Get the free Form 10-k

Get, Create, Make and Sign form 10-k

How to edit form 10-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-k

How to fill out form 10-k

Who needs form 10-k?

Comprehensive Guide to Form 10-K: Understanding and Navigating the SEC Filing

Understanding Form 10-K

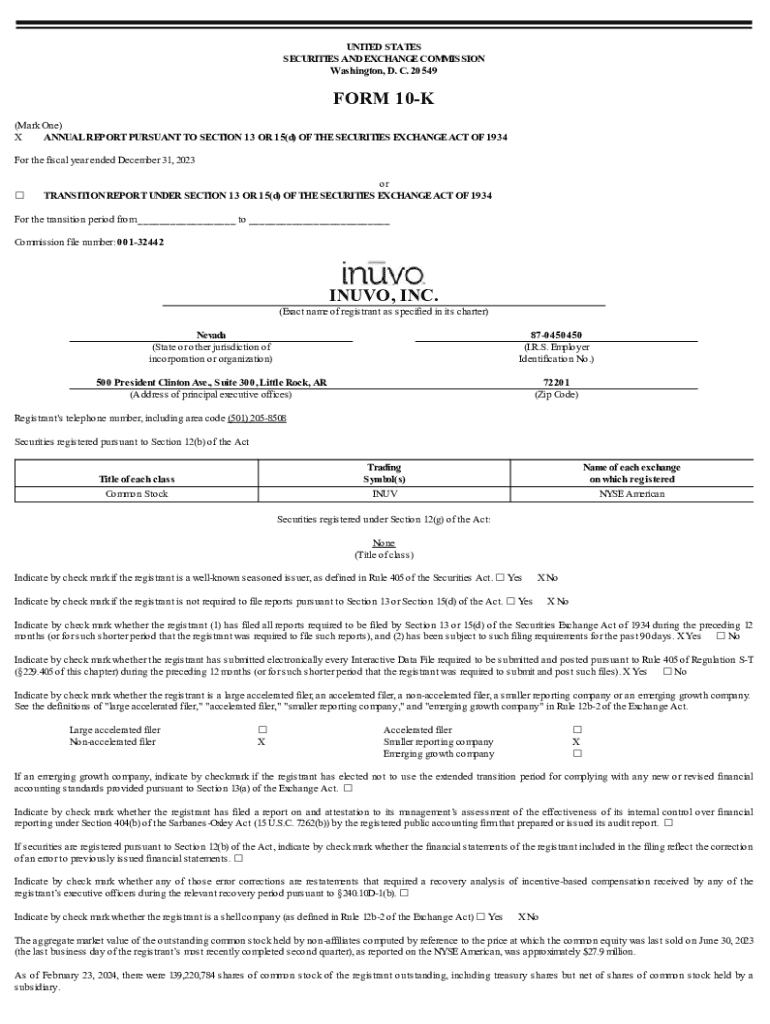

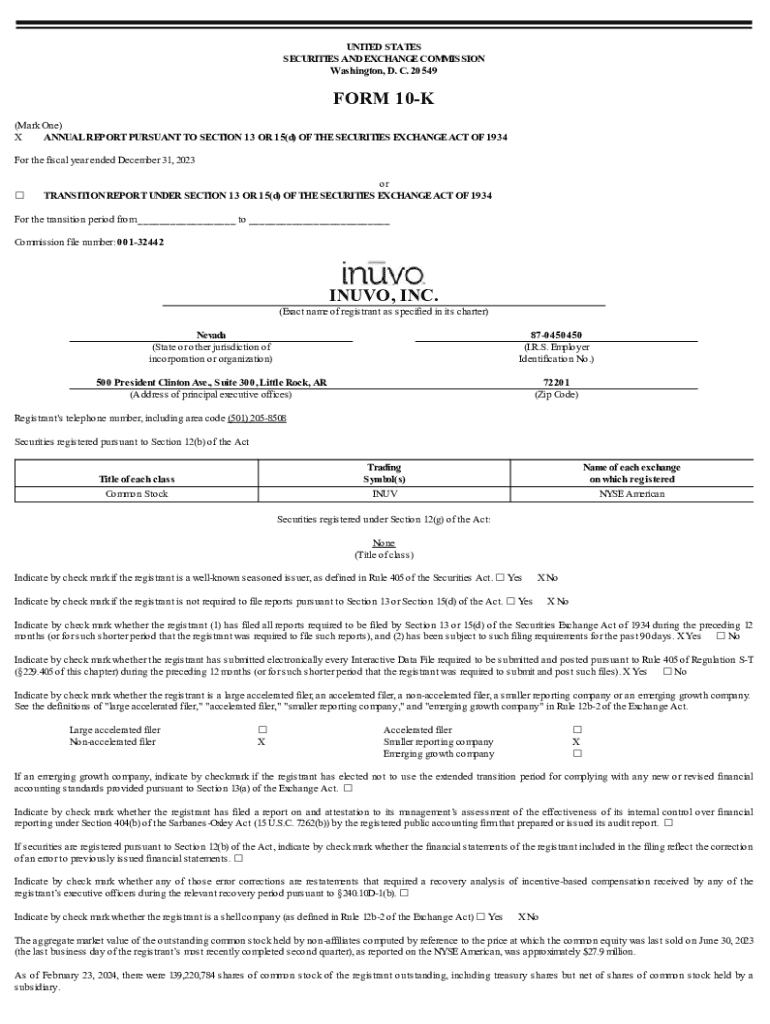

Form 10-K is a comprehensive report filed annually by publicly traded companies from the SEC (Securities and Exchange Commission). The purpose of this document is to provide a detailed overview of the company's financial performance and overall business condition, allowing investors and shareholders to make informed decisions. The insights found in a 10-K are beyond just numbers; they encapsulate the company's narrative, strategic direction, and potential risks, making it a crucial tool for stakeholders.

