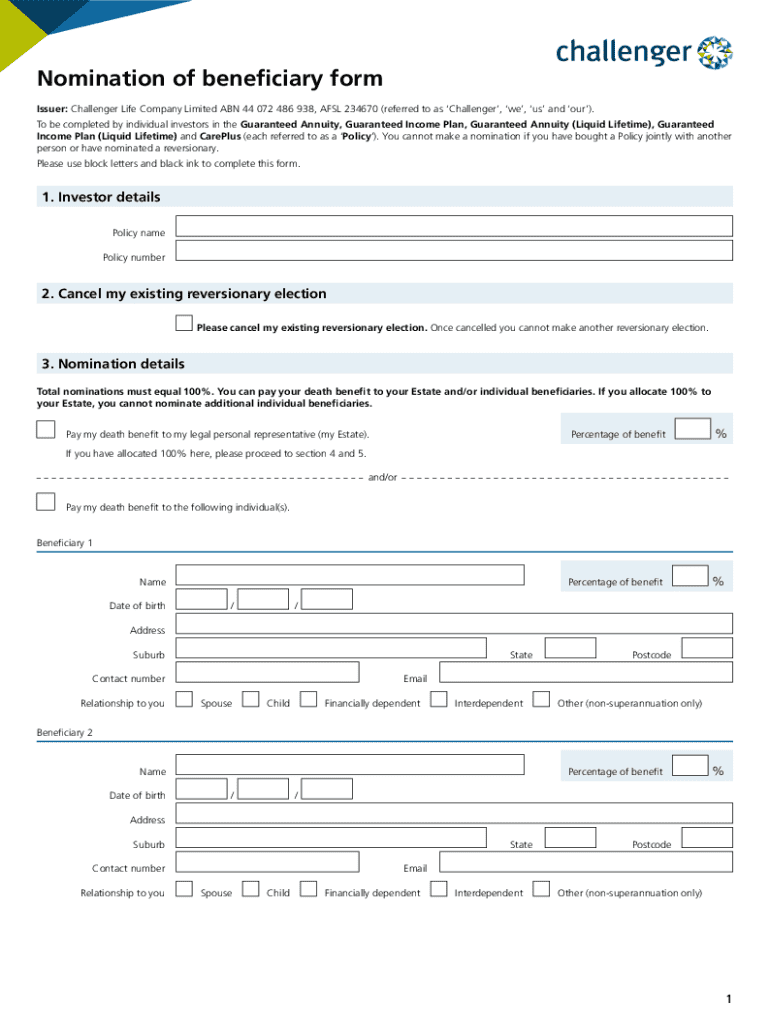

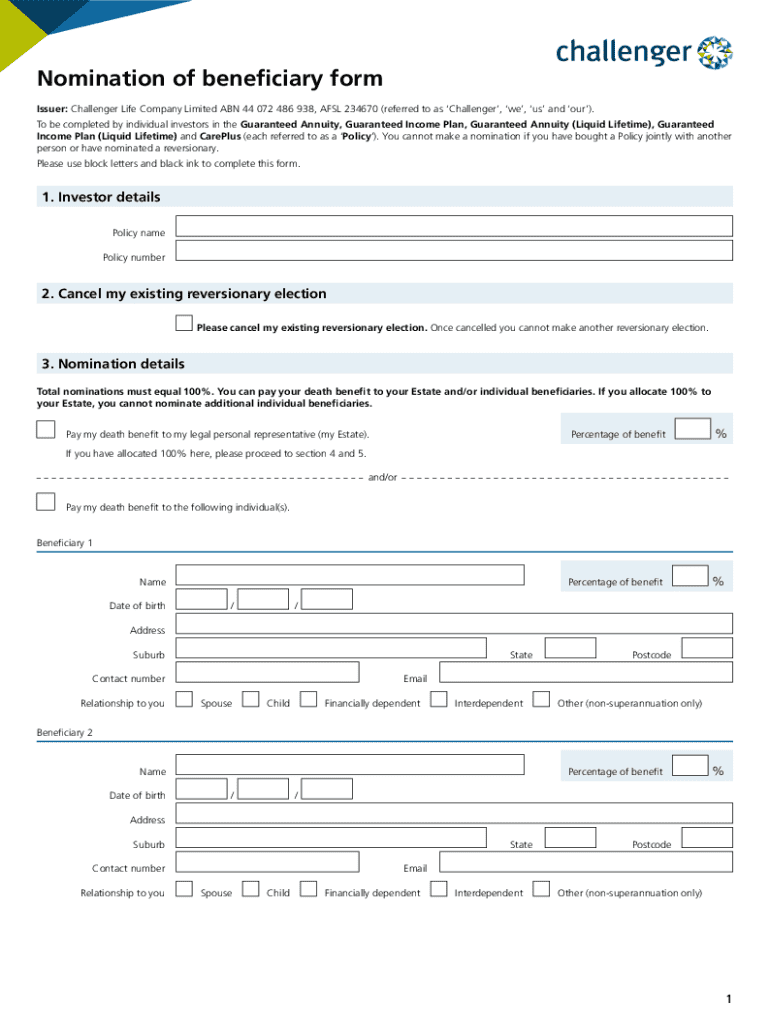

Understanding the Nomination of Beneficiary Form

Understanding the nomination of beneficiary form

The nomination of beneficiary form is a crucial document that designates who will receive benefits from an asset or account after the owner’s death. This form is commonly used in various financial and legal settings, ensuring that specific individuals or entities are recognized as the beneficiaries of policies or accounts. Without a well-defined beneficiary, your assets could end up in probate court, leading to delays, additional costs, and potential disputes among heirs.

