Get the free Streamlined Sales Tax Certificate of Exemption

Get, Create, Make and Sign streamlined sales tax certificate

Editing streamlined sales tax certificate online

Uncompromising security for your PDF editing and eSignature needs

How to fill out streamlined sales tax certificate

How to fill out streamlined sales tax certificate

Who needs streamlined sales tax certificate?

A comprehensive guide to the streamlined sales tax certificate form

Understanding the streamlined sales tax certificate form

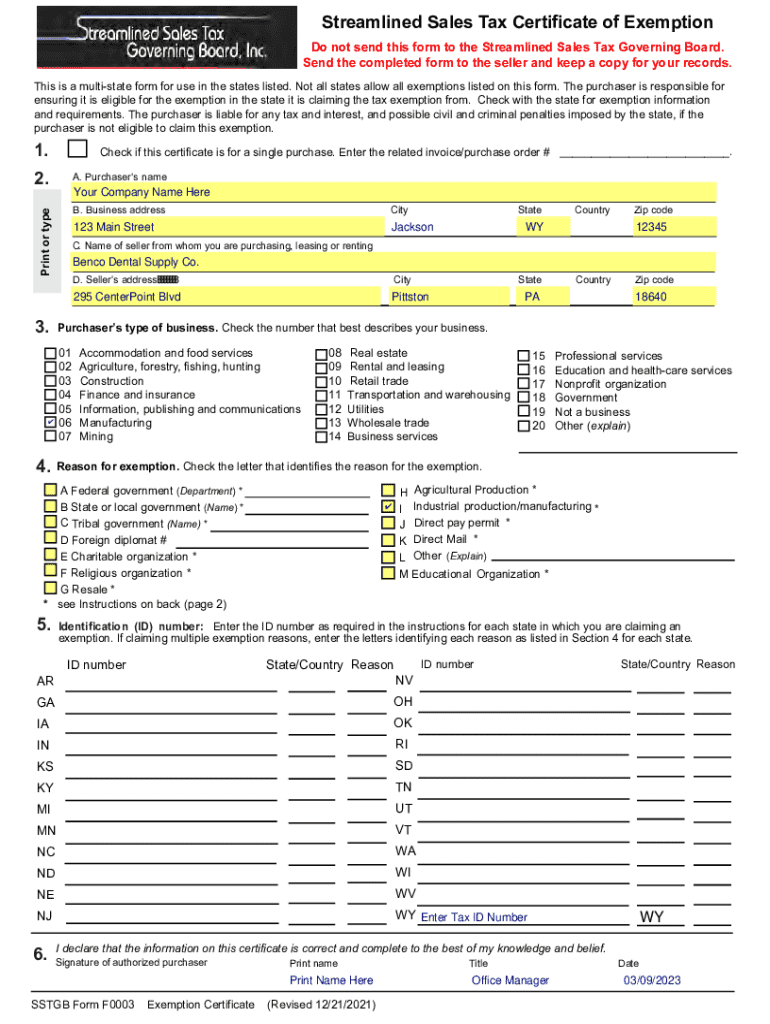

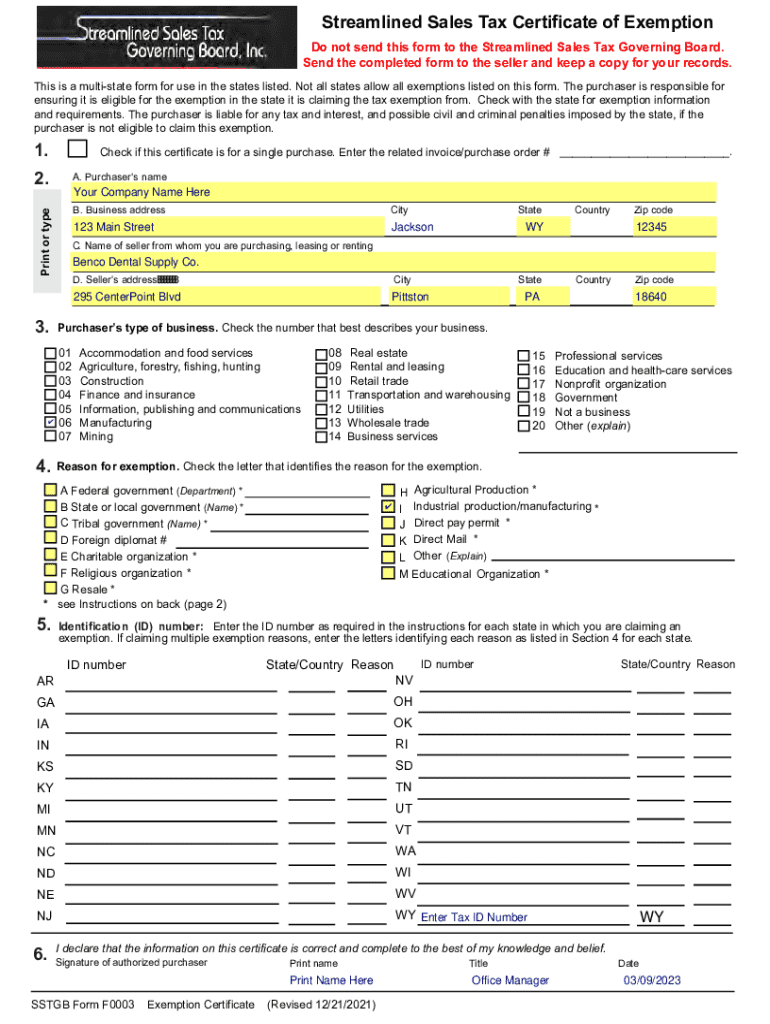

The streamlined sales tax certificate form is a crucial document for purchasers looking to claim tax exemptions on specific purchases. This form is standardized across multiple states that participate in the Streamlined Sales and Use Tax Agreement (SSUTA). By using this form, businesses and individuals can effectively communicate their tax-exempt status to sellers, thus avoiding unnecessary taxation on qualified purchases.

