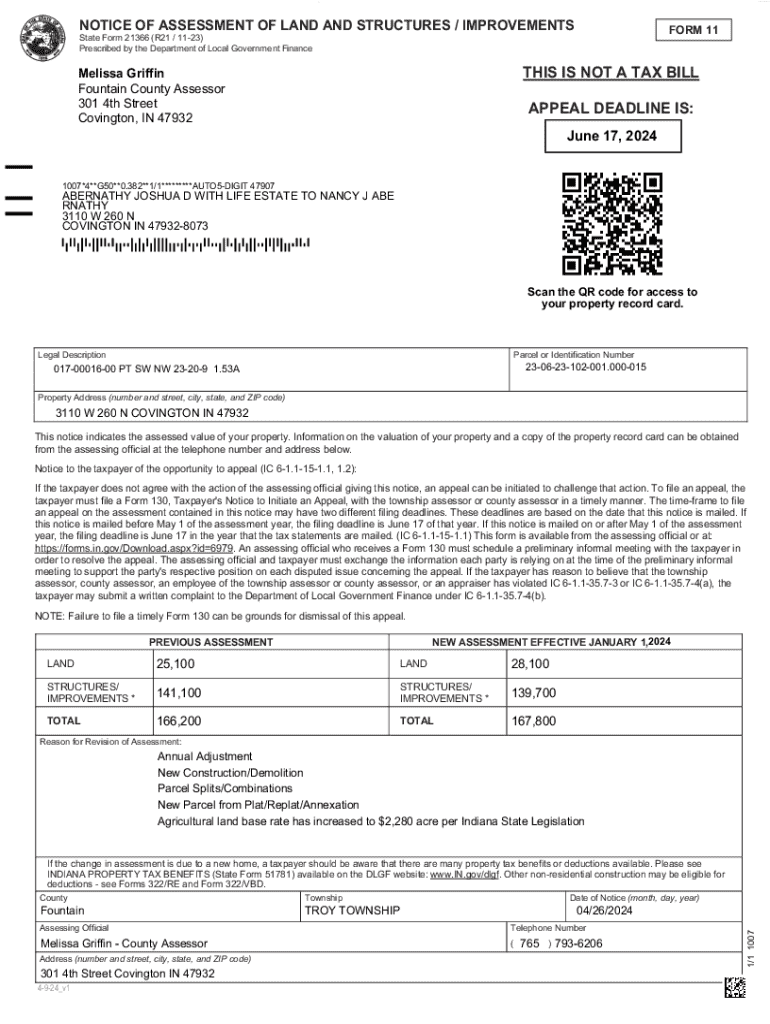

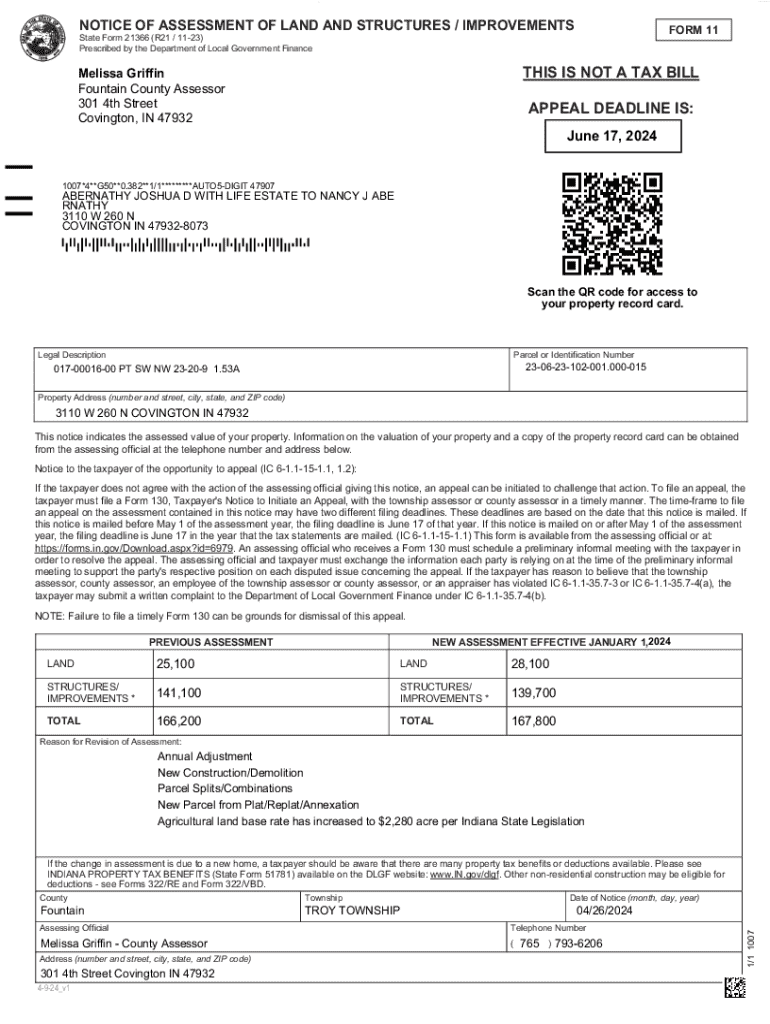

Get the free Notice of Assessment of Land and Structures / Improvements

Get, Create, Make and Sign notice of assessment of

How to edit notice of assessment of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notice of assessment of

How to fill out notice of assessment of

Who needs notice of assessment of?

