Get the free Nc-4 Ez

Get, Create, Make and Sign nc-4 ez

How to edit nc-4 ez online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nc-4 ez

How to fill out nc-4 ez

Who needs nc-4 ez?

Complete Guide to the NC-4 EZ Form for Tax Withholding in North Carolina

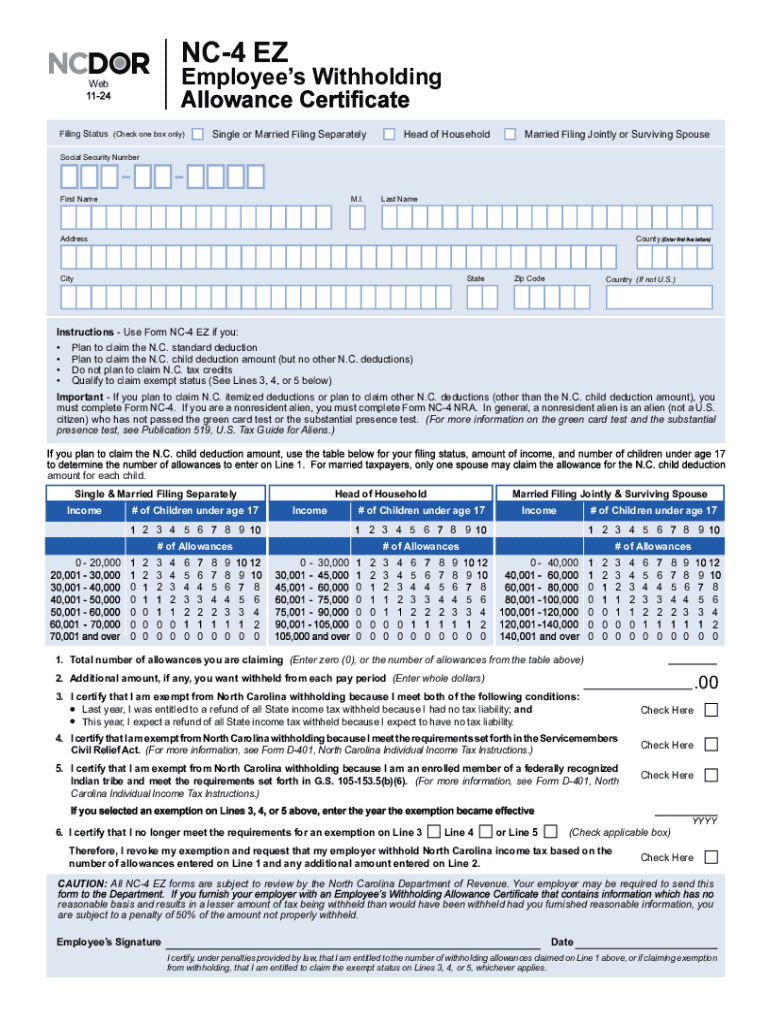

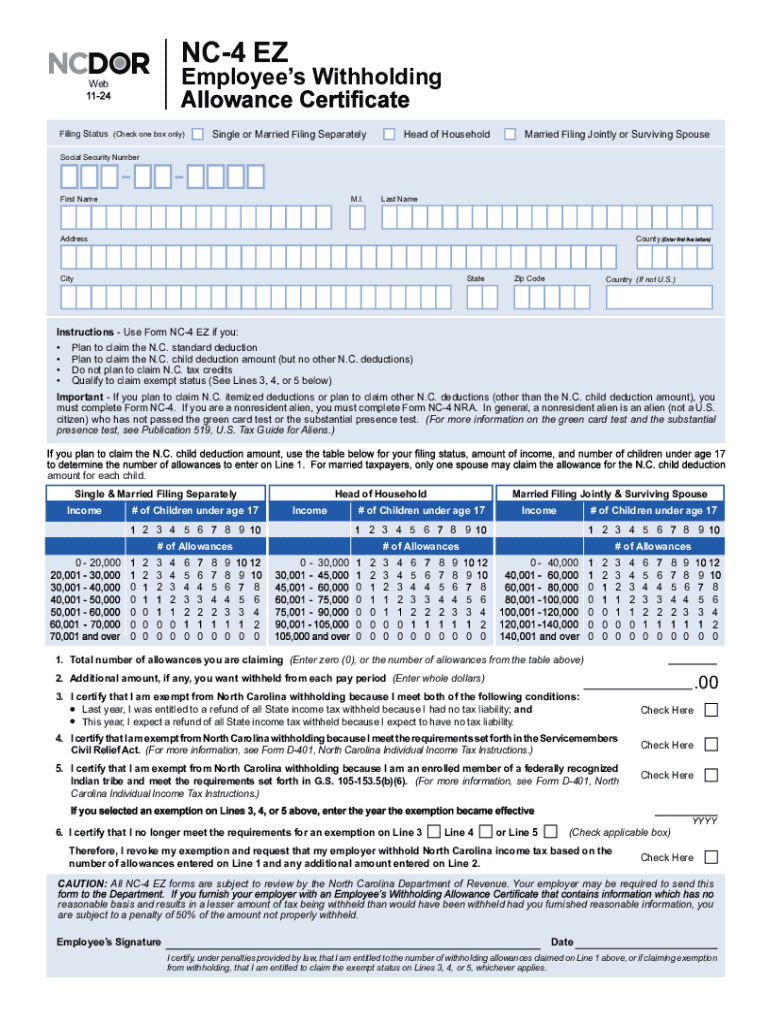

Overview of the NC-4 EZ form

The NC-4 EZ form is a simplified tax withholding certificate specifically designed for employees in North Carolina. Its primary purpose is to allow individuals to claim personal exemptions to reduce their income tax withholding amounts. Proper usage of this form is crucial in ensuring that state tax is withheld accurately, preventing either excessive taxation or under-withholding which could lead to tax penalties later.

For anyone earning an income in North Carolina, filling out the NC-4 EZ form is an essential step among tax-related procedures. This form makes it easier for employees to manage how much tax is withheld from their paychecks, thereby enhancing budgeting effectiveness and financial planning.

Who should use the NC-4 EZ form?

The NC-4 EZ form caters primarily to employees, freelancers, and seasonal workers living or working in North Carolina. Those who expect to owe less than the standard deductions can benefit significantly from utilizing this simplified form. Specifically, individuals in specific employment scenarios — such as part-time jobs or temporary positions — where income stability is uncertain can find great use of the NC-4 EZ. It enables them to tailor their tax withholding better to suit their financial situation, ensuring that they neither overpay nor underpay their state taxes.

Key features of the NC-4 EZ form

