Get the free Business Savings Application Form

Get, Create, Make and Sign business savings application form

How to edit business savings application form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business savings application form

How to fill out business savings application form

Who needs business savings application form?

Business Savings Application Form: A Comprehensive Guide

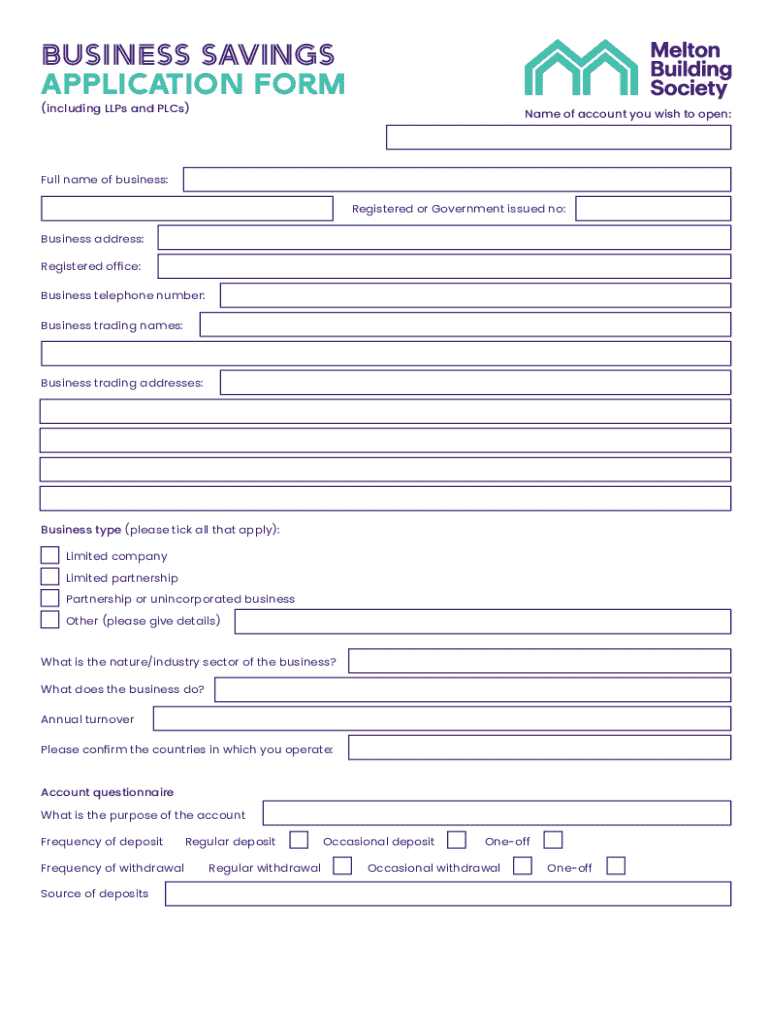

Understanding the business savings application form

A business savings application form is an essential document required by banks and financial institutions to open a dedicated savings account for a business. This form collects crucial information about the business and its owners, allowing the bank to assess the application’s legitimacy and financial viability. The primary goal of the form is to ensure that the financial institution complies with regulations while also understanding the needs of the business.

Having a dedicated business savings account offers multiple benefits, including clearer bookkeeping, improved cash flow management, and easier access to funding options. A business savings account not only helps in minimizing personal liability but also aids in building a financial history with the bank, which can be beneficial for future lending needs.

Preparing to fill out your business savings application form

Before diving into the application form, it's vital to gather all necessary documents and information. This preparation ensures a smooth application process and significantly reduces the chances of delays or rejections. Key documents include business registration papers, the tax identification number, personal identification for all business owners, and any pertinent financial statements or projections.

Another critical step in the preparation phase is choosing the right bank or financial institution. Factors to consider include fees associated with account maintenance, the interest rate offered on savings, and the overall quality of customer service. Researching both local banks and online financial institutions can help you find the best fit for your business needs.

Step-by-step instructions for completing the form

Completing the business savings application form is straightforward if approached systematically. The form generally consists of several sections related to business and owner information, financial details, and fund usage.

Editing and customizing your application form with pdfFiller

pdfFiller provides versatile editing features that streamline the process of completing your business savings application form. With its user-friendly interface, you can easily make modifications, ensuring that all information presented is accurate and up to date. This flexibility eliminates the need for printing and rewriting, saving time and resources.

To edit your business savings application form with pdfFiller, start by accessing the form on the platform. Utilize the editing tools provided to fill out the required sections, add comments, or include additional information as necessary. The ability to customize the form helps ensure all details are clear, which can positively impact your application’s success.

Signing the business savings application form

Once the form is filled out, signing it is the next crucial step. An eSignature is not only convenient but also provides a secure method of authorizing the document. This modern way of signing is recognized legally across various jurisdictions, making it a reliable choice for businesses.

To eSign your business savings application form using pdfFiller, you first need to set up your eSignature on the platform. This digital signature can then be applied directly to the form. Most importantly, this process creates a secure, legally binding document that can easily be shared with the bank or financial institution.

Submitting your business savings application form

After completing and signing the application form, you will need to submit it to the bank or financial institution. Understanding the submission options available is essential. Most banks now offer online submission via their secure portals, making it easy and quick to send your application. Alternatively, mailing in the form is still an option for those who prefer traditional methods.

After submission, it is advisable to track your application status. Following up with the bank or financial institution can provide insight into the processing times, typically ranging from a few days to a couple of weeks. Knowing how to check your application status can help alleviate any uncertainty during the waiting period.

Managing your business savings account after approval

Once your business savings application form is approved, managing your savings account efficiently becomes critical. Most banks provide online access to your account, where you can monitor your savings, make deposits, and manage withdrawals all from a convenient dashboard. Keeping up with your account regularly allows you to stay informed about your financial status and upcoming targets.

Utilizing pdfFiller for ongoing document management related to your business savings account is also a smart move. You can create financial reports, track expenses, and store essential supporting documents all in one place. This centralized document management capability reduces clutter and is particularly beneficial for businesses that require frequent updates and reporting.

Common mistakes to avoid when filling out the application

Filling out the business savings application form can seem straightforward, but several common mistakes can lead to unnecessary delays. One frequent error is inconsistent information between documents. Ensure that the details on your application form match those on your business registration papers and financial documents.

Another common pitfall is providing incomplete information. Double-checking all sections of the form can help avoid this mistake. Consider creating a checklist of required fields and reviewing it before final submission. Taking these precautions ensures that your application is as polished and professional as possible.

Frequently asked questions about business savings accounts

Several questions frequently arise around business savings accounts that can help clarify their importance. A common query is about the types of savings accounts available for businesses, which often include high-yield accounts, money market accounts, and traditional savings accounts tailored to business needs.

Another essential consideration for business owners is understanding how interest rates affect savings. Higher interest rates can significantly contribute to the accumulation of savings over time. Lastly, it is crucial to be aware of potential fees associated with the account, including monthly maintenance fees, transaction fees, and penalties for insufficient balances.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find business savings application form?

How do I complete business savings application form online?

How do I edit business savings application form in Chrome?

What is business savings application form?

Who is required to file business savings application form?

How to fill out business savings application form?

What is the purpose of business savings application form?

What information must be reported on business savings application form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.