Get the free Confirmation of Income Entitlements

Get, Create, Make and Sign confirmation of income entitlements

How to edit confirmation of income entitlements online

Uncompromising security for your PDF editing and eSignature needs

How to fill out confirmation of income entitlements

How to fill out confirmation of income entitlements

Who needs confirmation of income entitlements?

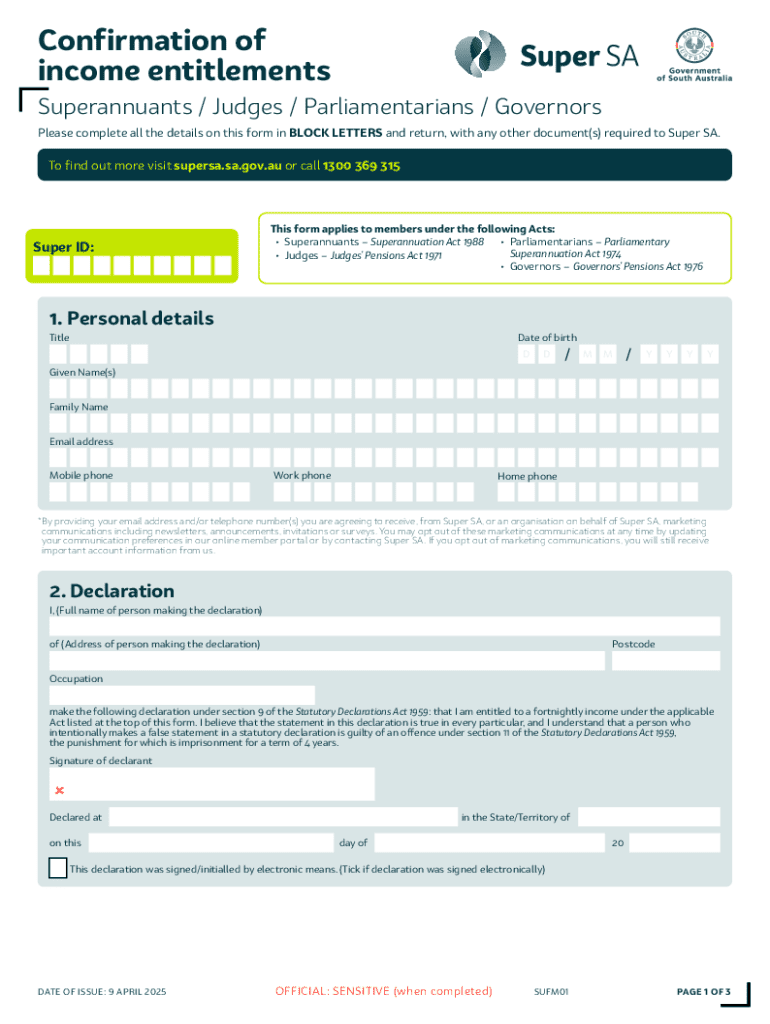

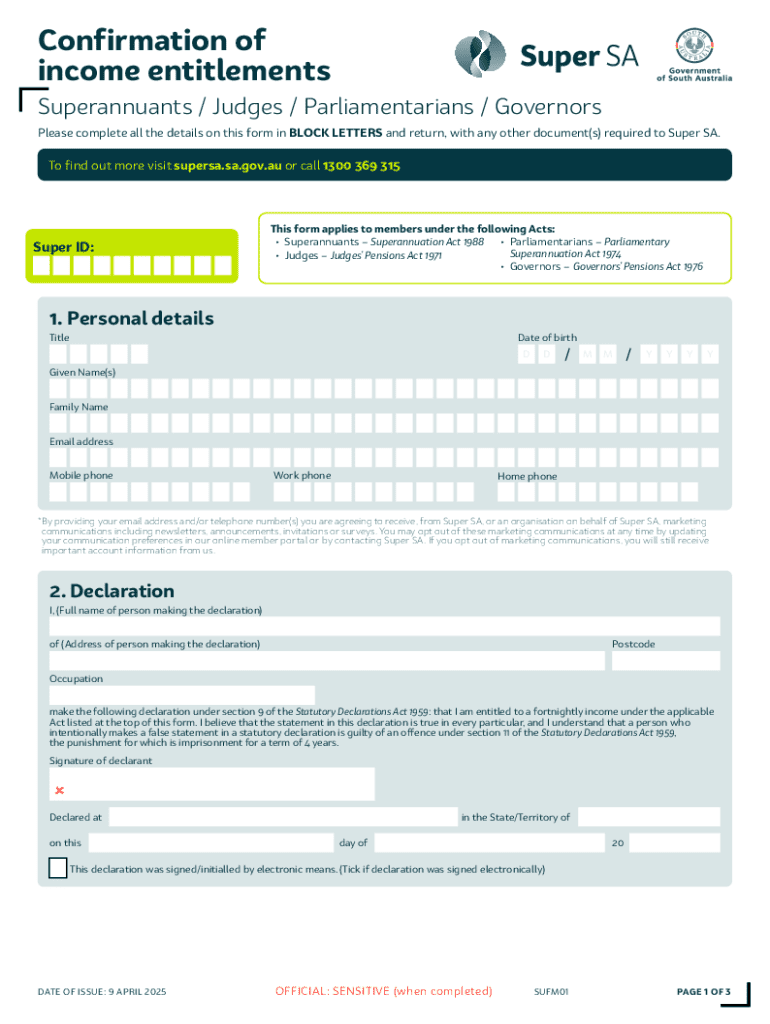

Understanding the Confirmation of Income Entitlements Form

Understanding the confirmation of income entitlements form

The confirmation of income entitlements form serves as a vital tool for individuals and organizations aiming to verify income for various purposes. Primarily, it is used during financial transactions such as loan applications, rental agreements, and qualification for financial aid. Providing accurate income verification can significantly influence the success of these requests, ensuring that all parties have a clear understanding of the financial capabilities involved.

For individuals, this form is usually required during major life events—like applying for a mortgage or financial aid for education. Organizations, too, utilize this form to establish income for potential employees or clients, playing a crucial role in the hiring process and contract negotiations.

Detailed breakdown of the confirmation of income entitlements form

The confirmation of income entitlements form features several sections, each designed to gather specific information that establishes a clear picture of the applicant's financial situation. Understanding each section can help ensure that the form is filled out correctly.

The form typically consists of the following sections:

While filling out the form, common mistakes can often derail the application process. Applicants should be careful not to overlook required fields, as these omissions can lead to delays or rejections. Additionally, misreporting income details, such as inflating or understating income, can affect the outcomes adversely.

Step-by-step guide to filling out the form

Filling out the confirmation of income entitlements form requires careful preparation and attention to detail. Here’s a structured approach to ensure accuracy and completeness.

Editing and managing your confirmation of income entitlements form with pdfFiller

pdfFiller provides a robust platform for managing PDF documents, making it easier to edit and collaborate on your confirmation of income entitlements form. Utilizing its tools can streamline the process significantly.

