Get the free N-70np

Get, Create, Make and Sign n-70np

How to edit n-70np online

Uncompromising security for your PDF editing and eSignature needs

How to fill out n-70np

How to fill out n-70np

Who needs n-70np?

Understanding the n-70np form: A Comprehensive Guide

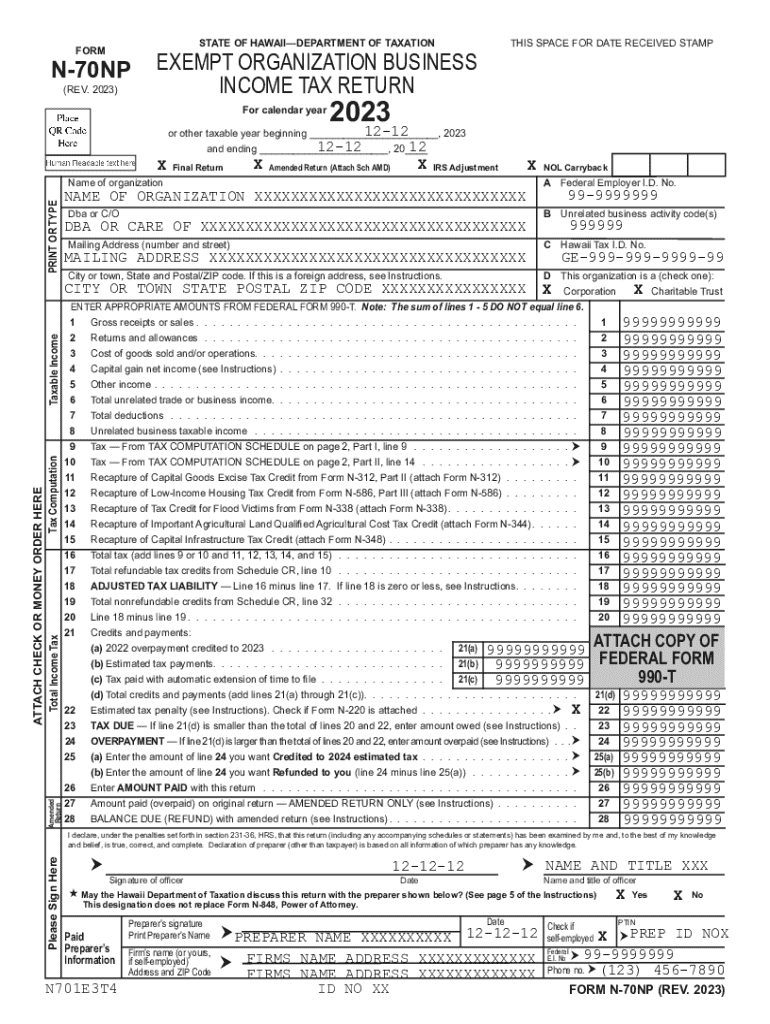

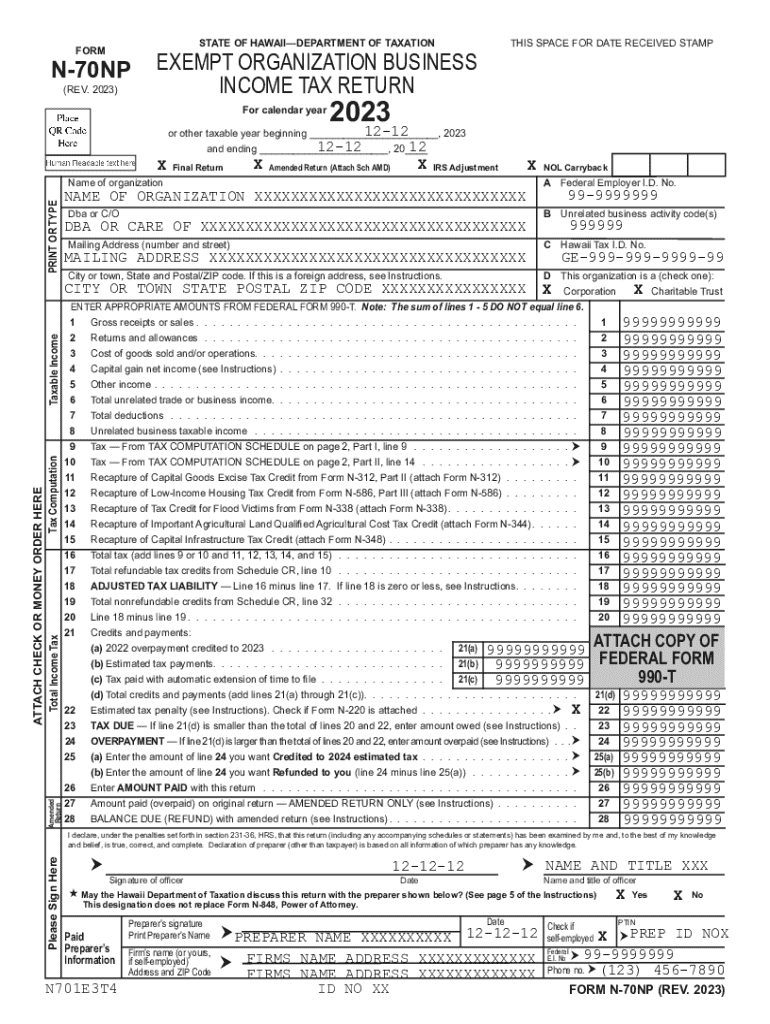

Overview of the n-70np form

The n-70np form is a crucial document often required in various administrative and legal contexts. It serves to provide detailed information regarding an individual's or entity's financial status, personal details, and consent for actions or agreements relevant to their situation. Proper completion of this form is not only vital for processing applications or claims efficiently but is also necessary to avoid delays and potential rejections due to inaccuracies. Many individuals and organizations rely on the n-70np form during financial disclosures, governmental submissions, or compliance checks.

