Get the free Business Savings Account Application Form

Get, Create, Make and Sign business savings account application

How to edit business savings account application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business savings account application

How to fill out business savings account application

Who needs business savings account application?

Comprehensive Guide to Business Savings Account Application Form

Understanding the business savings account

A business savings account is a specialized financial tool designed for companies to store their excess funds while earning interest. The primary purpose is to promote financial discipline by enabling businesses to save money for future investments, operational expenses, or emergency funds. This account distinguishes itself from standard checking accounts by focusing on savings accumulation rather than daily transactions.

Key features of a business savings account often include competitive interest rates, easy access to funds, and limited withdrawal capabilities, encouraging businesses to keep their funds intact. Unlike personal savings accounts, which cater to individual consumers, business savings accounts are structured to meet the demands of companies, offering features such as higher deposit limits and specialized customer support.

Advantages of opening a business savings account

Opening a business savings account has several distinct advantages. First, these accounts typically offer higher interest rates compared to personal accounts, allowing businesses to grow their idle funds. This is an essential aspect for any company looking to maximize their income without additional risk.

Enhanced financial management is another significant benefit. A dedicated savings account can help a business effectively allocate savings for specific needs, such as taxes or future investments. By separating personal and business finances, business owners can ensure clearer financial records, making it easier for accounting and budgeting.

