Get the free Brodie Building Key Loan

Get, Create, Make and Sign brodie building key loan

Editing brodie building key loan online

Uncompromising security for your PDF editing and eSignature needs

How to fill out brodie building key loan

How to fill out brodie building key loan

Who needs brodie building key loan?

Brodie Building Key Loan Form – How-to Guide Long-read

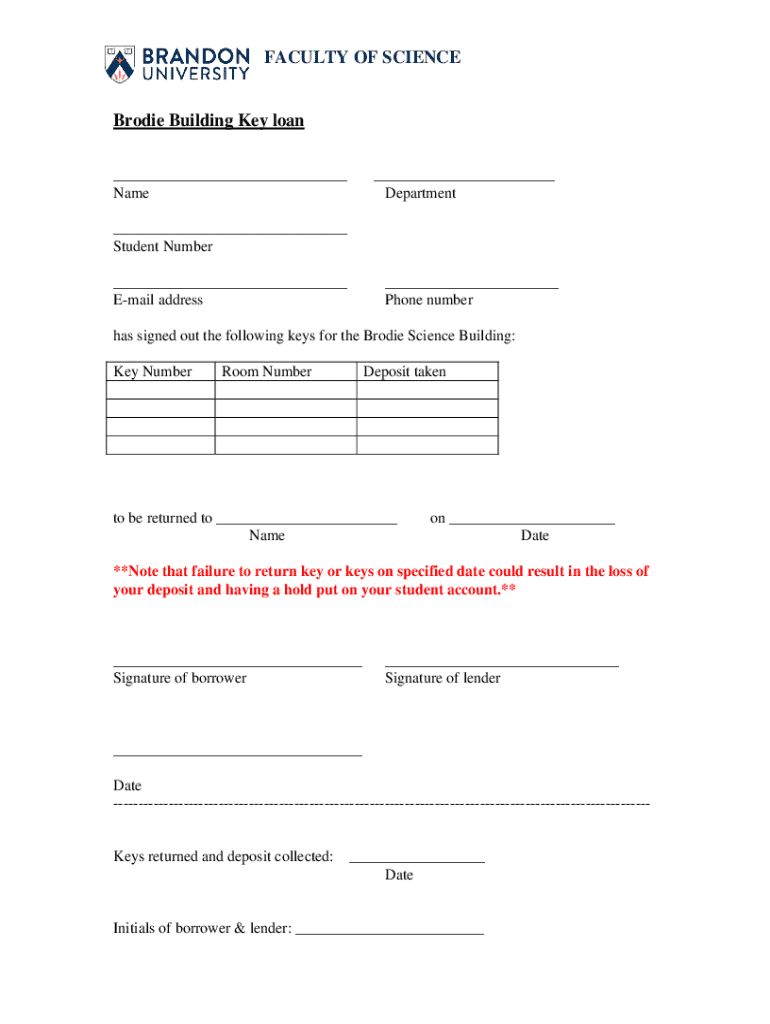

Understanding the Brodie Building Key Loan Form

The Brodie Building Key Loan Form serves as a crucial document for individuals and teams involved in securing loans for property within the Brodie Building and similar facilities. Its primary purpose is to streamline the borrowing process, ensuring that all parties are adequately informed of the terms and responsibilities associated with the loan. Understanding this form is essential for anyone looking to secure funding for property endeavors, as it lays out the foundational agreements and requirements necessary to move forward.

Those who need to use the Brodie Building Key Loan Form typically include potential property buyers, real estate developers, or financial agents representing these parties. This document acts not only as a request for financial support but also as a legal agreement outlining the responsibilities of the borrower and lender.

Key features of the loan form include sections dedicated to personal and financial information, a clear layout of loan terms, and signatures that confirm agreements. Each section plays a pivotal role in detailing responsibilities and ensuring transparency between involved parties.

Preparing to fill out the Brodie Building Key Loan Form

Before diving into filling out the Brodie Building Key Loan Form, it's crucial to gather all necessary information. This preparation phase is often overlooked but is vital for a smooth process. Required personal details typically include your full name, contact information, and identification, such as a driver's license or social security number. On the financial side, you may need to provide details regarding your income, employment status, and existing debts or loans. Ensuring you have this information on hand can save time and prevent errors during completion.

Understanding the eligibility criteria is another important step. Generally, financial institutions will require proof of stable income and a good credit score. Additionally, be mindful of common pitfalls, like omitting critical information or providing incorrect figures. Taking the time to double-check your data against official documents can make a significant difference in your application's acceptance.

Step-by-step guide to completing the Brodie Building Key Loan Form

Step 1: Accessing the loan form

To begin the process, access the Brodie Building Key Loan Form. This form is available online at pdfFiller, where users can log in or create an account to gain access to the form in a digital format. Alternatively, you might obtain a hard copy from the local real estate office if you prefer working with physical documents.