Here’s a look at some features of pdfFiller that stand out:

Additionally, pdfFiller enables tracking changes and collaborating with others. You can leave comments or feedback for team members, making it easy to refine the form collectively before final submission.

Signing the form electronically

The legal validity of eSigning documents is widely recognized, making it crucial for your confirmation of income entitlements form. An electronic signature not only saves time but also ensures a secure way to finalize your submission.

Here’s how to use pdfFiller for signing your document effectively:

Managing income verification requests

Submitting your confirmation of income entitlements form can be done through various methods, such as online, via email, or physically mailing the document. The choice depends on the requirements of the institution requesting the verification.

The submission should align with the regulatory requirements specific to different scenarios. Additionally, tracking the status of your submission can alleviate any concerns about waiting for a response.

Frequently asked questions (FAQs)

Navigating the confirmation of income entitlements form can raise several questions. Here are answers to some common queries applicants may have.

Additional considerations

When handling financial documents like the confirmation of income entitlements form, data privacy and security must be top priorities. Utilizing platforms like pdfFiller, well-regarded for its security features, helps protect sensitive information.

Understanding the role this document plays in loan applications and financial aid is also crucial, as many financial institutions depend on it to establish acceptance criteria. The clarity and accuracy of the income verification can significantly influence decision-making processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send confirmation of income entitlements for eSignature?

How do I make changes in confirmation of income entitlements?

How can I edit confirmation of income entitlements on a smartphone?

What is confirmation of income entitlements?

Who is required to file confirmation of income entitlements?

How to fill out confirmation of income entitlements?

What is the purpose of confirmation of income entitlements?

What information must be reported on confirmation of income entitlements?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.