Get the free Nab Dual Currency Investment

Get, Create, Make and Sign nab dual currency investment

How to edit nab dual currency investment online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nab dual currency investment

How to fill out nab dual currency investment

Who needs nab dual currency investment?

Understanding the NAB Dual Currency Investment Form

Overview of NAB Dual Currency Investment

NAB's Dual Currency Investment is a financial product designed to allow investors to earn returns based on the fluctuations of two currencies. This type of investment can be especially attractive in the volatile currency markets, where potential returns can outpace traditional fixed-income products.

In essence, a Dual Currency Investment involves investing a specified sum in one currency while having the option to receive returns in another currency, depending on predefined conditions related to exchange rates. According to financial experts, the benefits of this product include potentially higher returns, particularly when investors are knowledgeable about currency movements.

However, it's crucial to be aware of the risks involved, particularly exchange rate fluctuations that may lead to a lower return than initially anticipated or even a loss of principal for certain investments. This duality of risk and reward is essential to understand before engaging in such an investment.

NAB's offering in this sector involves unique features, including various currency options, competitive interest rates, and personalized support from investment advisors, making it an appealing option for both seasoned investors and those new to currency investments.

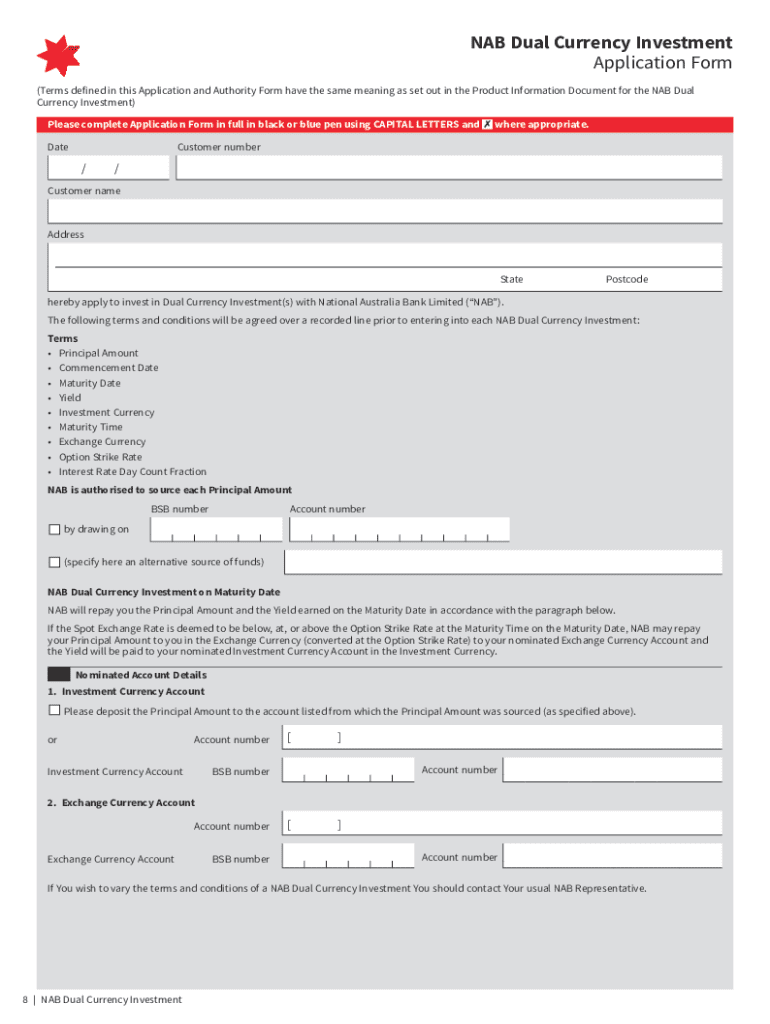

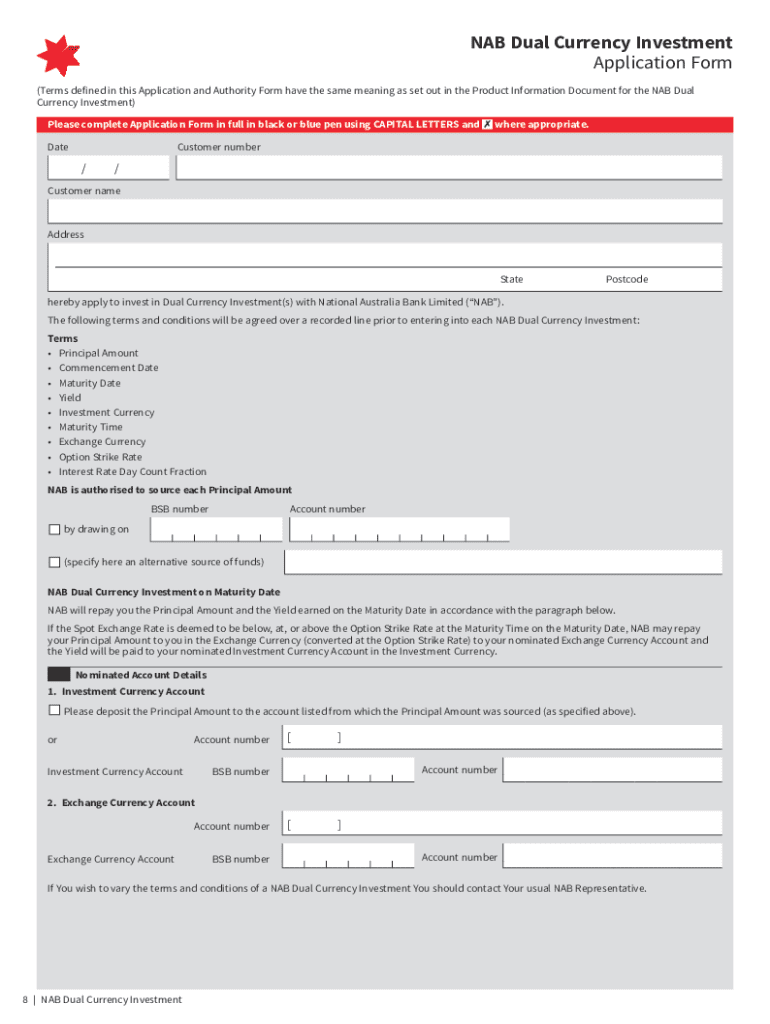

Understanding the NAB Dual Currency Investment Form

The NAB Dual Currency Investment Form serves as the official document for initiating your investment. It plays a vital role not only in recording your investment intentions but also in ensuring compliance with regulatory obligations. When you fill out this form, you set the stage for defining your investment parameters and preferences.

The importance of this form extends beyond mere paperwork; it acts as a contract between you and NAB, outlining terms, conditions, and the specifics of your chosen investments.

Additionally, the form outlines common terms and conditions, including fee structures you need to be aware of as well as any lock-in periods associated with your investments. Understanding these terms is crucial to managing your investment effectively.

Step-by-step instructions for completing the NAB Dual Currency Investment Form

Before diving into filling out the NAB Dual Currency Investment Form, preparation is key. Gather necessary documents like identification, proof of address, and any financial statements that outline your investment capacity. A clear understanding of your investment goals—whether for income generation or growth—will guide your currency selection and investment options.

When filling in your personal information, ensure accuracy. Pay close attention to the specific fields to avoid common pitfalls such as typos or incorrect information that could delay processing.

As for selecting investment options, carefully consider the currencies available for investment. Each currency has unique implications, from risk exposure to expected returns, so it’s advisable to consult with a financial advisor if you are uncertain.

