Get the free Employee Direct Deposit Enrollment Form

Get, Create, Make and Sign employee direct deposit enrollment

Editing employee direct deposit enrollment online

Uncompromising security for your PDF editing and eSignature needs

How to fill out employee direct deposit enrollment

How to fill out employee direct deposit enrollment

Who needs employee direct deposit enrollment?

A Comprehensive Guide to the Employee Direct Deposit Enrollment Form

Understanding direct deposit

Direct deposit is a financial transaction that allows wages, salaries, and other funds to be electronically transferred directly into an employee's bank account. This process eliminates the need for physical checks, making transactions quicker and more secure.

Among the various benefits of choosing direct deposit, users often find the speed with which they can access their funds is paramount. Money is typically available on payday, minimizing waiting periods associated with traditional checks, which can take days to clear.

Direct deposit also enhances security by reducing the risk of check fraud and theft. Because your funds automatically go into your bank account, there’s no risk of loss associated with checks being misplaced or stolen.

Overview of the enrollment process

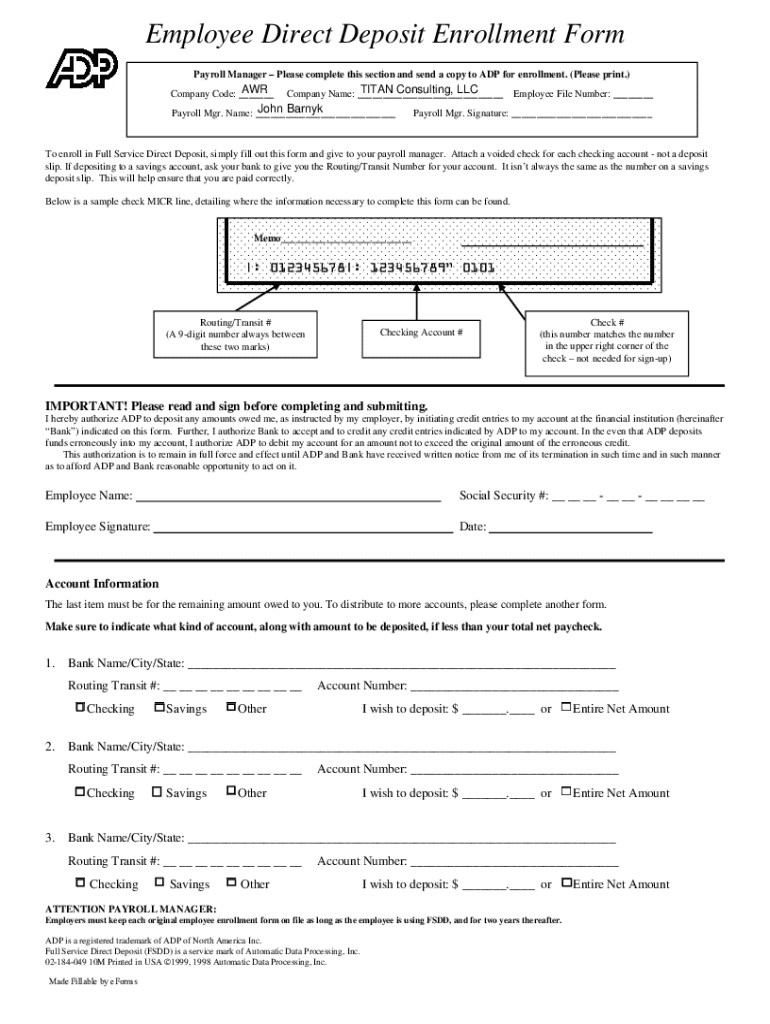

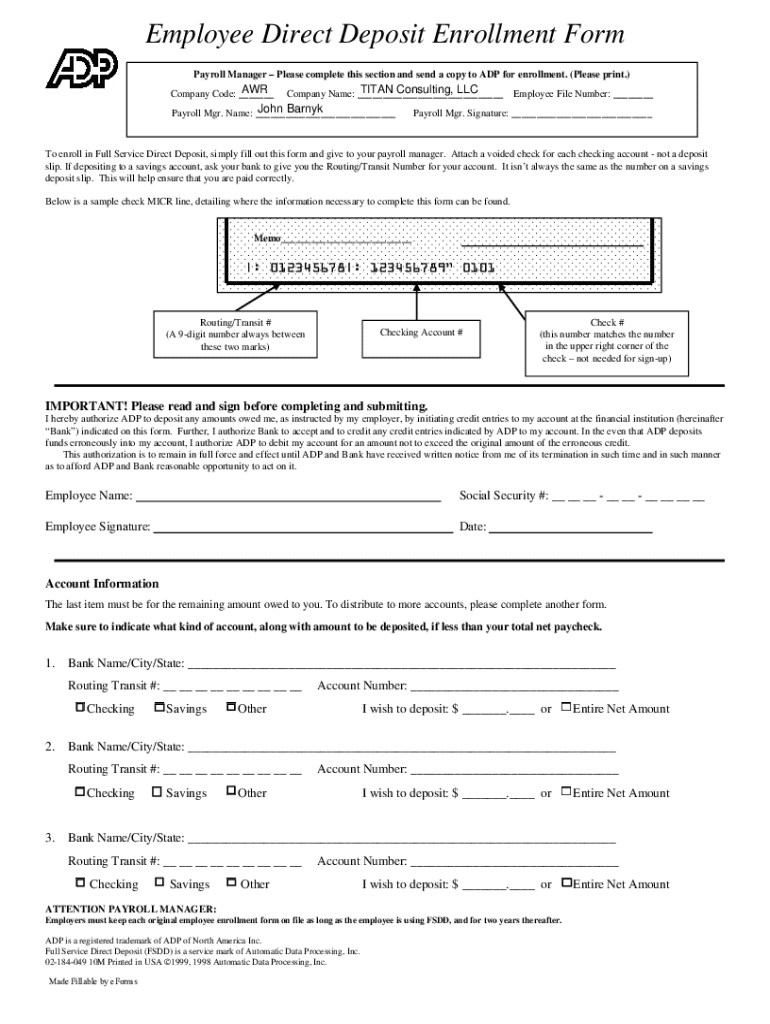

Enrolling in direct deposit involves several key steps, from gathering personal and bank information to filling out the enrollment form correctly. It’s vital to plan your enrollment timeline to ensure you are set up before your next payroll period.

The process typically starts with accessing the direct deposit enrollment form. Once you have this form, carefully follow the outlined steps to ensure you provide all necessary information.

Gathering required information

To accurately complete the employee direct deposit enrollment form, you need to gather some essential personal information. This includes your full name, address, and Social Security Number (SSN) for identification purposes. It’s crucial to ensure that all information provided matches your bank records.

Additionally, you'll need specific banking details, such as your bank's name, your account number, and the bank's routing number. Having this information readily available will make the enrollment process smoother and prevent delays.

Accessing the employee direct deposit enrollment form

The employee direct deposit enrollment form can typically be accessed online through your employer's HR portal or directly from pdfFiller. On pdfFiller, you will find various format options available for download, including PDF and online form formats based on your preferences.

Make sure to choose the format that best suits your needs, considering factors such as whether you prefer a fillable online version or a printable PDF.

Filling out the enrollment form

Completing the employee direct deposit enrollment form can be straightforward if you follow a systematic approach. Start by entering your personal information as requested at the top of the form. Be careful to double-check that all information is accurate and matches your banking details.

Next, enter your banking information, making sure that you include the correct bank name, account number, and routing number. Remember to read through any terms and conditions related to the enrollment to confirm your understanding and consent.

Editing and customizing your form

Once you have filled out your employee direct deposit enrollment form, you may need to edit or customize it for accuracy or personal preferences. Tools available within pdfFiller provide users with various editing options, from adding notes to modifying existing fields.

Utilizing online features can make customizing your document easy and accessible. However, keep in mind that any changes should still align with your banking and employment requirements.

Signing your enrollment form

