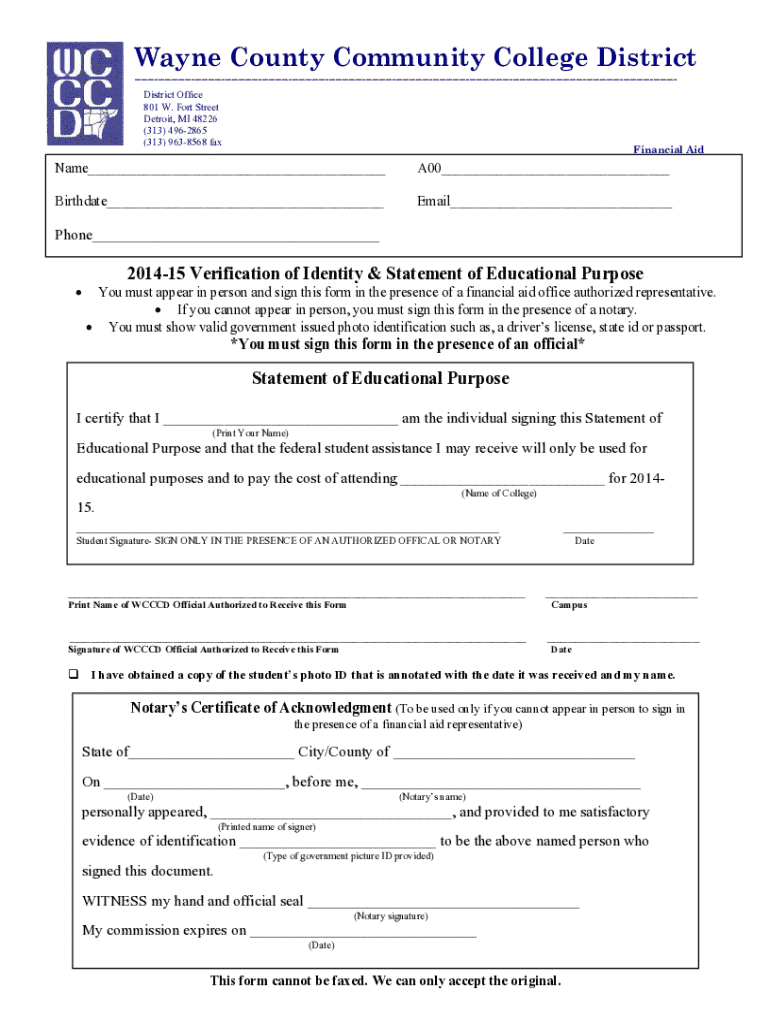

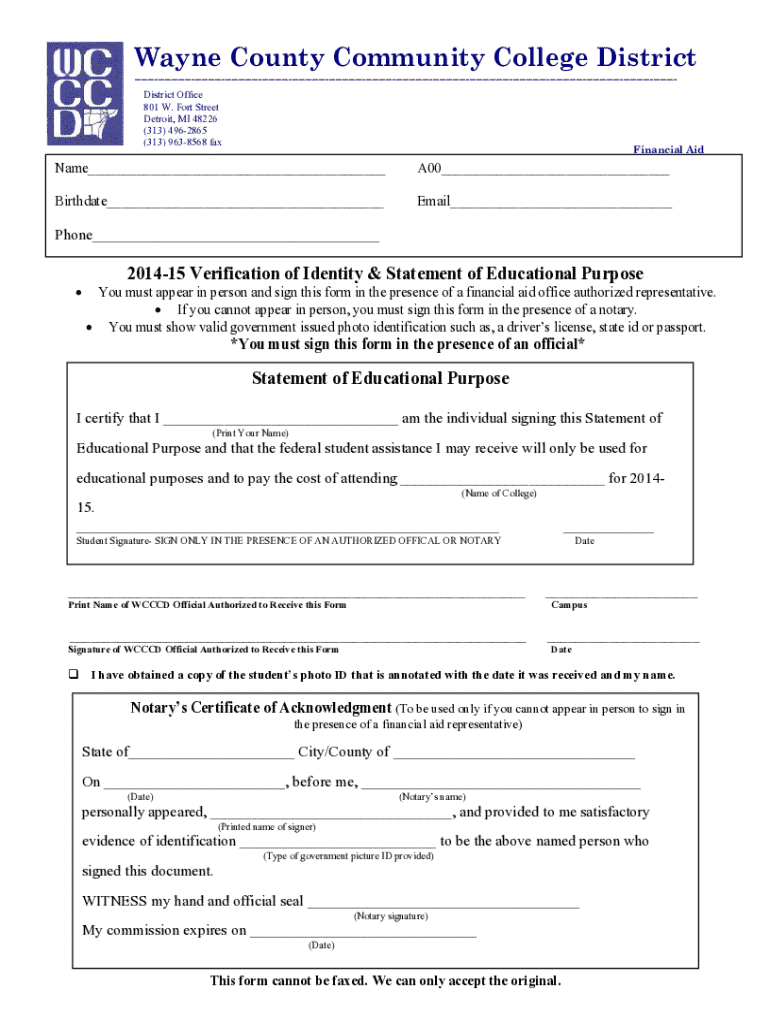

Get the free Financial Aid Verification of Identity Form

Get, Create, Make and Sign financial aid verification of

Editing financial aid verification of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial aid verification of

How to fill out financial aid verification of

Who needs financial aid verification of?

A Comprehensive Guide to Financial Aid Verification of Form

Understanding financial aid verification

Financial aid verification is a crucial process that confirms the accuracy of the information provided in your FAFSA (Free Application for Federal Student Aid) form. This procedure is undertaken by colleges and universities to ensure that the data aligns with official documents, allowing for the appropriate amount of aid to be disbursed. Not only does verification help ensure that resources are allocated correctly, but it also protects against fraud and ensures that deserving students receive the financial support they need.

The importance of verification can’t be understated; it serves as a safeguard for both students and institutions. For students, it means having a clear path to accessing necessary funding, while for institutions, it ensures compliance with federal regulations. However, the verification process can also influence your financial aid package significantly. If discrepancies arise during verification, your aid may be adjusted, or in some cases, revoked entirely.

Application and verification process

The financial aid verification process begins after the completion of the FAFSA submission. Once you submit your application, your institution may select you for verification based on various factors, which can happen randomly or due to specific discrepancies in your application. Notifications about your verification status are typically sent via email or through your school's financial aid portal soon after your FAFSA has been reviewed.

