Get the free Technical consultation - Inheritance Tax on pensions

Get, Create, Make and Sign technical consultation - inheritance

Editing technical consultation - inheritance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out technical consultation - inheritance

How to fill out technical consultation - inheritance

Who needs technical consultation - inheritance?

Technical Consultation - Inheritance Form: A Comprehensive Guide

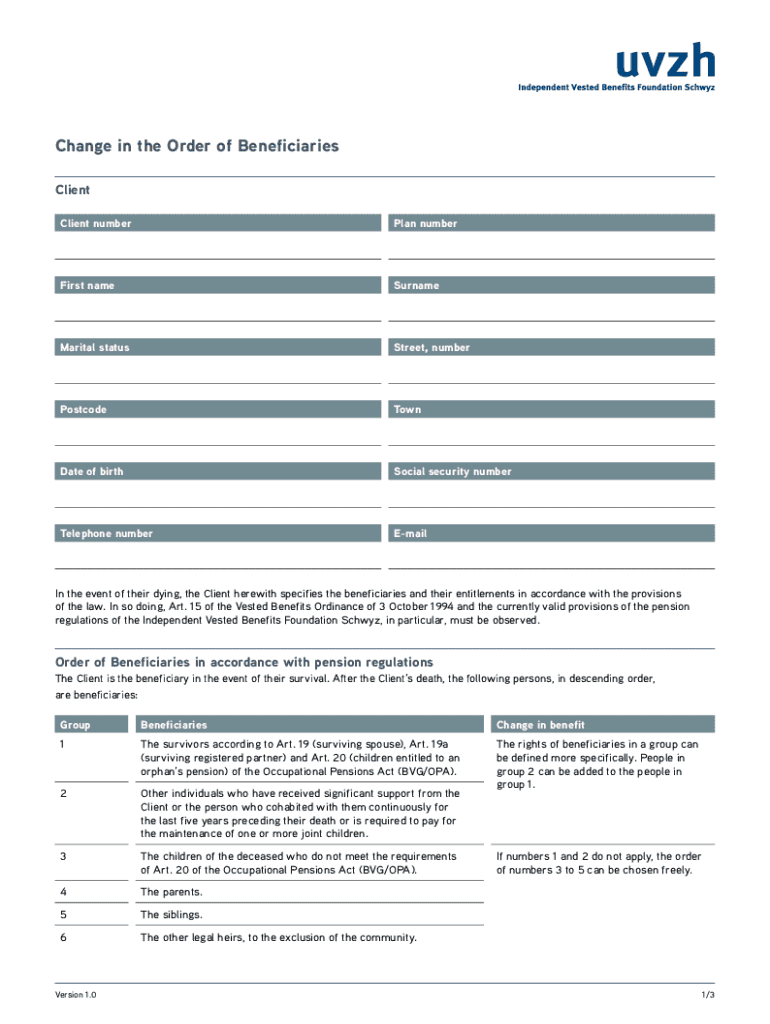

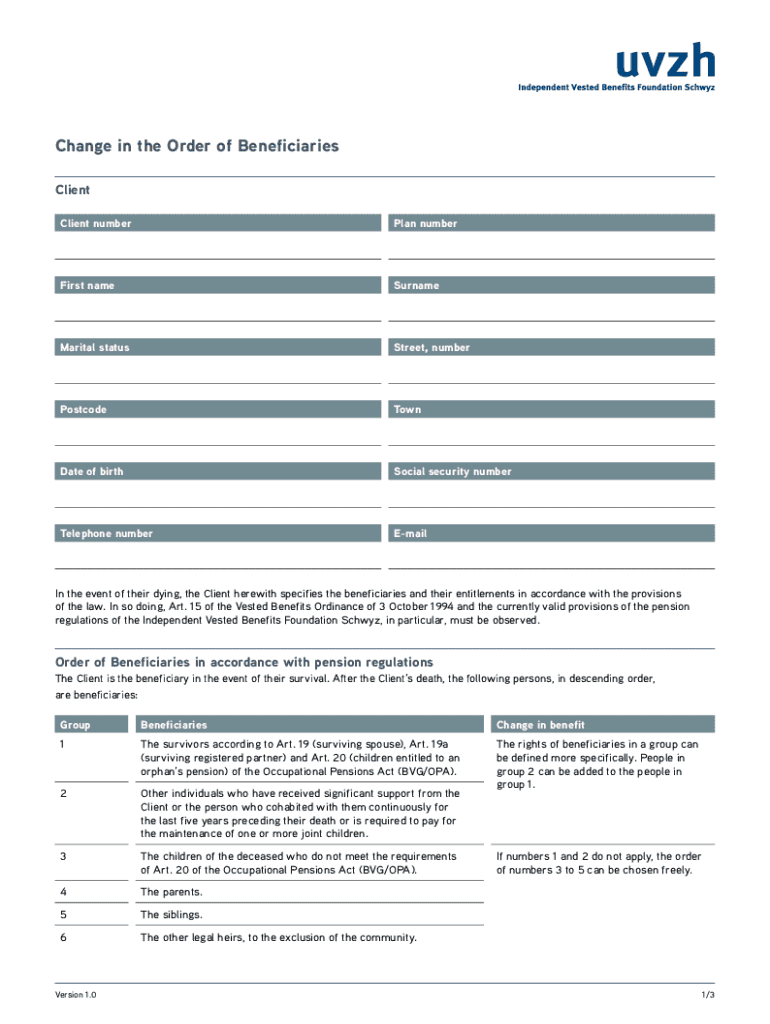

Understanding the inheritance form

An inheritance form is a crucial document used in legal contexts to formally declare the distribution of an individual’s estate after their passing. This form outlines the assets, liabilities, and beneficiaries involved, ensuring that everything is documented and compliant with the law. Typically, it serves a dual purpose: it's both a functional vehicle for transmitting wealth and a legal safeguard against disputes among heirs or interested parties.

The importance of an inheritance form transcends individual families. For legal professionals and estate planners, having a standardized framework empowers them to efficiently process estates. It ensures clarity among all parties involved, providing essential legal protection and peace of mind, especially during emotionally turbulent times following a loss.

Key features of the inheritance form

The inheritance form is composed of several essential components that vary by jurisdiction and individual circumstances. Key information typically includes personal details of the deceased, a detailed listing of their assets (real estate, bank accounts, personal property), and liabilities (debts or taxes owed). Additionally, it specifies beneficiaries, detailing who receives what, thereby facilitating a smooth transition of ownership.

Depending on the complexity of the estate, inheritance forms can range from simple declarations to intricate documents that account for trusts, estate taxes, and special bequests. Organizations like pdfFiller offer templates tailored for these varying specifications, enabling users to select a simple form for straightforward estates or a complex one for multi-layered distributions.

Seamless editing and customization

