Get the free Notice of Assessment of Land and Structures / Improvements

Get, Create, Make and Sign notice of assessment of

How to edit notice of assessment of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notice of assessment of

How to fill out notice of assessment of

Who needs notice of assessment of?

Understanding the Notice of Assessment of Form

Understanding the notice of assessment

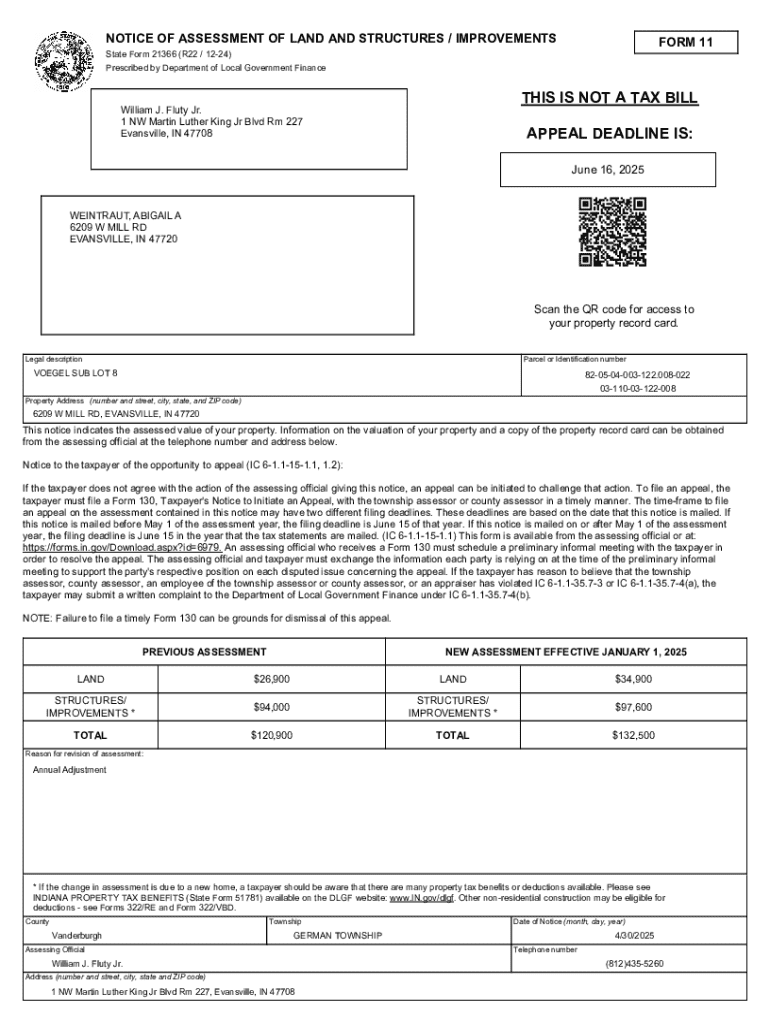

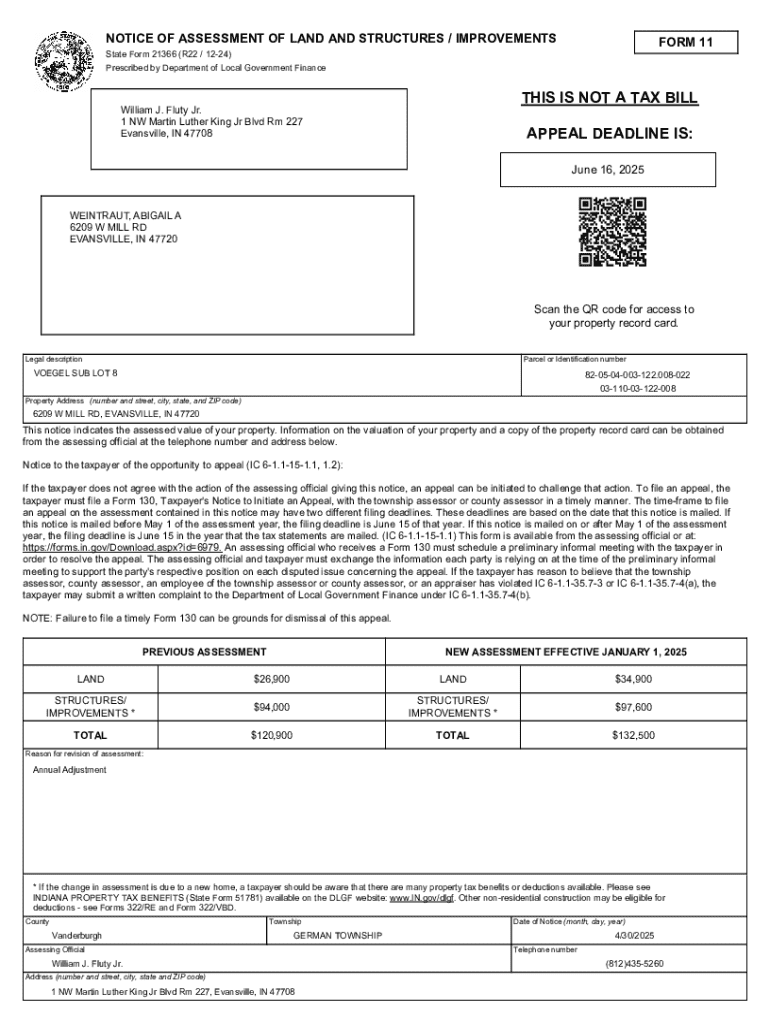

A Notice of Assessment (NOA) is a formal document issued by the tax authority following the submission of your annual tax return. It serves as a comprehensive report, detailing the assessment of your taxable income and the tax payable based on your filings. An NOA confirms that your tax return has been processed and lets you know if any adjustments were made during this process.

