Get the free Ptax-342-r

Get, Create, Make and Sign ptax-342-r

Editing ptax-342-r online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ptax-342-r

How to fill out ptax-342-r

Who needs ptax-342-r?

Complete Guide to the PTAX-342-R Form

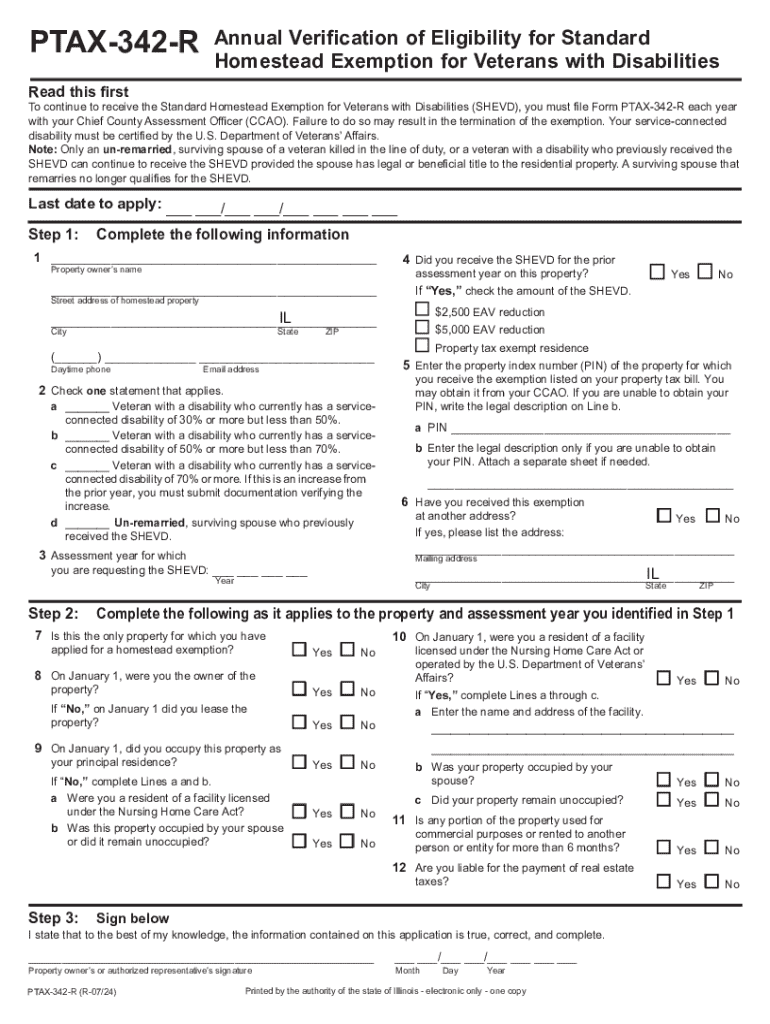

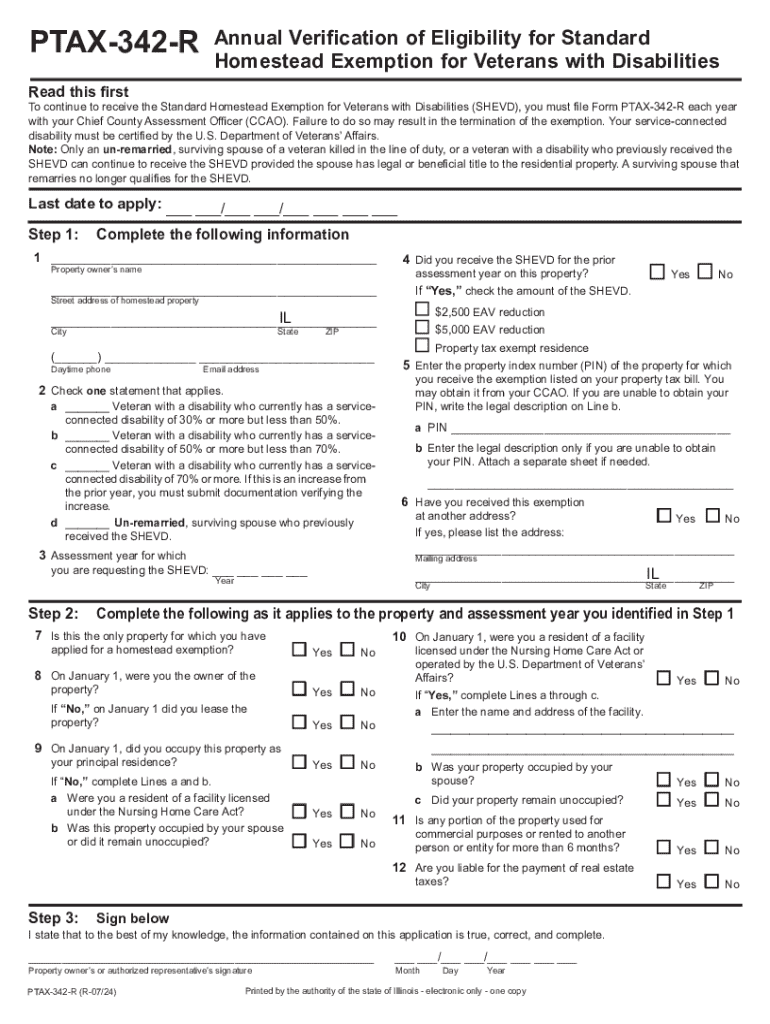

Overview of the PTAX-342-R form

The PTAX-342-R form is a crucial document utilized primarily in the realm of property taxation in certain jurisdictions. It serves as a request for property tax exemption, allowing eligible individuals or organizations to potentially reduce their tax liability. Accurate completion of the PTAX-342-R form is vital, as it directly influences the eligibility for tax exemptions and the subsequent financial implications for property owners.

Key features of the PTAX-342-R form

The PTAX-342-R form is structured in a way that facilitates the collection of essential information necessary for processing tax exemptions. The form is typically divided into three sections: Identification Information, Assessment Information, and Exemptions and Deductions. Each section plays a pivotal role in ensuring the correct evaluation of the exemption request.

Step-by-step guide to filling out the PTAX-342-R form

Filling out the PTAX-342-R form can seem daunting, but with a structured approach, it can be accomplished efficiently. The first step involves gathering necessary information and documentation, which includes prior tax returns, property deeds, and other pertinent records.

When tackling the form, follow these detailed instructions:

Interactive tools for PTAX-342-R form management

Utilizing interactive tools can significantly enhance the efficiency of managing the PTAX-342-R form. Platforms like pdfFiller provide features that streamline the process of filling out, editing, signing, and collaborating on documents.

Common mistakes to avoid when filling out the PTAX-342-R form

