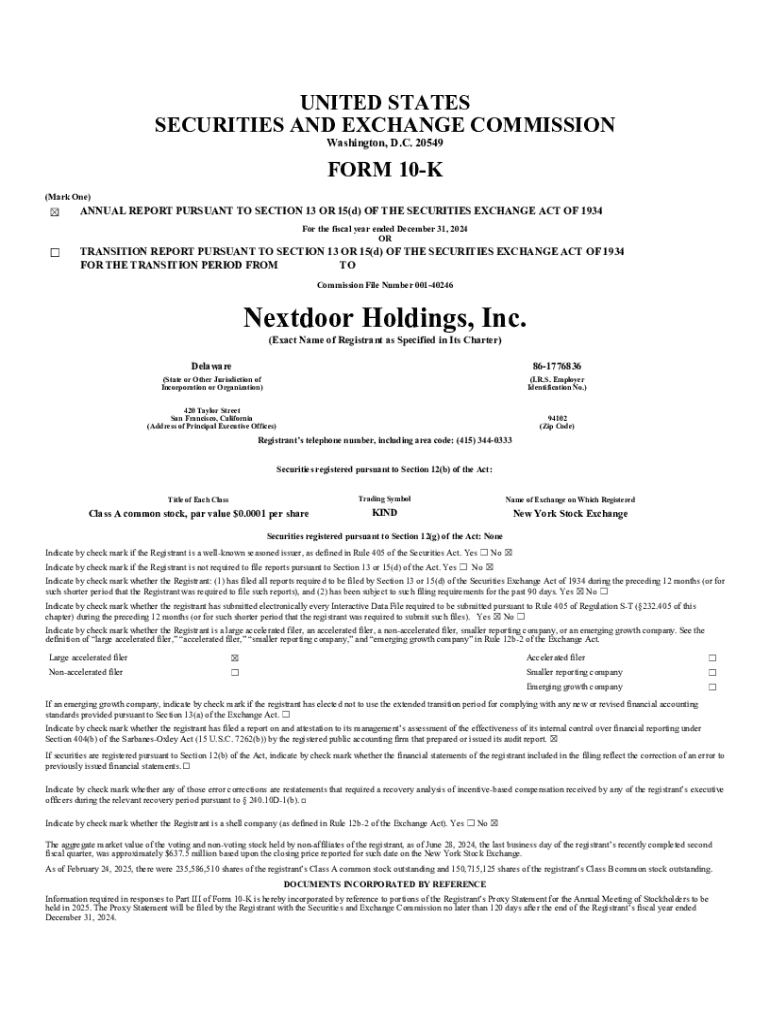

Get the free Form 10-k

Get, Create, Make and Sign form 10-k

Editing form 10-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-k

How to fill out form 10-k

Who needs form 10-k?

Comprehensive Guide to Form 10-K: Navigating Your Financial Filings

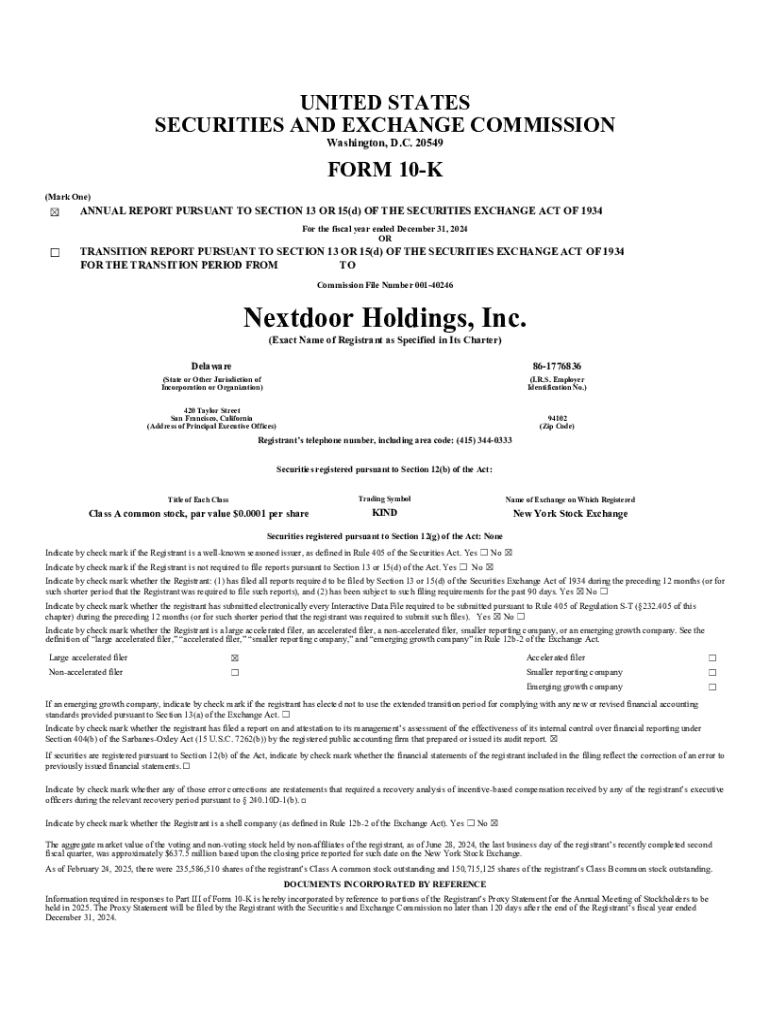

Understanding Form 10-K

Form 10-K is a comprehensive report filed annually by publicly traded companies with the U.S. Securities and Exchange Commission (SEC). It provides a detailed overview of a company’s financial performance, including an extensive disclosure of its operations, financial statements, and management analysis. The primary purpose of Form 10-K is to ensure that stakeholders can thoroughly assess the financial health of a company and make informed investment decisions.