The importance of the notice of assessment in taxation cannot be overstated, as it not only provides a clear record of your tax obligations but also serves as the basis for future tax-related decisions. Failure to review your NOA thoroughly could lead to discrepancies in your tax payments and penalties.

Key components of an NOA include:

How to obtain your notice of assessment

Individuals can easily obtain their Notice of Assessment through various methods. The most efficient way is through online channels. Most tax authorities provide access to NOAs directly from their websites.

You'll need to register for an online account, where you can not only access your NOA but also view your entire tax history. If you prefer a paper copy, you can request a mailed version from the tax authority. However, be mindful of the timeframe, as this can vary based on processing times commonly ranging from 2 to 4 weeks.

Within your online tax account, you can navigate through important sections that show your assessment history, payments made, and outstanding balances, giving you a fuller picture of your tax situation.

Key steps to take after receiving your NOA

Upon receiving your Notice of Assessment, the first critical step is to review it for accuracy. Cross-check all the information provided, including your income, deductions, and credits. It's not uncommon for errors like misreported income or missed deductions to occur, so vigilance is essential.

Moreover, understanding your tax liability is equally important. You need to determine whether you owe taxes or can expect a refund. Comparing this year's assessment with previous ones can also shed light on any changes in your financial situation or tax obligations.

Paying your taxes based on your notice of assessment

Once you've reviewed your NOA and established your tax liability, it’s time to make payment arrangements. The tax authority typically offers multiple payment options such as online payments via bank transfers or credit card, mailing a check, or even setting up a payment plan if needed.

Be sure to note the payment deadlines to avoid any late fees or penalties. Key deadlines should be highlighted on your NOA, and staying compliant with these dates will ensure that you avoid any unexpected tax complications.

Making adjustments to your notice of assessment

If you find discrepancies in your NOA or if your financial situation changes, you have options for making adjustments. The first step is to consider whether you need to file an appeal. This is especially relevant if you believe that the assessment was incorrect.

Filing an amended tax return may also be necessary in situations where new income sources arise or deductions were missed. Ensure that you follow the correct procedures outlined by your tax authority for submitting an amended return to correct your records.

Related topics to explore

In conjunction with understanding your Notice of Assessment, exploring tax credits and deductions is beneficial. Many individuals overlook available credits that can significantly affect their NOA. A yearly tax filing checklist can also help prepare essential documents and establish a timeline.

For those awaiting a refund, knowing how to navigate the refund process and tracking the status of your payment will prepare you for any anticipated outcomes.

FAQs about the notice of assessment

Questions surrounding the Notice of Assessment often include concerns about what to do if an NOA isn’t received. In such cases, taxpayers should reach out to their respective tax authority to inquire about the status of their assessment.

Another common inquiry involves disputing NOA outcomes. Here, understanding your rights and the processes for appeals is crucial. Having relevant information handy when contacting tax authorities, including your taxpayer ID and assessment number, can expedite the inquiry process.

Using pdfFiller for document management

pdfFiller offers individuals a seamless platform for managing their Notice of Assessment documentation. You can fill out and edit your NOA directly using pdfFiller’s user-friendly interface. This tool is particularly useful for those who need to make adjustments or share documents with tax professionals securely.

Additionally, e-signature solutions allow you to sign documents electronically, further streamlining your tax-related activities. Storing your tax files in pdfFiller's cloud-based storage ensures that you can access important documents from anywhere, safeguarding them against loss and improving organization.

Scenarios to consider

Some unique scenarios to consider include situations where a taxpayer cannot collect their NOA in person, or perhaps you have earnings from multiple sources that complicate your assessment. Each case can lead to different tax implications, and understanding your options of recourse will be invaluable.

For example, assessing a complex tax situation, such as non-traditional income streams or deductions not typically included, might require more tailored advice and deeper investigation into the NOA.

Support and resources

Various online tools are available to help you navigate your tax responsibilities better. Estimating tax liabilities and exploring calculators for potential refunds can save time and prevent over or underpayments. Community forums also offer a space for individuals to share experiences and insights regarding tax processes.

Leverage these resources to ensure you not only understand your Notice of Assessment but also make informed decisions regarding your tax planning and filing strategy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get notice of assessment of?

How do I edit notice of assessment of on an iOS device?

How do I edit notice of assessment of on an Android device?

What is notice of assessment of?

Who is required to file notice of assessment of?

How to fill out notice of assessment of?

What is the purpose of notice of assessment of?

What information must be reported on notice of assessment of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.