Receiving a notification that you’ve been selected for verification means it’s time to gather the necessary documentation. Understanding the details provided in your notification is essential for completing verification efficiently. Familiarize yourself with key terminology, such as 'Verification Worksheet,' as this form will guide you in providing the correct information required by your school.

Preparing for FAFSA verification

Preparing for financial aid verification can feel daunting, but a comprehensive checklist can simplify the process. Required documents often include your federal tax returns (IRS Form 1040), W-2 forms from your employer, and potentially additional financial statements such as bank statements or records detailing untaxed income. Each of these documents offers a snapshot of your financial situation, enabling your institution to verify the information you reported on your FAFSA accurately.

To ensure a smooth verification process, organization is key. Keeping both electronic and physical copies of all documents can save time and stress. Labeling your files—whether they are digital or printed—will aid in tracking what you’ve submitted and what still needs to be provided. By preparing meticulously, you not only ease your verification experience but also demonstrate responsibility, which can positively reflect during the review.

Types of verification

Verification is not a one-size-fits-all process. There are several types of verification tailored to different situations. The most common is the standard verification process. However, students who have filed an amended tax return may find themselves going through specific verification steps related to that situation. Additionally, there are provisions for victims of IRS identity theft, where different documentation is necessary to prove income and tax status.

Non-IRS income tax returns are also treated differently. Students who have income from sources outside the traditional IRS framework must provide different forms of verification, ensuring that all income is accounted for. Understanding these variations is crucial to fulfilling your verification requirements.

