Get the free Money Collection Form

Get, Create, Make and Sign money collection form

How to edit money collection form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out money collection form

How to fill out money collection form

Who needs money collection form?

Money Collection Form: Comprehensive Guide to Effective Management

Understanding money collection forms

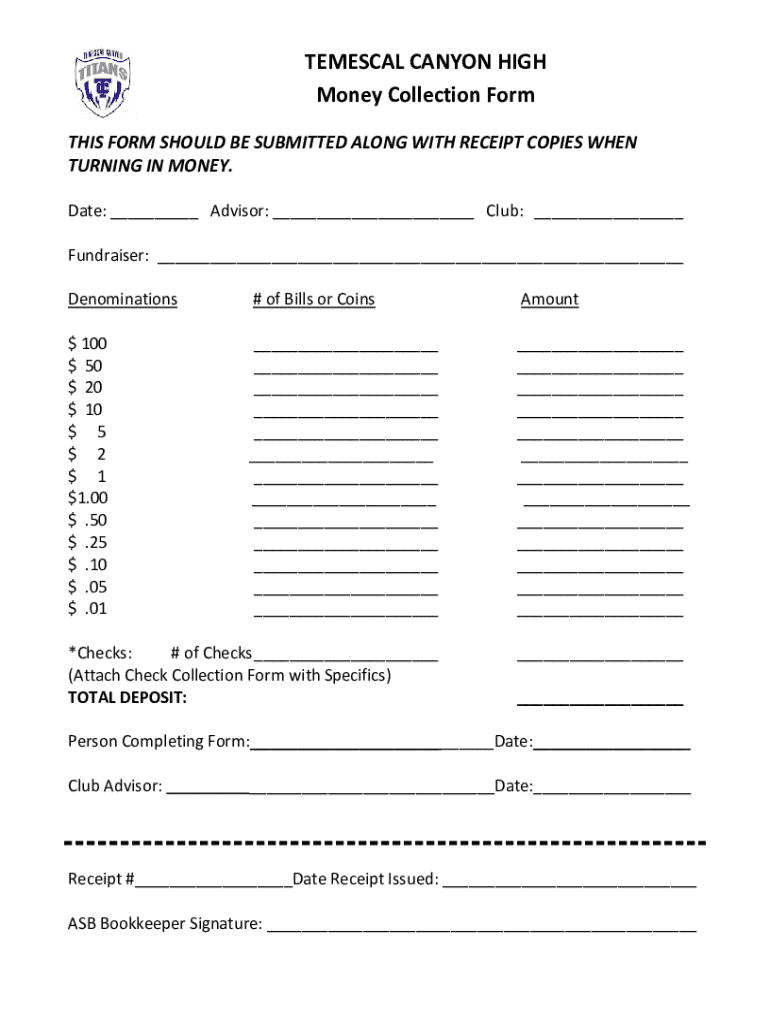

A money collection form is a structured document used to gather payment information from individuals or entities for various services, products, or donations. These forms provide essential details such as the payer's identity, payment amount, and the purpose of the transaction. Not only do they facilitate financial transactions, but they also serve legal and record-keeping purposes across different sectors.

The significance of money collection forms extends to diverse settings, primarily including educational institutions, non-profits and charities, as well as businesses and service providers. In schools, for instance, these forms might be used for collecting tuition or event fees. Non-profit organizations rely on them to gather donations efficiently, while businesses employ them to manage service charges or product sales effectively.

Key elements of a money collection form

To create an effective money collection form, several essential pieces of information must be included. At the forefront, the payer's name and contact details are critical, as these are necessary for tracking and confirming payments. Additionally, the purpose of the collection should be clearly stated, aiding in transparency. A detailed breakdown of costs or fees involved gives the payer clarity on the amounts being requested, while the date of the transaction ensures timely financial management.

Legal considerations also play a vital role in money collection forms. It's essential to ensure that forms comply with local and national financial regulations, safeguarding both the organization and the payer's rights. Using commonly recognized terms and phrases enhances the form's clarity and ensures that all parties can easily understand the requirements and obligations involved.

Types of money collection forms

There are various types of money collection forms that serve different purposes. Standard money collection forms typically cover basic information and can be used in numerous contexts, from school fees to retail transactions. Alternatively, customized money collection forms can be tailored to meet specific needs. These may either be templates from reputable sources or original designs crafted to match an organization’s branding and specific requirements.

Organizations must also consider legal and tax compliance forms, which can accompany standard collection forms to ensure financial integrity. As technology advances, businesses face the choice of utilizing digital or paper forms, each having distinct advantages and disadvantages. Digital forms offer ease of editing and accessibility from anywhere, whereas paper forms might still be preferable in certain traditional sectors.