Step 2: Filling in personal information

Once you've accessed the form, start filling in your personal information. Accuracy is paramount here. Make sure to input your full name, current address, contact phone numbers, and necessary identification details without any errors. Taking the time to ensure accuracy prevents delays or misunderstandings later in the loan process.

Step 3: Providing financial details

The next section involves providing financial details, which can include your annual income, the source of that income, and any existing liabilities. Be meticulous in calculating your income, taking into account all sources (e.g., salary, investments). Avoid rounding figures too early in the form to maintain accuracy in your financial reporting.

Step 4: Confirming property information

Clearly describe the property in question in the dedicated section of the form. Include the address, property type, and any distinctive features that may impact the loan – such as recent renovations or appraised value. Providing an accurate property history is crucial in showcasing your property’s value and ensuring the lender understands the collateral involved.

Step 5: Review and edit

Once you’ve filled out all relevant sections, utilize pdfFiller's editing tools to review your form. Ensure that all fields are completed, and consider running a checklist against the form's requirements to catch any overlooked details. This is also an excellent time to share the document with others for input or approvals if necessary.

Signing and submitting the Brodie Building Key Loan Form

eSignature process

With your form completed, the next step is to sign it. Utilizing pdfFiller's eSignature tools allows you to easily sign documents online. Legal implications of signing electronically remain intact, however, it’s wise to familiarize yourself with electronic signature laws applicable in your jurisdiction to ensure compliance.

Submission guidelines

Lastly, submission guidelines are essential to follow. Completed forms can typically be submitted electronically through pdfFiller or emailed to the relevant financial institution. Always confirm submission policies specific to the institution you're dealing with. To facilitate tracking, pdfFiller offers status updates on submissions, making it easier to monitor the progress through various stages.

Managing and accessing your Brodie Building Key Loan Form

Storing your form in the cloud

After submission, have a plan for managing your Brodie Building Key Loan Form. Storing the document in pdfFiller's cloud offers several benefits including easy accessibility across devices. You can organize your documents into folders for easy retrieval, ensuring that vital paperwork is always close at hand, whether you’re in the office or on the go.

Collaboration features

pdfFiller also allows for collaboration, enabling you to share documents with team members. They can review, comment, or make revisions to the document before submission. These features come in handy during the loan process as collaborative input can often enhance the quality and accuracy of the completion.

Troubleshooting common issues with the Brodie Building Key Loan Form

Common errors to watch for

Common errors made when filling out the Brodie Building Key Loan Form can include incomplete sections, inaccurate financial information, or missed deadlines for submission. These mistakes can lead to delays in loan approval. A helpful tip is to create a checklist based on the form sections to ensure everything is filled out correctly.

Solutions for delayed approvals

If your submission is delayed, identify the issue immediately. Review the submission confirmation you received to ensure all documents are in order. If necessary, follow up with the lender to inquire about any outstanding requirements or additional documentation needed. Being proactive can often expedite the resolution process.

Contacting support

When in doubt, don't hesitate to contact pdfFiller's customer support. Their team can assist you with questions regarding the Brodie Building Key Loan Form and the platform at large, offering advice tailored to your situation and helping you ensure your form is accurately filled out and submitted.

Frequently asked questions about the Brodie Building Key Loan Form

As with any significant document, users tend to have questions regarding the Brodie Building Key Loan Form. Understanding common inquiries, such as what documents are required for submission or how long approvals typically take, can ease any concerns. Common questions also revolve around eligibility criteria, allowing you to ascertain whether you meet the necessary requirements.

Detailed answers to these inquiries can be found on the pdfFiller platform, where resources are available to guide you. Leveraging pdfFiller can simplify the entire process, offering clarity and organization so that completing the Brodie Building Key Loan Form becomes manageable.

Leveraging pdfFiller for all your document needs

Beyond just the Brodie Building Key Loan Form, pdfFiller provides a robust suite of PDF editing capabilities tailored to meet all your document management needs. Users can create, edit, and store documents seamlessly in a centralized, cloud-based platform. This makes revisiting previous submissions or developing new documents simple and user-friendly.

Collaboration becomes efficiently streamlined through pdfFiller. The platform allows easy sharing, feedback collection, and document revisions. Accessing your files from anywhere is also a key benefit of this cloud-based solution, offering you flexibility and peace of mind for all your document processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my brodie building key loan in Gmail?

How do I complete brodie building key loan online?

How do I edit brodie building key loan online?

What is brodie building key loan?

Who is required to file brodie building key loan?

How to fill out brodie building key loan?

What is the purpose of brodie building key loan?

What information must be reported on brodie building key loan?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.