Get the free Annual Notice of Assessment

Get, Create, Make and Sign annual notice of assessment

Editing annual notice of assessment online

Uncompromising security for your PDF editing and eSignature needs

How to fill out annual notice of assessment

How to fill out annual notice of assessment

Who needs annual notice of assessment?

Annual Notice of Assessment Form - How-to Guide Long-Read

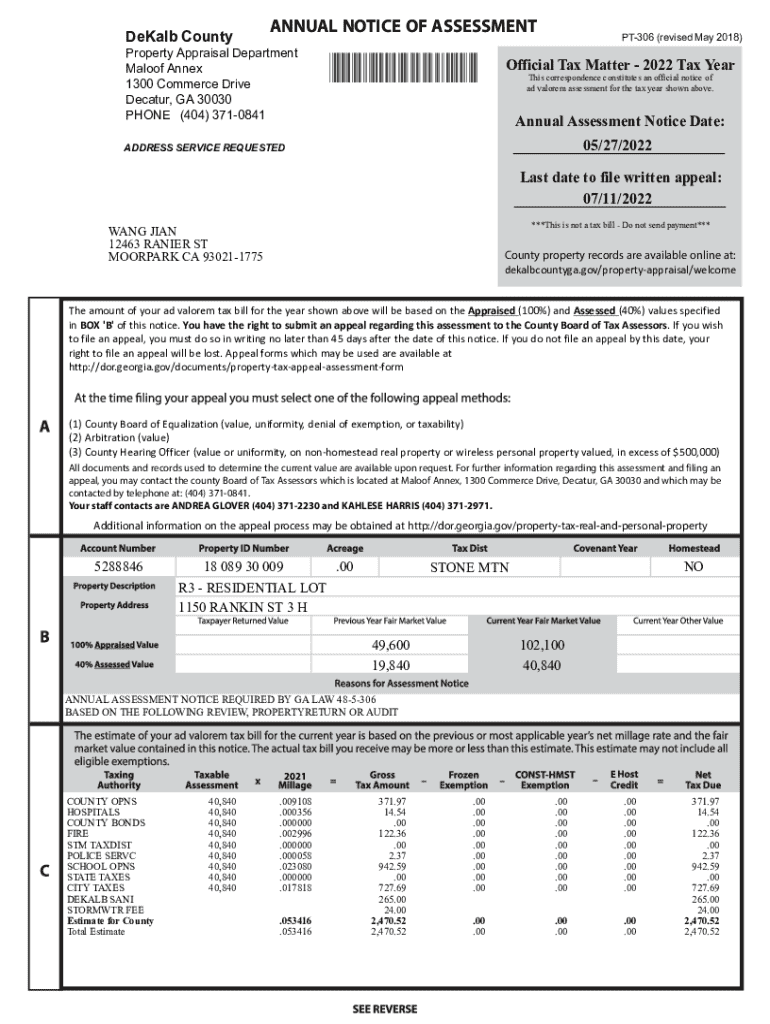

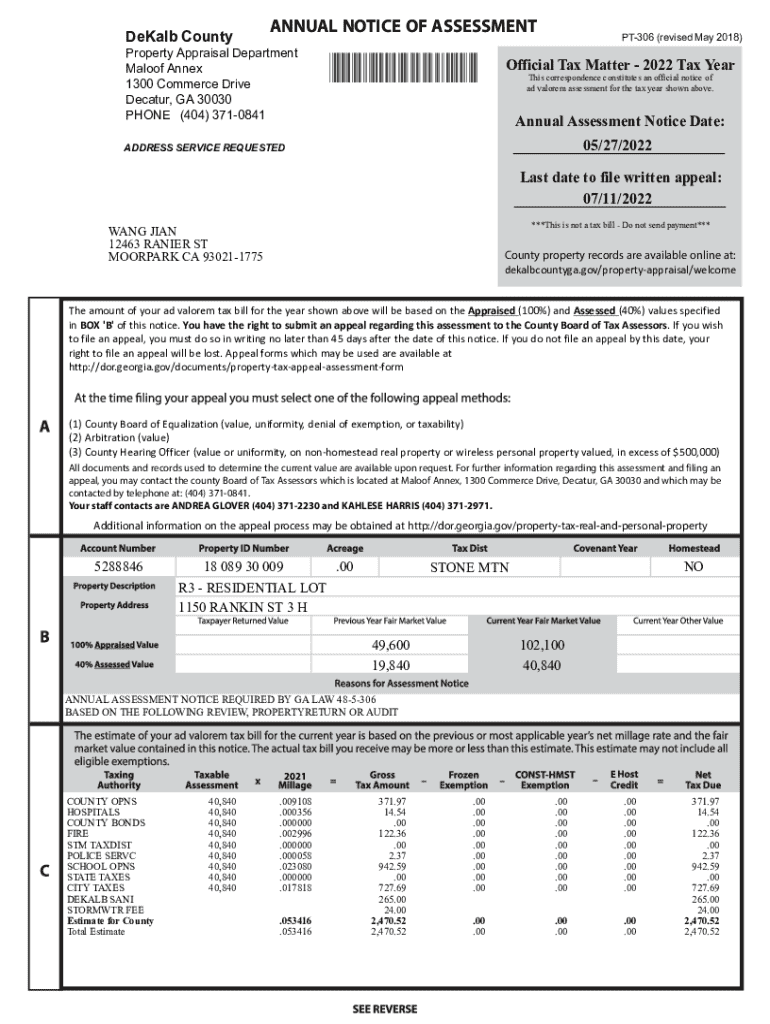

Understanding the Annual Notice of Assessment Form

The annual notice of assessment form is a critical document issued by local government authorities to inform property owners about the assessed value of their property. This form is not merely a formality; it serves as a pivotal aspect in the property taxation system. It outlines how much tax a homeowner is liable to pay based on the assessed value of their property, ultimately impacting local funding for schools, emergency services, and public infrastructure.

