Get the free Minnesota Gift Planning Association

Get, Create, Make and Sign minnesota gift planning association

Editing minnesota gift planning association online

Uncompromising security for your PDF editing and eSignature needs

How to fill out minnesota gift planning association

How to fill out minnesota gift planning association

Who needs minnesota gift planning association?

Understanding the Minnesota Gift Planning Association Form: A Comprehensive Guide

Understanding the Minnesota Gift Planning Association Form

The Minnesota Gift Planning Association (MGPA) was established to aid individuals and organizations interested in planned giving options. The MGPA Form serves as an essential tool that outlines various approaches to gift planning, making the process straightforward and effective. By utilizing this form, donors can structure their contributions, ensuring that their charitable intentions are fulfilled and their financial goals are met. Comprehensive gift planning is crucial because it recognizes the significance of aligning one's philanthropic vision with personal financial strategies.

Comprehensive gift planning not only maximizes the potential for sustained support for non-profits but also offers individuals an opportunity to leave a lasting legacy in their communities. By detailing the 'who, what, and how' of giving, the Minnesota Gift Planning Association Form is instrumental in simplifying the intricate process of planned giving.

Who can benefit from the Minnesota Gift Planning Association Form?

The Minnesota Gift Planning Association Form is beneficial for a variety of stakeholders. Primarily, it addresses individuals considering planned giving; whether they are first-time donors or seasoned philanthropists, the form provides a clear structure to articulate their intentions. Additionally, teams involved in fundraising and resource allocation within non-profits greatly benefit from the insights this form offers, allowing them to understand potential giving patterns and donor preferences effectively.

Moreover, non-profit organizations and their beneficiaries stand to gain from the detailed insights generated through the Minnesota Gift Planning Association Form. Such organizations can utilize the information to strategize and communicate with potential donors, ensuring that they understand and appreciate the impact of their contributions. Overall, various stakeholders can leverage this form to enhance their planning and outreach efforts.

