Get the free single member llc operating agreement hawaii

Get, Create, Make and Sign single member llc operating

How to edit single member llc operating online

Uncompromising security for your PDF editing and eSignature needs

How to fill out single member llc operating

How to fill out hawaii single-member limited liability

Who needs hawaii single-member limited liability?

Hawaii Single-Member Limited Liability Form: A Comprehensive How-to Guide

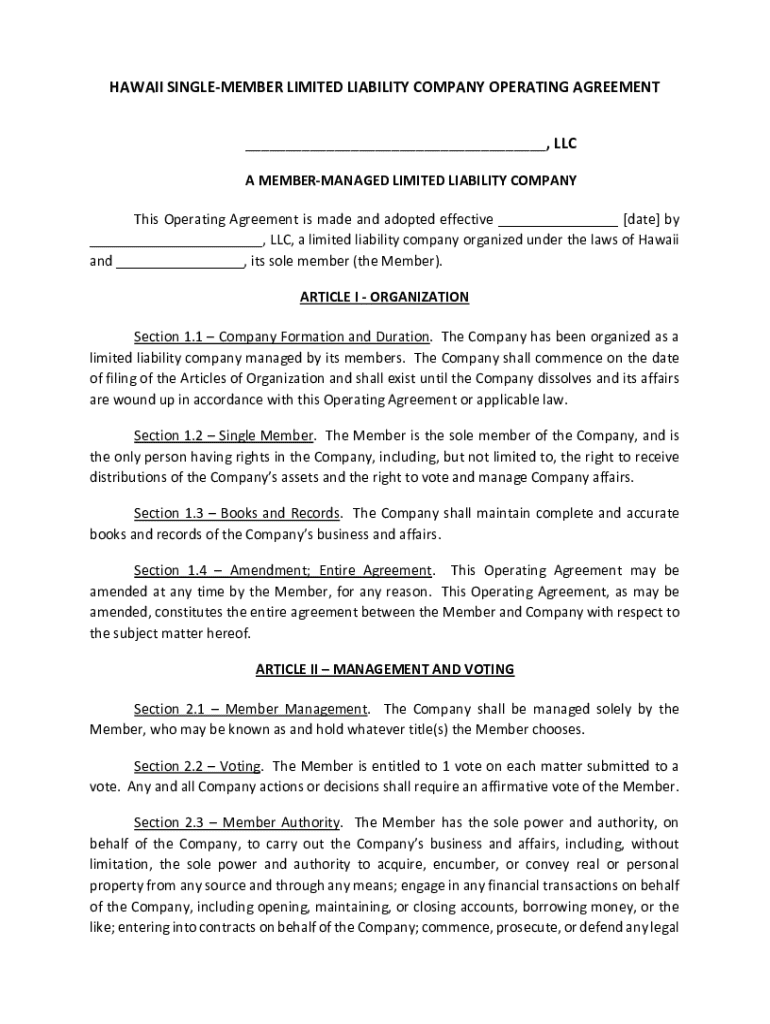

Understanding the single-member in Hawaii

A single-member limited liability company (LLC) in Hawaii is a business structure that is owned by one individual, providing both liability protection and tax flexibility. This structure allows a single owner to operate as a separate legal entity, which safeguards personal assets from business debts and legal actions. Unlike sole proprietorships, single-member LLCs maintain limited liability status, which is one of the primary benefits that attract entrepreneurs.

Choosing a single-member structure comes with several advantages. It offers simplified tax treatment, as the IRS treats it as a disregarded entity, and it can help avoid double taxation, which is common in corporations. The formation process is relatively straightforward compared to multi-member LLCs, making it accessible for solo entrepreneurs. Moreover, having an LLC can enhance credibility with clients and potential investors, as this structure indicates a formal commitment to your business.

When forming a single-member LLC in Hawaii, key considerations include understanding the state’s specific requirements, such as naming conventions and the need for an operating agreement, even though it is not mandated by law. Keeping in mind the potential costs and ongoing compliance requirements is equally crucial to successfully establish and maintain your business.

