Get the free Notice of Assessment of Land and Structures / Improvements

Get, Create, Make and Sign notice of assessment of

Editing notice of assessment of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notice of assessment of

How to fill out notice of assessment of

Who needs notice of assessment of?

Understanding Your Notice of Assessment of Form

Sidebar

Breadcrumbs

Home > Forms > Notice of Assessment

Understanding your notice of assessment

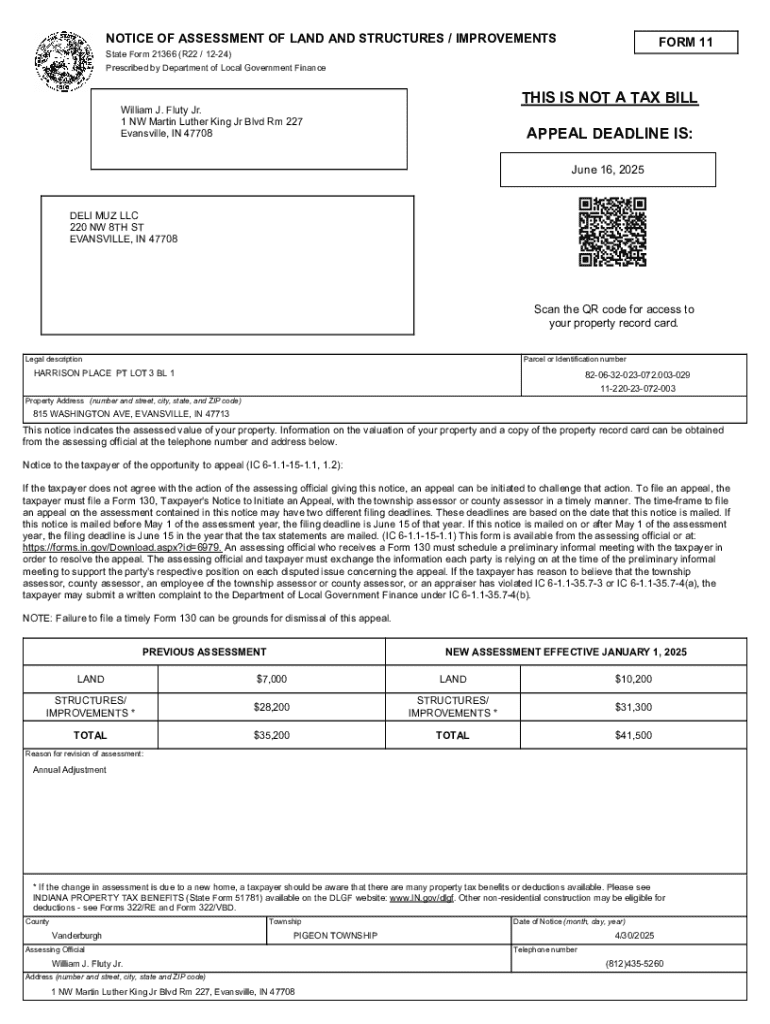

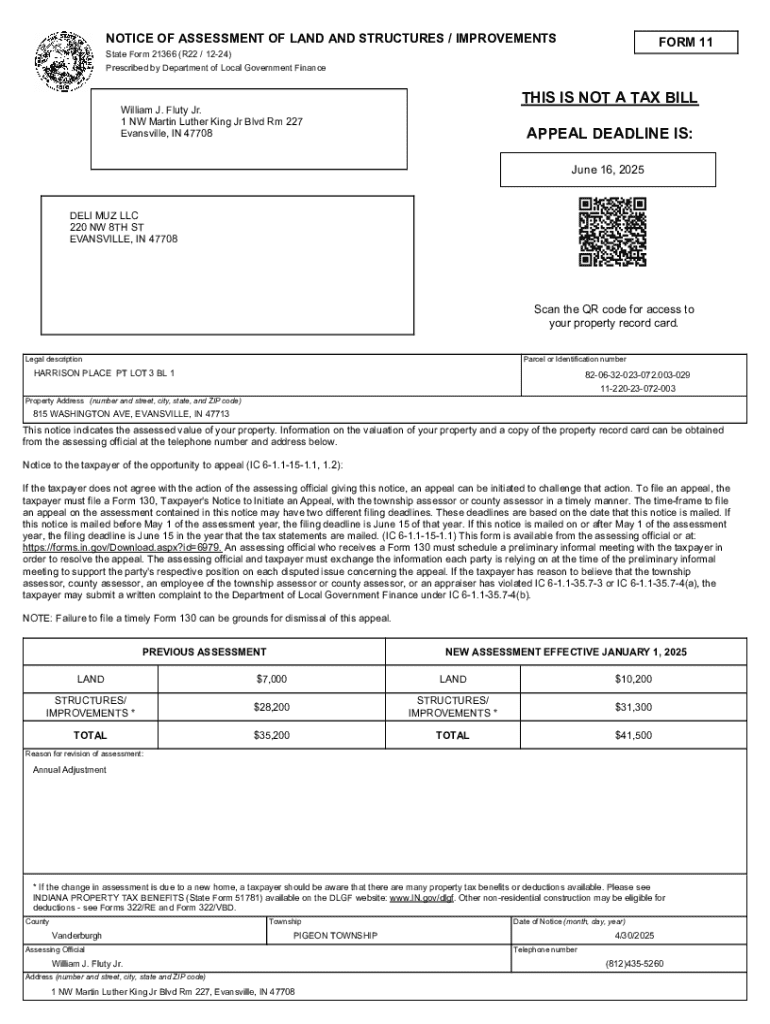

A Notice of Assessment is a formal communication issued by tax authorities detailing how much tax you owe based on your income and deductions reported for the year. It provides a summary of your tax situation, including any discrepancies that might require further action.

The importance of this document cannot be overstated; it plays a crucial role in the tax assessment process. It outlines your tax liability or refund amount and provides essential information needed to manage your finances effectively. A clear understanding of your assessment can significantly affect your financial planning, as it determines whether you owe additional taxes or are entitled to a refund.

Getting your notice of assessment

Finding your Notice of Assessment is straightforward; it may be sent via traditional mail or available through online portals, depending on your tax authority. If you prefer the convenience of digital access, many tax agencies provide online accounts where you can view and download your assessments.

To retrieve your assessment from an online platform, follow these steps: Log in to your tax authority's portal, navigate to the section labeled 'Notices' or 'Assessments,' and download the PDF file for the relevant tax year. For example, accessing your assessment through pdfFiller can simplify this process, as the platform allows direct storage and management of such documents.

Key components of the notice of assessment

Your Notice of Assessment contains several critical components that require attention. It usually specifies the tax year and period, indicating the timeframe in which the income was earned and taxes were calculated. Understanding these dates is paramount for keeping your financial records accurate.

The notice also details total tax owed versus taxes paid, which can determine your final financial standing for that year. This section may highlight whether you are eligible for a refund or if there is a balance due, which is vital for planning payments or budgeting for future expenses.

Additionally, the document will often include specific codes and terminology that can be confusing. Key definitions and acronyms will typically accompany the important figures, giving you context regarding the calculations.

Common scenarios related to your notice

If you disagree with your assessment, it’s essential to take action. File an appeal with supporting documentation to substantiate your claim. Make sure you are aware of the deadlines for filing appeals to avoid any complications that may occur if you delay your response.

