Get the free Form 10-q

Get, Create, Make and Sign form 10-q

Editing form 10-q online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-q

How to fill out form 10-q

Who needs form 10-q?

How to Fill Out Form 10-Q

Overview of Form 10-Q

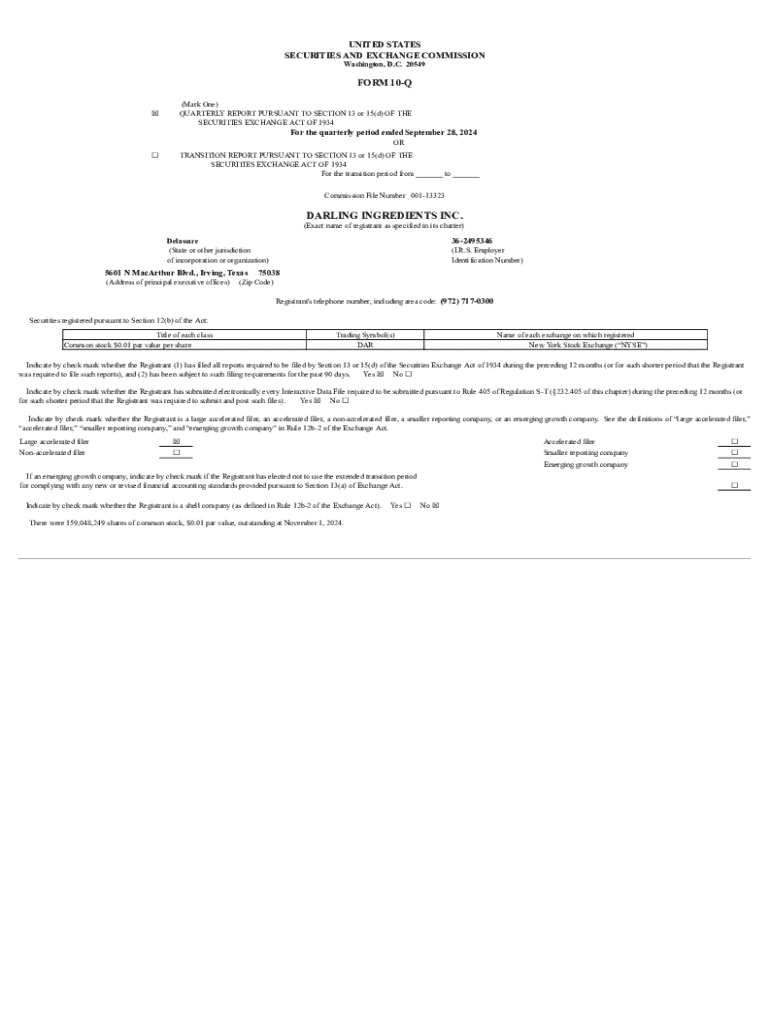

Form 10-Q is a comprehensive report that publicly traded companies in the U.S. must file with the Securities and Exchange Commission (SEC) on a quarterly basis. This document provides a snapshot of a company's financial performance, detailing revenue, expenses, and earnings over the most recent quarter. It's a crucial tool for maintaining transparency and compliance with federal regulations.

Understanding Form 10-Q is essential for stakeholders, investors, and analysts who rely on accurate and timely information to make informed decisions. While the annual Form 10-K provides a complete overview of the company's financial health for the year, the Form 10-Q includes important updates on the quarterly performance, giving a more frequent insight into the company's operations.

Purpose and key filing elements of Form 10-Q

The primary purpose of Form 10-Q is to ensure that investors have access to updated financial information about a company, enabling them to assess performance trends and make investment decisions. The filing must include three major components:

Who needs to file a Form 10-Q?

Essentially, any publicly traded company that operates in the U.S. is required to file Form 10-Q. This includes corporations, partnerships, and real estate investment trusts (REITs). Regularly filing Form 10-Q helps firms stay compliant with SEC regulations, while failure to do so can lead to severe penalties, including fines and loss of trading privileges. Thus, maintaining a consistent filing schedule is critical for all public companies.

Filing requirements for Form 10-Q

Companies are required to submit their Form 10-Q within 40 to 45 days after the end of each fiscal quarter, depending on their size. Smaller reporting companies, for instance, have a slightly extended deadline of 45 days. The filing must include:

Submissions for Form 10-Q are done electronically through the SEC’s EDGAR database, which allows public access to filings, supporting transparency and investor confidence.

Structure of Form 10-Q

A typical Form 10-Q comprises several essential sections:

How to access and obtain Form 10-Q

Finding existing Form 10-Q filings is simple with the SEC's EDGAR database. To locate a specific company's Form 10-Q:

This ensures that anyone interested can access key information needed for analysis and decision-making.

Completing Form 10-Q: step-by-step instructions

Completing Form 10-Q can seem daunting, but following these steps will simplify the process:

Common challenges when filling out Form 10-Q

Though filing Form 10-Q is a standard process, several challenges may arise. Misinterpretation of required information can lead to incomplete filings or inaccuracies. Companies must also ensure the accuracy of their financial data, which can sometimes be complicated. Furthermore, managing timelines effectively is crucial as deadlines loom, placing pressure on financial teams.

To mitigate these challenges, firms can implement rigorous internal checks and schedule regular updates throughout the quarter. This proactive approach can enhance the accuracy and timeliness of the filing.

Best practices for filing Form 10-Q

Establishing best practices can streamline the filing process and enhance the quality of disclosures. To do so, consider the following strategies:

These practices promote not just compliance but also help in building trust with stakeholders through transparency.

Pro tips for managing Form 10-Q compliance

Managing filings for Form 10-Q requires collaboration and organization. Here are pro tips to enhance compliance management:

Embracing these practices will help streamline the filing process and reduce the risk of errors.

FAQs about Form 10-Q

With so many intricacies associated with Form 10-Q, common queries often arise. Here are some frequently asked questions:

Trends and changes in Form 10-Q reporting

The landscape of Form 10-Q reporting is constantly evolving, influenced by regulatory changes and technological advancements. Recent updates from the SEC include efforts to streamline reporting requirements and reduce compliance burdens, particularly for smaller companies. This shift emphasizes a focus on materiality, allowing companies to report only the most relevant financial information.

Technology also plays a crucial role in these changes. Enhanced data analytics and automation tools are becoming more prevalent, allowing for more efficient data collection and reporting processes. In the future, the trend is likely to continue moving towards digital formats and real-time reporting, changing how companies view Form 10-Q compliance.

Engagement and support

Engaging with experts in the field can provide valuable insights and assistance during the filing process. Initiating conversations with legal advisors, accountants, and compliance officers can help clarify regulatory expectations and best practices. Additional support can be found through professional organizations and online communities focused on regulatory filings.

Interactive tools and resources

Utilizing tools like pdfFiller can significantly simplify the burdens associated with filling out Form 10-Q. By leveraging cloud technology, users can quickly edit, sign, and manage documents from anywhere. Accessing templates within pdfFiller can also provide users with a streamlined form that meets SEC requirements.

Staying connected

To remain informed about updates to regulatory requirements, it is beneficial to subscribe to newsletters, forums, or industry publications focused on SEC filings. Networking opportunities available at conferences or webinars can also provide insights and updates relevant to Form 10-Q and overall financial compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 10-q for eSignature?

Can I create an eSignature for the form 10-q in Gmail?

How do I edit form 10-q straight from my smartphone?

What is form 10-q?

Who is required to file form 10-q?

How to fill out form 10-q?

What is the purpose of form 10-q?

What information must be reported on form 10-q?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.