Key stakeholders involved in this process include taxpayers who receive the notices and assessors who prepare these assessments. Ensuring accuracy in these assessments is essential, as the values directly influence property tax bills and potential appeals. Understanding the annual notice of assessment form can empower homeowners to navigate their property assessments knowledgeably.

Key components of the annual notice of assessment form

The annual notice of assessment form comprises several key components that are essential for property owners to understand. Common fields typically include the owner’s name, property address, property type, and the assessed value. This document may also provide additional sections indicating due dates for taxes and options available for appealing the assessment if the property owner feels the valuation is inaccurate.

Understanding your assessment value is crucial. It is determined by local assessors using various methodologies, which may include recent sales of similar properties and overall economic conditions. Several factors can influence property valuations, such as property size, zoning regulations, and market conditions. For instance, a newly developed neighborhood may see rising assessment values as demand increases.

Accessing your annual notice of assessment

Locating your annual notice of assessment is essential for property owners. Most local governments provide online access to these notices through their official websites. You may need to navigate to the property assessment section, where you can enter relevant details such as your name or address to retrieve your specific notice.

For those who prefer traditional methods, assessment notices can often be mailed directly to property owners or made available in person at local government offices. If you do not receive your notice, there are steps to take. Firstly, verify your mailing address is current, then reach out to your local assessment office, providing them with your property details to obtain a copy of your notice.

Filling out the annual notice of assessment form

When filling out the annual notice of assessment form, begin by gathering all necessary information beforehand. You will need your property details such as the tax identification number, property size, and current market value as assessed by local authorities. This ensures that the information entered is accurate and reflective of your specific situation.

The form may be detailed and require careful walkthrough of each section. One effective method is to break down the filling process into manageable steps. Use tools such as pdfFiller to upload the annual notice, allowing for edits directly onto the form. This platform not only provides ease of access but also facilitates electronic signatures, making document management more efficient.

Making changes or appeals to your assessment

If you believe your assessment is inaccurate, understanding the appeal process is critical. Property owners can file an appeal based on reasons such as incorrect property value, misclassified property type, or significant external factors affecting property value. Usually, there is a stipulated timeline within which to file your appeal after receiving the notice—often within 30 days.

Gathering evidence to support your appeal is essential. This could include recent comparable sales data, photographs of your property, or third-party appraisals. Preparing this documentation beforehand helps in presenting a compelling case during the appeal process. Furthermore, checking the appeal status can typically be done via your local assessment office's website or by contacting them directly for updates.

Common questions about the annual notice of assessment

Receiving a notice that indicates an increase in assessment value can be alarming for homeowners. It often directly correlates with an increase in property taxes, which may impact a homeowner’s financial planning. Understanding the differences between the assessment notice and the tax bill is essential, as the former informs the property value, while the latter outlines the actual taxes owed based on that value.

Many owners also question how frequently properties are reassessed. Depending on local regulations, properties may undergo reassessment annually or every few years, which necessitates awareness of how this may impact your property's tax obligations. Additionally, being knowledgeable about potential exemptions and deductions available can offer significant financial relief for property owners.

Local government and assessment office resources

Accessing reputable resources can significantly ease the understanding of property assessments. Local assessment offices serve as a hub for information, providing directories that include contact details, operating hours, and the services they offer. Additionally, state-specific information regarding tax assessments and regulations can aid homeowners in understanding local laws and available resources.

Navigating these resources can streamline the assessment process for homeowners. Knowing where to find specific guidelines or whom to contact can enhance the way property owners engage with their local government concerning assessments and property taxes.

Quick reference for tax assessment terms

A clear understanding of tax assessment terms is critical in navigating the annual notice of assessment form. Familiarizing yourself with the glossary of key terms such as 'assessed value,' 'mill rate,' 'property tax exemption,' and 'appraisal' can simplify discussions with assessors and inform property owners of their rights and options.

This knowledge allows homeowners to engage proactively in discussions related to their assessments or appeals, ensuring they can advocate effectively on their behalf.

Popular searches and FAQs related to assessment notices

Queries about the annual notice of assessment form can often reflect common concerns among property owners. Popular searches include inquiries about how to file an appeal, deadlines for property tax payments, and options available for exemptions. Addressing these concerns through frequently asked questions can help demystify the process for many.

By equipping homeowners with readily available answers, they can approach their annual notice of assessment with confidence and clarity, ensuring they understand not just the forms but the broader implications on their finances and property ownership.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my annual notice of assessment in Gmail?

How can I send annual notice of assessment for eSignature?

How do I complete annual notice of assessment online?

What is annual notice of assessment?

Who is required to file annual notice of assessment?

How to fill out annual notice of assessment?

What is the purpose of annual notice of assessment?

What information must be reported on annual notice of assessment?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.