Get the free Form 990

Get, Create, Make and Sign form 990

Editing form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Form 990 Form: A Comprehensive Guide

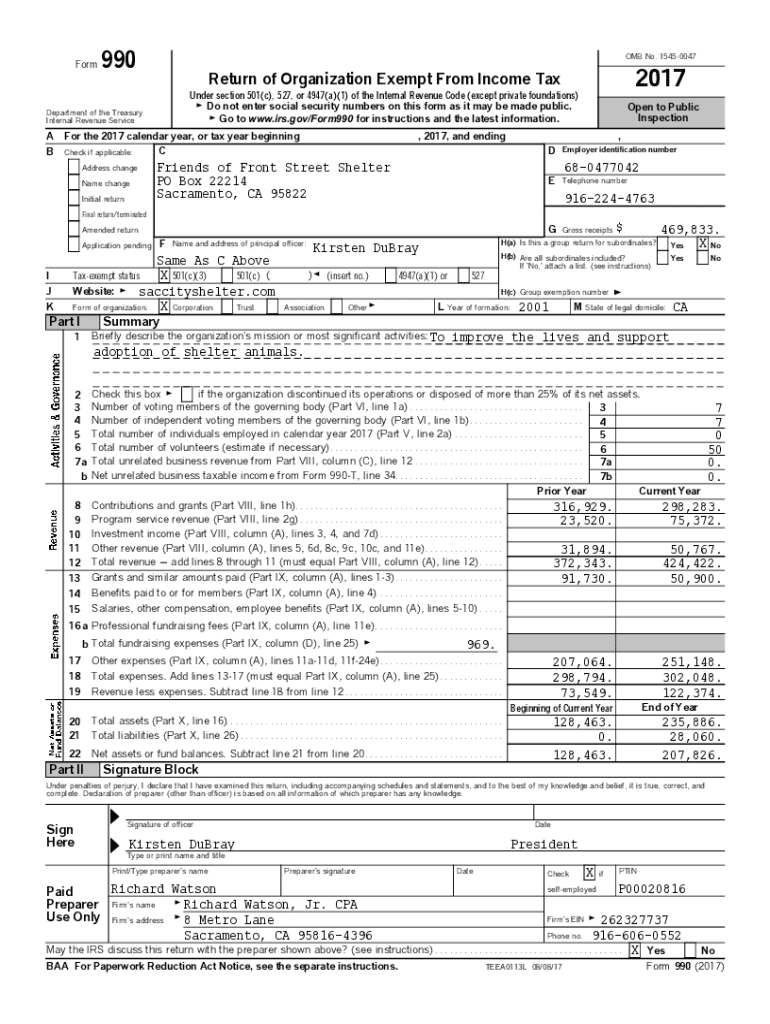

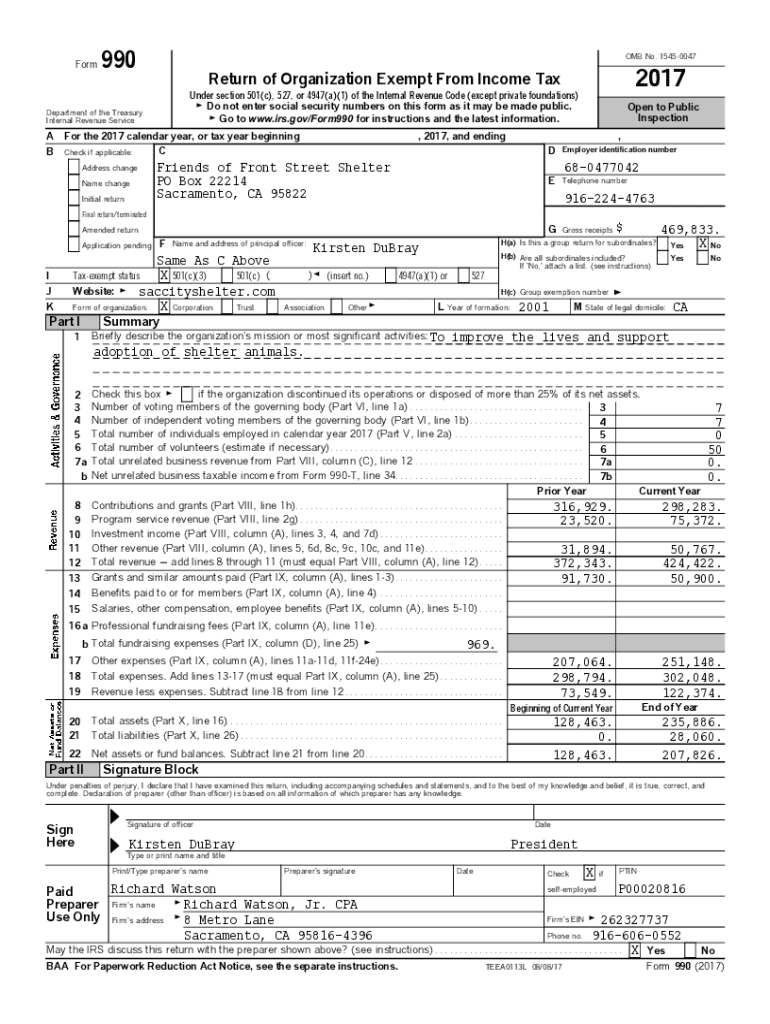

Understanding the Form 990

Form 990 is a crucial document for nonprofit organizations operating in the United States. Officially titled the 'Return of Organization Exempt from Income Tax,' it serves multiple purposes, primarily as a tool to ensure transparency regarding the finances and activities of nonprofits. It provides the IRS with essential information while also informing the public about how organizations utilize their resources.

Key stakeholders of Form 990 include government agencies, donors, board members, and the public. The information contained in Form 990 is fundamental for anyone looking to understand the operational integrity and financial health of a nonprofit.

Importance of Form 990 in the nonprofit sector cannot be overstated. As a standard for financial transparency and accountability, it plays a crucial role in fostering trust with stakeholders. Without this trust, nonprofits risk losing donor support and could face increased scrutiny from regulatory bodies.

Types of Form 990

Form 990 comes in several versions, each tailored to different types of organizations based on their size and revenue. The primary versions are as follows:

Choosing the right version of Form 990 is essential. Organizations must assess their size, revenue, and specific circumstances to select the appropriate form that meets IRS requirements while providing a true account of their operations.

Key components of Form 990

Completing Form 990 can seem daunting due to its detailed structures. Here’s a breakdown of its key sections:

Navigating these sections properly is essential to ensure compliance and to convey an accurate picture of the organization’s performance.

Filing requirements for Form 990

Understanding who is required to file Form 990 is critical. The IRS mandates that most tax-exempt organizations must file the form unless they qualify for exceptions based on their type, size, or revenue. Specifically, organizations with gross receipts under $200,000 and total assets under $500,000 may file Form 990-EZ, while those with revenues below $50,000 may choose the e-Postcard.

Filing deadlines are typically set for the 15th day of the 5th month after the end of an organization’s fiscal year, with an option for extensions available. However, neglecting to file can result in severe penalties, including loss of tax-exempt status after consecutive years of non-filing.

Managing the document: How pdfFiller enhances your Form 990 experience

Using pdfFiller can streamline the often complex process of completing and filing Form 990. The platform offers features designed to improve your experience when handling this essential document.