Using pdfFiller, editing inheritance forms is straightforward. Users can easily upload their documents to the platform, where various tools allow for real-time adjustments. The interface is user-friendly, offering drag-and-drop functionality to seamlessly add, modify, or remove content. This adaptability ensures that individuals can quickly tailor the form to their needs without any technical hassle.

Customization options further enhance the utility of the inheritance form. By utilizing pre-designed sections common in estate planning, users can focus on unique aspects of their estate without beginning from scratch. For instance, including specific legal clauses or adjusting beneficiary designations can be done in just a few clicks, making it a versatile tool for any estate planner.

eSigning made easy

Incorporating electronic signatures into your inheritance form is not only simple but pivotal in today's digital age. With pdfFiller, users can easily add eSignatures that are legally recognized, significantly speeding up the processing of these documents. This convenience ensures that required parties—beneficiaries, executors, and witnesses—can sign the document remotely without hassle.

The benefits of eSigning include not just convenience, but also enhanced security. eSignatures reduce the risk of fraud, ensuring that the identity of signers is verified before document submission. For individuals or teams managing multiple inheritances, this feature becomes a valuable asset in enhancing the entire workflow, keeping every document in compliance and easily accessible.

Collaboration tools for teams

For teams working on inheritance forms, collaborative features are essential. pdfFiller allows multiple users to edit the same document simultaneously, making it easier for families and legal teams to reach consensus regarding asset distribution. Users can leave comments, track amendments, and maintain an organized version history, ensuring that everyone involved stays informed about changes.

The ability to collaborate effectively streamlines communication, reducing misunderstandings or disputes that may arise during the inheritance process. By having all relevant changes documented, each participant can revert or view past versions, creating a clear audit trail that is particularly useful in legal contexts.

