Get the free Ach Electronic Funds Transfer

Get, Create, Make and Sign ach electronic funds transfer

How to edit ach electronic funds transfer online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ach electronic funds transfer

How to fill out ach electronic funds transfer

Who needs ach electronic funds transfer?

ACH Electronic Funds Transfer Form - How-to Guide

Understanding ACH Electronic Funds Transfers

ACH, or Automated Clearing House, serves as a vital system for electronic financial transactions. Designed to facilitate the movement of funds between banks, ACH transactions include direct deposits, electronic bill payments, and peer transfers. This system enables both individuals and businesses to transfer money conveniently without the need for physical checks or cash. Understanding how ACH works is crucial for utilizing electronic funds transfers efficiently.

The primary purpose of ACH transactions is to streamline payment processes, making them quicker and more efficient. It supports a wide range of financial activities, from payroll deposits to consumer bill payments.

Benefits of using ACH electronic funds transfers

One of the primary advantages of ACH transactions is cost-effectiveness. They generally incur lower fees compared to traditional wire transfers, making them an economical choice for businesses and individuals. Additionally, ACH payments can lead to cost savings by reducing the need for paper checks and stamps.

Security is another key feature of ACH transfers. The National Automated Clearing House Association (NACHA) oversees compliance and implements stringent regulations to protect users from fraud. With encryption and secure processing, users can feel confident in the safety of their transactions.

Finally, ACH transactions are processed quickly, often within one to two business days. This speed contrasts with traditional banking processes, significantly improving cash flow management for businesses and ease of access for individuals.