Understanding the Notice of Assessment of Form

Understanding the Notice of Assessment (NOA)

A Notice of Assessment (NOA) is a formal document issued by tax authorities that summarizes the findings of an individual's or business’s tax return. It outlines the income, deductions, and taxes assessed by the authorities for a specific tax year. Understanding this document is crucial, as it serves as a formal verification of your tax situation and provides essential information for financial planning and compliance.

The primary purpose of an NOA is to communicate the tax authorities' reconciliation of your filed return against their records. It informs you of your taxable income, the deductions allowed, any credits applied, and the final amount of tax owed or refunded. Thus, it plays a vital role in ensuring transparency and clarity in your fiscal responsibilities.

How to access your Notice of Assessment

Accessing your Notice of Assessment has become significantly easier with digital solutions. Most tax authorities offer online portals where taxpayers can retrieve their NOA quickly and securely. To do this, you will need to visit the official taxation authority's website and log in to your account using secure credentials.

Here’s a simple step-by-step guide for accessing your NOA online:

If you prefer a physical copy of your NOA, you can request one through the relevant office. This usually involves filling out a specific form or sending a written request. Ensure to include your personal details and any identification number required to expedite the process.

Detailed interpretation of your NOA

Once you have your Notice of Assessment, interpreting the details can seem overwhelming. However, breaking it down into important data points can make understanding it much simpler. Key information typically includes your total income for the year, allowable deductions, and any tax credits applied.

Here are some common terms you will find on your NOA, simplified for easy comprehension:

If upon reviewing your NOA, you believe that there are discrepancies in the amounts reported, it is critical to take immediate action. Verify these figures against your records and, if necessary, prepare to dispute any incorrect entries.

Taking action based on your Notice of Assessment

Understanding the financial impact of your Notice of Assessment is essential, particularly with regard to your payment obligations. Your NOA will specify any amount due, along with payment deadlines, which must be adhered to avoid penalties.

Payment methods typically include:

If you detect an error in your NOA, it is within your rights to dispute the assessment. Here’s a step-by-step guide on how to file an objection:

Managing your documents with pdfFiller

Careful management of your tax documents, including your Notice of Assessment, is crucial for organized financial planning. pdfFiller provides a comprehensive solution for individuals and teams to manage these documents seamlessly in a cloud-based environment.

To get started with pdfFiller, follow these steps:

Moreover, pdfFiller enables you to eSign your NOA, facilitating smoother processes when applying for loans or investments where tax documents are required. You can easily share your signed document through secure online methods.

Tips for future tax assessments

To prepare for future tax assessments and ensure a smoother experience next tax season, maintaining accurate records is vital. Keeping your documents organized and easily accessible can save you time and stress. Best practices include archiving previous year's assessments with your current year’s paperwork.

Using pdfFiller for ongoing document management helps streamline the process even further. By leveraging interactive tools.

By adopting proactive measures in managing your documents, you can enhance your readiness for upcoming tax assessments.

Frequently asked questions (FAQs)

It’s common for taxpayers to have questions concerning their NOA. Here are some frequently asked questions that might help clarify your concerns:

Real-life scenarios: What to do after receiving your NOA

Understanding what actions to take after receiving your Notice of Assessment can be crucial in addressing your financial situation effectively. Here are three scenarios illustrating different potential outcomes based on the results found in your NOA:

These scenarios emphasize the importance of timely and informed actions upon receipt of your NOA, tailored to your specific findings.

Interactive tools and resources

Utilizing tools that simplify document management tailored to tax forms can streamline your filing process. pdfFiller offers several features designed explicitly for tax-related documents, ensuring your forms are accurate and well-organized.

To get started with pdfFiller, new users can follow these steps:

By implementing these resources, you can effectively manage your tax documents and ensure that your future NOAs are processed smoothly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify notice of assessment of without leaving Google Drive?

How do I edit notice of assessment of straight from my smartphone?

How do I edit notice of assessment of on an iOS device?

What is notice of assessment of?

Who is required to file notice of assessment of?

How to fill out notice of assessment of?

What is the purpose of notice of assessment of?

What information must be reported on notice of assessment of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.