Get the free Notice of Assessment of Land and Structures / Improvements

Get, Create, Make and Sign notice of assessment of

Editing notice of assessment of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notice of assessment of

How to fill out notice of assessment of

Who needs notice of assessment of?

Understanding the Notice of Assessment of Form

Understanding the Notice of Assessment

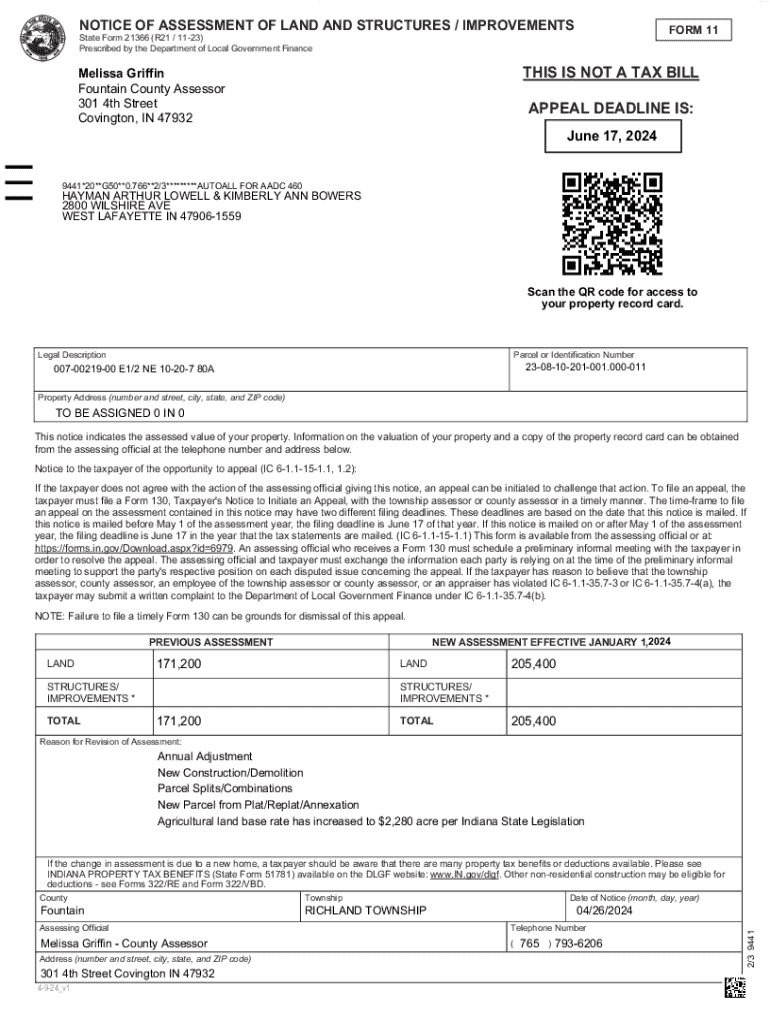

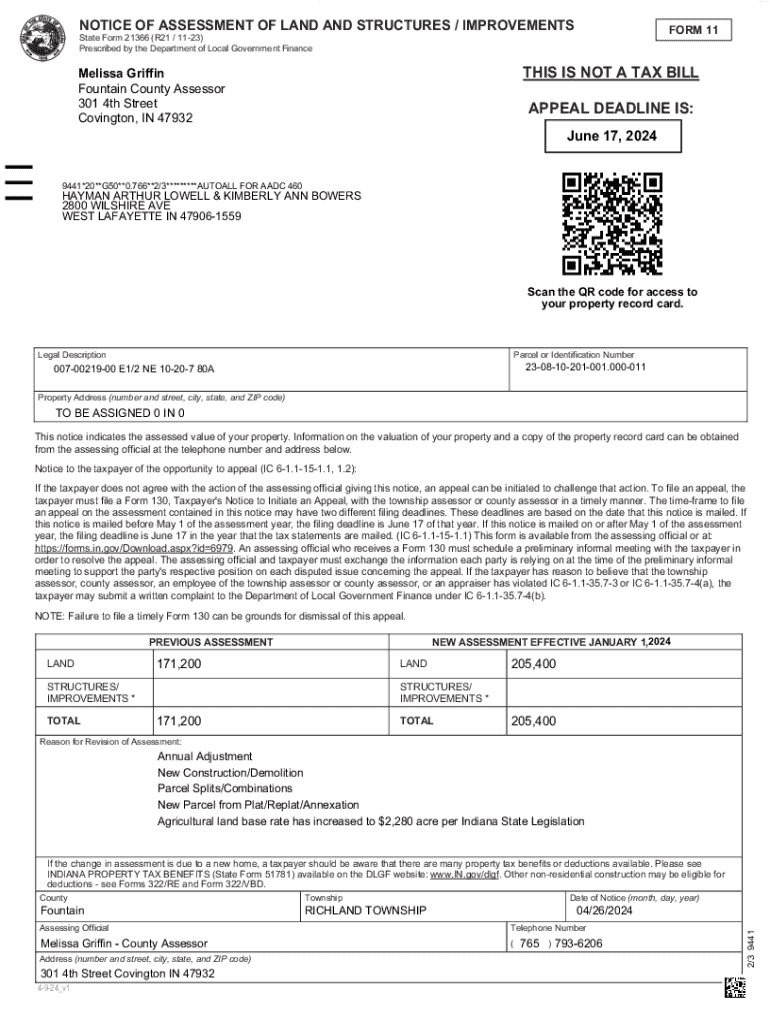

A Notice of Assessment, often abbreviated as NOA, is a critical document sent by tax authorities to inform individuals of their tax obligations. This document outlines the calculation of taxes owed based on the submitted income tax return. Understanding the details of your NOA is essential, as it provides insight into your tax status, including how much you owe, any refunds due, and potential adjustments made during the review process.

