Get the free 990 ez form online

Get, Create, Make and Sign 990 ez form online

How to edit 990 ez form online online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 990 ez form online

How to fill out form 990-ez

Who needs form 990-ez?

Form 990-EZ Form: A Comprehensive How-to Guide

Understanding Form 990-EZ

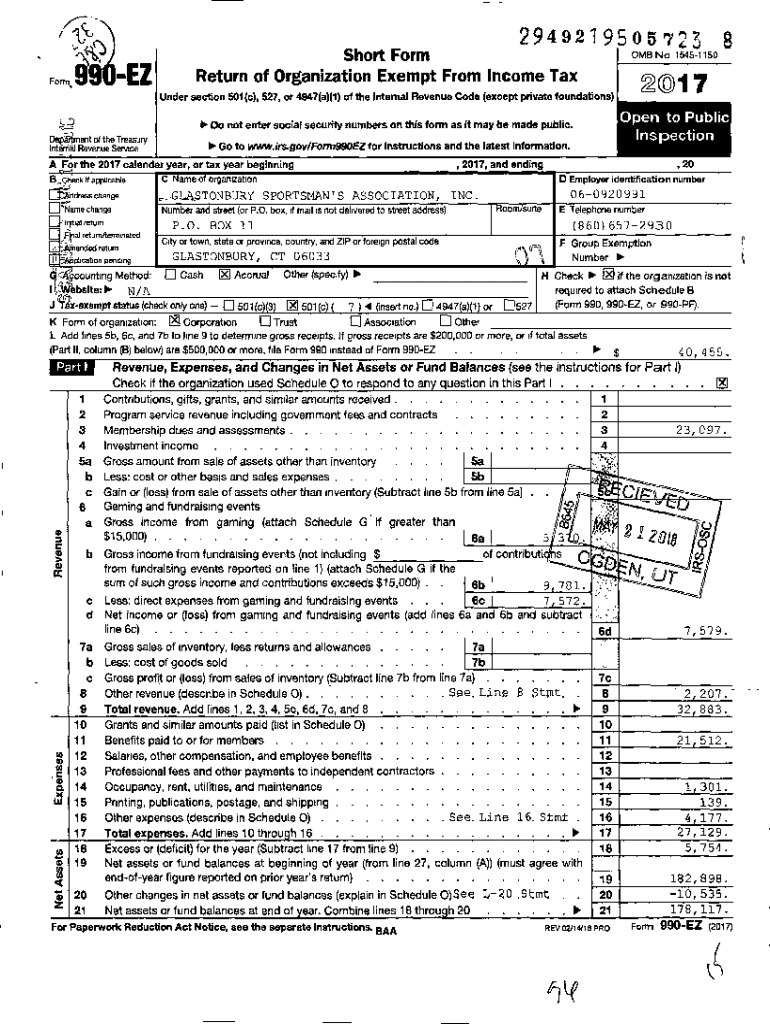

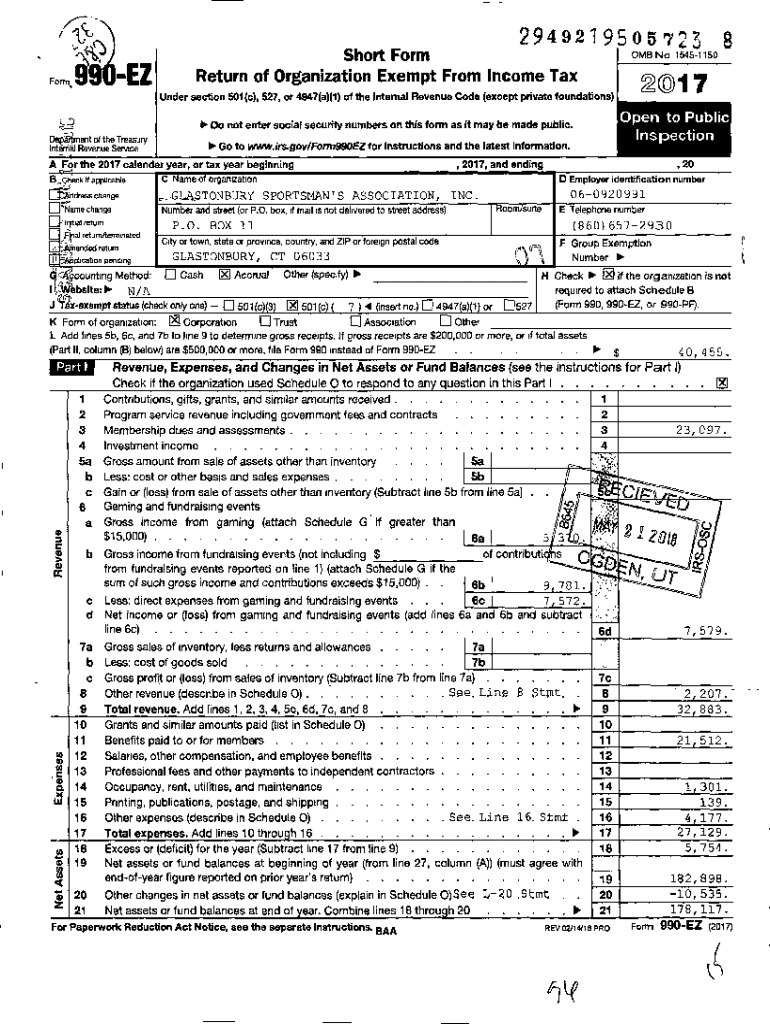

Form 990-EZ is a streamlined version of the IRS Form 990, specifically designed for small tax-exempt organizations, including charities and nonprofits. The primary purpose of the Form 990-EZ is to provide the IRS with necessary financial information and operational details about an organization’s activities, helping ensure they comply with federal regulations and maintain transparency.

