Get the free Financial Assistance Application

Get, Create, Make and Sign financial assistance application

Editing financial assistance application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial assistance application

How to fill out financial assistance application

Who needs financial assistance application?

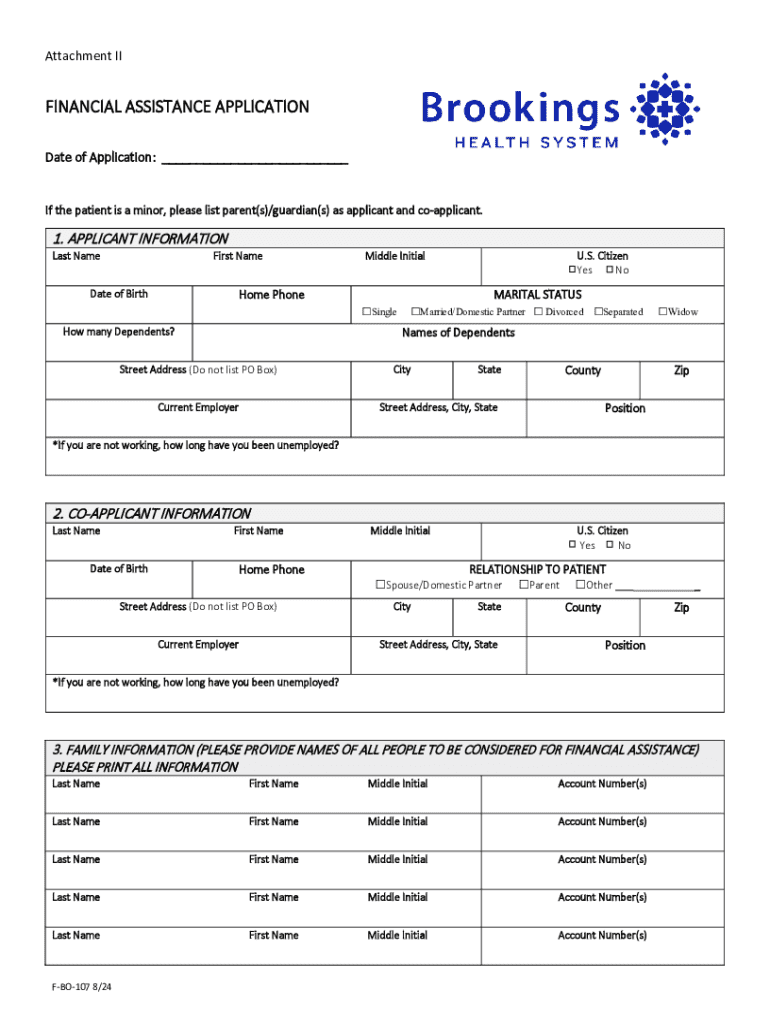

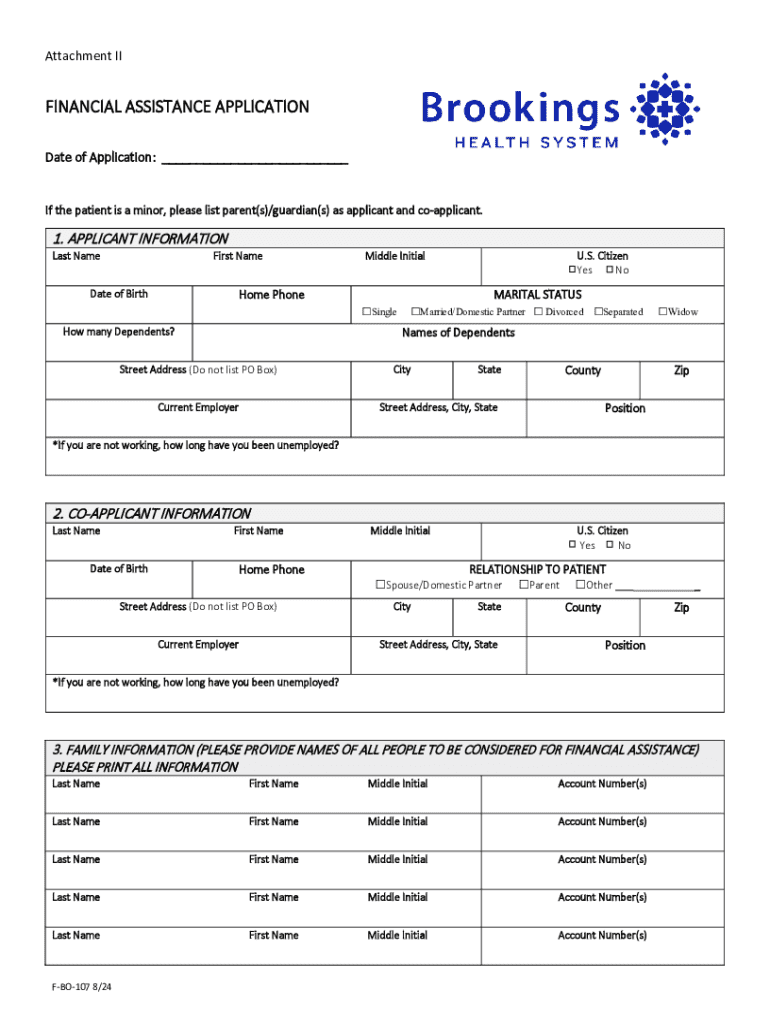

Comprehensive Guide to Filling Out a Financial Assistance Application Form

Understanding financial assistance

Financial assistance provides critical support to individuals and families facing economic hardship. It encompasses various programs, grants, and loans designed to alleviate financial burdens caused by medical expenses, education fees, or other essential costs. Understanding the purpose and benefits of financial assistance is crucial for anyone seeking support.

The primary purpose of financial assistance is to ensure that individuals can access necessary services and resources without the barrier of overwhelming costs. By applying for financial assistance, applicants can gain access to a lifeline that not only addresses immediate financial needs but also fosters a path toward financial stability.

Eligibility criteria for financial assistance programs often vary by provider, but common factors include household income, number of dependents, and specific financial burdens. Researching the requirements beforehand can help streamline the application process.

Getting started with the financial assistance application form

Once you've determined eligibility, the next step is navigating the financial assistance application form. This process generally starts with understanding the specific requirements of the program you wish to apply for. Each program may have distinct procedures, yet the initial steps often share similarities.

Typically, you will need to gather various documents to support your application. Essential information includes personal identification, proof of income, and any medical bills or relevant documentation that outlines your financial situation.

Having all necessary documentation prepared will streamline the application process and increase the chances of approval.

Detailed breakdown of the application form sections

Understanding each section of the financial assistance application form is vital for providing accurate information. Let’s break down the main segments you'll encounter:

Filling out the financial assistance application form