The main distinction between the NC-4 and the NC-4 EZ form lies in the complexity of the applications: while NC-4 may involve more detailed calculations, the NC-4 EZ offers a straightforward process, optimizing efficiency for users. The primary advantage of using the NC-4 EZ form is its streamlined structure, allowing easy navigation and quicker completion without sacrificing accuracy.

The NC-4 EZ form includes essential sections that require tax filers to provide their personal details and determine withholding allowances. These sections typically require information such as: the taxpayer's full name, Social Security number, address, and the number of allowances they wish to claim based on their filing status. By answering these straightforward questions accurately, individuals can ensure their expected tax withholding mirrors their actual financial circumstances more closely.

Step-by-step instructions for filling out the NC-4 EZ form

Filling out the NC-4 EZ form can be accomplished efficiently by following three simple steps. The first step involves gathering necessary information. Taxpayers should have the following documents at hand: their W-2 or 1099 forms, Social Security number, and a completed personal financial checklist to determine their filing status.

Step two is to complete the form itself. Begin by filling out personal details like your name, Social Security number, and address. Next, determine your filing status based on whether you file taxes as single, married, or head of household. Finally, calculate your withholding allowances. The form includes sections that guide you through estimating these allowances accurately by considering family size, dependents, and other allowances you may be entitled to.