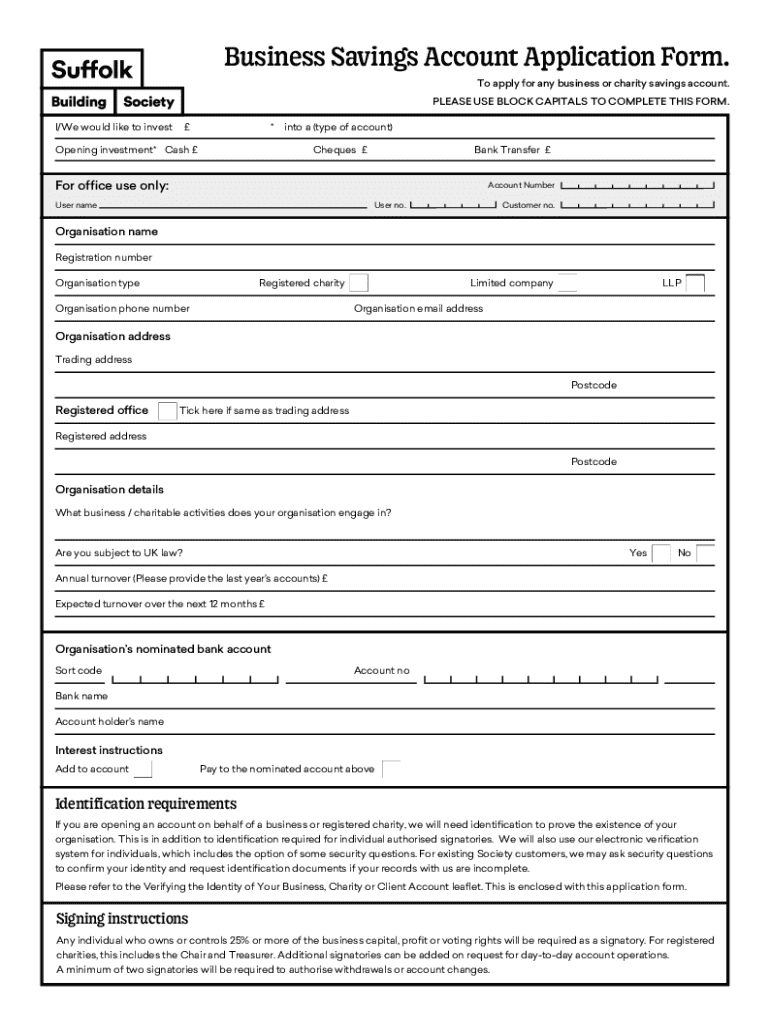

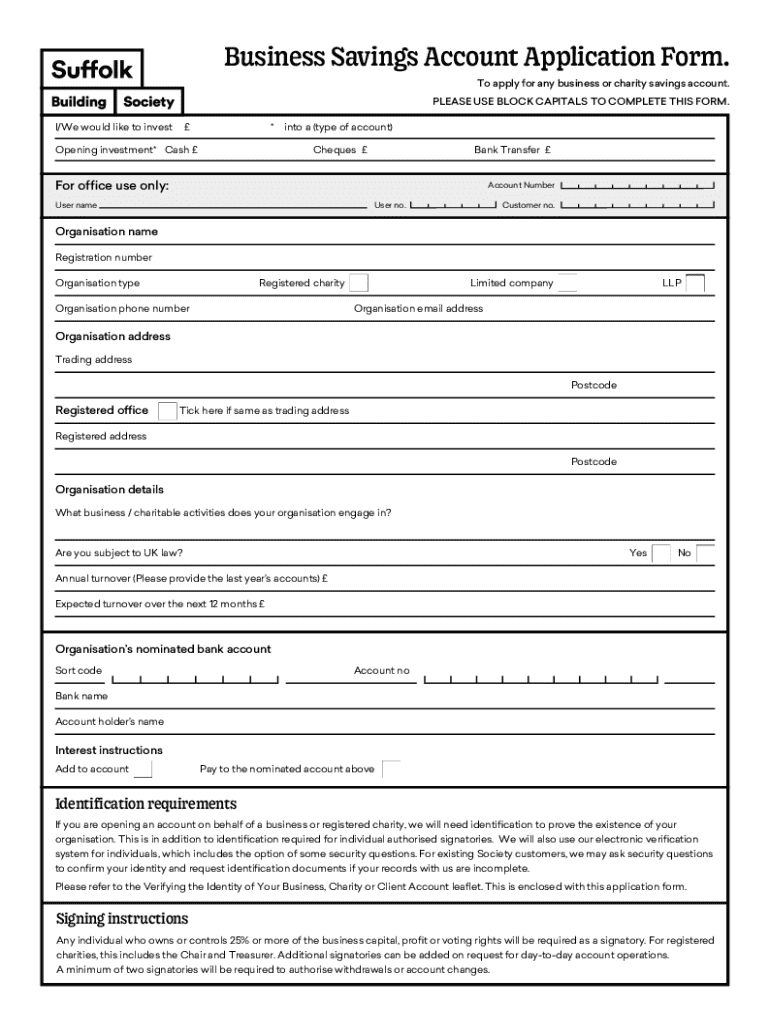

Key requirements for the business savings account application

Before applying for a business savings account, it’s essential to understand the key requirements. Eligibility criteria typically depend on the type of business structure. Common structures eligible include Limited Liability Companies (LLC), Corporations, Partnerships, and Sole Proprietorships. Most banks also require a minimum deposit upon account opening, which varies by institution.

In addition to the structure of the business, necessary documentation is crucial for the application process. Generally required documents include proof of business registration, such as a business license, the Tax Identification Number (TIN), and personal identification of owners or partners involved in the business.

Step-by-step guide to filling out the business savings account application form

To efficiently fill out the business savings account application form, first, download the form from pdfFiller, which provides a user-friendly interface for documents. Begin by accurately entering your business information, including business name, address, and type of business entity.

Next, you’ll need to provide owner information, listing all authorized signatories as well as their identification details. This is crucial for the bank to establish responsible parties for the account. Finally, complete the financial information section, which should include your initial deposit amount and any additional sources of income that may be deposited in the account.

For accurate completion, ensure all entries are legible and consistent. Common mistakes include omitting crucial information or providing mismatched details. Double-check all fields before submitting to prevent delays.

Editing and managing your business account application

Once your application is filled out, pdfFiller offers editing tools to enhance the document further before submission. You can add text, annotations, and even insert digital signatures to ensure your application meets all requirements. This capability is especially useful for businesses that may need to make revisions or updates as needed.

Additionally, pdfFiller provides robust cloud-based storage options, allowing you to save and manage your application easily. With cloud access, you'll have peace of mind knowing that you can retrieve your documents from anywhere at any time, supporting a flexible work environment.

Submission process for your application

Submitting your business savings account application can be done easily online. After ensuring your form is complete, you can submit it through your bank’s designated online platform, often facilitated by services like pdfFiller. Following submission, it's crucial to keep track of the necessary follow-up steps, which may include providing additional documentation if requested.

The timeframe for application processing can vary between banks, but it generally takes a few business days. Make sure to confirm the estimated processing time with your bank to stay informed on when to expect account confirmation.

Managing your business savings account after approval

Once your business savings account is approved, you can begin managing it online. Most banks provide digital interfaces that allow you to monitor your account balance, analyze transactions, and review account statements. Understanding how to read your account statements is critical to keeping track of your financial health.

Beyond simple account management, many banks offer additional services. Digital banking solutions may include mobile banking apps, online bill pay, and integrations with accounting systems, which can significantly streamline operations for your business.

Important considerations and FAQs

When dealing with business savings accounts, it’s vital to understand the associated fees. Some accounts might have monthly maintenance fees, withdrawal limitations, or fees for exceeding transaction limits. Ensure you read the fine print to avoid unexpected costs.

Withdrawal limitations are also part of the account features. Many business savings accounts enforce limits on the number of withdrawals made per month to encourage saving. Additionally, understanding the insured deposits under federal regulations is essential for risk management, ensuring your funds remain secure.

Related services from pdfFiller

pdfFiller provides an array of document templates tailored specifically for business operations. From contracts to tax forms, businesses can access various tools and templates designed to streamline paperwork management. Additionally, pdfFiller's eSigning solutions cater to the needs of modern businesses wanting efficient document processing.

Furthermore, collaboration tools offered by pdfFiller allow teams to work together on documents in real time. This integration facilitates seamless teamwork and efficient document management, making it simpler for businesses to stay organized and responsive.

Contact information for further assistance

If you have any questions or require further assistance regarding the business savings account application, customer support is readily available. Most banks offer various channels for inquiries, including phone support, email services, and live chat options on their websites.

Additionally, you can find helpful resources on pdfFiller for navigating document processes, enhancing your experience in dealing with forms and applications. Checking the FAQ sections or user support forums can provide answers to common queries.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete business savings account application online?

How can I fill out business savings account application on an iOS device?

How do I complete business savings account application on an Android device?

What is business savings account application?

Who is required to file business savings account application?

How to fill out business savings account application?

What is the purpose of business savings account application?

What information must be reported on business savings account application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.