Get the free Form 990

Get, Create, Make and Sign form 990

How to edit form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Form 990: A Comprehensive How-To Guide

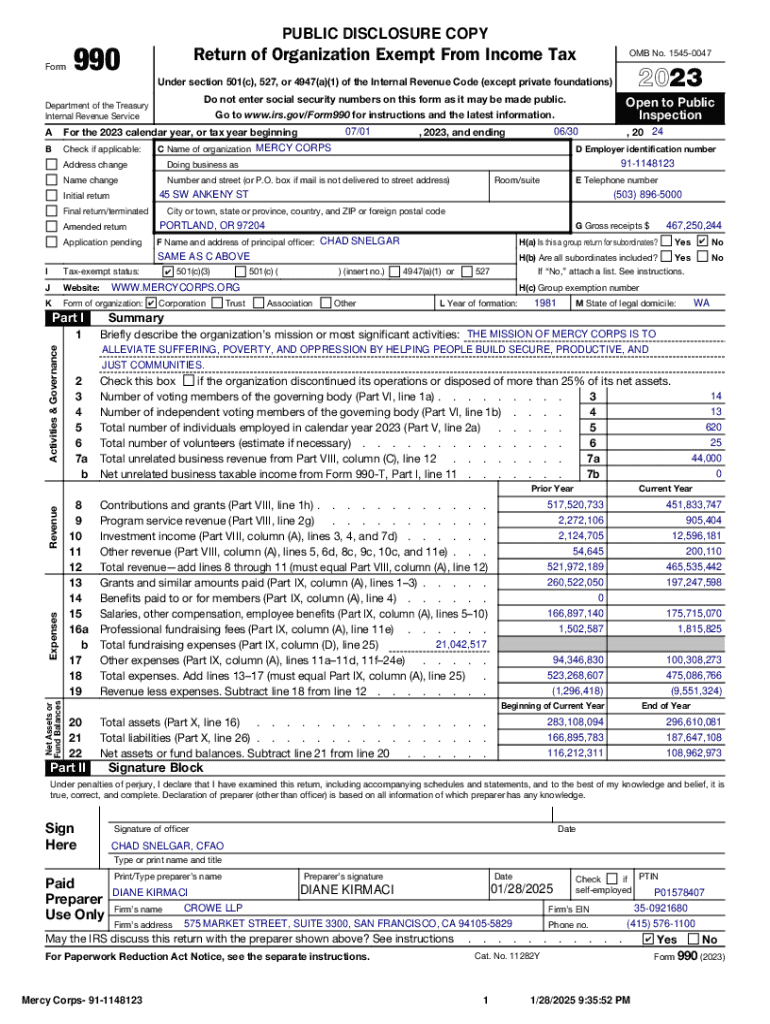

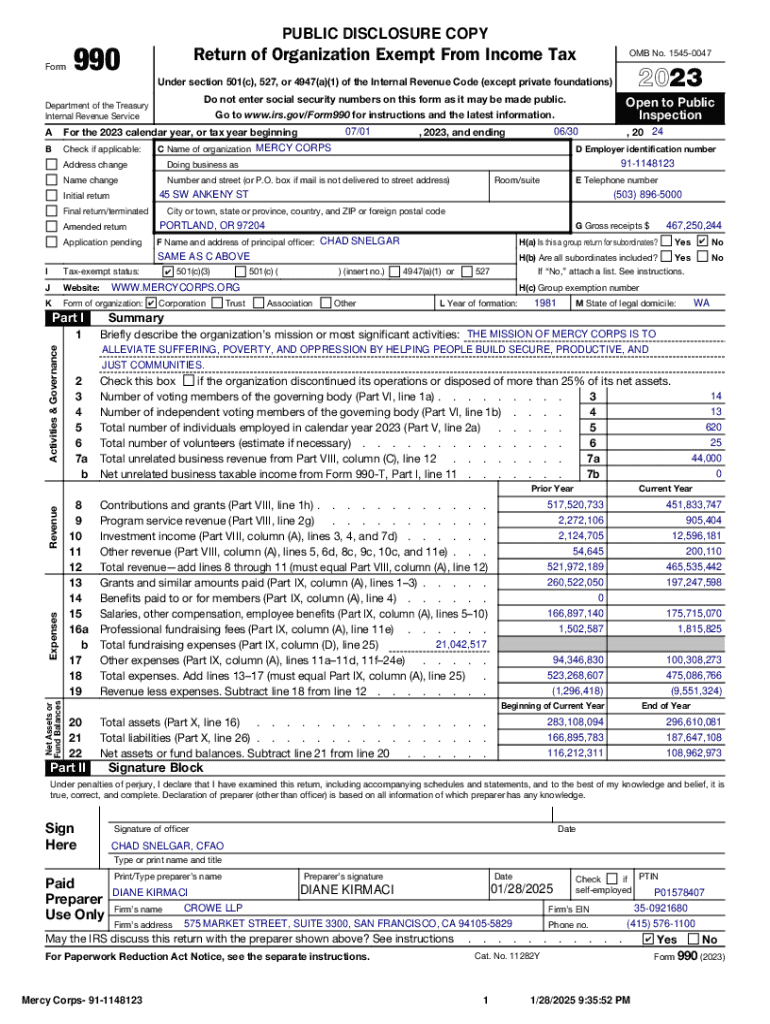

Understanding Form 990

Form 990 serves as an essential tax document for nonprofit organizations, providing comprehensive financial information to the IRS. Its primary purpose is to ensure transparency and accountability in the nonprofit sector, allowing the IRS to assess compliance with tax-exempt status and enabling the public to evaluate the organization's activities. Nonprofits across the United States are required to file this annual return, demonstrating their operational effectiveness and resource management.

