Get the free Non-cash/in Kind Donation Receipt

Get, Create, Make and Sign non-cashin kind donation receipt

Editing non-cashin kind donation receipt online

Uncompromising security for your PDF editing and eSignature needs

How to fill out non-cashin kind donation receipt

How to fill out non-cashin kind donation receipt

Who needs non-cashin kind donation receipt?

Mastering the Non-Cash In-Kind Donation Receipt Form

Understanding non-cash in-kind donations

Non-cash in-kind donations refer to contributions made by individuals or organizations that do not involve monetary exchange but rather the donation of goods or services. These donations play a vital role in philanthropy, allowing non-profits and community organizations to receive what they need to fulfill their missions without direct financial expenditure. Unlike cash donations, which provide straightforward monetary support, in-kind donations can range from office supplies to food items, further exhibit the donor’s commitment to supporting a cause beyond just financial contributions.

By understanding the importance of non-cash donations, organizations can maximize their resources and provide critical services. This distinction between cash and non-cash donations is essential, as different strategies for acknowledgment and record-keeping may apply. Proper documentation through a non-cash in-kind donation receipt ensures that both donors and organizations benefit from tax incentives and accurate records.

Key features of a non-cash in-kind donation receipt

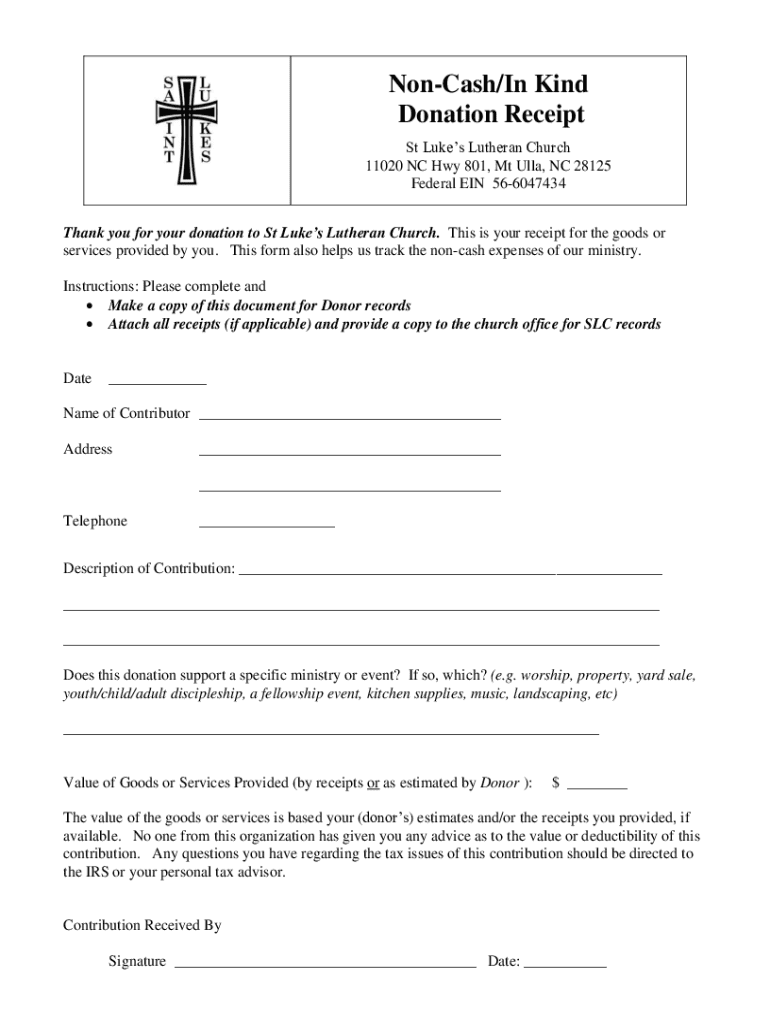

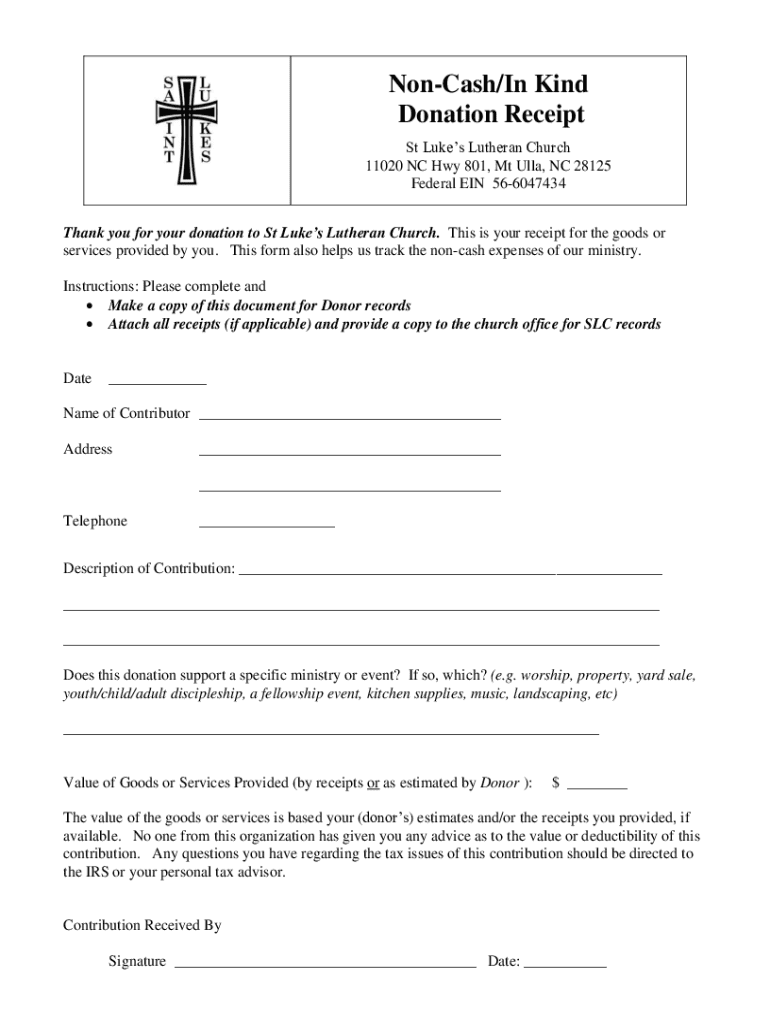

A non-cash in-kind donation receipt is a formal document that acknowledges the receipt of goods or services donated to a non-profit organization. By providing detailed records of such transactions, organizations can meet legal requirements and maintain transparency with their donors. It is crucial to ensure that each receipt contains specific information that validates the donation for both the donor’s and organization’s records.

Types of non-cash in-kind donation receipts

Non-cash in-kind donations can take many forms, and the specific needs of an organization will often dictate the types of donations they receive. Here are some common examples of non-cash donations:

When dealing with specific types of donations, organizations must be aware of special considerations for valuation and compliance with reporting requirements. Understanding these nuances helps ensure that every donation is appropriately documented and valued for tax purposes.

Steps to create a non-cash in-kind donation receipt

Creating an effective non-cash in-kind donation receipt involves several key steps. Following a structured approach helps maintain clarity and accuracy throughout the documentation process.

Best practices for managing non-cash in-kind donation receipts

