Get the free Notice of Assessment of Land and Structures / Improvements

Get, Create, Make and Sign notice of assessment of

How to edit notice of assessment of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notice of assessment of

How to fill out notice of assessment of

Who needs notice of assessment of?

A comprehensive guide to your notice of assessment of form

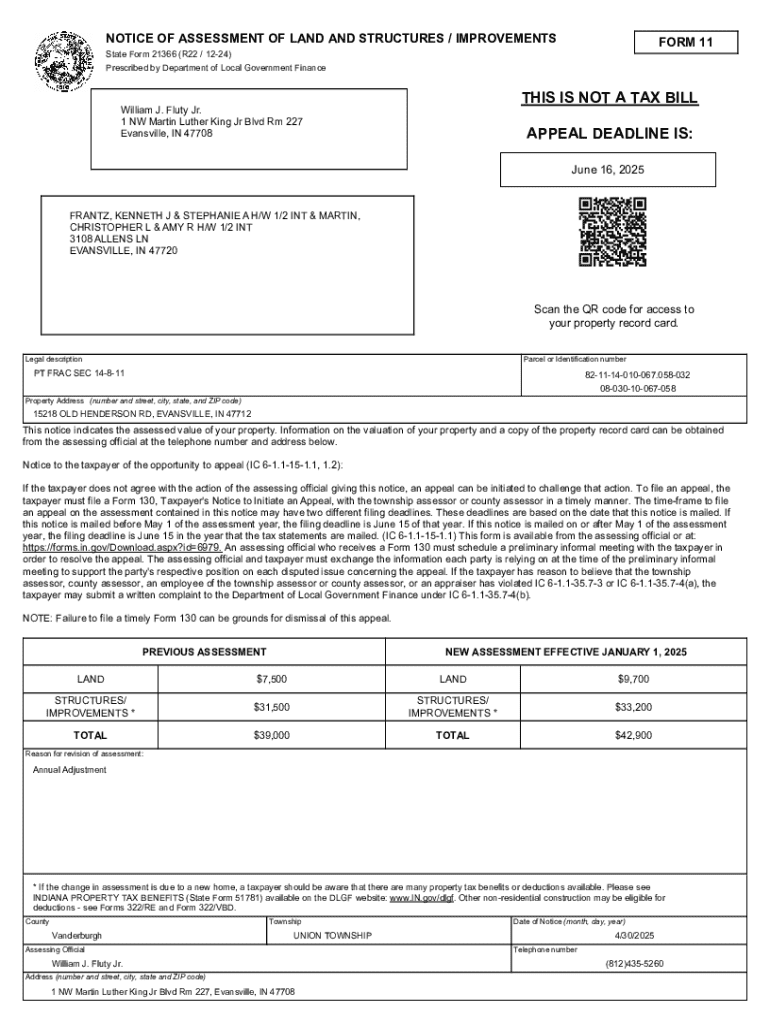

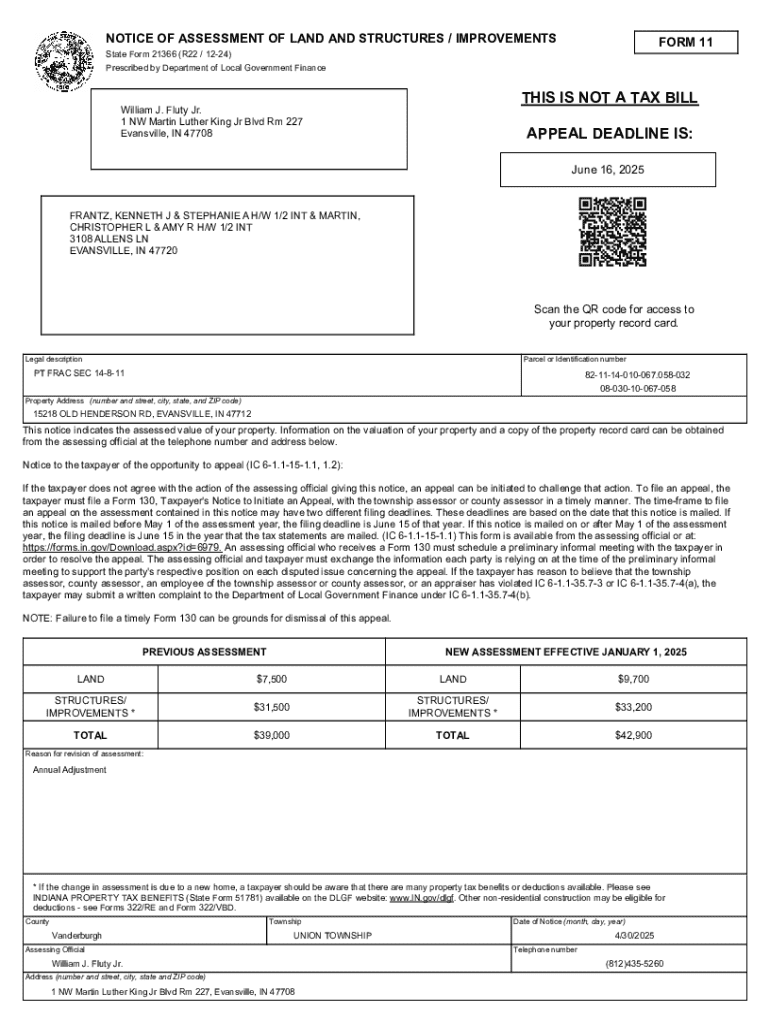

Understanding the notice of assessment

A Notice of Assessment (NOA) is a formal document generated by tax authorities to inform taxpayers about their tax obligations for a particular year. It outlines how much tax you owe, any refunds you may be entitled to, and provides important details regarding your tax situation. The significance of an NOA lies in its role as an official record of the tax authority's determination regarding your tax filings, making it a critical document in managing your tax obligations.