Key stakeholders who utilize Form 10-K include investors, financial analysts, regulatory bodies, and credit rating agencies. By providing a transparent account of a company's operations, this document plays a vital role in fostering investor trust and facilitating informed decision-making.

Importance of Form 10-K in Financial Reporting

The significance of Form 10-K in financial reporting cannot be overstated. It serves as a cornerstone of corporate transparency, as it provides detailed insights into a company's financial condition, operational capabilities, and risk exposures. Investors and analysts rely heavily on this form to evaluate a company's past performance while projecting its future potential.

Moreover, the disclosures mandated within the Form 10-K contribute to heightened accountability, as companies are expected to provide accurate and comprehensive information. This expectation ensures that stakeholders can engage with the company in a more meaningful way, making it easier for investors to compare different companies within the same industry.

Key components of the Form 10-K

The structure of Form 10-K is standardized by the SEC, ensuring consistency and comparability across different companies. Each filing is divided into several sections, each focusing on different aspects of the company’s performance and operations. Understanding the standard format can significantly improve the interpretation of the document.

Filing procedures for Form 10-K

Filing Form 10-K is a critical task for ensured compliance with SEC requirements. The deadlines for submitting this form depend on the size of the company. Smaller companies typically have 90 days to file after the end of their fiscal year, while larger companies must file within 60 days.

Preparation for filing involves gathering pertinent information and documentation. This includes collecting audited financial statements, assessing internal risks, and ensuring all changes in management or strategic direction are disclosed. To file, companies utilize the SEC's EDGAR system, which requires attention to detail to avoid common mistakes such as omissions or misreported figures.

Analyzing Form 10-K filings

Analyzing Form 10-K filings requires an understanding of key financial data. Investors and analysts often focus on the financial statements presented, as they provide insight into the company’s profitability, liquidity, and operational efficiency. Key metrics such as return on equity (ROE), earnings before interest and taxes (EBIT), and debt-to-equity ratio are commonly used to evaluate a company's performance.

Risk factors disclosed in the form are equally critical, as they outline uncertainties management believes could impair future operations or profitability. Identifying these risk elements can significantly enhance decision-making processes for potential investors.

Best practices for completing Form 10-K

Ensuring accuracy and compliance is paramount when completing Form 10-K. Companies should implement a structured review process to validate all data being submitted. This includes cross-verifying figures with management’s estimates, obtaining counsel from legal experts, and involving external auditors to ensure adherence to SEC regulations.

Collaborative editing and management tools can significantly streamline the Form 10-K preparation part. Utilizing cloud-based platforms, like pdfFiller, not only enhances document management but also allows multiple team members to edit, sign, and collaborate in real-time, creating a more efficient filing process.

Resources for deepening your understanding of Form 10-K

Accessing historical Form 10-K filings is vital for comparative analysis and understanding industry trends. Investors and analysts can utilize the SEC's EDGAR database to find past filings and obtain valuable insights into a company’s performance over time. Several financial modeling tools also facilitate scenario analysis based on these historical data.

Additionally, understanding related forms such as Form 10-Q (quarterly report) and Form 8-K (current report) is essential for a comprehensive view of a company’s disclosure practices. Each form serves a specific purpose; comparing these can provide further context to the information presented in the Form 10-K.

Tools and templates for effective filing

Using tools like pdfFiller can significantly streamline the filing process for Form 10-K. Users can take advantage of various interactive features designed for filling, editing, and signing documents. Such tools facilitate a smoother workflow by enabling secure document sharing and real-time collaboration among stakeholders.

Furthermore, exclusive templates can help simplify the filing process. By utilizing customizable templates available through pdfFiller, companies can ensure they adhere to the SEC formatting guidelines while saving time on document preparation.

Future trends and modifications in Form 10-K filings

The SEC continues to evolve the requirements for Form 10-K filings, reflecting advancements in technology and shifts in market demand. Companies are anticipating changes that may require enhanced disclosures on environmental, social, and governance (ESG) factors, which are increasingly relevant to modern investors. As such trends develop, staying informed will be crucial for compliance and competitive positioning.

Technology also plays a pivotal role in modern filing processes. Digital tools are reshaping the way companies manage and submit their Form 10-K filings, with automation and analytics becoming essential features for efficiency and insights. Embracing these innovations can empower companies to streamline their processes and ensure they remain agile in a fast-changing regulatory landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in form 10-k without leaving Chrome?

Can I create an electronic signature for signing my form 10-k in Gmail?

Can I edit form 10-k on an iOS device?

What is form 10-k?

Who is required to file form 10-k?

How to fill out form 10-k?

What is the purpose of form 10-k?

What information must be reported on form 10-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.