Get the free Business Account Opening Information Sheet

Get, Create, Make and Sign business account opening information

How to edit business account opening information online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business account opening information

How to fill out business account opening information

Who needs business account opening information?

Comprehensive Guide to the Business Account Opening Information Form

Understanding the business account opening process

Business accounts are specific types of banking accounts designed to cater to the financial needs of businesses rather than individual consumers. They serve multiple purposes, from managing daily transactions to providing access to various banking services tailored for commercial operations. Establishing a business account is essential for a solid financial foundation, which aids in separating personal finances from those of the business, facilitating better financial management and clarity.

Having a dedicated business account not only enhances credibility in the eyes of customers and vendors but also simplifies tax reporting and accounting processes. Common types of business accounts include checking accounts, savings accounts, and merchant accounts, each serving distinct operational requirements.

Key considerations before completing the form

Before diving into the details of the business account opening information form, understanding what is needed for a smooth application process is vital. One must first establish the legal structure of the business—whether it’s a Sole Proprietorship, LLC, Corporation, or Partnership. Each structure has different requirements and implications, especially regarding taxes and liability.

Another essential aspect is the required initial deposit, which can vary significantly across banks. Knowing the amount beforehand prevents surprises that could delay the account opening.

Additionally, it’s important to prepare essential documentation, including the owner's personal identification, business licenses and permits, and the tax identification number (EIN).

Choosing the right bank also plays a critical role. It's beneficial to compare fees, services, and customer service preferences across different banks to find the best fit for your business needs.

