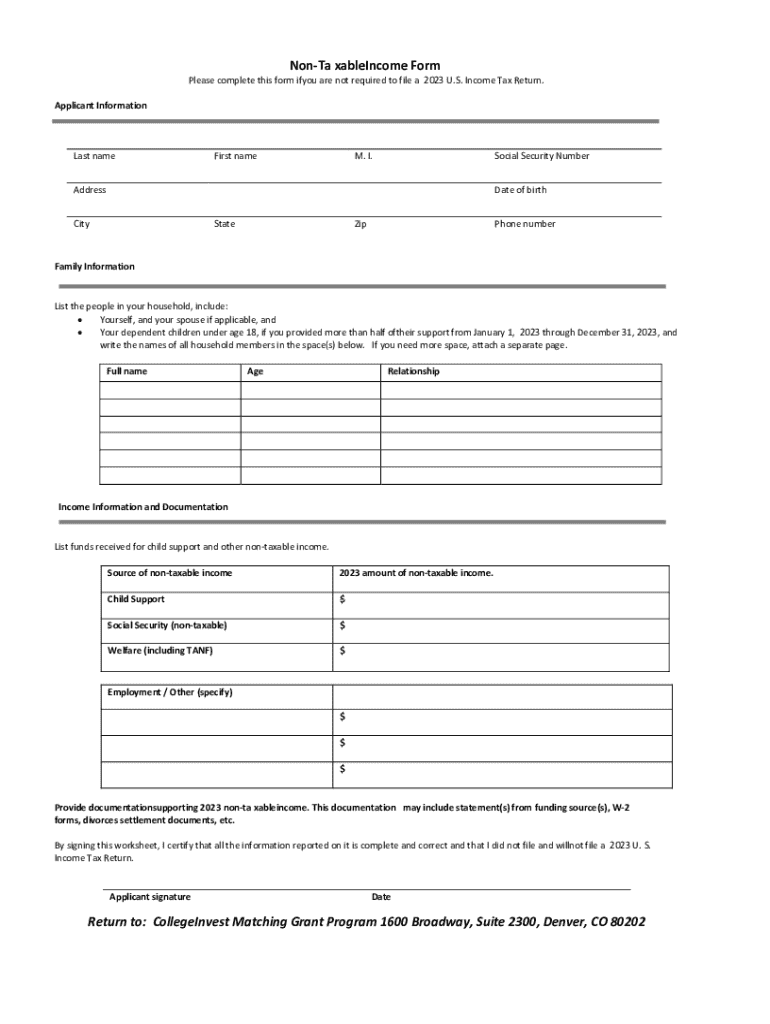

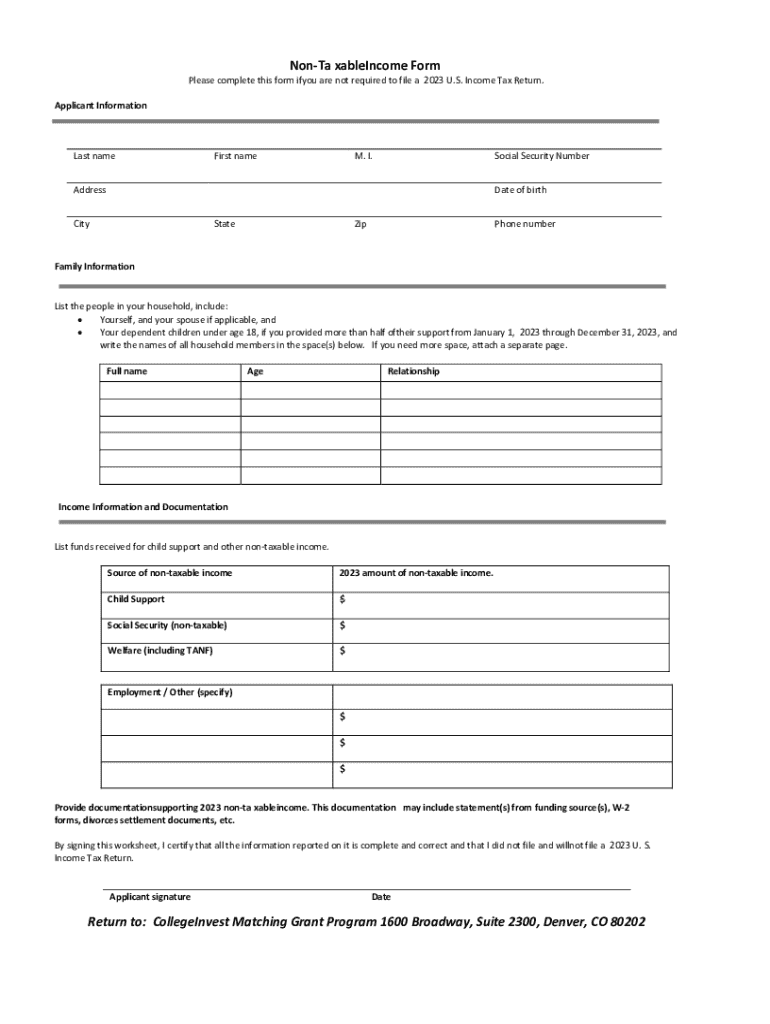

Get the free Non-taxable Income Form

Get, Create, Make and Sign non-taxable income form

Editing non-taxable income form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out non-taxable income form

How to fill out non-taxable income form

Who needs non-taxable income form?

A Comprehensive Guide to Non-Taxable Income Form

Understanding non-taxable income

Non-taxable income refers to income that is not subject to taxation. This type of income is crucial for individuals and teams as it can have significant effects on overall financial planning and tax obligations. Understanding what counts as non-taxable income can help you manage resources more effectively.

Several types of income fall under this category, including:

Identifying non-taxable income is vital in financial planning since it helps individuals strategize their income and understand their taxable status more conclusively.

Common non-taxable income forms

When reporting non-taxable income, certain forms are often essential. The IRS Form 1040, for instance, requires a comprehensive overview of your income sources, including both taxable and non-taxable income.

Supporting documentation is equally important. This includes:

You can access and download these forms from the IRS website or through reliable tax preparation software. Many online platforms also offer interactive tools to help assess income types distinctly.

How to determine your non-taxable income

Determining which of your income sources are non-taxable requires meticulous evaluation. It first involves examining the various sources of your income to identify what fits the criteria. Legal guidelines can help clarify designated non-taxable statuses as well.

Here are systematic steps to evaluate your income:

This approach ensures that you accurately categorize your income, allowing for a more effective tax strategy.

Documenting non-taxable income

To substantiate claims of non-taxable income, necessary documentation must be prepared. Income verification letters, as well as tax returns and additional records, provide essential proof for tax authorities.

Organizing evidence can become tedious without effective strategies. Here are some tips for replicating order:

Effective documentation proves crucial during tax filing, ensuring that all claims of non-taxable income are legitimate and well-supported.

The tax treatment of non-taxable income

Non-taxable income does not reduce your taxable income. However, it does have implications on your overall tax strategy. Understanding these implications helps in future tax planning.

Misunderstandings about how to handle non-taxable income can lead to errors. Some common misconceptions include:

Clarifying these misconceptions is an essential part of effective tax preparation.

Special cases: non-taxable income scenarios

Certain situations present unique challenges regarding non-taxable income classification. For instance, scholarships and grants awarded for education may not incur taxes, depending on their use.

Compensation for injuries or sickness is generally non-taxable. Additionally, if you've been working abroad, the treatment of income can vary based on tax treaties.

Consider a case study: windfall gains, such as lottery winnings that may be partially exempt from state taxes. Understanding these unique scenarios requires careful evaluation of individual cases.

Filling out the non-taxable income form

Completing the non-taxable income form involves careful attention to detail. By systematically breaking down the form section by section, you can avoid frequent pitfalls.

Here’s a step-by-step guide to help you through the form:

Using tools like pdfFiller can help edit and store your forms seamlessly.

Collaborating with financial advisors

Securing wisdom from financial advisors may be beneficial when faced with complicated questions regarding non-taxable income. A professional's guidance can simplify intricate tax laws.

Effective communication with tax professionals involves sharing complete documentation and being transparent about all income sources. Make sure you utilize platforms like pdfFiller for secure document sharing.

Staying compliant with tax regulations

Complying with tax regulations requires understanding common reporting mistakes. Errors can lead to unforeseen penalties during audits.

Avoiding common pitfalls includes:

Stay updated on changes to tax laws through the IRS website and follow consistent updates using reliable tax news sources.

FAQs about non-taxable income and tax forms

Understanding the nuances of non-taxable income can lead to many questions. Here are some frequently asked queries:

Interactive features for document management

Using digital tools for document creation can streamline processes, making it easier for individuals and teams to manage non-taxable income forms.

Platforms like pdfFiller offer cloud-based features that can enhance your document management experience. Consider the following benefits:

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit non-taxable income form from Google Drive?

Can I create an eSignature for the non-taxable income form in Gmail?

How can I fill out non-taxable income form on an iOS device?

What is non-taxable income form?

Who is required to file non-taxable income form?

How to fill out non-taxable income form?

What is the purpose of non-taxable income form?

What information must be reported on non-taxable income form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.