When you're ready to fill out the application form, it’s essential to approach each section with care. Here’s a step-by-step guide to ensure accurate completion.

Taking your time to ensure all data is correctly inputted will reduce the likelihood of follow-up requests or denials.

Editing, signing, and managing your application

After filling out the financial assistance application form, utilizing tools like pdfFiller can enhance your submission experience. This platform simplifies the process of editing, signing, and managing documents.

pdfFiller provides an intuitive environment for tracking changes and comments, fostering a collaborative approach to document management.

Tips for a successful application

Maximizing your chances of approval for financial assistance requires diligence. Here are some effective tips to ensure quality submissions.

Implementing these strategies significantly boosts your application's likelihood of success.

What to expect after submission

After submitting your financial assistance application, understanding the subsequent steps demystifies the process.

Typically, a review process follows, wherein the application is evaluated based on the information provided. The timelines for approval can vary, but being prepared for potential follow-up questions is standard practice.

Frequently asked questions (FAQs)

As you navigate the financial assistance application process, you may encounter several common concerns worth addressing.

Clear communication and thorough research can alleviate these common concerns as you prepare your application.

Additional support and resources

Utilizing available resources can enhance your financial assistance application experience. Engage with support teams to clarify doubts or access specific tools designed for applicants.

Access to these resources can empower you to navigate the complexities of financial assistance effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send financial assistance application for eSignature?

How do I make changes in financial assistance application?

How do I edit financial assistance application in Chrome?

What is financial assistance application?

Who is required to file financial assistance application?

How to fill out financial assistance application?

What is the purpose of financial assistance application?

What information must be reported on financial assistance application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.