Get the free Business Debt Schedule

Show details

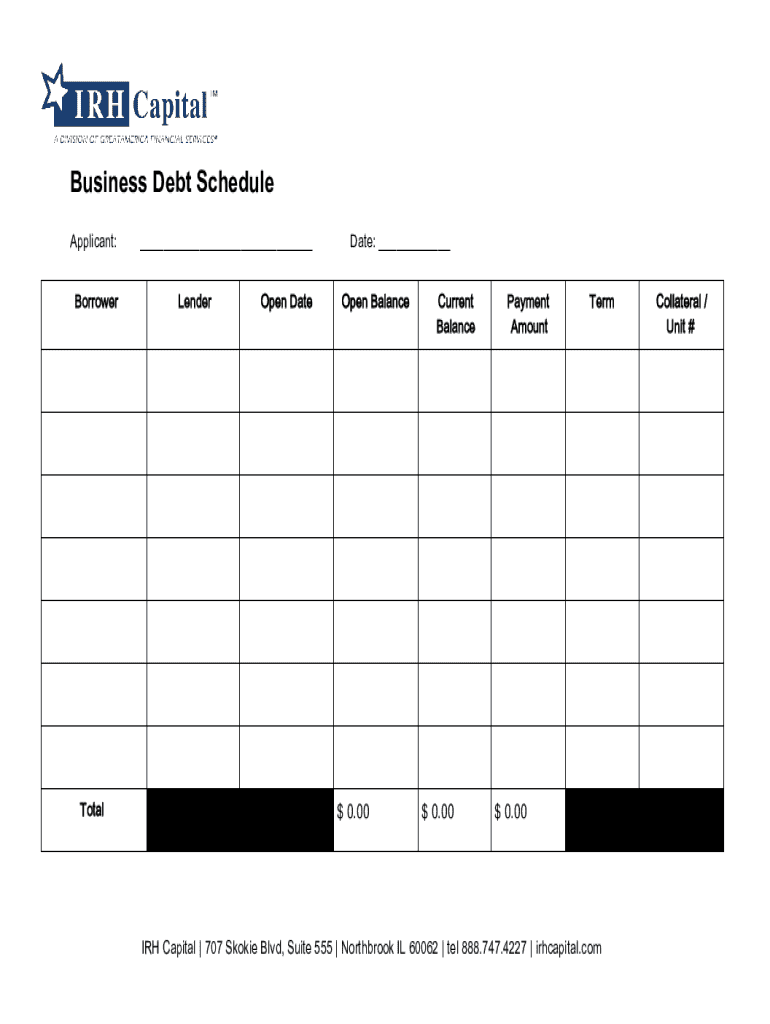

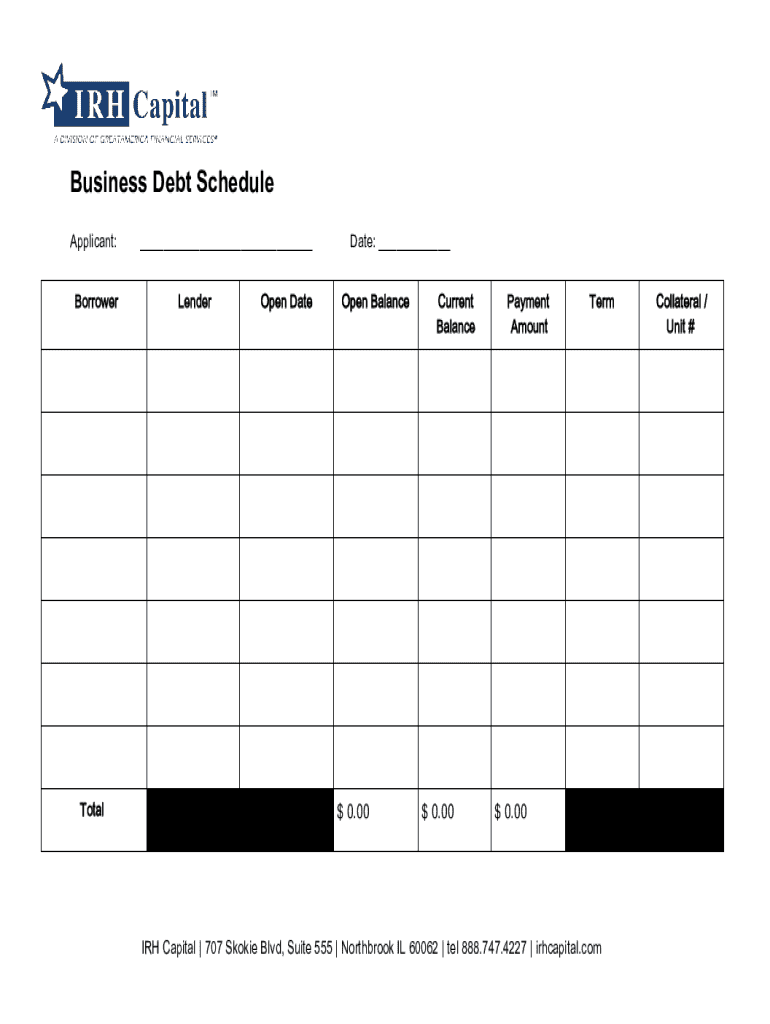

A document used to outline the details of business debt including lender information, open date, balance, payment amount, and related collateral.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business debt schedule

Edit your business debt schedule form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business debt schedule form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing business debt schedule online

To use our professional PDF editor, follow these steps:

1

Sign into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit business debt schedule. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business debt schedule

How to fill out business debt schedule

01

Gather all relevant financial documents, including loan agreements and credit card statements.

02

List each debt separately, including the creditor's name, type of debt, and account number.

03

Document the total amount owed for each debt.

04

Specify the interest rate for each debt to understand the cost of borrowing.

05

Note the minimum monthly payment required for each debt.

06

Specify the maturity date or due date for each debt to track payment schedules.

07

Add sections for any collateral tied to secured debts.

08

Regularly update the schedule to reflect payments made or new debts incurred.

Who needs business debt schedule?

01

Business owners looking to manage their company's debt effectively.

02

Financial analysts assessing the financial health of a business.

03

Investors interested in evaluating the risk associated with a business's debt.

04

Lenders who need to understand a borrower's current debt obligations before approving new financing.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit business debt schedule from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your business debt schedule into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I complete business debt schedule online?

Filling out and eSigning business debt schedule is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I edit business debt schedule on an Android device?

You can edit, sign, and distribute business debt schedule on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is business debt schedule?

A business debt schedule is a detailed record of a business's liabilities and debts, including terms, interest rates, and repayment schedules.

Who is required to file business debt schedule?

Business debt schedules are typically required for businesses seeking loans, engaging in mergers, or preparing for tax filings, particularly for partnerships and corporations.

How to fill out business debt schedule?

To fill out a business debt schedule, list each debt item, including the creditor's name, outstanding balance, interest rate, payment terms, and payment frequency.

What is the purpose of business debt schedule?

The purpose of a business debt schedule is to provide a clear overview of a company's financial obligations, aiding in financial planning and management.

What information must be reported on business debt schedule?

Information required includes the creditor's name, loan amount, outstanding balance, interest rate, payment terms, and the payment schedule.

Fill out your business debt schedule online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Debt Schedule is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.