The significance of the Form 10-K cannot be overstated. It serves not only as a regulatory requirement but also as a powerful communication tool that illustrates transparency and accountability in financial reporting. Investors analyze Form 10-K to assess a company’s viability and future prospects, which plays a key role in investment strategies and portfolio management.

Key components of a Form 10-K

A standard Form 10-K encompasses several key components that give a thorough overview of a company’s operations, finances, and risk factors. These are structured to provide clarity and depth, making it easier for readers to navigate. The main sections of the 10-K include the Business Overview, Risk Factors, Financial Statements, and Management Discussion and Analysis.

Navigating the contents of Form 10-K

To fully leverage the information presented in Form 10-K, it's essential to navigate its detailed contents effectively. The form typically begins with Item 1, where the business overview is succinctly presented, followed by a frank assessment of risk factors in Item 1A. This section outlines significant risks such as economic conditions, competition, and regulatory changes that may impact financial performance.

Item 7 delves into Management's Discussion and Analysis (MD&A), which provides crucial context surrounding financial results. This commentary helps investors understand performance trends, operational issues, and forward-looking statements. For example, management may discuss shifts in market demand that influenced revenue growth or fluctuations influenced by global supply chain challenges.

Filing requirements and deadlines

Every U.S. public company must file a Form 10-K with the SEC after the end of their fiscal year. The submission deadlines vary depending on the company’s public float. For large accelerated filers, the Form 10-K is due 60 days after the close of the fiscal year, while for accelerated filers, the deadline is 75 days. All other reporting companies have 90 days for their submission.

Understanding these deadlines is essential for compliance and helps avoid potential penalties. Furthermore, not all companies are required to file a 10-K; only public companies that are registered with the SEC need to do so. This includes corporations traded on major stock exchanges, hence establishing the foundation for investor protection.

How to prepare your Form 10-K

Preparing a Form 10-K requires meticulous preparation and collaboration among various departments within a company. The initial step is gathering accurate financial data, ensuring all numbers reconcile with actuals reported throughout the year. Input from various segments including finance, legal, and operations is essential to provide a holistic view of the company's condition.

Drafting the business overview and MD&A sections requires a keen understanding of not just financials but also the company’s strategic objectives. Here are some practical steps to create an accurate Form 10-K:

Analyzing a Form 10-K

Analyzing Form 10-K requires a keen eye for detail and an understanding of financial metrics that matter. Key performance indicators such as revenue and expenses must be scrutinized for trends. Investors look for growth patterns, profitability margins, and operational efficiency—metrics that can serve as signals for investment viability.

Another critical aspect involves examining the risk factor disclosures, as they provide insight into the potential drawbacks to consider before making any financial commitments. Management discussions and forecasts contained in the MD&A section should be carefully analyzed to understand management’s outlook and the strategies they plan to implement.

Related forms and filing comparisons

Form 10-K is one of several key filings required by the SEC, each designed to serve different purposes. For instance, while Form 10-K is an annual report, Form 10-Q is a quarterly report that provides updates on the company’s financial performance and operations within each quarter. On the other hand, Form 8-K must be filed to report significant events that may affect the company, such as acquisition news or changes in leadership.

Understanding when to utilize each form ensures proper compliance and communication with stakeholders. Additionally, leveraging other financial reports alongside the 10-K can paint a more comprehensive picture of the company’s operations and financial health. Consistently reviewing these forms collectively can inform better decision-making.

Leveraging pdfFiller for Form 10-K management

pdfFiller provides a versatile platform for creating, editing, and managing Form 10-K and other SEC filings seamlessly. The cloud-based solution allows all team members to collaborate in real-time, ensuring that contributions can be made regardless of location. This enhances the efficiency and accuracy of your filing process, ultimately leading to better compliance and reporting outcomes.

With pdfFiller, users can easily navigate through forms, make necessary edits, and securely eSign documents. The platform offers a host of features designed for ease of use, helping to streamline all aspects of document management. Tools like interactive templates and cloud storage mean you spend less time managing forms and more time focused on critical financial analysis.

Resources for further learning

Further enhancing your understanding of Form 10-K can be achieved through additional resources such as webinars and training sessions. These tools can help you acquire advanced skills in financial analysis and reporting, ensuring that you stay ahead in compliance and strategic business decisions.

Furthermore, creating a free account on pdfFiller unlocks access to exclusive templates and tools that can simplify your filing requirements. This includes templates specifically designed for Form 10-K, enhancing efficiency and accuracy. Exploring advanced financial modeling will also provide valuable insights into analyzing and integrating financial reports effectively.

FAQs on Form 10-K

As you navigate the complexities of Form 10-K, common questions often arise among users. Understanding its significance, who must file, and the key components can clear up confusion and help streamline the filing and analysis process. Numerous resources are available to provide clarification on such topics.

Moreover, studying case studies of successful Form 10-K filings can provide valuable insights. Observing well-prepared filings can reveal best practices, particular attention to detail, and innovative ways of presenting financial data. Learning from others’ successes empowers future filings with improved clarity and accuracy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form 10-k in Gmail?

How do I edit form 10-k online?

How can I edit form 10-k on a smartphone?

What is form 10-k?

Who is required to file form 10-k?

How to fill out form 10-k?

What is the purpose of form 10-k?

What information must be reported on form 10-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.