Correctly filling out the n-70np form is important as inaccuracies can lead to complications, fines, and legal repercussions. Many common use cases for this form include tax filings, financial aid applications, or legal agreements concerning property or services. Therefore, understanding its components and processes is essential for successful submission.

Key components of the n-70np form

The n-70np form consists of several key components that applicants must understand thoroughly. Breaking down the form reveals various sections, starting with the personal information section, where essential identifying details must be accurately logged. This section typically requires the applicant's full name, contact information, and relevant identification numbers.

Financial disclosure requirements follow, where applicants must provide comprehensive and truthful financial data. This could include income sources, liabilities, and assets, which are crucial for accurate assessments. Furthermore, there are consent and agreement clauses that applicants must review and acknowledge, affirming their understanding of the information provided. It's also vital to attach the required supporting documents like identification proof and financial statements, particularly as inaccuracies here can delay the review process.

Step-by-step instructions for filling out the n-70np form

Filling out the n-70np form may seem daunting, but with a structured approach, the process can be streamlined. The first step involves gathering all necessary information that will be required throughout the form. It is wise to create a checklist that includes personal details, financial documents, and any legal agreements pertinent to the submission.

Next, complete each section of the form meticulously. Pay special attention when entering personal information, ensuring that names and identification numbers match exactly what is on official documents. Tips for accurate financial reporting include using recent financial statements and double-checking numerical entries for consistency. Once all sections are filled, proceed to review and verification. Self-check techniques involve comparing entries against source documents and ensuring all required fields are complete. It's crucial to double-check everything before finalizing the submission.

Tips for using pdfFiller to manage the n-70np form

pdfFiller enhances the experience of managing the n-70np form through its interactive tools and user-friendly interface. To start, users should access the n-70np form via the pdfFiller platform, which can be done easily with a simple login. Once opened, you can utilize interactive tools to edit or fill in the form electronically. These features not only simplify the completion process but also reduce the likelihood of errors.

Additionally, pdfFiller allows users to highlight and annotate important sections, making it easier to pinpoint areas needing attention. Adding digital signatures is another feature, ensuring that your consent clauses are seamlessly integrated. For teams collaborating on the n-70np form, the platform offers collaboration tools, enabling you to share the form with team members instantly and gather real-time feedback, thus streamlining the process even further.

Common challenges when dealing with the n-70np form

Navigating the n-70np form comes with its own set of challenges. One frequent issue arises from common errors during form completion, such as misreporting financial information or omitting required signatures. Such mistakes can lead to unnecessary delays or even rejections of submissions, which can be quite frustrating for users. To mitigate these challenges, it is essential to familiarize oneself with the form thoroughly before starting the filling process.

Moreover, applicants often face complexities relating to unique financial situations, which may require additional documentation beyond the standard requirements. Instances involving self-employment income or mixed revenue streams can complicate the financial disclosure section. Understanding specific rules or guidelines that apply to these scenarios can greatly aid in streamlining the process and avoiding pitfalls that lead to incomplete or inaccurate submissions.

FAQs about the n-70np form

Several questions commonly surface regarding the n-70np form, particularly about the submission timeline and how to rectify mistakes. Understanding how long the submission process takes can help users plan ahead, as processing times vary based on volume and completeness of the form. It is advisable to submit the form well in advance of deadlines to account for any delays that may arise.

In case of mistakes on the form, applicants should not panic; most submission processes include provisions for corrections. Knowing how to amend the form accurately without causing confusion is critical. Moreover, users must be clear on their legal obligations and adhere to filing deadlines to avoid penalties. The consequences of inaccurate submissions can range from fines to legal ramifications, emphasizing the need for carefulness.

Additional resources for n-70np form users

For individuals seeking further guidance on the n-70np form, numerous resources are available. Official government guidelines provide valuable insights into the specifics of filling out the form, clarifying legal requirements and expectations. Additionally, online support forums and communities offer peer insights and tips on overcoming obstacles encountered during the process.

pdfFiller enhances user experience significantly by facilitating an easy way to fill out, edit, and manage the n-70np form. Customer testimonials highlight the positive experiences of users who have benefited from its comprehensive feature set. Specialized support for n-70np form users is also available, aimed at ensuring all users can navigate their document needs effectively, ensuring compliance and ease.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send n-70np to be eSigned by others?

Where do I find n-70np?

Can I edit n-70np on an Android device?

What is n-70np?

Who is required to file n-70np?

How to fill out n-70np?

What is the purpose of n-70np?

What information must be reported on n-70np?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.