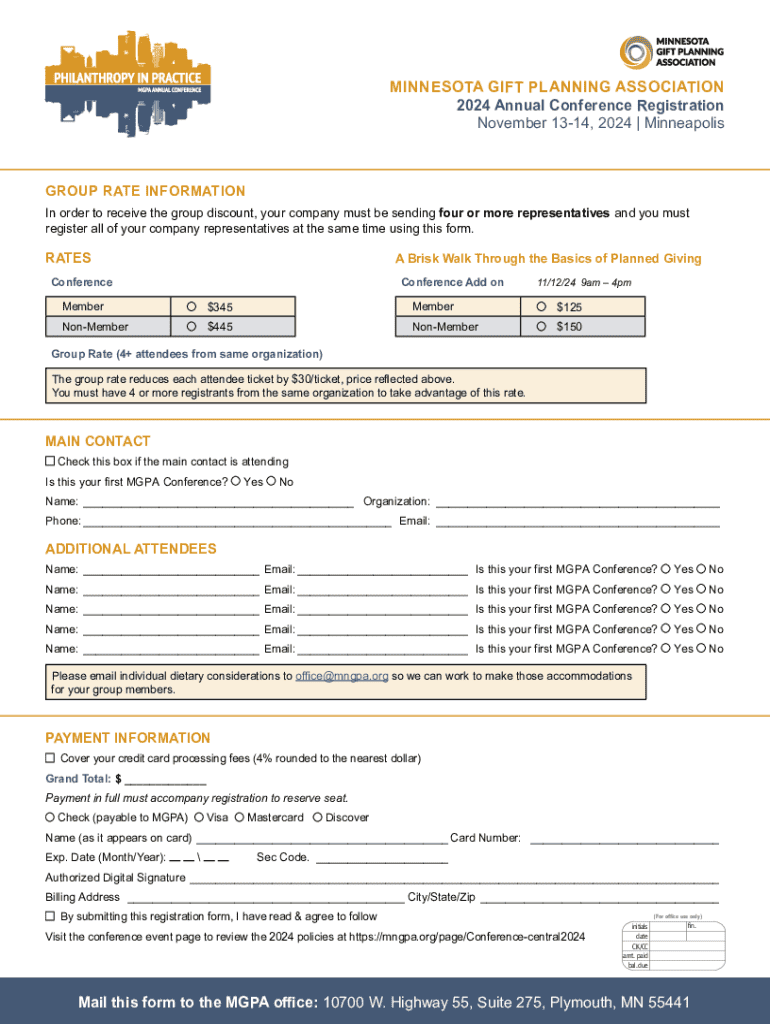

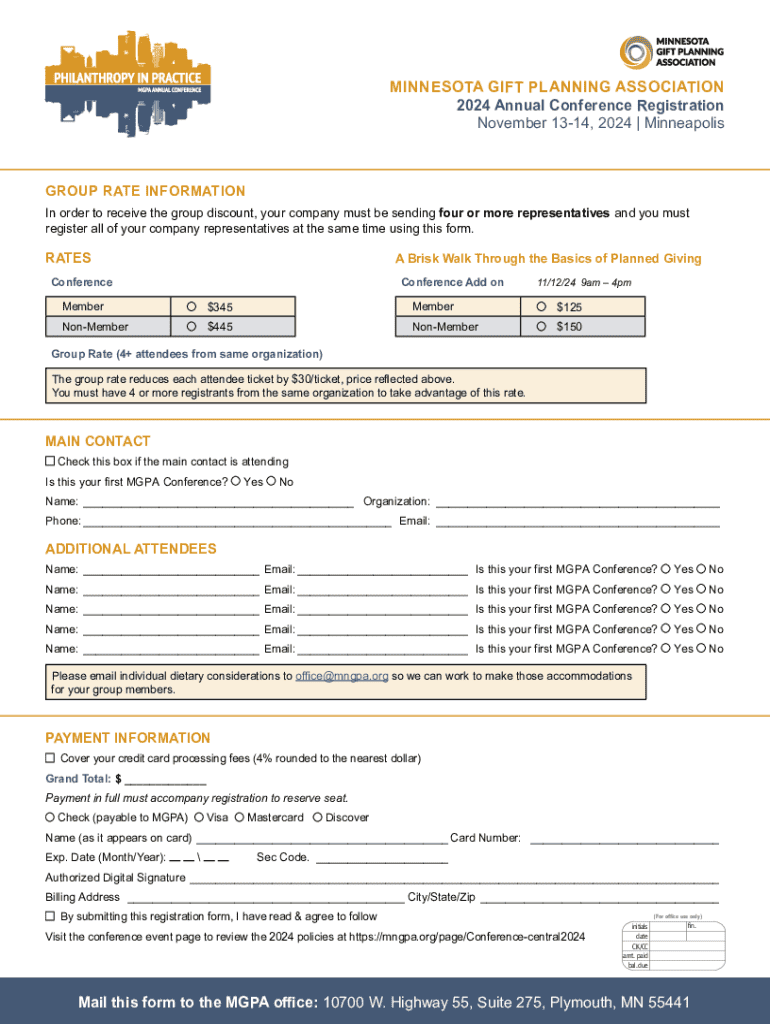

Essential elements of the Minnesota Gift Planning Association Form

The Minnesota Gift Planning Association Form encompasses several key sections essential for effective gift planning. Each section is thoughtfully designed to capture vital information about potential gifts, allowing for a streamlined approach to donation. Required information typically includes the donor’s personal details, financial capabilities, and preferences regarding the types of gifts they wish to consider.

Additionally, the form outlines various gift types, encompassing cash donations, stocks, bonds, real estate, and even more complex financial products. This range of options allows donors to make informed decisions that align with their philanthropic goals and financial situations. A thorough understanding of these elements enables donors and organizations to tailor their approaches and foster lasting relationships.