With such capabilities, pdfFiller empowers nonprofits to focus more on their missions without getting bogged down by clerical tasks.

Tips for completing Form 990 successfully

Filling out Form 990 accurately is critical for compliance and effective communication with stakeholders. Here are some best practices to keep in mind:

Resources are widely available for assistance, including IRS publications, nonprofit advisors, and interactive tools that provide guidance.

Public inspection regulations

Form 990 is typically a public document that anyone can access, which promotes transparency in the nonprofit sector. Understanding how this impacts your organization is vital.

Organizations must make their filed Form 990 available for public inspection, often upon request. Many nonprofits choose to upload their forms directly to their websites to facilitate ease of access. This transparency can help build public trust and demonstrate accountability.

The role of Form 990 in charity evaluation

Form 990 serves as a critical tool for evaluating nonprofit effectiveness. Donors frequently use the information provided in the form to make informed decisions regarding their contributions. Key factors such as revenue sources, program service accomplishments, and management practices can significantly influence donor confidence.

In essence, the data presented in Form 990 can act as a barometer for nonprofit organizations, giving stakeholders insights into operational integrity and financial stability.

Changes and updates to Form 990

Staying informed about changes to Form 990 is essential, as the IRS regularly updates the form and its instructions. Recent modifications aimed at increasing the clarity of information and improving compliance have been rolled out. Nonprofits should take note of these updates, as they can have significant implications for how financial data is reported and disclosed.

Looking ahead, organizations should be prepared for anticipated changes in regulations that could further impact how Form 990 is utilized. Being proactive in understanding these updates is crucial for maintaining compliance and ensuring organizational integrity.

Additional tools and resources

For nonprofits seeking to navigate the complexities of Form 990, effective tools and resources can make a significant difference. pdfFiller provides online tools specifically designed to assist users in filing Form 990, enhancing ease-of-use and compliance.

These resources can be invaluable for organizations aiming to enhance their filing experience and maintain compliance while focusing on their primary missions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form 990 in Gmail?

How can I edit form 990 from Google Drive?

Can I sign the form 990 electronically in Chrome?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.