Get the free Tax Preparer Affidavit

Get, Create, Make and Sign tax preparer affidavit

Editing tax preparer affidavit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax preparer affidavit

How to fill out tax preparer affidavit

Who needs tax preparer affidavit?

Understanding the Tax Preparer Affidavit Form: A Comprehensive Guide

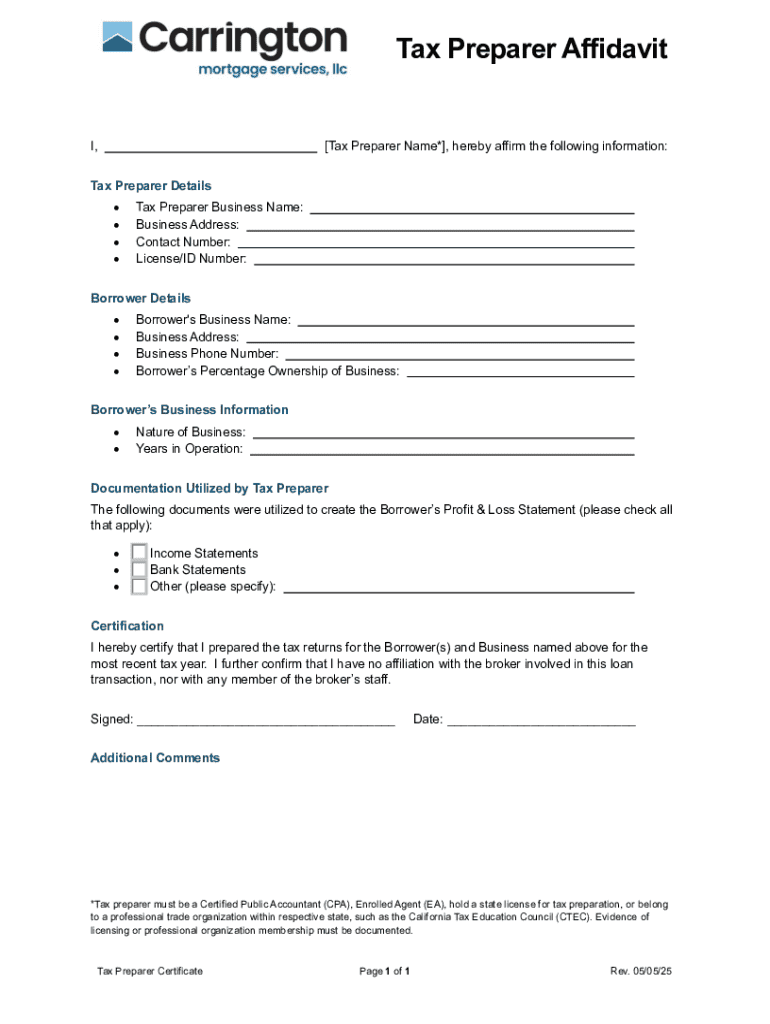

Understanding the Tax Preparer Affidavit Form

The tax preparer affidavit form serves as a legal document that individuals can file when they believe they've been misled or deceived by their tax preparer. This form plays a crucial role in maintaining accountability and transparency within tax-related services. Its primary purpose is to provide a formal mechanism for clients to report issues, ensuring that tax preparers uphold ethical standards while adhering to legal requirements.

Filing the tax preparer affidavit form is integral to tax compliance, as it allows individuals to add a layer of protection against potential fraud or misconduct. By addressing concerns, this form not only protects the individual taxpayer but also aids tax authorities in identifying and rectifying issues within the tax preparation field. It effectively documents any grievances or malpractices, fostering a safer environment for tax services.

Key features of the tax preparer affidavit form

When engaging with the tax preparer affidavit form, utilizing tools like pdfFiller can streamline the process significantly. One of the standout features of pdfFiller is its interactive tools, which facilitate quick navigation through the form. This can greatly enhance user experience, allowing for an efficient completion process and minimizing the risk of errors.

Additionally, pdfFiller offers cloud-based document management capabilities, ensuring that users can access their documents anytime and anywhere. This is particularly beneficial for individuals who may need to file subsequent forms or revisits their affidavit. With seamless editing and eSigning features, users can easily customize their submissions, eliminating the need for cumbersome printing and mailing processes.

Who needs to file the tax preparer affidavit form?

Several scenarios can prompt the need for filing a tax preparer affidavit form. Individuals who felt misled by their tax preparer—whether through misinformation, improper handling of their tax returns, or unethical practices—should consider filing this affidavit. Acknowledging the tax preparer's accountability is imperative in these situations to ensure that the person or entity responsible for the alleged misguidance is held to a standard.

Moreover, tax professionals who are not following compliance measures or who have displayed negligence in their services may warrant the need for an affidavit. If a tax preparer has repeatedly failed to adhere to regulations or industry standards, it is vital that concerned clients document these instances. Any situation characterized by misconduct, unethical actions, or negligence should prompt potential clients to utilize the tax preparer affidavit form to safeguard their interests.