How to create an effective money collection form

Creating an effective money collection form involves a strategic approach. First, determine the purpose and audience of the form. This foundational step shapes how the form is designed and what information it collects. Next, selecting the right template or format can significantly ease the creation process, allowing for customization that meets specific needs.

Customization is key; adding interactive elements like checkboxes or dropdowns enhances usability. Furthermore, incorporating branding elements can help align the form with the organization’s identity. Ensure that clarity and conciseness dominate the form—use user-friendly language and structure information logically to facilitate easy comprehension.

Editing and managing money collection forms

Once you have developed your money collection form, effective management is crucial for ensuring that it meets its purpose over time. Tools like pdfFiller provide robust editing capabilities, allowing users to modify forms easily as needed. Utilizing cloud-based solutions also enhances collaboration, enabling multiple team members to access and edit the form in real-time.

Collaboration becomes all the more effortless with features that support real-time editing. Team members can offer feedback on design or functionality, ensuring that the final product is polished and effective for users. By fostering an environment where expedient revisions and discussions can take place, organizations can enhance the accuracy and utility of their money collection forms significantly.

Securing payments and data

A critical aspect of managing money collection forms is ensuring the security of payments and the safety of sensitive data. Several payment processing options are available, including integration with online payment systems that streamline the transaction process. Ensuring secure transactions not only protects the organization but also builds trust with users, reassuring them that their data is handled responsibly.

Privacy and security considerations are paramount. Safeguarding personal information is non-negotiable. Organizations must comply with data protection laws to avoid potential legal complications. Utilizing encryption for online forms and adhering to best practices for data storage are essential in protecting sensitive information throughout the collection process.

Common challenges with money collection forms

Navigating the challenges associated with money collection forms can be daunting. Common issues include incomplete submissions, which can significantly delay processing or complicate financial records. Moreover, errors during payment processing can frustrate users and impact the organization's reputation. Identifying and troubleshooting these challenges swiftly is vital for maintaining smooth operations.

Improving collection efficiency can mitigate potential problems. Automated reminders and follow-up communications prompt payers, encouraging timely responses and reducing instances of late payments. Streamlining approval processes can also hasten transaction completion, allowing organizations to maintain a steady cash flow and positive relationships with stakeholders.

The future of money collection forms

As technology continues to evolve, so too do money collection forms. Emerging trends in digital payment solutions are reshaping how organizations collect funds, with contactless transactions becoming increasingly widespread. This trend not only elevates user convenience but also enhances transaction speed, enabling quicker processing and improved cash flow.

Moreover, the role of AI and automation in streamlining money collection processes is becoming more prominent. Automated systems can analyze payment data, predict cash flow patterns, and even send reminders, ensuring organizations remain proactive in collection efforts. These innovations will continue to foster efficiency and effectiveness in money management, creating smoother experiences for both organizations and their clients.

Frequently asked questions (FAQs)

What makes a money collection form legally binding? A money collection form can be considered legally binding when it contains all necessary details, including identification of both parties, the agreed payment amount, and signatures if required. This ensures safeguards are in place should disputes arise.

Can I create a money collection form for different purposes? Yes, a money collection form can be tailored to various contexts, whether for tuition fees, donations, or service payments. The key is ensuring the form captures the appropriate details specific to each scenario to facilitate accurate processing.

How do I ensure my money collection form is user-friendly? To enhance user-friendliness, use clear language and intuitive design. Incorporate logical structures, interactive elements, and thorough instructions where necessary. Regular user testing and feedback can also help improve clarity and usability.

Using pdfFiller for your money collection needs

pdfFiller offers an extensive suite of features designed to revolutionize document management, including money collection forms. With its document editing capabilities, users can swiftly customize forms, ensuring they meet all organizational needs efficiently. The e-signature functionality facilitates quick approvals and secure transactions, making it a valuable tool for organizations seeking streamlined operations.

Moreover, pdfFiller enhances efficiency and collaboration by allowing team members to work on documents concurrently. With cloud-based access, teams can collaborate from any location, sharing insights and revisions seamlessly. Customer success stories highlight how pdfFiller has empowered organizations to enhance their document management processes, showcasing its efficacy in handling diverse form needs.

Appendices

Appendix A features sample money collection forms and templates relevant to different contexts, while Appendix B provides a glossary of terms to help users familiarize themselves with terminology related to money collection. Lastly, Appendix C includes contact information for pdfFiller support, ensuring users have access to assistance when needed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send money collection form for eSignature?

How do I make edits in money collection form without leaving Chrome?

How do I edit money collection form straight from my smartphone?

What is money collection form?

Who is required to file money collection form?

How to fill out money collection form?

What is the purpose of money collection form?

What information must be reported on money collection form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.