Filling out the PTAX-342-R form correctly is essential to avoid unnecessary complications. Common pitfalls can significantly delay processing and result in forfeited exemption opportunities.

Frequently asked questions (FAQs) about the PTAX-342-R form

When navigating the complexities of the PTAX-342-R form, many users often have similar queries. Understanding these can alleviate apprehension.

Related forms and documentation

Understanding the PTAX-342-R form is beneficial in relation to several related documents that may play a role in property tax exemptions. For individuals looking to navigate this realm, it can be valuable to be aware of these forms.

Contact and support options

Navigating the PTAX-342-R form can be overwhelming, but there are several support options available to assist individuals in this process.

Updates and changes to the PTAX-342-R form

Staying informed about changes to the PTAX-342-R form is essential for ensuring compliance and maximizing exemption benefits. Recent modifications may arise due to legislative updates or changes in tax policy.

User success stories and testimonials

Hearing from users who successfully completed their PTAX-342-R submissions can provide valuable insights and inspiration. Many individuals can attest to the positive impact of correctly submitting the form, from securing significant savings to navigating the complexities of tax documentation with ease.

Additional resources for document management

For individuals managing their PTAX-342-R forms, accessing additional resources can bolster their confidence and knowledge. Knowing where to find helpful documents or guidelines can make a considerable difference.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit ptax-342-r from Google Drive?

How do I make changes in ptax-342-r?

Can I create an eSignature for the ptax-342-r in Gmail?

What is ptax-342-r?

Who is required to file ptax-342-r?

How to fill out ptax-342-r?

What is the purpose of ptax-342-r?

What information must be reported on ptax-342-r?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.