Get the free Verification of Rollover

Get, Create, Make and Sign verification of rollover

Editing verification of rollover online

Uncompromising security for your PDF editing and eSignature needs

How to fill out verification of rollover

How to fill out verification of rollover

Who needs verification of rollover?

A Comprehensive Guide to Verification of Rollover Form

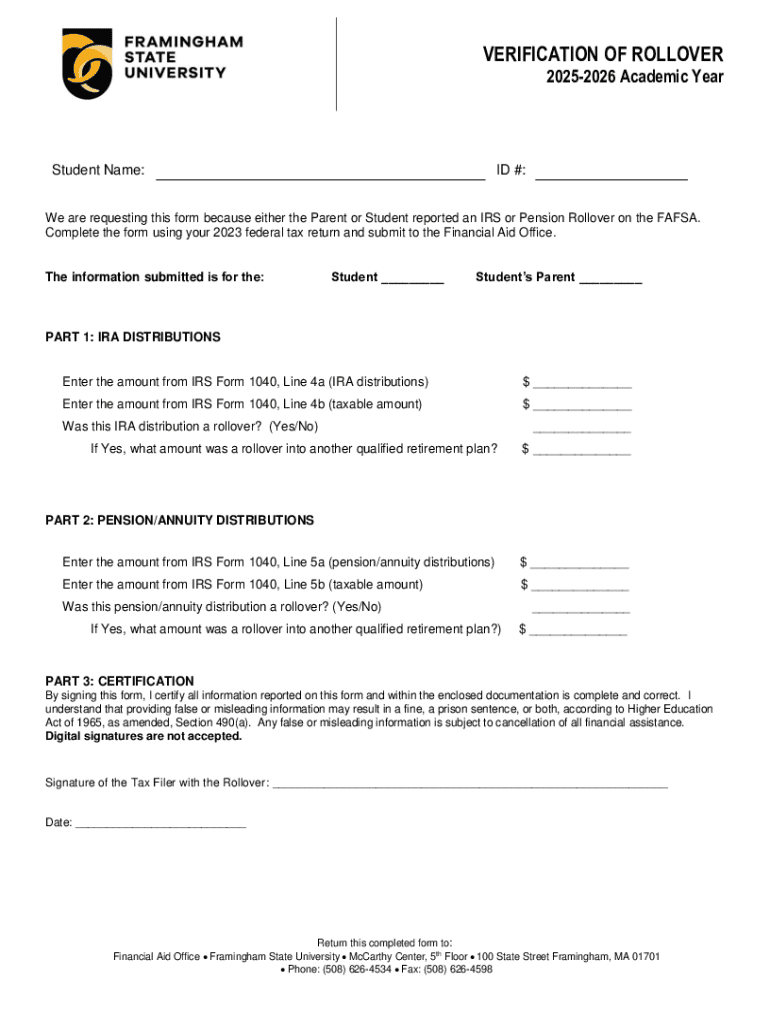

Understanding the rollover form

A rollover form is a crucial document used when transferring retirement funds from one account to another, such as moving an IRA or 401(k) to a new plan. This document serves to ensure that funds are moved in accordance with tax laws and regulations, effectively preserving the tax-deferred status of the account. Without accurate verification of the rollover form, you risk severe financial implications including taxation and penalties.

Verification is essential in rollover procedures because it guarantees that all provided information is accurate and aligns with IRS requirements. Common scenarios requiring a rollover form include changing jobs, transferring accounts, or consolidating retirement funds. By understanding the nuances of this process, individuals and teams can better navigate their financial decisions.

Key components of the rollover form

To complete a rollover form successfully, several key components must be filled out correctly. Essential fields typically include the account holder’s personal information, details about the existing retirement account, and the new account information. Additionally, documentation requirements generally involve providing account statements or beneficiary designations, ensuring compliance with the IRS guidelines.

Common errors to avoid when completing the rollover form include incorrect account numbers, mismatched personal details, or failing to sign the document. Such mistakes can lead to prolonged delays or even rejection of the rollover request, emphasizing the need for meticulous attention to detail.

Verification process overview

The verification process for your rollover form involves several crucial steps that must be executed diligently. First, review the entire form for accuracy, checking that all mandatory fields are filled out correctly. Next, gather all necessary documentation to support your submission, and ensure they are correctly labeled and organized.