For individuals and teams, understanding the NOA can help prevent unexpected tax liabilities and ensure compliance with applicable tax laws. Accurately interpreting the details in your NOA empowers you to stay informed about your financial responsibilities and helps you plan accordingly.

Who issues the notice of assessment?

Typically, the federal tax authority or state departments of revenue are responsible for issuing the Notice of Assessment. At the federal level, the Internal Revenue Service (IRS) issues NOAs in the United States, while state governments have their own respective agencies that handle similar assessments. This means that the format and content of an NOA can vary between federal and state documents, reflecting jurisdictional differences in tax regulations and processes.

Federal NOAs are generally standardized and follow federal tax laws, while state NOAs can include specific regulations relevant to that state. Taxpayers should ensure they view the appropriate NOA corresponding to their jurisdiction to understand their obligations fully.

Key components of a notice of assessment

A Notice of Assessment comprises several crucial sections that detail your tax situation. Familiarizing yourself with these components helps you understand your standing and plan effectively. Key sections include:

An understanding of common terminology used in the NOA is also essential. Terms such as 'audit,' 'adjustments,' and 'credits' can appear, each carrying specific implications. Familiarity with these terms ensures you can respond effectively to your NOA and manage your taxes responsibly.

How to obtain your notice of assessment

Accessing your Notice of Assessment is a straightforward process. Most tax authorities provide online portals where you can securely check your tax status and download your NOA. This is the quickest and most efficient method for obtaining the document.

To access your NOA online, usually, you will need to log in to your tax authority’s secure website using your credentials. If you have not registered for access, there may be a registration process that asks for your tax identification information for verification.

In addition to online access, taxpayers can also request a physical copy of their NOA through mail. This process generally involves contacting the relevant tax authority and requesting a copy, which may take several days to arrive. If you find that you cannot locate your NOA, consider the following steps:

What to do upon receiving your noa

The receipt of your Notice of Assessment should trigger a thorough review process. Verifying the details on your NOA is essential to ensure the information reflects your tax situation accurately. Start by confirming that your personal information, including your name, address, and social security number (if applicable), is correct.

Next, carefully examine the tax amounts owed or refundable. If the assessment indicates an amount differing from your calculations, it is vital to understand why. Here are common errors to look for in the assessment:

If you disagree with any portion of your NOA, the tax authority provides mechanisms for contesting the assessment. This may involve filing an appeal or submitting supporting documentation to dispute inaccuracies. Understanding how to approach these procedures is crucial for effective resolution.

Requests for clarification or adjustments can also be submitted through formal channels, and it’s advisable to maintain records of all communication and documentation related to your assessment.

Payments and deadlines

Understanding the payment process upon receiving your NOA is paramount to avoiding penalties and interest. Typically, the NOA will specify the total amount owed, the payment methods available, and instructions on how to make the payment. Common payment options include:

It is equally important to be aware of key deadlines associated with payments and any responses you may need to make. Failure to meet deadlines could result in penalties or accruing interest on unpaid balances. Typically, NOAs specify a due date along with any extended timelines for payment plans. Keeping a proactive approach to these deadlines will help maintain your financial standing.

Additional information about tax assessments

When navigating the landscape of tax assessments, several common questions often arise regarding Notices of Assessment. Addressing these frequently asked questions (FAQs) can enhance your understanding and prepare you better.

Real-life scenarios can illustrate the importance of understanding your NOA. For instance, a taxpayer who received an NOA indicating a larger tax liability than expected realized through careful review that certain credits were not considered. Upon contacting the tax authority and providing additional information, the taxpayer was able to amend their assessment successfully, reducing their liability.

Tools for managing your notice of assessment

In today's digital age, tools to manage tax documents can significantly ease the burden of paperwork. pdfFiller offers an interactive suite of features specifically designed for editing and managing your tax documents, including your Notice of Assessment. With pdfFiller, you can easily edit your NOA and other related tax forms directly in your browser.

The platform features allow seamless eSigning, making it efficient to provide your signature on any necessary documentation. Additionally, its collaboration tools enable individuals and teams to work together to address and solve potential issues regarding their NOA, facilitating streamlined communication and action. Using such tools can prevent loss or confusion, keeping your tax records organized and accessible.

Benefits of using a cloud-based document management system

Employing a cloud-based document management system like pdfFiller provides several advantages. First and foremost, it allows for seamless access to your past Notices of Assessment and related documents from anywhere with an internet connection, promoting flexibility in managing your tax records.

It aids in the organization and retrieval of essential documents, reducing time spent searching for past assessments. Furthermore, users can collaborate effortlessly with tax professionals or team members, enhancing the overall experience in managing financial documentation. This organized approach can lead to increased accuracy and compliance in your tax filings.

Conclusion

Having a solid understanding of your Notice of Assessment is fundamental to effectively managing your finances and ensuring compliance with tax obligations. By staying informed about what the NOA entails and utilizing resources such as pdfFiller, you can empower yourself to manage your tax documentation proactively. The integration of interactive tools and features provides a user-friendly approach to editing, collaborating, and organizing your documents, making the entire process smoother and more efficient.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in notice of assessment of?

Can I create an electronic signature for signing my notice of assessment of in Gmail?

How do I edit notice of assessment of straight from my smartphone?

What is notice of assessment of?

Who is required to file notice of assessment of?

How to fill out notice of assessment of?

What is the purpose of notice of assessment of?

What information must be reported on notice of assessment of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.