Get the free Notice of Assessment of Land and Structures / Improvements

Get, Create, Make and Sign notice of assessment of

How to edit notice of assessment of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notice of assessment of

How to fill out notice of assessment of

Who needs notice of assessment of?

Understanding the Notice of Assessment of Form: A Comprehensive Guide

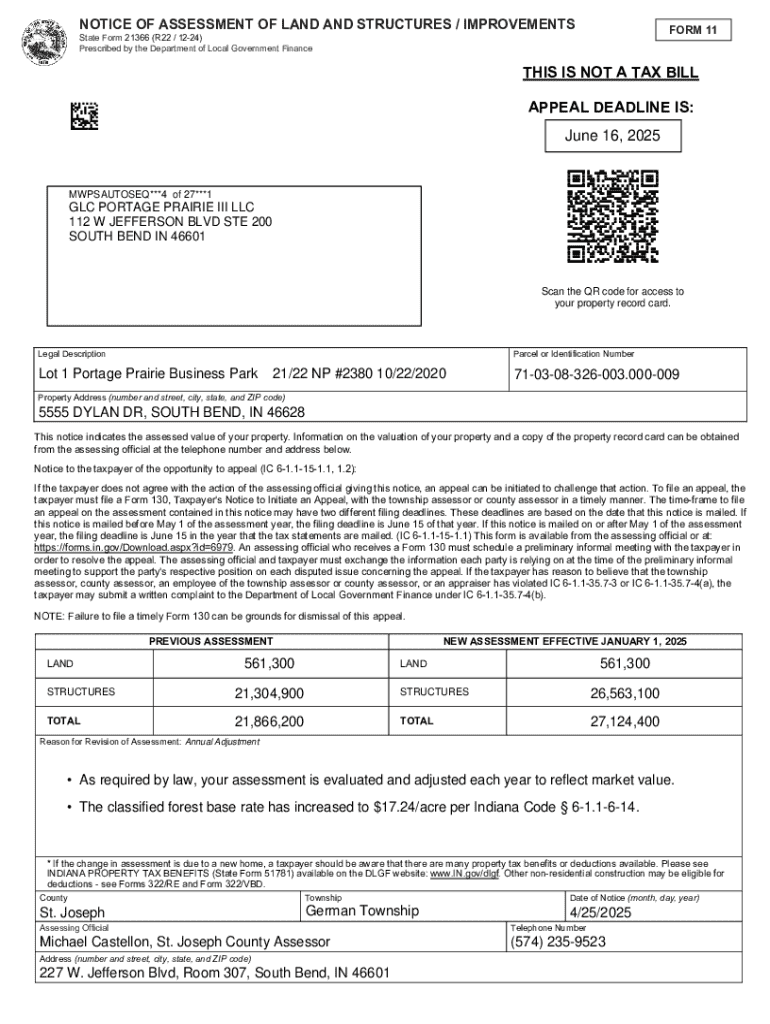

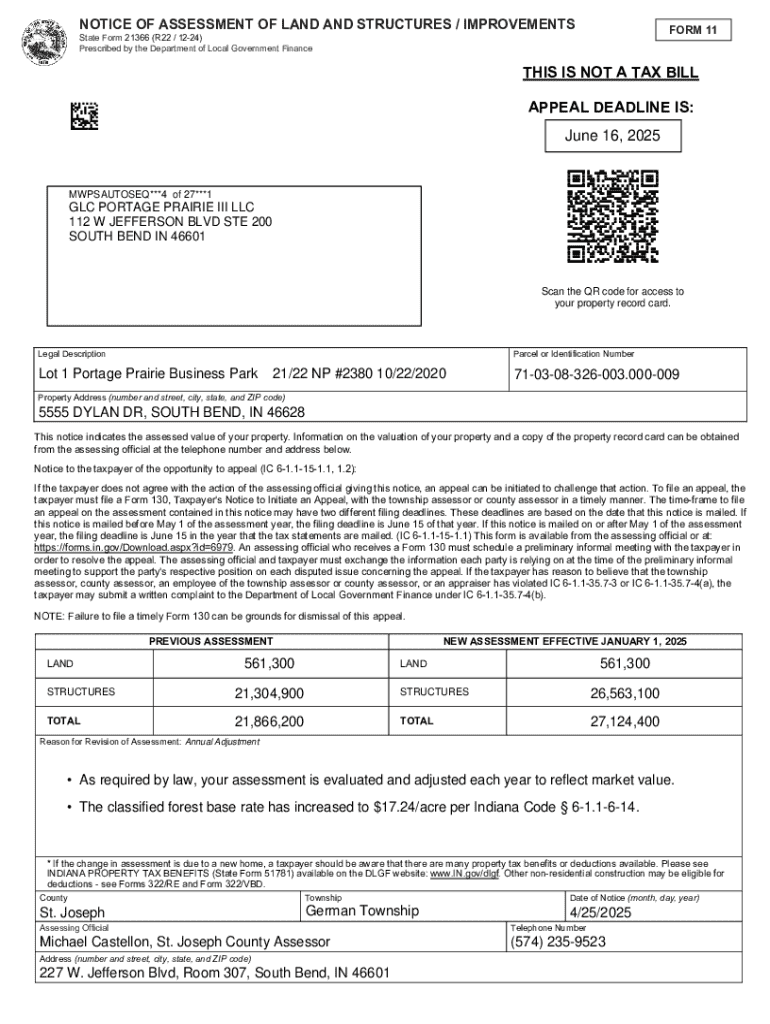

Understanding the notice of assessment

A Notice of Assessment is a crucial document issued by tax authorities that provides a taxpayer with detailed information about their tax return. This official communication outlines the tax due, any refunds, and the overall assessment of the submitted tax return. Understanding this document is vital for effective tax management and compliance.

The importance of the Notice of Assessment cannot be overstated. It serves as the tax authority’s confirmation of your tax return filings, detailing the calculations of your income, deductions, credits, and the resulting tax liability. Misinterpretation or neglect of this document can lead to misunderstandings regarding one's tax obligations, potential penalties, or missed refund opportunities.

Key components of the notice of assessment form

Every Notice of Assessment form contains several critical components that should be examined closely to ensure accuracy and completeness. Understanding these key elements is essential for both individual and corporate taxpayers.

How to obtain your notice of assessment

Obtaining your Notice of Assessment can vary depending on your location and tax authority's processes. However, it generally follows a few standard routes. Taxpayers can access their assessments via government or tax agency websites, where secure login options allow for immediate access to digital copies.

For those who prefer physical documents, requesting a copy through mail or customer service channels is typically an option. It is imperative to be aware of any regional differences in access that may alter how you receive this important document.

Step-by-step guide to completing the notice of assessment form

Filling out the form

Completing the Notice of Assessment form accurately requires thorough preparation. Before starting, gather necessary documentation, including your prior tax returns, W-2s, and any 1099 forms, which provide critical income details needed to complete your assessment.

Common mistakes to avoid

To mitigate errors, it's important to avoid common pitfalls. Mistakes often arise from incorrect personal information, such as typos in names or addresses, which can cause issues with the processing of the form. Additionally, ensure that your income or deductions are calculated accurately, as discrepancies can lead to audits or penalties.

Editing and managing your notice of assessment

Once you have your Notice of Assessment, you might find the need to edit or manage this document. Tools like pdfFiller provide you with the ability to edit your PDF forms easily. You can add notes, highlight important information, or even redact sensitive data.

Moreover, collaborating on these documents with team members is seamless through pdfFiller’s platform, allowing for real-time reviews and input. Once finalized, securely storing and sharing your assessment with stakeholders is accessible through cloud-based solutions.

