Get the free Notice of Assessment of Land and Structures / Improvements

Get, Create, Make and Sign notice of assessment of

Editing notice of assessment of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notice of assessment of

How to fill out notice of assessment of

Who needs notice of assessment of?

Notice of Assessment of Form: A Comprehensive Guide

Breadcrumbs

Home > Forms > Notice of Assessment

Sidebar

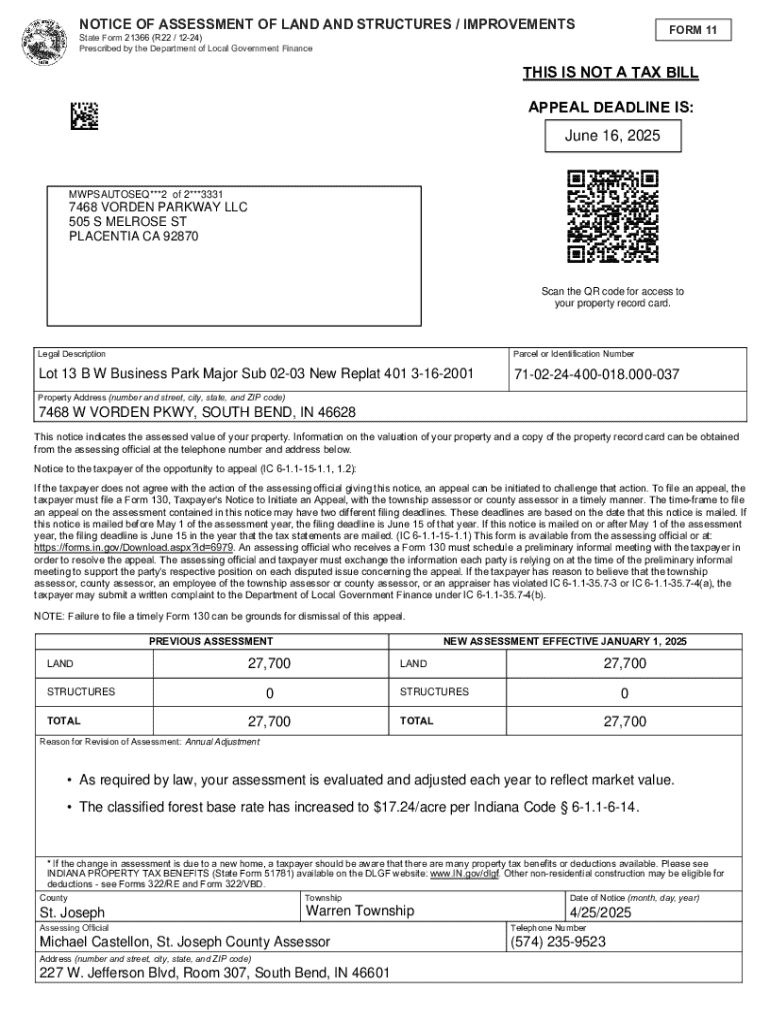

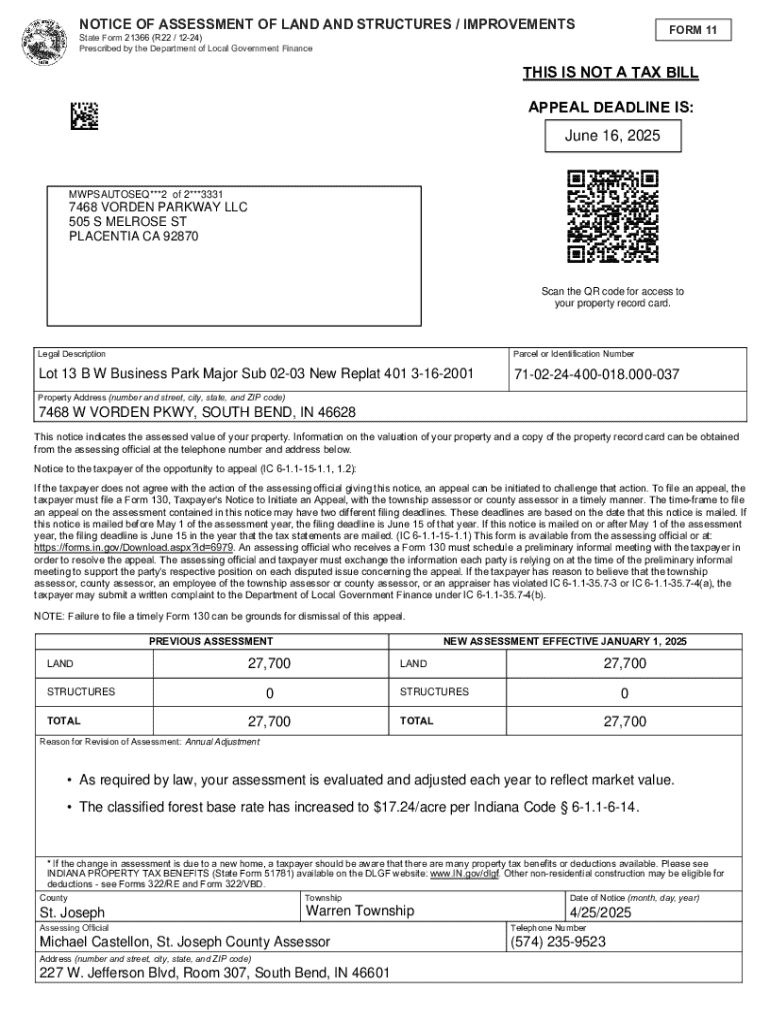

Understanding the notice of assessment

A notice of assessment is an essential document issued by governmental tax authorities, detailing the evaluated tax liabilities of an individual or business. It serves as a formal communication summarizing one’s taxable income, applicable deductions, and overall tax obligations. Understanding this document is crucial for effective tax planning and compliance.

The notice informs taxpayers of their assessment results based on tax returns filed, and it is fundamental in ensuring that individuals are aware of their tax responsibilities. It highlights not only what is owed but also clarifies potential refunds, making the document pivotal for personal finance management.

Who receives a notice of assessment?

Typically, notices of assessment are received by both individual taxpayers and business owners. Individuals in employment, freelancers, contractors, and self-employed persons may receive assessments following the annual tax filing. Business owners can expect these documents as assessments are frequently tied to corporate tax obligations.

Types of assessments

There are primarily two types of assessments: preliminary and final. A preliminary assessment is often issued early in the assessment process. It outlines initial findings but may be subject to revision based on further review, whereas a final assessment usually comes after all the necessary information and calculations have been validated.