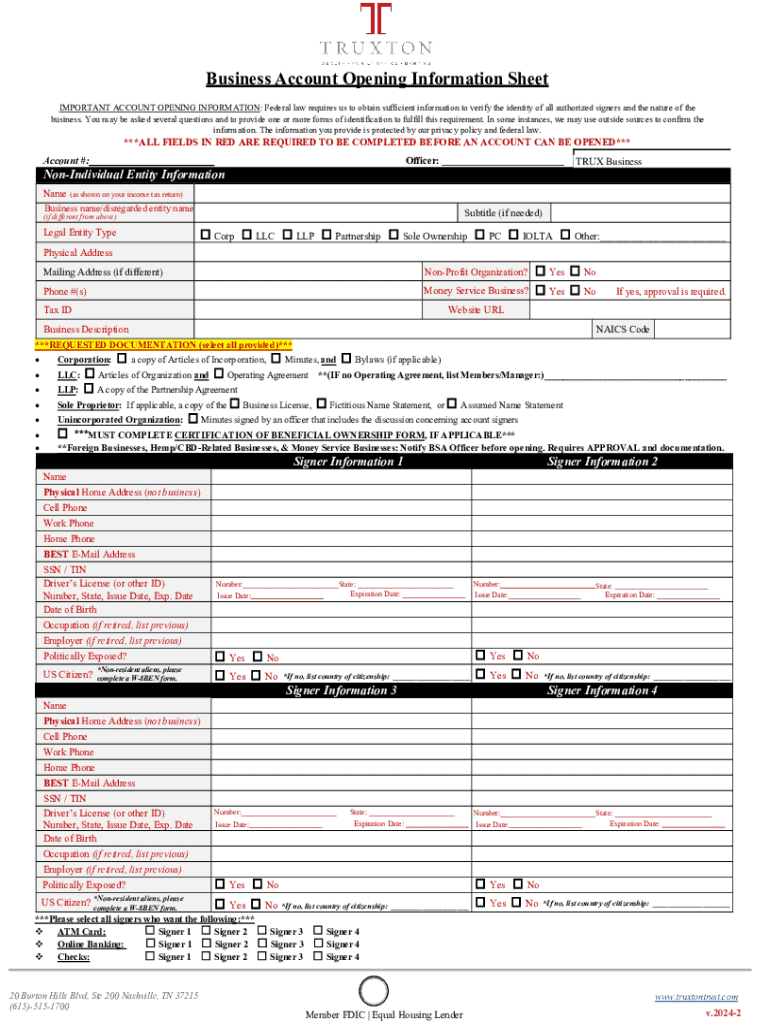

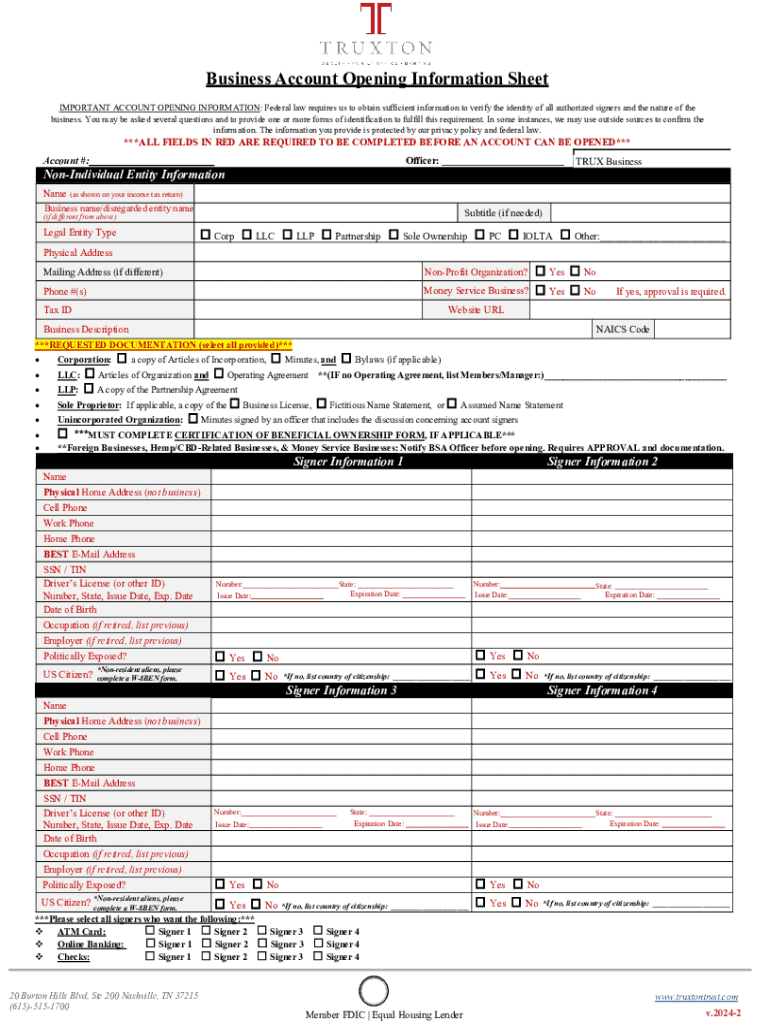

Detailed breakdown of the business account opening information form

The business account opening information form may appear daunting at first glance, but breaking it down into sections makes it manageable. Typically, the form includes various sections that gather necessary information about the business and its owners.

Filling out the form: best practices

When filling out the business account opening information form, accuracy is key. Use clear and precise language to avoid misunderstandings or errors that could delay processing. One common pitfall is entering incorrect business or contact details, which can lead to verification issues.

Taking the time to double-check all entries for accuracy validates information and expedites the process. Ensure all signatures and required documents are included before final submission.

Editing, signing, and submitting the form through pdfFiller

pdfFiller is an excellent platform to ease the process of filling out the business account opening information form. Users can access the form directly on pdfFiller and utilize its editing tools to make necessary adjustments.

This includes adding signatures, comments, or notes. Once the form is completed to satisfaction, users can save and submit it easily—either through digital channels or by printing it for physical delivery.

Post-submission steps

After submitting the business account opening information form, it’s essential to know what to expect. Many banks will provide processing time frames, often ranging from a few days to a couple of weeks. During this period, applicants may receive notifications regarding approval or requests for additional information.

Once the account is opened, managing it becomes a priority. Businesses can take advantage of online banking features to conduct transactions efficiently. Keeping accurate records and documentation is vital to ensure financial health and compliance.

Interactive tools and resources available on pdfFiller

pdfFiller offers a variety of interactive tools to streamline document management. Users can make quick edits to the business account opening information form, share it with team members, and collaborate effectively.

Customer support options are available to assist with any questions. An extensive FAQ section provides immediate answers regarding form completion or submission processes.

Common questions about business account opening forms

As a new business owner, it’s common to have questions about the business account opening process. Each financial institution may have unique requirements, but general queries about form completion and submission remain consistent. Clarifications on account limits and regulations are vital before opening an account.

Success stories: how pdfFiller helps businesses streamline their document management

Many businesses have successfully utilized pdfFiller’s services to simplify document management. Case studies highlight the ease with which various industries have navigated the business account opening process using the platform's intuitive features.

User testimonials frequently cite enhanced productivity and decreased turnaround times, illustrating how pdfFiller’s document solutions support business goals.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify business account opening information without leaving Google Drive?

How can I fill out business account opening information on an iOS device?

How do I fill out business account opening information on an Android device?

What is business account opening information?

Who is required to file business account opening information?

How to fill out business account opening information?

What is the purpose of business account opening information?

What information must be reported on business account opening information?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.