Get the free Notice of Assessment of Land and Structures / Improvements

Get, Create, Make and Sign notice of assessment of

How to edit notice of assessment of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notice of assessment of

How to fill out notice of assessment of

Who needs notice of assessment of?

Your Essential Guide to the Notice of Assessment of Form

Overview

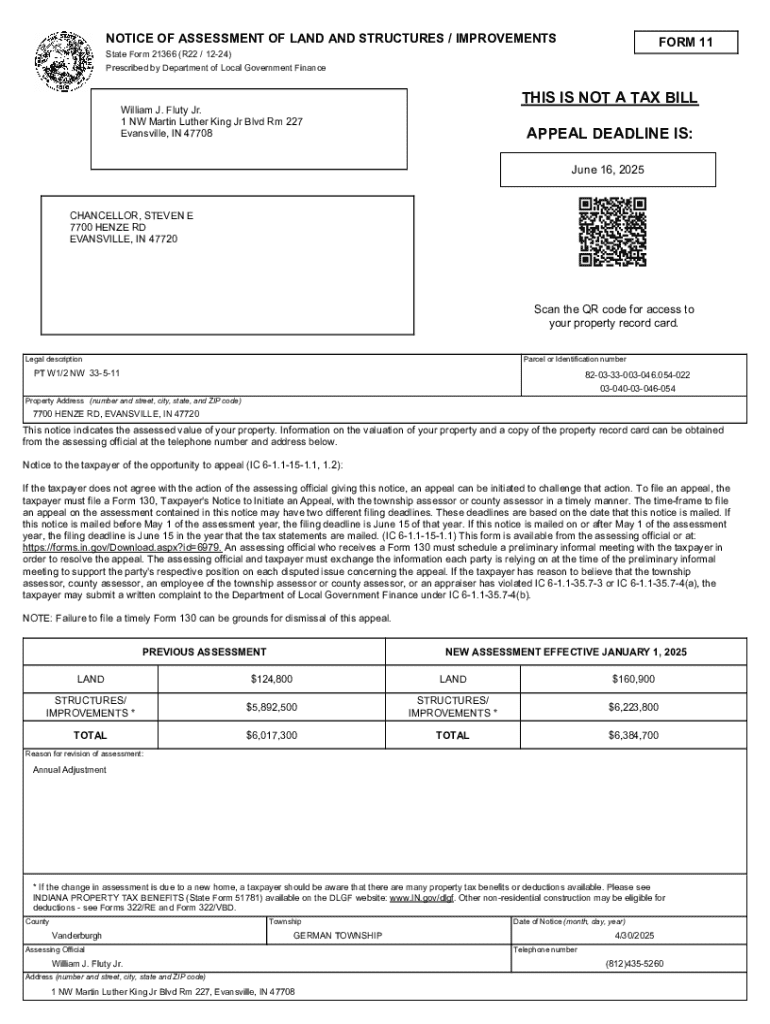

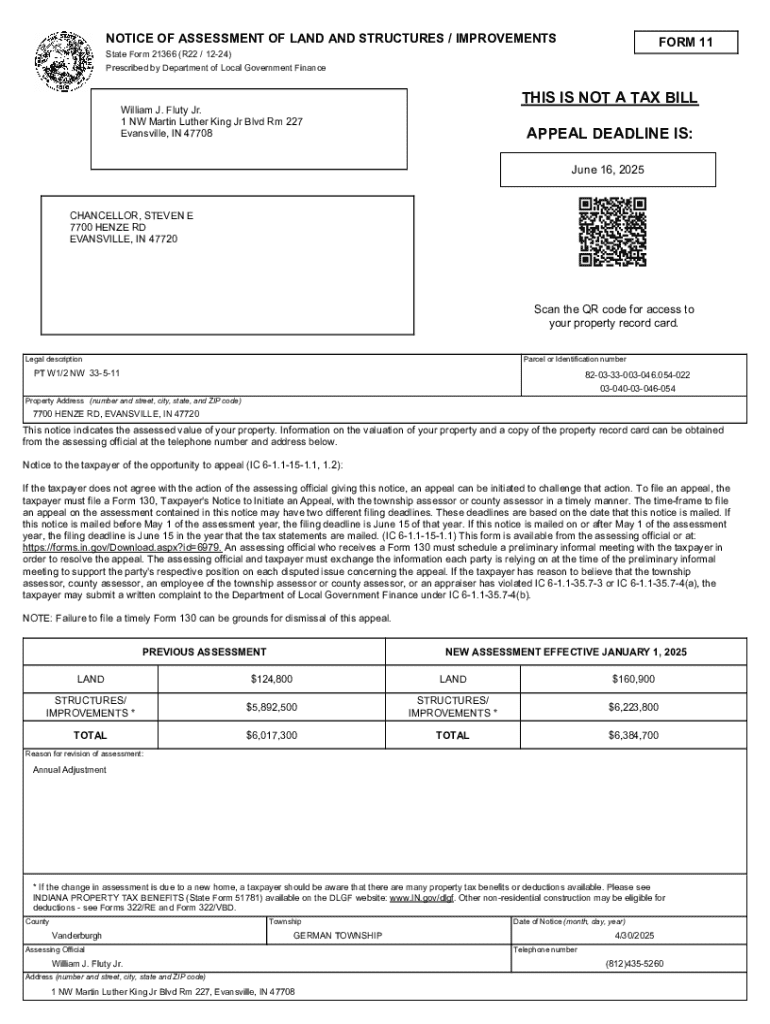

The Notice of Assessment (NoA) is a critical document issued by tax authorities to inform taxpayers of their tax liability based on submitted returns. It summarizes the details of the assessment process, serving as a formal acknowledgment of the taxpayer's financial standing with respect to tax obligations. Receiving your NoA is a significant moment for both individuals and organizations alike as it outlines responsibilities and any potential refunds.