Step-by-step guide to completing the form

Completing the Minnesota Gift Planning Association Form can be made simple by following a structured approach. Here’s a step-by-step guide to ensure a successful submission:

Interactive tools and resources for gift planning

The Minnesota Gift Planning Association Form can be significantly enhanced with various interactive tools and resources available online. For instance, accessible online calculators can help estimate the potential impacts of various gifts, offering a clearer picture of how different contributions can fit into one’s financial landscape.

Additionally, templates and examples of completed forms can serve as excellent guides for first-time users. Frequently asked questions that address common concerns can further illuminate the main aspects of gift planning processes, ensuring that individuals are not left in the dark regarding their choices.

How to make changes to your Minnesota Gift Planning Association Form

Editing submitted forms and making necessary changes is crucial, given that personal or financial circumstances may evolve over time. To amend your Minnesota Gift Planning Association Form, begin by reviewing the procedures outlined by the MGPA to edit content accurately.

If using a cloud-based platform like pdfFiller, collaboration features can facilitate teamwork when updating forms. Ensuring compliance with any applicable regulations and keeping personal information up-to-date is essential for maintaining the integrity of your planned giving approach.

The role of pdfFiller in managing your gift planning documents

pdfFiller plays an integral role in enhancing the management of your Minnesota Gift Planning Association Form. Its features are tailored to simplify form editing, allowing users to fill out and adjust their documents easily. No more worrying about formatting issues; pdfFiller empowers you to maintain professionalism and accuracy.

Furthermore, the benefits of eSigning your completed forms cannot be overstated. With secure and efficient electronic signatures, you can finalize and send your forms confidently. Collaborating with family members or advisors on gift planning documents is also seamless, making it easier to involve all necessary stakeholders in significant decisions.

Case studies: Successful gift planning with the Minnesota Gift Planning Association Form

Understanding the impact of the Minnesota Gift Planning Association Form can be exemplified through real-life success stories. For instance, a local community foundation utilized the form to engage donors in establishing a scholarship fund for underprivileged students. By defining their vision clearly, they attracted contributions from various sources, ultimately helping numerous students achieve their educational goals.

Another notable case involved an arts organization that successfully expanded its outreach through careful gift planning. They strategically used the form to outline their needs, which drew interest from high-net-worth individuals wishing to support local arts. These instances illustrate how effective gift planning not only aids organizations but also enriches the communities they serve, fostering a culture of giving.

Frequently asked questions about the Minnesota Gift Planning Association Form

The Minnesota Gift Planning Association Form can raise several concerns and questions among potential donors. Common concerns often revolve around the legalities of planned giving and how gifts may be utilized by organizations post-donation. It is important to understand the legal considerations to ensure compliance with current laws and regulations.

Moreover, misconceptions about the complexity of the process may deter individuals from engaging in gift planning. Providing clarity about required commitments and potential tax implications can alleviate these concerns. Accessible support channels for assistance, such as consultations with financial advisors or direct inquiries with the MGPA, can further empower individuals to proceed confidently.

Next steps for your gift planning journey

Once the Minnesota Gift Planning Association Form has been completed, it serves as a foundation for future planning. Donors should consider connecting with financial advisors or estate planners to explore their options for implementing their philanthropic strategies effectively. These professionals can offer tailored advice that aligns with individual goals.

Moreover, it is beneficial to stay informed about updates pertaining to the Minnesota Gift Planning Association, ensuring that you are aware of any enhancements or changes in policies that may affect your planned giving. Continuous education on best practices and potential new opportunities in planned giving will enrich your philanthropic journey.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute minnesota gift planning association online?

Can I create an eSignature for the minnesota gift planning association in Gmail?

How do I edit minnesota gift planning association straight from my smartphone?

What is Minnesota Gift Planning Association?

Who is required to file Minnesota Gift Planning Association?

How to fill out Minnesota Gift Planning Association?

What is the purpose of Minnesota Gift Planning Association?

What information must be reported on Minnesota Gift Planning Association?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.