Get the free Business Savings Change of Business Details Form

Get, Create, Make and Sign business savings change of

Editing business savings change of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business savings change of

How to fill out business savings change of

Who needs business savings change of?

Navigating the Business Savings Change of Form: A Comprehensive Guide

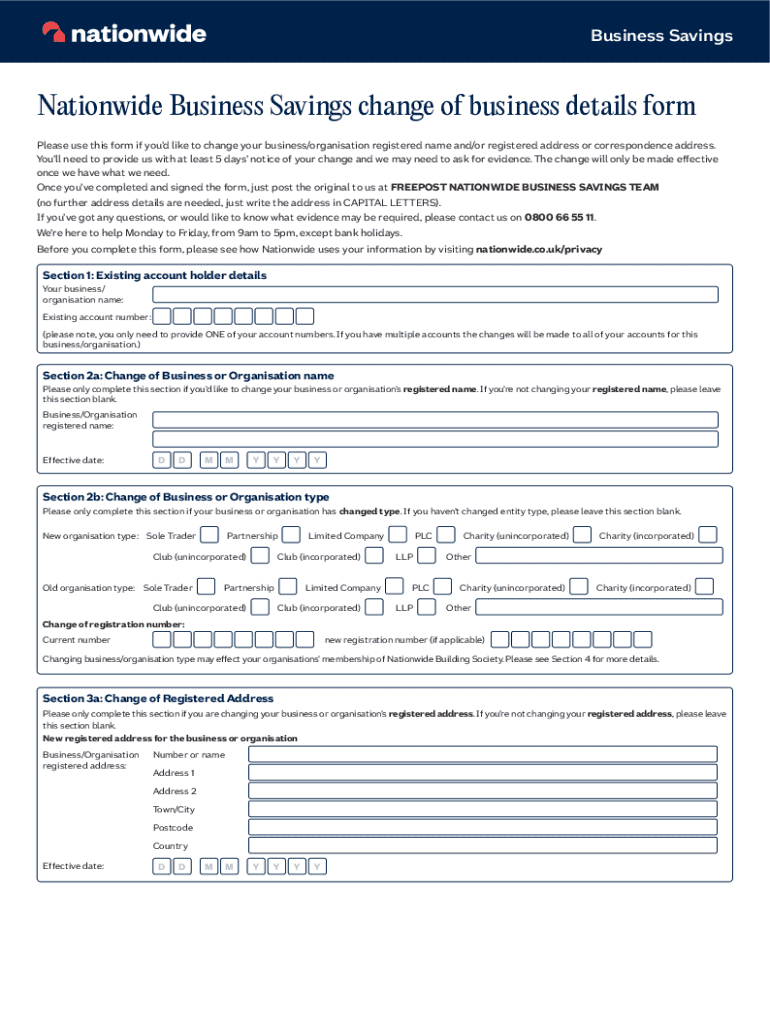

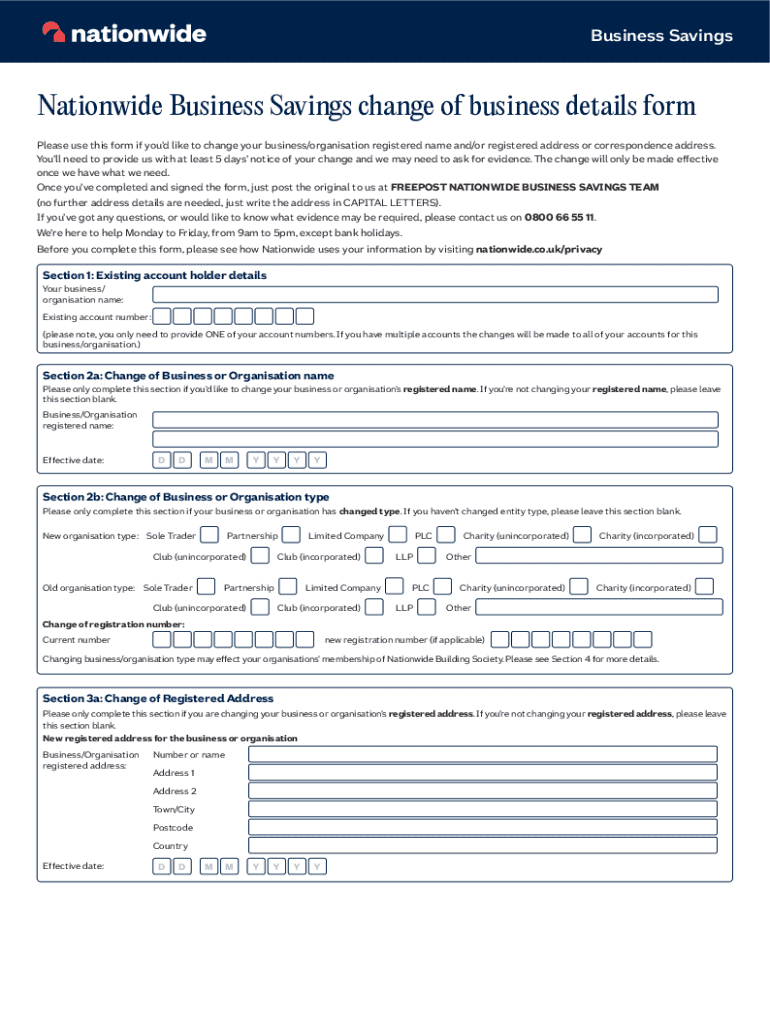

Understanding the business savings change of form

A business savings change of form is a critical document required when a business decides to update its savings account information. This could include changing the account's details, the individual authorized to manage the account, or even the business structure itself. Ensuring that this information is accurate is vital for maintaining optimal financial operations and compliance with banking regulations.