Accuracy in verification is paramount; even minor discrepancies can lead to significant delays or the rejection of the form. The consequences of improper verification can result in taxable distributions, increased penalties, or difficulties in managing your retirement accounts. It’s vital to take each step seriously to safeguard your financial future.

Tools and features for effective verification

Using pdfFiller’s interactive tools can greatly enhance the efficiency of filling out the rollover form. The platform allows users to complete the form online, ensuring all fields are filled with precision. Users can easily navigate through required fields with prompts that guide them along the way.

eSigning your rollover form with pdfFiller adds a layer of convenience and compliance, making it easier to authenticate your documents without the hassle of printing. Furthermore, the collaboration features enable teams to work together seamlessly, allowing for real-time feedback and verification among team members, ensuring every step is done right before submission.

Real-time verification tips

It's crucial to double-check all your information before submission to prevent errors that can lead to costly delays. Start by cross-checking your personal information against your identification documents. Ensure that numbers, dates, and names are spelled correctly and match other documentation you are submitting.

Frequently asked questions around rollover form verification cover topics like common errors, submission timelines, and the necessary documentation. Familiarizing yourself with these factors can streamline the process and improve accuracy. Reviewing examples of well-verified rollover forms could serve as great practice for ensuring you complete your forms correctly.

Managing and tracking your rollover form

Once your rollover form is completed and submitted, managing and tracking becomes vital. pdfFiller provides an efficient way to save and store your rollover forms securely in the cloud, ensuring you have access whenever needed. Keeping your documentation organized helps prevent future mishaps and allows for easier reference during follow-ups.

Additionally, using the tracking feature allows you to monitor the status of your rollover submission. Knowing where your form stands in the process helps in anticipating any potential issues. After submission, engage in frequent follow-up actions such as checking in with your new financial institution to confirm receipt and approval of your rollover.

Troubleshooting common verification issues

When verifying your rollover form, it's essential to identify and rectify common mistakes to avoid delays. Mistakes such as incorrect social security numbers, wrong account types, or omitted signatures can often lead to rejection. Taking the time to review the completed form against a checklist can help catch these issues before submission.

If your rollover form is rejected, it is crucial to promptly contact your financial institution for the specific reasons behind the rejection. This outreach allows you to understand any mistakes and correct them efficiently. Engaging with customer service representatives who specialize in rollover processing can provide guidance and expedited solutions.

Enhancing future rollover submissions

Implementing best practices for future rollover form submissions can save time and reduce errors. Make use of templates provided by pdfFiller to streamline the process and ensure you have all pertinent information before you begin. Creating a checklist tailored to your specific rollover form requirements can serve as an invaluable tool for maintaining accuracy.

Leveraging past experiences by analyzing what worked and what didn’t can also enhance your approach moving forward. Documenting these lessons helps create a feedback loop that can improve the verification process significantly.

Insights on document management

Managing your rollover forms with a cloud-based solution like pdfFiller offers numerous benefits. Not only does it provide easy access to your documents from anywhere, but it also improves organization and security. With features that allow for easy editing and collaboration, teams can work together seamlessly to ensure nothing is overlooked during the rollover process.

The role of eSigning enhances document security and compliance, allowing you to verify your identity without the need for traditional signatures. This method not only speeds up the process but also ensures that your forms remain secure. Given the sensitive nature of financial documents, incorporating secure solutions fosters trust and compliance in your financial handling.

User testimonials and case studies

Success stories reveal how effective verification of rollover forms using pdfFiller transforms the experience for users. Many customers have praised the ease of use and efficiency that the platform provides, allowing for smoother transitions during retirement fund transfers. Users report fewer errors and expedited processing times thanks to the structured approach to document management.

Feedback from users highlights the importance of the various tools available within pdfFiller, such as easy editing, collaboration tools, and comprehensive support. Lessons learned from real users emphasize the significance of taking the time to verify forms rigorously, ensuring both accuracy and compliance, ultimately leading to stress-free rollover experiences.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute verification of rollover online?

How do I make changes in verification of rollover?

How do I complete verification of rollover on an iOS device?

What is verification of rollover?

Who is required to file verification of rollover?

How to fill out verification of rollover?

What is the purpose of verification of rollover?

What information must be reported on verification of rollover?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.