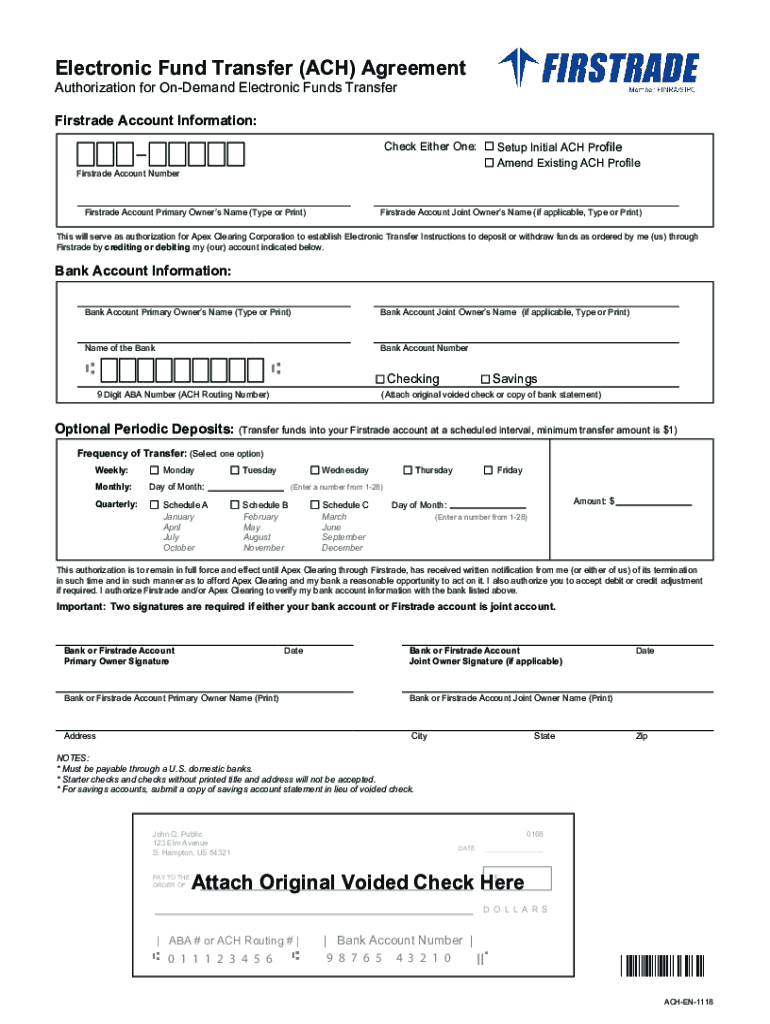

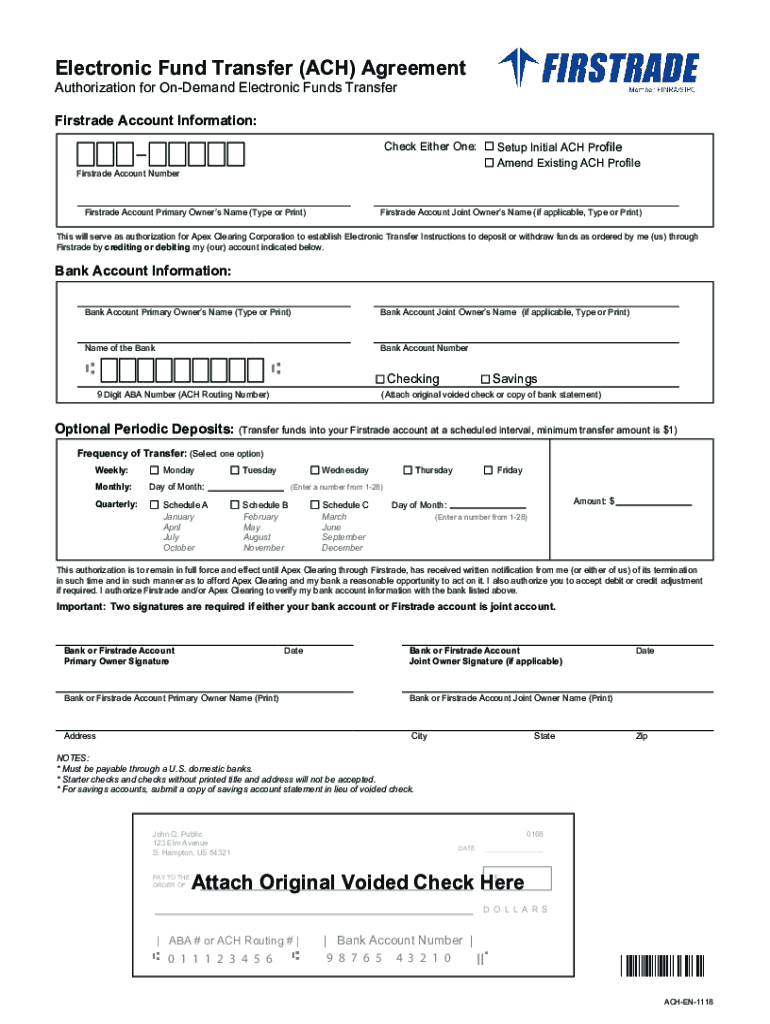

The ACH electronic funds transfer form explained

The ACH electronic funds transfer form is a crucial document that authorizes your bank to initiate fund transfers between accounts. This form serves as your official permission to allow transactions, streamlining the process of moving money electronically.

You will use the ACH form when setting up direct deposits or making payments through your bank. This straightforward document is essential for anyone looking to leverage the conveniences of electronic funds transfers.

Key components of the form

Key components of the ACH electronic funds transfer form include several required fields to ensure accurate processing. These generally feature account details such as your full name, bank name, and account numbers, along with an authorization section.

Optional fields may include additional information that could facilitate the transaction or help clarify the purpose of the transfer. Familiarizing yourself with these components before filling out the form can lead to a smoother experience.

Common terminology

Understanding the terminology associated with ACH transactions is vital. Terms like 'debit' and 'credit' refer to the direction of the funds — debit indicating money being withdrawn and credit signifying deposits. Additionally, 'originator' refers to the entity initiating the transfer, while 'receiver' indicates the account receiving the funds.

How to complete the ACH electronic funds transfer form

Completing the ACH electronic funds transfer form requires a systematic approach to ensure accuracy and efficiency. Begin by gathering all necessary personal and financial details related to the transfer.

Step-by-step instructions

When filling out the form, pay attention to detail. Errors can delay your transaction or result in incorrect fund transfers.

Special considerations

If you are handling a joint account, both account holders typically need to provide authorization. In contrast, businesses may have additional considerations such as verifying company information and obtaining necessary internal approvals before initiating the transfer. This ensures that all parties involved are aware and consent to the transaction.

Editing, signing, and submitting the form with pdfFiller

pdfFiller serves as an exceptional platform for managing documents like the ACH electronic funds transfer form. With its user-friendly interface, you can efficiently edit, sign, and submit forms electronically, significantly enhancing your document management experience.

Using pdfFiller for document management

The platform offers various features that allow you to create and modify documents seamlessly. You can type directly into the form, add annotations, or upload previous documents for editing. This versatility makes pdfFiller the go-to choice for individuals and teams looking to streamline their document workflows.

Editing the ACH electronic funds transfer form

With pdfFiller, editing the ACH electronic funds transfer form is straightforward. Users can easily customize their forms by adding or changing text, modifying fields, or inserting necessary information. This feature allows you to tailor the document to fit your needs without requiring extensive technical skills.

Electronic signing options

Signing the form electronically through pdfFiller is not only convenient but also legally valid. The platform offers easy methods for adding e-signatures, ensuring that all agreements are securely captured just as they would be through traditional methods.

Submitting the form

Submitting your completed ACH form via pdfFiller is effortless. After filling the form, you can submit it directly to the designated financial institution. Alternatively, you can download it for mailing or keep it for your records. This flexibility saves users time and reduces unnecessary back-and-forth, especially when immediate transactions are needed.