Forms and documentation required

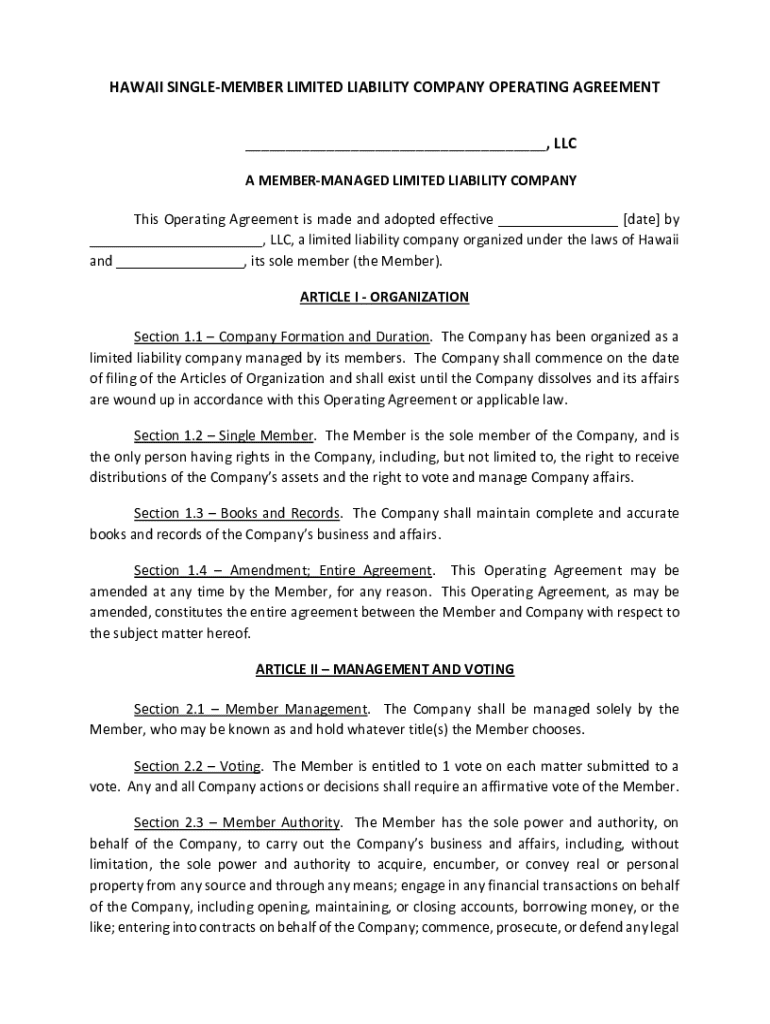

Establishing a single-member LLC in Hawaii necessitates specific documentation, primarily the Articles of Organization. This essential form is submitted to the state’s Department of Commerce and Consumer Affairs to officially register your business. An operating agreement, while not legally required, is highly recommended to outline the workings of the LLC and define the member’s rights and responsibilities.

The Hawaii single-member LLC operating agreement should cover vital aspects of the business, including capital contributions, profit distribution, management structure, and procedures for any potential future disputes. This document also serves as evidence of your limited liability status and can prevent personal liability exposure.

When drafting your operating agreement, it’s important to include clear language regarding initial capital contributions, allocation of profits and losses, and procedures for transferring ownership. This clarity helps ensure smooth operations and can serve as a reference in legal matters.

Getting started: Step-by-step guide to forming a Hawaii single-member

Forming a single-member LLC in Hawaii involves a series of straightforward steps. Follow this step-by-step guide to successfully establish your business.

Step 1: Choose a unique name for your

Your LLC name must be unique and distinguishable from existing businesses registered in Hawaii. It should include the phrase 'Limited Liability Company' or abbreviations like 'LLC' or 'L.L.C.' You can check name availability through the Hawaii Department of Commerce and Consumer Affairs online database. If desired, reserve your name for 120 days while you complete the formation process.

Step 2: Appoint a registered agent

A registered agent is an individual or business designated to receive legal documents on behalf of your LLC. In Hawaii, the registered agent must have a physical address in the state. This ensures that your LLC remains compliant with state law and can receive important documents in a timely manner.

Step 3: File Articles of Organization

To officially form your LLC, you must file the Articles of Organization with the Hawaii Department of Commerce and Consumer Affairs. This document requires basic information about your LLC, including its name, registered agent, and the nature of your business. You can submit the form online, by mail, or in-person. Ensure all information is accurate to avoid delays.

Common mistakes to avoid when filing include incorrect or omitted information, choosing a non-compliant name, and not providing a registered agent’s address.

Step 4: Create your operating agreement

While not required by law, having an operating agreement is crucial for operating a single-member LLC. This document details the governance of your business, including management responsibilities and procedures for making amendments. You can find templates online, such as those offered by pdfFiller, and customize them to suit your needs.

Step 5: Obtain your EIN (Employer Identification Number)

An EIN is necessary for tax purposes and allows you to legally hire employees, open a business bank account, and file your business taxes. You can apply for an EIN online through the IRS website, and obtaining one is free of charge.

Step 6: Secure necessary business licenses and permits

Depending on the type of business you operate, you may need various licenses and permits. Hawaii regulations can vary by industry and locality, so check with state and local agencies to ensure compliance. For instance, businesses dealing in food services may need health permits, while others may require specific industry licenses. Resources like the Small Business Administration can help clarify requirements based on your business.

Step 7: Register for state payroll taxes

If you plan on hiring employees, it’s necessary to register for payroll taxes with the Hawaii Department of Taxation. Understanding your obligations concerning state unemployment and employee withholdings is essential to ensure compliance and avoid penalties.