Once you've filled out the form, engage in a thorough review and verification process. Cross-check all entries and validate that everything complies with NAB's policies before finalizing your submission. This will help mitigate the risk of errors that could affect your investment outcomes.

Utilizing pdfFiller for the NAB Dual Currency Investment Form

pdfFiller presents an efficient way to manage your NAB Dual Currency Investment Form. By using this cloud-based platform, you can easily access your documents from anywhere, ensuring that your investment process is as seamless as possible.

The interactive features of pdfFiller make editing a breeze. With easy drag-and-drop functionality, users can fill out their forms with precision, while eSignature capabilities facilitate quick and secure submissions.

This digital approach not only saves time but also enhances your overall investment management experience with easy document tracking and fewer chances for errors.

Frequently asked questions (FAQs) about the NAB Dual Currency Investment Form

Mistakes happen, and if you find yourself in a situation where you've made an error on the NAB Dual Currency Investment Form, it’s crucial to address it quickly. Begin by contacting NAB support to understand the process for rectifying mistakes, which may include submitting a new form.

Processing times can vary depending on several factors, but typically you can expect your investment to be processed within a few business days. After submission, many investors wonder if they can change their chosen currency; generally, this is not allowed after submission, making careful selection imperative.

NAB provides various support channels for customers who may have questions regarding the Dual Currency Investment Form. These include phone support, online chat, and in-branch assistance, catering to different preferences for communication.

Additional considerations after submission

Once you've submitted your NAB Dual Currency Investment Form, tracking the status of your investment is important. Users can frequently check their investment status via NAB's online banking or dedicated investment portal, keeping them informed about any changes or developments.

It's also essential to remain compliant and actively manage your investment. Expect to receive regular updates, including reports and statements, that will help you monitor performance. Should your investment strategy require adjustments, make sure to communicate with your NAB representative for appropriate guidance.

Closing thought

As you navigate the complexities of your NAB Dual Currency Investment Form, utilizing tools like pdfFiller enhances the entire process. The platform empowers users to seamlessly edit, eSign, and collaborate on documents, ensuring a structured approach to managing investments effectively. By streamlining these processes, pdfFiller ultimately improves your overall investment experience with NAB.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in nab dual currency investment without leaving Chrome?

Can I create an electronic signature for the nab dual currency investment in Chrome?

Can I edit nab dual currency investment on an iOS device?

What is nab dual currency investment?

Who is required to file nab dual currency investment?

How to fill out nab dual currency investment?

What is the purpose of nab dual currency investment?

What information must be reported on nab dual currency investment?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.