Managing non-cash in-kind donation receipts effectively is crucial in maintaining accurate records and ensuring smooth operations. Best practices in this area can enhance donor relations and compliance with regulations.

Common mistakes to avoid

While creating and managing non-cash in-kind donation receipts, organizations can stumble upon several pitfalls that may compromise their documentation efforts.

Frequently asked questions about non-cash in-kind donation receipts

Donors often have queries regarding the specifics of non-cash in-kind donation receipts, and organizations should be ready to address these concerns promptly.

Advantages of using a digital non-cash in-kind donation receipt

Using electronic formats for non-cash in-kind donation receipts significantly enhances efficiency and accessibility for both the organization and the donors. Digital receipts streamline record-keeping and can be easily updated or duplicated in case of any requirement.

Testimonials and case studies

Real-world experiences often highlight the advantages of meticulous receipt management. Organizations that effectively utilize non-cash in-kind donation receipts can share success stories demonstrating how improved documentation practices have aided their fundraising efforts and donor relationships.

Feedback from donors can also be invaluable. Hearing how streamlined acknowledgment processes have positively influenced their giving decisions emphasizes the importance of effective receipt management.

Customer support and guidance

For organizations starting on their journey of creating non-cash in-kind donation receipts, having reliable resources and support is key. Companies like pdfFiller provide comprehensive help through their customer service channels, ensuring users tap into all available features for efficient document management.

Moving forward with non-cash in-kind donations

In conclusion, non-cash donations are tremendously valuable for the sustainability of many organizations. These donations not only expand resource availability but also strengthen relationships with the community and stakeholders.

By embracing best practices for managing non-cash in-kind donation receipts and leveraging tools like pdfFiller, organizations can foster an environment of transparency and efficiency that ultimately benefits both donors and recipients alike.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get non-cashin kind donation receipt?

How do I execute non-cashin kind donation receipt online?

How do I complete non-cashin kind donation receipt on an iOS device?

What is non-cashin kind donation receipt?

Who is required to file non-cashin kind donation receipt?

How to fill out non-cashin kind donation receipt?

What is the purpose of non-cashin kind donation receipt?

What information must be reported on non-cashin kind donation receipt?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.