Managing ACH transactions with pdfFiller

Once you have submitted your ACH transactions, managing them becomes crucial for maintaining financial oversight. pdfFiller provides various tools and features that allow users to track their transfers effectively.

Tracking your transfers

Users can easily monitor the status of their ACH transactions within the pdfFiller dashboard. This feature allows for real-time updates on the progress of each transfer, ensuring you are informed about timings and any issues that may arise.

Modifications and cancellations

In scenarios where changes are necessary, pdfFiller equips users with straightforward options to amend or cancel ACH transfers. Whether you made an error or need to alter the transaction details, following the platform’s guided steps can help resolve these situations effectively.

Potential issues and troubleshooting

Common issues may arise, such as returned transfers or incorrect authorization. Understanding how to troubleshoot these problems efficiently can prevent delays and ensure smooth financial operations. Utilizing the knowledge base and resources provided by pdfFiller can further assist you in these situations.

Security and compliance in ACH transactions

As the ACH system continues to grow, so does the importance of understanding its security and compliance requirements. ACH transactions are closely regulated, with NACHA establishing guidelines to protect against fraud and ensure seamless operations.

Understanding regulatory requirements

Familiarizing yourself with the rules set by NACHA ensures that you remain compliant while performing electronic funds transfers. These rules are designed to uphold financial integrity and protect consumer rights during electronic transactions.

Best practices for secure transactions

To enhance security, follow these best practices while handling ACH transactions: 1. Never share sensitive information like account numbers or PINs. 2. Utilize strong passwords and change them regularly. 3. Always verify the identity of the payer or payee. 4. Maintain updated software and antivirus programs to protect against malware.

Additionally, learn to identify phishing attempts that may compromise your account. Familiarize yourself with signs of fraudulent communications to safeguard your transactions effectively.

Frequently asked questions (FAQs)

Individuals new to ACH transactions often have common concerns regarding the process. Addressing these frequently asked questions can help clarify doubts and facilitate smoother transactions.

What if make a mistake on the form?

If you make an error on the ACH form, promptly contacting your financial institution for guidance is essential. Many banks can assist in correcting minor mistakes if addressed swiftly.

How long does it take for ACH transactions to process?

Typically, ACH transactions can take 1-2 business days to process, although same-day processing options are available for certain transaction types.

What happens if my funds are not transferred?

In cases where funds are not transferred, checking with both the sending and receiving banks is crucial. There may be holds, errors in account information, or other issues requiring clarification.

Accessing support and resources on pdfFiller

pdfFiller provides a plethora of resources for users looking to optimize their document management and understand the ACH process. The platform’s user-friendly design offers comprehensive support channels.

Contacting customer support

For any questions or custom needs, pdfFiller offers various customer support channels, including email, live chat, and comprehensive FAQs directly through the platform. Diverse options maximize convenience for users.

Additional learning materials

Users can access tutorials, webinars, and guides specifically focused on related financial topics and document management. This rich repository enables users to enhance their skills and understanding of effective document handling.

Use cases for ACH electronic funds transfer

The ACH electronic funds transfer form finds utility across multiple scenarios, primarily in personal finance management and business transactions.

Personal finance management

Individuals can use ACH transfers to manage personal budgets, such as setting up direct deposits for payroll or paying recurring bills. This automation minimizes the risks of late payments and enhances financial reliability.

Business payment processes

Businesses utilize ACH transfers for vendor payments, payroll, or transaction processing, allowing for streamlined operations and reduced administrative burdens. The efficiency of the ACH process supports cashflow management.

Payroll disbursements

Paying employees through direct deposit using ACH is a standard practice among businesses today. This method provides convenience for both employers and employees, allowing for timely wage distribution and eliminating check-processing delays.

Tools and resources for effective document management

Incorporating interactive tools within pdfFiller, users can enhance their experience with the ACH electronic funds transfer form and other documents.

Interactive tools on pdfFiller

Features provided on the pdfFiller platform, such as document merging and collaboration tools, significantly enhance the document experience. These interactive aspects improve functionality and user engagement with document workflows.

Related document templates

For users requiring similar forms, pdfFiller offers access to a variety of templates for additional document needs, making document management more integrated and efficient.

Conclusion of how to utilize the ACH electronic funds transfer form

Understanding how to effectively utilize the ACH electronic funds transfer form is key to streamlining your financial transactions. With detailed instructions, access to editing and signing tools through pdfFiller, as well as resources for managing and tracking transfers, you can simplify your financial processes. Embracing these tools not only enhances your transaction experience but also provides security and efficiency, making financial management straightforward.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify ach electronic funds transfer without leaving Google Drive?

How do I edit ach electronic funds transfer online?

How do I edit ach electronic funds transfer in Chrome?

What is ACH electronic funds transfer?

Who is required to file ACH electronic funds transfer?

How to fill out ACH electronic funds transfer?

What is the purpose of ACH electronic funds transfer?

What information must be reported on ACH electronic funds transfer?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.