Step 8: Maintain compliance for your

Once your LLC is formed, maintaining compliance requires ongoing responsibilities, including filing annual reports and paying necessary fees. Stay informed about the latest regulatory changes to ensure your business remains in good standing. Regular assessments of your operating agreement will also help in adapting to the evolving needs of your business.

Hawaii costs and fees

Starting a single-member LLC in Hawaii involves some initial formation costs. The filing fee for the Articles of Organization is approximately $50. Depending on your business type and location, additional costs may arise from permits and licenses, which can vary widely. It’s wise to budget for these initial expenses to avoid unexpected financial strain during your setup process.

Ongoing costs are also a part of maintaining an LLC. This may include annual report filing fees, which are about $15, along with any business taxes and potential costs associated with legal consultations. To ensure your LLC remains manageable financially, utilizing online resources that streamline compliance and minimize risks, like those offered by pdfFiller, can be beneficial.

Specific legal and tax considerations

Single-member LLCs are typically treated as pass-through entities for tax purposes, meaning that the income is reported on the owner's personal tax return, avoiding double taxation faced by corporations. However, it is crucial to understand how this impacts personal income tax obligations in Hawaii. You should also be aware that while the IRS does provide certain tax flexibility, state and local regulations may vary, which necessitates consulting with tax professionals well-versed in Hawaii laws.

Additionally, it's important to differentiate between LLCs, PLLCs (Professional Limited Liability Companies), and other business structures, as each has varying legal obligations and operational nuances. Understanding your legal obligations helps you stay compliant and can safeguard your business against potential legal challenges.

Comparing structures: Single-member vs. multi-member LLCs

Comparing single-member LLCs and multi-member LLCs reveals distinct advantages and pitfalls for each. Single-member LLCs offer simplicity and ease of management, making them ideal for solo entrepreneurs who may prefer a streamlined operation without the complexities of multiple owners. In contrast, multi-member LLCs can attract additional capital and resources but also bring the requirement of consensus among members on major business decisions.

For those considering scale, a multi-member LLC may provide the chance to share responsibilities, widen expertise, and access a broader network. However, if control and decision-making autonomy are priorities, a single-member LLC may be more advantageous, allowing you to steer your business in any direction without needing approval from partners.

Essential resources and tools

For individuals and teams that require efficient document creation and management tools, pdfFiller offers invaluable resources. Utilizing interactive templates specifically designed for document creation related to LLC formation can save time and ensure accuracy. Their platform supports e-signatures and collaboration features, making it simple to manage all aspects of your LLC documentation in one place.

Resources such as downloadable templates for the operating agreement and filing forms are readily available, empowering you to create necessary documents with little hassle. With cloud-based accessibility, you can manage your business affairs from anywhere.

Common FAQs about Hawaii single-member formation

Several questions often arise when considering forming a single-member LLC in Hawaii. A common inquiry is whether anyone can form an LLC, to which the answer is generally yes, as long as they adhere to state regulations. While hiring an attorney is advisable for complex legal structures, it’s not strictly necessary for straightforward single-member LLC formations.

If you ever need to dissolve your LLC, it involves a formal process of filing dissolution forms with the state and paying any outstanding obligations. Organizations that hold tax-exempt statuses should be aware of peculiar regulations, particularly those affecting their LLC structure. Finally, while not every single-member LLC needs a business license, depending on the industry, certain licenses may still be necessary.

My account: Leveraging pdfFiller tools for your needs

Utilizing pdfFiller’s tools enhances the LLC formation journey significantly. The platform allows seamless editing and signing of documents, which is crucial when managing forms like Articles of Organization or operating agreements. The collaboration features enable multiple stakeholders to contribute efficiently, ensuring that your LLC formation is completed with precise documentation.

Additionally, having access to your documents from anywhere ensures that critical files are always at your fingertips, whether you’re at home or on the go. This level of accessibility can streamline communications with clients and regulatory bodies, further advancing your business objectives.

Conclusion: Empowering your business journey with pdfFiller

Navigating the world of single-member LLC formation can be a daunting task, but with the right tools and knowledge, you can streamline the process efficiently. pdfFiller provides an excellent platform for managing all your LLC documentation needs, allowing you to focus on the core aspects of your business. Taking proactive steps toward proper formation and maintenance not only protects your interests but sets the stage for future growth and success.

Empower your entrepreneurial journey with pdfFiller’s user-friendly solutions, which ensure that you are equipped with the necessary documents and support to thrive in a competitive environment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit single member llc operating from Google Drive?

How can I edit single member llc operating on a smartphone?

How can I fill out single member llc operating on an iOS device?

What is hawaii single-member limited liability?

Who is required to file hawaii single-member limited liability?

How to fill out hawaii single-member limited liability?

What is the purpose of hawaii single-member limited liability?

What information must be reported on hawaii single-member limited liability?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.