The purpose of a Notice of Assessment is multifaceted. It serves to confirm the accuracy of the tax return you filed and to provide an official record of the government’s assessment of your tax liability. Moreover, the NOA seeks to clear any uncertainty regarding your tax situation, allowing you to plan your financial obligations accordingly. Failure to review the NOA can result in unanticipated financial burdens or missed opportunities for deductions and credits.

Finding your Notice of Assessment

Locating your Notice of Assessment can be straightforward if you know where to look. Most often, tax authorities provide access to these documents through their online portals. For instance, logging into the relevant tax authority's website allows you to download your NOA directly from your account profile after inputting your personal information.

For those who prefer or need physical copies, notices are often mailed to your address about a month after tax returns are processed. It's worthwhile to keep physical copies for your records, as these documents can be essential for future financial planning and auditing purposes.

Key components of a Notice of Assessment

The Notice of Assessment comprises several crucial components. One of the primary elements is the assessment year and the corresponding dates, which indicate the relevant tax period the assessment applies to. Understanding this timeframe is fundamental for accurate financial record-keeping.

Another central aspect of the NOA is the income reporting and deductions breakdown. This section showcases how your reported income is calculated, any deductions you have claimed, and how each affects your taxable income. A detailed examination of this information can reveal additional deductions you may have overlooked.

Reviewing your Notice of Assessment

Reviewing your Notice of Assessment thoroughly is essential to ensure accuracy. Start by verifying your personal information, such as name, address, and Social Security number. Accuracy in these details guarantees that your tax returns are correctly matched with your identity.

Next, analyze the income and deductions reported on the NOA. This scrutiny is crucial because tax authorities may have adjusted what was reported on your return. Cross-checking calculations ensures that there are no discrepancies in the tax owed or refund expected, as errors can lead to varied future implications.

Common errors to look for include incorrect income levels, missed deductions, or miscalculated tax rates. If you discover mistakes, it’s critical to address them promptly to avoid potential penalties or larger tax liabilities.

When finding mistakes in your NOA, you should document everything clearly and contact the appropriate tax authority with the necessary evidence of the correct figures.

Managing your taxes post-assessment

Once the assessment has been reconciled, understanding your payment obligations is the next step. The NOA provides specific deadlines and payment options. Payments can typically be made online through the tax authority’s website, via mail, or in person at designated offices. Each option has different processing times, so it is essential to choose wisely.

Alongside managing payments, handling refunds is another critical aspect following your Notice of Assessment. After filing taxes successfully, many taxpayers eagerly await their refunds. Use tracking services provided by your tax authority to ensure that your refund is processed, and keep your eye on any notifications regarding delays or discrepancies.

How to respond to your Notice of Assessment

If you find discrepancies or wish to contest your Notice of Assessment, you may need to file an appeal. This process typically requires evidence and documentation that substantiates your claims. Gathering relevant documents—such as pay stubs, receipts, and prior tax returns—will help support your case during the appeals process.

Timelines for filing appeals are usually stringent, so it's crucial to act promptly upon receiving your NOA. Communicating effectively with tax agencies is essential. Constructing clear, concise messages that articulate your concerns or requests can facilitate smoother interactions.

Additional considerations

Seeking professional help can significantly ease the burden of managing your taxes and handling any disputes arising from your Notice of Assessment. Tax advisors can provide valuable insights, especially if your tax situation is complex. Early consultation before filing can prevent issues and save time in the long run.

Understanding the fees and services offered by tax professionals will ensure that you engage effectively without unexpected costs. Utilization of document management tools like pdfFiller can streamline your workflow related to tax documentation, including editing, signing, and securely storing important documents.

Common scenarios and FAQs

Disagreements can arise regarding your NOA, particularly if you believe your assessment does not accurately reflect your financial situation. Follow the proper channels for contesting your notice if you find discrepancies. Document your position clearly and have supporting documentation ready to present your case.

Assessments also play a significant role in financial planning. They can affect your credit score and future tax filings, which is why strategic planning around these assessments is advisable.

Frequently asked questions about Notice of Assessment typically revolve around accessing prior assessments and dealing with assessments for incorrect years. Be sure to maintain thorough records and know your rights regarding historical assessments.

Resources for further assistance

For additional help regarding your Notice of Assessment, visit your tax authority's website. Most authorities provide extensive resources and guidance on taxes and appeals related to NOAs. Furthermore, consider utilizing tools like pdfFiller for document management, allowing you to edit and securely store your assessments and related paperwork.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my notice of assessment of in Gmail?

How can I send notice of assessment of for eSignature?

How can I fill out notice of assessment of on an iOS device?

What is notice of assessment of?

Who is required to file notice of assessment of?

How to fill out notice of assessment of?

What is the purpose of notice of assessment of?

What information must be reported on notice of assessment of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.