Signing your employee direct deposit enrollment form is a critical step that establishes your authorization for electronic deposits. pdfFiller offers multiple options for eSigning your document, which can be satisfying in terms of convenience while maintaining legal validity.

To ensure your signature is securely added, consider using verified eSignature options provided by pdfFiller, which adhere to electronic signature laws and ensure your consent is documented properly.

Submitting the enrollment form

After filling out and signing your enrollment form, the next task is to submit it to your HR department. There are various submission methods available, including email, printing and mailing, or direct upload via your company's online platform.

Ensuring a successful submission involves double-checking to confirm your form has been received. After submission, expect communication from your HR team regarding the status of your direct deposit setup.

Managing your direct deposit

Once you have completed the enrollment process and your direct deposit is in place, ongoing management is essential. Familiarize yourself with the process of tracking your direct deposit status, which can typically be done through your bank's online services.

If you ever need to modify or update your enrollment details, ensure you follow the necessary steps to keep your banking information up-to-date. Be proactive in troubleshooting common issues like missed payments or incorrect deposits by promptly contacting your HR representative.

Collaborating with your team

Encouraging team members to enroll in direct deposit can foster a more efficient payroll process within your workplace. Sharing the enrollment form among colleagues can promote a unified approach and emphasize the importance of timely enrollments.

Best practices include discussing how direct deposit simplifies payments and reduces administrative tasks associated with payroll, thereby benefiting both employees and the organization.

Frequently asked questions (FAQs)

Many individuals have questions concerning the employee direct deposit enrollment process. Common inquiries include areas of uncertainty about security, how long it takes for direct deposits to begin, and the protocols surrounding issues like changes to banking information.

By addressing questions and common concerns upfront, employers can alleviate fears and clarify misconceptions, ultimately aiding in smoother enrollment for all employees.

Utilizing pdfFiller's features for your forms

pdfFiller provides a range of digital solutions that enhance the management of your employee forms, including the direct deposit enrollment form. Their interactive tools allow users to edit, eSign, and collaborate on documents seamlessly.

Moreover, integrations with other business tools simplify document management, making it easier to keep all necessary forms organized and accessible from a single, cloud-based platform.

Conclusion of the enrollment process

Completing your enrollment for direct deposit is a significant step toward achieving financial ease and security. By following the outlined steps and efficiently utilizing tools like pdfFiller, you can ensure a smooth transition to digital payments.

Once your direct deposit is set up, it’s vital to remain proactive in managing your account, thereby maximizing the advantages of this convenient payment method.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send employee direct deposit enrollment to be eSigned by others?

How do I execute employee direct deposit enrollment online?

How can I edit employee direct deposit enrollment on a smartphone?

What is employee direct deposit enrollment?

Who is required to file employee direct deposit enrollment?

How to fill out employee direct deposit enrollment?

What is the purpose of employee direct deposit enrollment?

What information must be reported on employee direct deposit enrollment?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.