The importance of updating business savings information cannot be overstated. This routine practice serves as a safeguard against potential operational hiccups. For instance, transactions may be delayed or even rejected if the bank’s records do not match the current business information. Moreover, various scenarios necessitate a change of form, such as ownership transitions, rebranding, or expansions.

Key components of the business savings change of form

The business savings change of form encompasses several essential components that must be accurately filled out to facilitate a smooth transition. Firstly, business identification details are crucial. This includes the official business name, physical address, and the tax identification number, which ensures that the bank can verify the legitimacy of the entity making the changes.

Next, account information solidifies the foundation of the request. This section requires current savings account details along with newly updated account requirements, highlighting what exactly needs to be changed. Additionally, the information for owners or authorized signatories must be provided. This includes personal details such as names, addresses, and possibly information verifying their authority to manage the business accounts, along with signature authentication requirements.

Detailed steps to complete the business savings change of form

Completing the business savings change of form involves a systematic approach to ensure all details are accurate. Start by gathering all required information. This means you should prepare a list of supporting documents, including valid identification, proof of business address, and any applicable legal documents you may need to demonstrate ownership or management rights.

Once you have everything ready, the next step is accessing the change of form. You can easily find and download this form from pdfFiller, which provides a comprehensive array of templates for your needs. Users can choose to fill out the form online for convenience or download it to complete offline, depending on their preference. When filling out the form, you should follow specific instructions to enter all information correctly to avoid errors.

After filling out the form, it's crucial to review and edit the document. Take advantage of pdfFiller’s editing tools to correct any mistakes before submission. A thorough review can save you time and prevent future complications.

eSigning and submitting your business savings change of form

Adding eSignatures to your document is one of the final steps before submission. With pdfFiller, you can easily create and insert eSignatures, which are considered legally binding for business documentation. This means you can complete your submission without the need for physical signatures, streamlining the entire process.

The final submission process can be straightforward. Preferred submission methods include online submission through pdfFiller or traditional mailing. It's important to keep an eye on the document's status after submission. If the bank requires further action or rejects the submission, knowing how to handle these situations promptly can help you maintain your business’s financial wellbeing.

Managing updates post-submission

Keeping track of your form's status is easily manageable through pdfFiller. Users can check the status of their submitted forms readily, ensuring they are informed throughout the processing phase. Communication from the banking institution can vary, but knowing what to expect can keep your business prepared for any changes that may arise.

Common FAQs regarding business savings change of form

Understanding when changes to your business savings form should be made is key. Typically, it’s advisable to review and update your form at least once a year or whenever a significant change occurs within your business. If you need to make corrections after submission, pdfFiller allows for easy access and modifications, though you may need to resubmit to your bank for approval.

Fees associated with changing your business savings account can depend on your bank's policies. It's always prudent to inquire about these charges upfront to avoid unexpected fees.

Security and privacy considerations

Data security is paramount during business transactions, especially when dealing with sensitive information like financial records. pdfFiller takes extensive measures to protect your data during the document creation and submission processes. This includes encryption and secure access protocols, ensuring that your business’s private information remains confidential.

When sharing or storing sensitive documents, best practices include utilizing secure cloud services, regularly updating passwords, and limiting access to authorized personnel only. Following these guidelines can help mitigate risks associated with data breaches or unauthorized access.

Conclusion on the importance of timely updates

The financial implications of failing to update your business savings information can be significant. Inaccurate records could lead to denied transactions, loss of access to funds, or worse. Therefore, timely updates not only contribute to the smooth operation of your business but also ensure compliance with banking regulations, protecting your company’s interests.

Regular updates and management of your business's savings changes also reflect good financial stewardship. Utilizing tools like pdfFiller enhances how you handle these forms, making the entire process easier and more efficient.

Interactive tools for enhanced document management

pdfFiller offers an array of tools designed to enhance document collaboration and management. From templates specifically geared towards different types of business forms to interactive editing tools, users can efficiently manage document changes without hassle. This functionality not only saves time but ensures accuracy across all business documentation.

Utilizing templates for future savings form submissions can streamline the process even further, providing a consistent structure to follow for business alterations. Easy access to previous documents allows for quick resubmissions with necessary updates, enabling ongoing management of business savings information.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my business savings change of directly from Gmail?

How do I make edits in business savings change of without leaving Chrome?

How do I edit business savings change of straight from my smartphone?

What is business savings change of?

Who is required to file business savings change of?

How to fill out business savings change of?

What is the purpose of business savings change of?

What information must be reported on business savings change of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.