The completion of Form 990-EZ not only fulfills federal requirements but also offers an opportunity for these organizations to confirm their tax-exempt status and promote accountability to stakeholders.

Benefits of filing Form 990-EZ

Filing Form 990-EZ offers significant benefits for small organizations, streamlining the reporting process and making it more manageable. Organizations with gross receipts of less than $200,000 and total assets below $500,000 are eligible, allowing many smaller nonprofits to meet their filing needs without overwhelming detail.

E-filing through services like pdfFiller can further enhance the experience by providing simple navigation tools and error-checking features, which ensure that submissions are complete and accurate. Simplified reporting minimizes the time spent on paperwork, empowering organizations to focus more on their mission.

Who needs to file Form 990-EZ?

Organizations that typically need to file Form 990-EZ include charities, religious organizations, and other tax-exempt entities that have gross receipts under the aforementioned thresholds. It's essential for organizations to assess their eligibility before filing the form to ensure compliance with IRS guidelines.

For comparison, larger organizations might need to file Form 990, while those with very minimal gross receipts (typically under $50,000) can opt for the simpler Form 990-N, also known as the e-Postcard. Understanding the nuances between these forms is vital for nonprofit compliance.

Preparing to file Form 990-EZ

Preparation is key to successfully filing Form 990-EZ. Before starting, organizations should gather essential documents, including their financial statements, records of income, expenses, and program services provided. A balance sheet reflecting the organization's assets, liabilities, and net assets, as well as a statement of functional expenses, should be ready as they are crucial to completing the form.

Common challenges include discrepancies in financial data or misunderstandings regarding reporting requirements. It's beneficial for organizations to designate a specific person or team to manage the preparation process and utilize checklists to avoid pitfalls.

Filling out Form 990-EZ

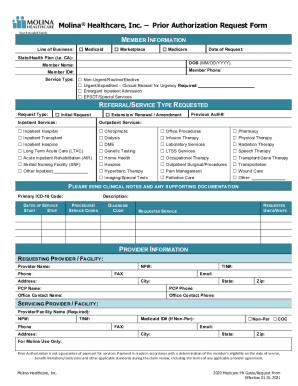

Completing Form 990-EZ involves filling various sections which include basic organizational information, revenues, expenditures, and functional expenses. Start with entering the organization's name, address, and EIN at the top of the form. Then, systematically input income data from all sources, including contributions, grants, and any earned income.

Next, the expenditures section allows organizations to detail their functional expenses. Accuracy is critical; an error here could lead to compliance issues later. Ensure that you double-check entries before submission, focusing on frequently missed sections like grant agreements and significant changes in financial activities.

E-filing your Form 990-EZ

Filing Form 990-EZ electronically streamlines the process and enhances accuracy. To e-file, organizations can utilize IRS-approved software or services like pdfFiller to ensure compliance. The process begins with selecting compatible software, preparing your form, and then uploading it securely to the IRS electronic filing system.

One of the biggest advantages of e-filing is the immediate confirmation of submission and improved tracking of the filing status, eliminating the anxieties of traditional mail delays. It's crucial to keep a record of your submission and any confirmations received.

Managing follow-up after filing

After filing Form 990-EZ, organizations should monitor their filing status and confirm that the IRS has received their submission without any issues. If errors are discovered after submission, amending Form 990-EZ is possible, but it must be completed under specific guidelines. This involves filing Form 990-EZ again, indicating that it’s an amended return, and clearly explaining the changes made.

Organizations must also be mindful of filing deadlines, as penalties apply for late submissions. Understanding the consequences is essential to avoid future filing errors and maintain proper standing as a nonprofit organization.

Additional resources and tools

Utilizing interactive tools available on platforms like pdfFiller can simplify the completion and submission of Form 990-EZ. These tools not only enable users to fill out forms easily but also allow collaboration with team members, fostering a more effective review process.

Furthermore, resources aimed directly at nonprofits, such as webinars and instructional materials, can provide valuable insights into fulfilling tax obligations and understanding compliance issues more deeply.

Frequently asked questions (FAQ)

Many organizations often have questions regarding the Form 990-EZ filing process. Common queries include the due date for filing, which is typically the 15th day of the 5th month following the end of the organization’s accounting period. Organizations can file for an automatic extension using Form 8868 if they require extra time.

Another common question revolves around the necessity of electronic filing. While e-filing is not mandatory, it is highly recommended due to its convenience and speed, as well as the ability to easily confirm receipt of submissions with the IRS.

Testimonials and user experiences

Users of pdfFiller have reported numerous success stories regarding their experience with Form 990-EZ. Many appreciate the intuitive interface and user-friendly features that facilitate easy form completion. Additionally, the collaborative tools help teams collectively manage their filing, ensuring all necessary information is accounted for before submission.

Feedback indicates that navigating through the platform is straightforward, dramatically reducing the time spent on paperwork and eliminating common errors, ultimately allowing organizations to focus on their core missions.

Snippets for easy navigation

To assist readers in navigating this guide, we have included quick links to key sections that address common inquiries and processes related to the Form 990-EZ. Whether you are seeking detailed instructions or clarification on filing requirements, you can easily jump to those sections for the information you need.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 990 ez form online without leaving Google Drive?

Can I create an electronic signature for the 990 ez form online in Chrome?

Can I edit 990 ez form online on an iOS device?

What is form 990-ez?

Who is required to file form 990-ez?

How to fill out form 990-ez?

What is the purpose of form 990-ez?

What information must be reported on form 990-ez?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.