Detailed step-by-step guide to completing the tax preparer affidavit form

Completing the tax preparer affidavit form entails multiple steps, and following a systematic approach can alleviate potential misunderstandings. The first step is to obtain the affidavit form, which is easily accessible via pdfFiller. Users can download the form directly from the platform, ensuring they have the most updated version available.

Step 1: Obtain the affidavit form

Accessing the form through pdfFiller not only simplifies the process but also ensures it is ready for use. It provides options for users to download and print the form, should they prefer an offline method. If working online, users can also fill it directly in their browser.

Step 2: Review the instructions thoroughly

Prior to filling out the form, it’s essential to review the instructions thoroughly. Understanding each section of the form will help in accurately conveying the information needed. Attention to detail is invaluable, as even small mistakes can lead to complications or delays in the review process.

Step 3: Gather necessary information

Before starting to fill out the form, gather all necessary personal information, including your full name, contact details, and potentially your tax identification number. Additionally, you need to document specific details regarding the tax preparer you're addressing in your affidavit, including their name, contact information, and the services they provided. This information will form the basis of your complaint.

Step 4: Completing the form

When completing the form, ensure that you fill out your personal information accurately and completely. Document your complaints or concerns clearly and concisely, providing concrete examples where applicable. Being specific about what transpired will strengthen your case and ensure clarity in your claims.

Step 5: Consent and signature

At the bottom of the form, there will be a section for consent and signature. This is where you formally affirm the accuracy of the information you provided. Understand that your signature is an acknowledgment that you're sending a truthful representation of events, which is crucial for the affidavit's validity.

Step 6: Options for submission

After completing the form, users have options for submission. For offline submission, you can print the affidavit and mail it to the relevant tax authority. However, for a more streamlined process, online submission via pdfFiller is recommended. This method not only saves time but also ensures that your application is securely transmitted and logged for your reference.

eFiling considerations

When utilizing eFiling options, ensuring the security and validity of your submission is paramount. PdfFiller provides encrypted transmissions and secure document storage, offering users peace of mind.

Common mistakes to avoid when filing the tax preparer affidavit form

Being aware of common pitfalls can significantly enhance your filing experience. Incomplete information is one of the most common mistakes; each section of the form must be filled out completely for it to be functional. Double-checking the provided information can prevent unnecessary complications.

Another frequent error involves failing to read the instructions. It is vital to understand what is required so you can submit a comprehensive and accurate affidavit. Issues related to signatures and consent are also common: neglecting to sign the form can render it invalid, so be sure to complete this step to finalize your submission.

After you file: What to expect

Once you have filed your tax preparer affidavit form, it’s beneficial to understand what happens next. Initially, it may take some time for tax authorities to review your complaint thoroughly, often a few weeks or months, depending on their workload. Stay patient but also proactive in checking back for updates.

If you do not hear back within the expected timeframe, following up may be necessary. Knowing the review process well can frame your expectations and help you remain organized during these critical stages. Being prepared for potential requests for additional information can also facilitate a smoother resolution.

Special considerations for different scenarios

Certain situations require unique considerations. For example, if you intend to file for multiple tax years, be sure to clearly denote this in your affidavit to provide clarity to the reviewing authorities. Handling complicated cases may require legal advice or professional assistance to ensure that all angles are appropriately addressed.

Additionally, exploring resources for additional help, such as contacting professional bodies for guidance, can provide extra support during this process. Leveraging community resources may uncover more information regarding best practices and common solutions related to such filings.

Utilizing pdfFiller for managing your documents

Managing documents effectively while navigating the tax preparer affidavit form can significantly ease the filing process. PdfFiller provides a suite of features that enhance document collaboration, enabling users to communicate seamlessly with tax professionals or advisors during the completion process.

Keeping track of submissions is another important feature. PdfFiller allows users to monitor their document status in real-time, which is pivotal for staying updated on outcomes and responses from tax authorities. Integrating with other services means that you can efficiently manage all necessary documents related to your tax situation from a single platform.

Real-life success stories

DocuSign and pdfFiller has received numerous testimonials from users who successfully leveraged the platform for filing their tax preparer affidavit forms. Many report that the ease of using the interactive tools made the process significantly less daunting than anticipated.

Case studies highlight successful affidavit filings that led to favorable outcomes, showcasing the importance of accurately documenting grievances and utilizing reliable tools like pdfFiller. Personal experiences shed light on the positive implications of filing these affidavits within the compliance landscape.

Related forms and templates to explore

As you navigate the tax preparer affidavit form, exploring related forms and templates can provide additional insight. Forms related to tax preparers often include those for reporting financial discrepancies or tax evasion concerns. It's crucial to familiarize yourself with various templates, ensuring you're fully equipped to tackle any tax-related issues.

Overviewing other relevant tax documentation prepares you for potential obligations or submissions in the future. Ensuring you have access to all pertinent forms via platforms like pdfFiller will facilitate smoother transactions when handling tax matters.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my tax preparer affidavit in Gmail?

How do I make edits in tax preparer affidavit without leaving Chrome?

Can I sign the tax preparer affidavit electronically in Chrome?

What is tax preparer affidavit?

Who is required to file tax preparer affidavit?

How to fill out tax preparer affidavit?

What is the purpose of tax preparer affidavit?

What information must be reported on tax preparer affidavit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.