In another scenario, should you miss the deadline for tax payment, you risk incurring penalties and interest on the unpaid amount. It’s vital to understand the implications of a missed payment and take swift action to either pay the owed amount or negotiate a payment plan to prevent further complications.

Managing your tax assessment

Paying your tax assessment can be conveniently managed through various channels, including online payment options via pdfFiller. Utilizing cloud-based solutions allows you to settle your tax liability right from your device without the stressful wait often associated with mailing payments.

Moreover, if you're concerned about managing payments, many tax authorities offer structured payment plans that can ease the burden. Be sure to inquire about these options when addressing your tax balance.

Tracking pending refunds is another crucial aspect of managing your assessment. Understanding how to check on your refund status allows you to remain informed and plan accordingly.

Editing and updating your tax information

Updating your information on your Notice of Assessment is critical to ensure accurate representation of your financial status. Always notify your tax authority of any significant changes such as job status, marital status, or changes in income within a timely manner.

Utilizing pdfFiller can streamline the process of amending your Notice of Assessment. The platform provides resources for editing essential fields in your form while ensuring compliance with tax regulations. This can help avoid penalties and ensure accurate future assessments.

Frequently asked questions (FAQ)

It's not uncommon to encounter issues with your Notice of Assessment. Many individuals wonder what to do if they never received their notice or how they might view past years' assessments. Keeping track of your notices is important for tax record purposes.

Resources for further assistance

For additional help navigating your Notice of Assessment, consider exploring the links to support from your official tax authority. pdfFiller also provides extensive blogs on related tax topics that can guide you through various processes.

Conclusion: empowering your document management

Understanding and managing your Notice of Assessment is crucial for effective financial planning. With the right tools, like those provided by pdfFiller, users can streamline their document handling, ensuring that they remain informed and compliant with tax regulations.

Leveraging pdfFiller’s features can empower you to manage not only your tax assessments but a wide range of documents with ease. We encourage you to explore more of our solutions to enhance your document creation and management capabilities.

Related content

Features of pdfFiller enhancing your experience

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my notice of assessment of directly from Gmail?

How do I make edits in notice of assessment of without leaving Chrome?

Can I create an eSignature for the notice of assessment of in Gmail?

What is notice of assessment of?

Who is required to file notice of assessment of?

How to fill out notice of assessment of?

What is the purpose of notice of assessment of?

What information must be reported on notice of assessment of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.