Step-by-step guide to completing verification

Completing verification may seem overwhelming, but you can approach it step-by-step. First, gather all required documents as outlined earlier. This foundational step ensures you have everything at hand when needed. Then, you need to complete the Verification Worksheet. You can usually access this document from your school’s financial aid office or website. Each section will require specific pieces of information, so it’s essential to fill it out accurately.

Next, you will submit your verification documents. Both online and mailed formats are often acceptable. If you’re using an online submission, many institutions have secure portals for this purpose. After submission, it can be helpful to check your FAFSA platform or directly with the financial aid office to confirm that your documents have been received and are in the process of being reviewed.

How to resolve issues during verification

During verification, issues may arise. Common problems include missing documents or discrepancies in reported information. If you've inadvertently submitted incomplete paperwork or entered incorrect figures on your FAFSA, it's important to act quickly. Contact your financial aid office for guidance; they can inform you of the next steps.

Many institutions have resources to assist students in navigating issues during verification. Whether it’s scheduling a quick consultation or providing additional resources online, utilizing these services can lead you to a smoother resolution.

Reducing the chances of verification

While verification processes are sometimes random, there are proactive steps you can take to minimize your chances of being selected. Accurate reporting on your FAFSA plays a critical role in this. Ensuring that all information is correct, including income figures, helps establish credibility and may deter selection for verification.

Additionally, utilizing the IRS Data Retrieval Tool (DRT) during the FAFSA application can streamline the process. This tool automatically pulls tax data straight from the IRS, reducing the chances of errors and discrepancies that lead to verification. Taking these steps not only saves you time but also enhances the accuracy of your financial aid application.

Consequences of not completing verification

Failing to complete the financial aid verification process can have serious consequences. Without verification, you may lose eligibility for federal financial aid altogether. This loss affects grants, work-study opportunities, and federal loans crucial to funding your education.

Moreover, financial aid disbursement can be delayed significantly if verification is incomplete. This timeline can affect your ability to pay tuition and other fees, posing additional stress during an already challenging time. Understanding the potential outcomes can motivate timely and accurate completion of the verification requirements.

Frequently asked questions

As you navigate financial aid verification, questions are bound to arise. For example, what happens if you miss the verification deadline? Typically, late submissions can jeopardize your financial aid eligibility. If you find yourself in this situation, promptly contact your financial aid office for possible solutions.

Can you appeal a verification decision? Yes, students may appeal decisions made during the verification process, particularly if they believe there was an error. Lastly, the verification process can differ by academic institution, so it’s important to consult your school’s specific guidelines. Resources for financial aid counseling are often available through your institution or online to assist you further.

Related financial aid topics

To gain a deeper understanding of the financial aid landscape, exploring related topics can be beneficial. First, familiarize yourself with the different types of financial aid available today. Additionally, understanding the differences between grants and loans is crucial. Lastly, learning how to navigate federal student aid effectively will empower you to maximize the financial resources at your disposal.

These related topics provide valuable insights that can align with the verification of your financial aid forms, ensuring you are well-informed and ready for any step in the financial aid process.

Utilizing pdfFiller for effective verification management

pdfFiller is an invaluable tool for managing your financial aid verification documents effectively. You can edit and finalize your verification documents directly on the cloud, ensuring everything is in order before submission. The platform allows you to eSign your forms securely, adding an extra layer of convenience.

Collaboration with financial aid advisors online is also seamless, providing you with real-time assistance. The benefits of using a cloud-based document management system like pdfFiller cannot be overstated, particularly when navigating the often complex landscape of financial aid verification.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute financial aid verification of online?

How do I edit financial aid verification of online?

Can I create an electronic signature for signing my financial aid verification of in Gmail?

What is financial aid verification of?

Who is required to file financial aid verification of?

How to fill out financial aid verification of?

What is the purpose of financial aid verification of?

What information must be reported on financial aid verification of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.