Managing your inheritance document

Managing important documents like inheritance forms requires careful organization. Best practices for digital document management include using descriptive file names, consistent tagging, and organizing them into folders on cloud storage systems. This approach not only makes retrieval easier but also reinforces security; most reputable cloud storage providers offer encryption and regular backups.

Establishing a retention policy is equally important. Guidelines suggest retaining the inheritance form until one year after all related assets have been distributed or any potential disputes are resolved. This period is crucial to prevent any challenges to the will or distribution process. After this time, individuals can decide whether to archive or permanently delete the document, depending on their jurisdiction's requirements.

Troubleshooting common issues

While working with inheritance forms, common issues sometimes arise. For instance, users may struggle with formatting lorsqu filling out digital forms—such as fields not aligning or text disappearing. These often occur due to browser compatibility issues or interruptions during the upload process.

To resolve these common problems, consider checking browser settings, switching to a recommended browser, or clearing the cache. When dealing with signature concerns, double-check that all signers understand the eSigning process, including any required authentication steps. pdfFiller’s support and FAQ sections provide solutions to these issues, ensuring users have access to the assistance they need.

Legal considerations and compliance

Understanding the legal framework governing inheritance forms and estate distribution is vital for compliance. Each state has specific regulations regarding how these forms must be completed and filed. For instance, some jurisdictions require notarization of the inheritance form, while others may have different requirements based on the value of the estate.

Compliance with these laws mitigates the risk of disputes that often arise when documentation is insufficient or incorrect. Consulting with legal experts familiar with estate planning can help ensure that all forms meet local legal standards, thus avoiding future complications. Utilizing pdfFiller's robust documentation options can assist in meeting these requirements with updated templates reflecting the latest legal criteria.

Recent trends and changes in inheritance law

Keeping informed about recent trends and legislative changes concerning inheritance law is essential. For example, trends like digital inheritance—how assets held online are treated among beneficiaries—are becoming increasingly relevant. Digital assets might not be adequately addressed in older forms unless specific provisions are added, which is something pdfFiller enables users to do easily.

Additionally, tracking new legislation may define rights for various beneficiary categories, such as stepchildren or unmarried partners. Resources like legal seminars, blogs, and updates from estate planning organizations can be invaluable for stakeholders looking to keep their forms current and compliant.

Interactive tools and additional features on pdfFiller

pdfFiller provides advanced tools that elevate inheritance form management beyond standard editing. Features include form analytics, allowing users to understand who has accessed the document and when—crucial for ensuring that all parties are on track. Automated reminders can notify participants when it’s time to review or sign, minimizing delays typical in the inheritance process.

Utilizing these advanced functionalities not only enhances the overall experience but also increases the efficiency of estate management. As a result, users get a comprehensive, interactive approach to handling sensitive documents, ensuring peace of mind throughout the inheritance process.

Success stories and testimonials

Real-world applications of the inheritance form highlight its effectiveness in streamlining processes. Many users have reported significant time savings in drafting and finalizing legal documents. Testimonials often emphasize the ability to collaborate efficiently, with one team noting how pdfFiller's features helped them resolve family estate issues amicably and expediently.

Incorporating users' feedback, pdfFiller remains committed to enhancing user experience by integrating new features based on practical needs. By showcasing these real-life scenarios, potential users can appreciate how the inheritance form can transform their estate planning efforts.

Navigating complex scenarios

Handling complicated inheritance cases—those involving blended families, special trusts, or significant assets—requires tailored strategies. Each unique family dynamic presents its own challenges, so having a customizable inheritance form becomes crucial. Users must think critically about how assets will be split and consider the potential for disagreements.

Implementing specific provisions in the inheritance form that cater to these unique scenarios can alleviate future disputes. For example, clearly outlining how the trust operates for minor beneficiaries or detailing specific directions for personal property can prevent misunderstandings later. Utilizing pdfFiller’s customization can help frame these scenarios effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit technical consultation - inheritance from Google Drive?

Can I create an electronic signature for the technical consultation - inheritance in Chrome?

How do I complete technical consultation - inheritance on an Android device?

What is technical consultation - inheritance?

Who is required to file technical consultation - inheritance?

How to fill out technical consultation - inheritance?

What is the purpose of technical consultation - inheritance?

What information must be reported on technical consultation - inheritance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.