Understanding which version of Form 990 to use is crucial, as it can determine filing requirements and impact organizational credibility. Larger nonprofits typically use the full Form 990, while smaller entities can opt for the simplified Form 990-EZ or the 990-N based on their revenue thresholds.

Navigating the structure of Form 990

Form 990 is structured into major sections, each serving a distinct purpose in detailing the organization’s financial data. The prominent sections include revenue, expenses, and net assets. The revenue section captures all income sources, while the expenses section details expenditures across various categories. Net assets present the organization's financial position at year-end, providing insights into its fiscal stability.

Additional sections cover governance, reporting on board members, and program accomplishments, giving stakeholders a well-rounded view of organizational effectiveness and compliance.

Filing requirements

Determining whether your organization must file Form 990 hinges on specific criteria. Organizations with gross receipts over $200,000 or total assets exceeding $500,000 need to file the standard Form 990. Meanwhile, those with receipts below these thresholds may qualify for the EZ version, while the smallest organizations may use the 990-N.

Submission deadlines for Form 990 are crucial, with the standard due date being the 15th day of the 5th month after the end of the nonprofit's accounting period. For many organizations, this means May 15th for a December 31st year-end. Failing to file can lead to penalties and jeopardize tax-exempt status, making timely submission imperative.

Step-by-step instructions for completing Form 990

Before you dive into filling out Form 990, it’s essential to gather the necessary documentation. This includes financial statements, previous year’s Form 990, board minutes, and any grant agreements that reflect revenue and expenses accurately. Having this information readily available will streamline the filing process and help ensure accuracy.

While filling out each section, ensure that you are precise in reporting figures. For instance, accurately detail revenue from donations, grants, and fundraising activities, noting any restrictions on the funds. It's beneficial to consult the form’s instructions for common pitfalls and to employ the pdfFiller editing tools, which simplify the process with features such as easy editing, template utilization, and real-time collaboration.

E-signing and submitting Form 990

Compliance with e-signature laws has become increasingly important as organizations transition to digital documentation. Under the Electronic Signatures in Global and National Commerce (ESIGN) Act, e-signatures are considered valid, supporting efficiency in the filing process. When using platforms like pdfFiller, organizations can leverage secure e-signature solutions, ensuring their Form 990 is signed and dated correctly.

PdfFiller enhances the submission process by providing a user-friendly platform for generating and submitting Form 990 electronically, eliminating the cumbersome aspects of traditional filing.

Managing and storing your Form 990

Effective document management is key to ensuring your organization maintains compliance and transparency. Establishing a system for organizing past filings can significantly facilitate future submissions. Best practices include categorizing documents by year and ensuring all required records are readily accessible for review or audits.

Leveraging cloud storage solutions, such as those offered by pdfFiller, allows for secure document management and accessibility. Utilizing these tools ensures that your organization has access to Form 990 anytime, anywhere, while protecting sensitive financial information.

Navigating public inspection regulations

Public inspection requirements stipulate that Form 990, along with three previous years of filings, be made available to the public. This requirement enhances transparency, allowing donors and funders to review an organization's financial health and strategic direction.

Utilizing Form 990 for transparency can bolster public trust and engagement. By proactively sharing this information, organizations can demonstrate responsible stewardship of funds while attracting potential donors.

Leveraging Form 990 for charitable evaluation

Form 990 plays a pivotal role in the decision-making processes of donors. Funders often look for insights related to an organization’s financial stability, funding sources, and expenditure patterns. Essential information such as revenue growth and program spending informs donor confidence.

Leveraging Form 990 as a research tool allows organizations to assess their effectiveness and compare metrics against industry benchmarks, guiding strategic decisions and improving program outcomes.

Resources for further assistance

For additional support with Form 990, numerous third-party organizations provide guidance and assistance. Websites such as the IRS and nonprofit-focused advocacy groups offer resources tailored to aid nonprofits in navigating tax compliance.

PdfFiller stands out as a platform that connects users to expert advice and practical tools. Its offerings extend beyond Form 990 to include other essential templates, ensuring that all document needs are met efficiently.

Frequently asked questions about Form 990

Common questions surrounding Form 990 often include inquiries about who exactly needs to file, what information is mandatory, and how to rectify mistakes after submission. Organizations frequently seek clarification on understanding financial metrics and the implications of non-filing.

Addressing these concerns promptly ensures organizations remain compliant and transparent. Employing platforms like pdfFiller for guidance can help mitigate challenges associated with Form 990 filings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I edit form 990 on an iOS device?

How do I complete form 990 on an iOS device?

How do I complete form 990 on an Android device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.