Understanding the nuances of the NoA is essential, as it impacts financial decision-making and compliance. Whether you're an employee, a self-employed individual, or running a corporation, knowing the implications of your Notice of Assessment can significantly influence your future financial planning.

Understanding the Notice of Assessment

What exactly is a Notice of Assessment? In essence, it is an official document that tax authorities send after reviewing your tax returns. Its primary purpose is to validate the information submitted and inform you of any discrepancies or confirmations regarding your tax obligations. This document is not just a formality; its significance lies in its direct impact on how much tax you owe or are entitled to receive as a refund.

The NoA is vital for strategic financial planning. By providing a clear breakdown of tax liabilities, it allows individuals and businesses to understand their financial situation better, anticipate future tax responsibilities, and make informed decisions about savings and investments.

Who receives a Notice of Assessment?

A wide variety of taxpayers receive a Notice of Assessment, which includes employees, freelancers, and the self-employed. Each of these groups needs to keep track of their NoA as it reflects their tax obligations. Small businesses and corporations also receive NoAs. In specific scenarios—like property ownership or instances involving tax-exempt organizations—the NoA can take on unique significance since different tax rules may apply.

Being aware of who receives a Notice of Assessment helps one anticipate its relevance to their specific tax situation, ensuring they are well-prepared to respond.

Key components of the Notice of Assessment

Understanding the components of your NoA can help demystify tax assessments. At its core, a Notice of Assessment contains vital information such as taxpayer details, the assessment year, the period covered, different tax categories, and calculations that lead to the final amounts owed or refunded. Breaking this information down is critical for accurate understanding and management.

To interpret your NoA correctly, familiarity with tax codes and terminologies can be extremely valuable. If you notice discrepancies in your assessment, knowing how to address these issues and engage with tax officials can save time and stress.

Step-by-step guide to manage your NoA

Receiving your Notice of Assessment is just the beginning. Here are steps to ensure you manage it effectively.

Step 1: Receiving your notice

Notices can be delivered via mail, email, or through an online tax portal. The mode of delivery can affect the timeliness of the information provided. When you receive your NoA, make note of any deadlines for response or payment to avoid unnecessary penalties.

Step 2: Reviewing your NoA

Reviewing your NoA should be a thorough process. Create a checklist that includes verifying your personal details, the assessment year, and the accuracy of calculations. Look out for common errors, such as miscalculated income, incorrect deductions, or incorrect filing status.

Step 3: Filing a dispute or appeal

If you disagree with your NoA, you have the right to dispute it. Check the assessment for inconsistencies and gather the required documentation to support your case. Submitting an appeal involves outlining your reasons and providing concrete evidence to back your claim.

Step 4: Making payments or arranging repayment plans

Once you've reviewed your NoA, you may need to make a payment or arrange a repayment plan for any amounts due. Be aware of payment deadlines and explore the options available for setting up payments to mitigate financial strain.

Step 5: Keeping records for future reference

Keeping records of your NoA and related documents is paramount for future tax filings and accountability. Retain copies of your NoA and any correspondence with tax authorities, ideally in both digital and physical formats.

Interactive tools for document management

Utilizing tools like pdfFiller can simplify the management of your Notice of Assessment. This platform allows you to edit your NoA, sign it electronically, and securely share it while organizing all your documents in the cloud.

With pdfFiller, not only can you maintain your NoA efficiently, but you can also streamline all your financial records, ensuring they are easily accessible wherever you need them.

Additional considerations and insights

You may have questions about your Notice of Assessment, especially if you didn't receive one. Not receiving a NoA can occur due to various factors, including filing errors or the need for further review by tax authorities. Understanding the timeline and processing times can be vital for resolving these issues.

State-specific regulations also come into play, as processing times and requirements may vary by region. Knowing your local resources for assistance will aid your understanding of what to expect.

Scenarios and case studies

Consider the following scenarios where taxpayers disagreed with their NoA. Each situation highlights the importance of thorough review and the steps taken towards resolving these disputes. For instance, a taxpayer might notice erroneous reported income figures leading to a larger tax liability. Upon disputing, they provided supporting documents demonstrating their correct income was lower, resulting in a favorable adjustment.

In another example, a first-time taxpayer may find the NoA confusing but soon learns to interpret components effectively. Through a methodical review and use of pdfFiller's resources, they managed to keep their financial records organized, leading to successful filing for subsequent years.

Related content

Stay informed about the tax laws affecting your Notice of Assessment and filing duties. For continuous updates, explore resources around tax simplicity and access essential tips on deadlines, maximizing refunds, and financial planning.

As your understanding of the Notice of Assessment deepens, you can leverage your knowledge to benefit your financial future, ensuring you're always one step ahead in managing your tax responsibilities effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify notice of assessment of without leaving Google Drive?

How can I send notice of assessment of to be eSigned by others?

How do I execute notice of assessment of online?

What is notice of assessment of?

Who is required to file notice of assessment of?

How to fill out notice of assessment of?

What is the purpose of notice of assessment of?

What information must be reported on notice of assessment of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.