How to access your notice of assessment

Accessing your notice of assessment is straightforward and can be accomplished either online or through traditional mail. Online access offers the advantage of immediate availability and ease of review, while mail can take additional time. Many tax authorities are transitioning to more digital processes, making online retrieval an increasingly popular option.

Where to find it

To find your notice of assessment, navigate to the online portal of your respective tax authority. This usually requires creating an account or logging in with existing credentials. For those opting for physical copies, keep an eye on your mail; these are typically sent to the address on your tax return.

Setting up online access

Setting up online access generally includes the following steps:

Components of the notice of assessment

Your notice of assessment will typically include various key components crucial for your understanding and record-keeping. Firstly, you will find basic identification information that covers your name, address, and tax identification number, ensuring that the assessment is correctly attributed.

Secondly, it outlines the assessment details which inform you about the tax owed or any refund due based on your calculations. Details about deductions and credits applied to your situation are essential for understanding how the final numbers were derived and can affect future returns.

Understanding key terms

Steps to review and interpret your notice of assessment

Once you receive your notice of assessment, taking time to review and interpret it is essential to ensure accuracy and compliance. There are specific steps to take during this review process.

Step 1: Verify personal information

Start by ensuring that your name, address, and tax identification number are correct. Any inaccuracies can lead to issues down the line, including delays in processing or even penalties.