Nominating a beneficiary is vital for several reasons. First, it provides clarity on who inherits your assets, minimizing potential conflicts. Moreover, certain assets like life insurance policies and retirement accounts pass directly to the beneficiary, bypassing the complex probate process entirely. This efficiency can be crucial during emotionally challenging times for the beneficiary, who may need immediate access to these benefits to alleviate financial burdens.

Common scenarios requiring a beneficiary nomination include life insurance policies, retirement plans, and bank accounts designed to allow transfer upon death. Additionally, many trusts require beneficiaries to be named, making the nomination of beneficiary form integral to estate planning.

Key terms related to the beneficiary nomination

To fully understand the nomination of beneficiary form, it's essential to familiarize yourself with key terms. A beneficiary is the individual or entity entitled to receive benefits or assets from a policy, account, or trust upon the owner’s death. Beneficiaries can be categorized as primary or contingent. A primary beneficiary is the first in line to receive benefits, while a contingent beneficiary is next in line should the primary beneficiary be unavailable.

Legal implications are also significant when it comes to beneficiary designations. Once you fill out and file your nomination of beneficiary form, it often cannot be changed without following specific procedures. Therefore, it’s essential to ensure that the information provided is accurate and reflects your current wishes. Failing to designate beneficiaries or making errors in the nomination can lead to legal disputes and prolonged resolution times, causing unwanted stress during an already difficult time.

When to use the nomination of beneficiary form

The nomination of beneficiary form is particularly prevalent in various situations. For life insurance policies, this form allows policyholders to specify who will receive the death benefit, ensuring timely disbursement without the need for probate. Similarly, for retirement accounts like IRAs and 401(k)s, a beneficiary designation is crucial, as these accounts also bypass probate requirements and the assets can be transferred directly to designated individuals.

Trusts and wills also require clarity regarding beneficiaries. While a will directs the distribution of assets upon death, it does not cover assets that pass by beneficiary designation, making it critical to align these documents. Other situations include healthcare decisions, where one may wish to appoint a healthcare proxy or agent for medical decisions, necessitating documentation that outlines these wishes.

Step-by-step guide to completing the nomination of beneficiary form

Filling out the nomination of beneficiary form can be straightforward when you follow a step-by-step approach. Here's how to do it effectively using pdfFiller.

Editing and managing your nomination of beneficiary form

After submission, it's possible that you may need to edit your nomination of beneficiary form due to various life circumstances—marriage, divorce, or changes in your relationship with beneficiaries are common reasons. pdfFiller allows you to access your documents easily, enabling you to edit and update your beneficiary nominations as necessary.

Keeping beneficiary information current is crucial. Outdated beneficiary details can lead to unintended consequences, such as an ex-spouse inheriting assets intended for someone else. Regularly reviewing your nominations can help mitigate these risks. Key reasons for updating a nomination include the birth of a child, the death of a previously designated beneficiary, or any significant change in your personal or financial situation.

Frequently asked questions (FAQs)

Understanding the nuances of the nomination of beneficiary form often leads to questions. Here are some commonly asked queries.

Additional tips and best practices

To enhance the clarity and effectiveness of your beneficiary nominations, consider these tips. First, be explicit in your beneficiary designations; vague terms can lead to misinterpretation. Rather than saying 'my children', specify their names and details to avoid confusion.

In addition, keeping your chosen beneficiaries informed about their designation is a prudent practice. This transparency can prevent misunderstandings and ensure that they are prepared in the event of your passing. Lastly, consulting a legal advisor can provide expert guidance tailored to your specific situation, especially if your estate is complex.

Interactive tools for beneficiary management

pdfFiller provides a suite of features designed to support users in managing forms efficiently. One standout tool is the document tracking feature, which allows you to see real-time updates on the status of your nomination of beneficiary form.

Digital storage and retrieval of your documents ensures that you can access your nomination anytime, anywhere. If working in teams, pdfFiller also facilitates collaborative forms, allowing multiple team members to manage and edit beneficiary designations seamlessly.

Real-life scenarios and case studies

Real-life cases can illuminate the importance of proper beneficiary nominations. For example, consider a situation where a policyholder neglects to update a life insurance beneficiary after a divorce, leaving the ex-spouse as the beneficiary. This oversight can lead to litigation and emotional toll at a time of loss.

Conversely, individuals who proactively manage their beneficiary designations often find their wishes honored without issue, reinforcing the crucial nature of regular reviews and updates. Case studies frequently showcase errors due to lack of clarity or outdated information, exemplifying the need for vigilance in managing beneficiary nominations.

Customer support for pdfFiller users

For users navigating the nomination of beneficiary form, pdfFiller offers extensive customer support. You can access a variety of resources including tutorials, manuals, and FAQs directly on the pdfFiller website, ensuring that you can find answers promptly.

In case of specialized queries, contacting support directly is simple and effective. Whether you require assistance with technical issues or have specific questions about your nominations, pdfFiller’s customer service is ready to assist. Additionally, engaging with community forums can provide additional insights and shared experiences from other users.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the nomination of beneficiary form form on my smartphone?

How do I edit nomination of beneficiary form on an iOS device?

Can I edit nomination of beneficiary form on an Android device?

What is nomination of beneficiary form?

Who is required to file nomination of beneficiary form?

How to fill out nomination of beneficiary form?

What is the purpose of nomination of beneficiary form?

What information must be reported on nomination of beneficiary form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.