The purpose of the streamlined sales tax certificate form extends beyond mere convenience. This document is essential for maintaining compliance with tax regulations and ensuring that exempt purchases are recognized by sellers. Its significance is particularly noticeable in sectors where tax matters can quickly become complicated, ensuring that all parties fulfill their tax obligations accurately.

Key features of the streamlined sales tax certificate form

The streamlined sales tax certificate form consists of several critical components that ensure clarity and proper use. First, it requires essential information such as the detailed identification of the purchaser and the seller. All parties must provide basic contact information, including names, addresses, and business identification numbers, if applicable. This transparency fosters trust and accountability in transactions.

Notably, the form includes sections where the purchaser must identify the type of purchase being made and detail the exemptions being claimed. This information is crucial as it directly impacts the seller's understanding of sales tax applicability. Furthermore, each form must be signed and dated, confirming the authenticity of the information provided. Ensuring accuracy in these sections minimizes the risk of future disputes or audits.

Who can use the streamlined sales tax certificate?

Eligible purchasers of the streamlined sales tax certificate form include a variety of entities, each capable of claiming tax exemptions. This may encompass non-profit organizations, governmental agencies, and certain types of businesses engaged in resale or manufacturing activities. Understanding the eligibility criteria is essential to avoid unnecessary tax implications.

Additionally, personal use cases can also be included, such as individuals purchasing items for exempt purposes like educational materials. On the seller's side, it's important to note that only sellers within states participating in the SSUTA can accept this form. States participating include Arkansas, Georgia, and Indiana, among others.

Filling out the streamlined sales tax certificate form

Successfully completing the streamlined sales tax certificate form requires careful attention to detail. Begin by gathering the necessary information, such as the purchaser’s details and the seller's business information. Take time to understand each section distinctly to minimize the chances of errors.

In the sections.

Common mistakes to avoid include inaccuracies in contact information and failing to sign the form. Always double-check for typos or misinterpretations that could lead to complications later. Implementing a methodical approach will enhance accuracy.

To ensure completion, consider using helpful tools and resources available on pdfFiller. For instance, their platform enhances document accuracy through collaborative features and easy editing tools.

Editing and managing your streamlined sales tax certificate form

One notable advantage of utilizing pdfFiller for managing your streamlined sales tax certificate form is the benefit of real-time document editing. This capability allows users to fill, edit, and update forms quickly, without the hassle of printing or scanning. Users can also eSign the certificate directly within the platform, ensuring a faster turnaround time.

Storing and accessing forms anywhere is another powerful feature. The cloud-based system allows for secure document storage that can be accessed from virtually any device. This means users can work from home, the office, or on the go without the risk of losing critical paperwork.

Frequently asked questions (FAQs)

While the streamlined sales tax certificate form is quite straightforward, several questions frequently arise regarding its use. One main concern is about common exemptions that can be claimed. These often include sales for resale, specific manufacturing equipment, and purchases made by non-profit organizations.

Ensuring that your form is accepted by sellers is vital; it is wise to verify that all the required information is present and accurate. If doubts arise, communicate directly with sellers to clarify their requirements. Additionally, if you ever receive a notice of audit, it’s crucial to retain copies of all submitted forms and relevant correspondence to defend your exempt status.

Supporting documentation

When using the streamlined sales tax certificate form, it's important to gather any additional documents that may be required for your specific exemption. This could include certificates of exemption or proof of non-profit status, depending on the purchase being made. Ensure that all supporting documents are accurate and readily available as they contribute significantly to your exemption claim.

Adopting best practices for record-keeping is essential. Maintain copies of the completed certificates, related correspondence, and supporting documents for efficient organization. Having these records at hand not only eases the audit process but also ensures that you understand your rights and responsibilities as a purchaser.

Special considerations for drop shipments

Drop shipments often create complex tax liability scenarios, particularly regarding who is responsible for sales tax. In many cases, the retailer is liable for tax unless they can demonstrate that the goods were delivered to a tax-exempt entity. When completing the streamlined sales tax certificate form for drop shipments, it is crucial to accurately represent how the transaction aligns with exemption criteria.

All parties involved should clearly understand their responsibilities. For example, third-party suppliers may need to validate that the shipment meets the necessary conditions for exemption. This makes accurately completing the streamlined sales tax certificate form even more critical to ensure valid transactions.

Resources for further assistance

If further assistance is required regarding the streamlined sales tax certificate form, there are numerous resources available. Accessing tax regulation resources can provide valuable insights into specific state requirements or updates regarding tax laws. Consulting with tax professionals can also yield personalized advice, ensuring compliance with the most current regulations.

For more immediate support related to document management, pdfFiller offers exceptional customer service. Their support resources are tailored to assist users in navigating the platform's features effectively while ensuring successful document completion.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my streamlined sales tax certificate in Gmail?

How do I edit streamlined sales tax certificate straight from my smartphone?

How do I complete streamlined sales tax certificate on an Android device?

What is streamlined sales tax certificate?

Who is required to file streamlined sales tax certificate?

How to fill out streamlined sales tax certificate?

What is the purpose of streamlined sales tax certificate?

What information must be reported on streamlined sales tax certificate?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.