Addressing issues with your notice of assessment

If you believe there are errors in your Notice of Assessment, it’s imperative to address them quickly. Reach out to your tax authority promptly and follow the necessary steps to dispute or appeal the assessment. This often involves submitting a correction form along with any supporting documentation that aids your case.

Frequently asked questions (FAQs)

The Notice of Assessment often raises many questions among taxpayers. Here are some common inquiries answered:

Related forms and documents

In addition to the Notice of Assessment, there are several other forms that you might need when filing your taxes. These documents can vary based on your personal or business tax situation. Accessing templates through pdfFiller can streamline your document management.

Tax filing scenarios

For individuals

Individual taxpayers, especially those who are self-employed, need to consider unique aspects when dealing with the Notice of Assessment. Self-employed individuals must track their income and expenses closely, as the assessment directly reflects their taxable income. Maintaining meticulous records is crucial to ensure all eligible deductions are properly accounted for.

For businesses

Businesses face different requirements in their assessments. Corporate tax filings often involve additional forms and qualified deductions. Therefore, understanding the distinctions is essential for business owners to maintain compliance and ensure no potential tax benefits are overlooked.

State-specific information on notices of assessment

It's important to note that Notices of Assessment may vary considerably across different state jurisdictions. Each state has its own tax laws and regulations that could influence how the assessment is issued and what information must be included. Therefore, being aware of the specific requirements of your state will help you navigate the tax landscape effectively.

Resources are often available on state revenue department websites that offer guidance and provide templates or example assessments, making it easier for taxpayers to understand what to expect.

Interactive tools and resources

To assist in predicting assessments and potential payments, various online calculators and tools can be beneficial. These interactive resources allow taxpayers to input their specific financial situations to estimate what their future assessments may look like.

Additionally, examples of different assessment outcomes can provide a practical understanding of how certain factors—such as changes in income or deductions—can significantly affect your tax liability.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in notice of assessment of without leaving Chrome?

Can I edit notice of assessment of on an Android device?

How do I fill out notice of assessment of on an Android device?

What is notice of assessment of?

Who is required to file notice of assessment of?

How to fill out notice of assessment of?

What is the purpose of notice of assessment of?

What information must be reported on notice of assessment of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.