In step three, reviewing your entries is essential. Verification helps prevent errors which could lead to tax discrepancies. Recommended tips for checking your information include ensuring all numbers are entered correctly, confirming your eligibility for the amount of allowances claimed, and reviewing your contact information for accuracy.

Editing and signing the NC-4 EZ form

After filling out the NC-4 EZ form, users can make edits as necessary using pdfFiller, a robust tool for document management. pdfFiller offers various features to seamlessly edit the form, making it easy to correct any inaccuracies or add pertinent notes for clarity. Users can add comments directly onto the form, providing enhanced context for themselves or their filing parties.

Applying an electronic signature is likewise straightforward with pdfFiller. Users can create a legally valid eSignature that can be affixed directly onto the document. The legal validity of electronic signatures in North Carolina adheres to the E-Sign Act and UNCITRAL Model Law, making eSignatures just as binding as traditional handwritten signatures.

Submitting the NC-4 EZ form

Upon completion and signing, users have several submission options available for their NC-4 EZ form. Submission can be conducted online via the NC Department of Revenue website, mailed directly to the relevant tax office, or submitted in person at local revenue offices. Each option offers convenience based on individual preference and location.

It’s equally important to be aware of submission deadlines, as failing to submit on time can lead to unnecessary complications. Typically, it’s advisable to submit the NC-4 EZ form at the very beginning of your employment or as soon as there are changes in your tax situation. Staying proactive with submission ensures your withholding aligns effectively with your current tax obligations.

Managing your NC-4 EZ form with pdfFiller

pdfFiller not only facilitates the editing and signing of the NC-4 EZ form but also provides features for document management such as cloud storage. Users can save completed forms securely online, making them easily accessible from anywhere, eliminating the risk of losing important tax documents. This cloud capability supports effective organization and legal compliance.

Collaboration is also made simple with pdfFiller. Users can easily share their forms with team members for group input, enhancing teamwork in tax preparation efforts. The document tracking feature allows users to see who has viewed, edited, or made comments on the document, providing clear visibility into collaborative processes.

Frequently asked questions (FAQs)

Common issues that arise when filling out the NC-4 EZ form typically involve misunderstandings around personal allowances or missing documentation. To troubleshoot effectively, ensure you have all your financial documents accessible before starting the form, and revisit how withholding allowances are calculated. This can mitigate potential errors significantly.

For additional assistance, a wealth of resources is available, including the North Carolina Department of Revenue's website, which offers guides, help desks, and contact information for inquiries regarding tax forms like the NC-4 EZ. Users can also refer to accounting professionals who specialize in North Carolina tax law for personalized support.

Revision history and updates to the NC-4 EZ form

Maintaining awareness of the revision history of the NC-4 EZ form is essential, as updates can impact how the form is filled out each tax year. The North Carolina Department of Revenue periodically revises its forms, and taxpayers should refer to the official website for the latest versions and any accompanying guidelines.

For any further inquiries, taxpayers can reach out directly to the NC Department of Revenue's contact center via phone or email. These resources are invaluable for obtaining accurate, timely information about current forms and filing requirements.

Authority and legislation governing the NC-4 EZ form

The NC-4 EZ form is governed by a framework of state regulations which dictate appropriate withholding practices in compliance with North Carolina's income tax laws. Understanding these regulations is crucial for taxpayers who utilize the form to navigate their tax responsibilities accurately.

Taxpayers must familiarize themselves with their rights and responsibilities concerning tax withholding. Knowledge of state ordinances and updates can help individuals ensure compliance, avert under-withholding issues, and secure their taxation rights effectively within North Carolina’s jurisdiction.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my nc-4 ez in Gmail?

How do I edit nc-4 ez straight from my smartphone?

How can I fill out nc-4 ez on an iOS device?

What is nc-4 ez?

Who is required to file nc-4 ez?

How to fill out nc-4 ez?

What is the purpose of nc-4 ez?

What information must be reported on nc-4 ez?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.