Step 2: Analyze tax calculations

Next, closely analyze the tax calculations presented. This includes breaking down your taxable income and deductions, ensuring they align with your records.

Step 3: Identify discrepancies

If you notice any discrepancies or errors, it is vital to document them properly. Common errors might include incorrect income figures or misplaced deductions. Understanding your rights and the appeal process is essential if you find errors.

Step 4: Understanding your rights

Lastly, familiarize yourself with your rights as a taxpayer. Each jurisdiction has specific rules and regulations regarding disputes or challenges to assessments. Knowing these can empower you to take appropriate action.

Actions to take after receiving your notice of assessment

After reviewing your notice of assessment, it is important to know how to proceed. Being proactive can help you manage your tax obligations effectively.

Paying your tax bill

If tax is owed, you have several options available for payment. You can often pay online directly through the tax authority's website, via mail using a check, or even in person at designated locations. Ensure you are aware of deadlines to avoid penalties.

Filing for a tax refund

Should your notice indicate that you are due a refund, verify the eligibility criteria for claiming it, and follow the indicated steps promptly. This typically involves verification of previous tax filings and submission of relevant forms.

Appealing your assessment

For taxpayers who disagree with an assessment, appealing is an option. Familiarize yourself with the process, which usually requires specific documentation and adherence to established timelines for your appeal.

Common scenarios and solutions

Understanding potential issues related to the notice of assessment can alleviate stress. Here are some common scenarios along with potential solutions.

What if you cannot access your assessment?

If you face trouble accessing your notice of assessment online, start by double-checking the login credentials. Clear your browser cache or try a different browser if issues persist. If problems continue, do not hesitate to contact the tax authority support for assistance.

Changing your personal information

If you need to update personal information due to a name change, change of address, or any other reason, consult your tax authority regarding the appropriate procedure. Updating this information is vital to ensure seamless communication in the future.

Scenario: unable to collect in person at revenue house

Should you be unable to visit the revenue office in person, explore alternative methods for document retrieval and submission. Many tax authorities offer options such as requesting documents via mail or email, providing the flexibility needed in managing your tax obligations.

Additional tips for managing your tax documents

Managing your tax documents effectively is essential for personal and business financial health. One recommended practice is using tools like pdfFiller, which enables efficient document management through a cloud-based platform.

Best practices for document keeping

Organizing your documents can reduce clutter and make access easier in the future. Here are best practices to consider:

Collaborating with team members

For teams managing tax documents together, pdfFiller offers robust collaboration features. You can share documents securely for feedback and edits, thereby fostering a collaborative environment while ensuring compliance and accuracy.

Related content

Understanding the wider tax landscape is crucial. Here are some forms and content that may enhance your knowledge further.

Table of fees

Being aware of potential fees linked to assessments ensures you are prepared for any unexpected costs. Here are a few common fees to consider:

Example walk-through: searching for years of assessment

Retrieving past tax documents can be essential for various reasons, such as filing for a refund or verifying your tax history. Here’s a walk-through on how to search for historical tax documents online.

Example 1: retrieving tax bills for 2018 and 2019

To retrieve years of assessment such as 2018 and 2019, follow these steps:

Future updates and maintaining compliance

Tax regulations often change, and staying informed is a vital part of compliance. Utilize resources provided by your tax authority for updates and changes in regulations that may affect subsequent filings.

Keeping up with tax changes

Furthermore, set reminders on your calendar for important tax dates. This proactive approach can help avoid missed deadlines and ensure that you stay compliant with regulations.

In conclusion, understanding the notice of assessment of form, its processes, and implications is crucial for effective tax management. Utilizing tools like pdfFiller can simplify document handling, ensuring an organized and efficient way to manage your realities as a taxpayer.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit notice of assessment of in Chrome?

How do I fill out the notice of assessment of form on my smartphone?

How do I edit notice of assessment of on an iOS device?

What is notice of assessment of?

Who is required to file notice of assessment of?

How to fill out notice of assessment of?

What is the purpose of notice of assessment of?

What information must be reported on notice of assessment of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.