Get the free W-9

Get, Create, Make and Sign w-9

Editing w-9 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out w-9

How to fill out w-9

Who needs w-9?

W-9 Form: A Comprehensive How-to Guide

Understanding the W-9 form

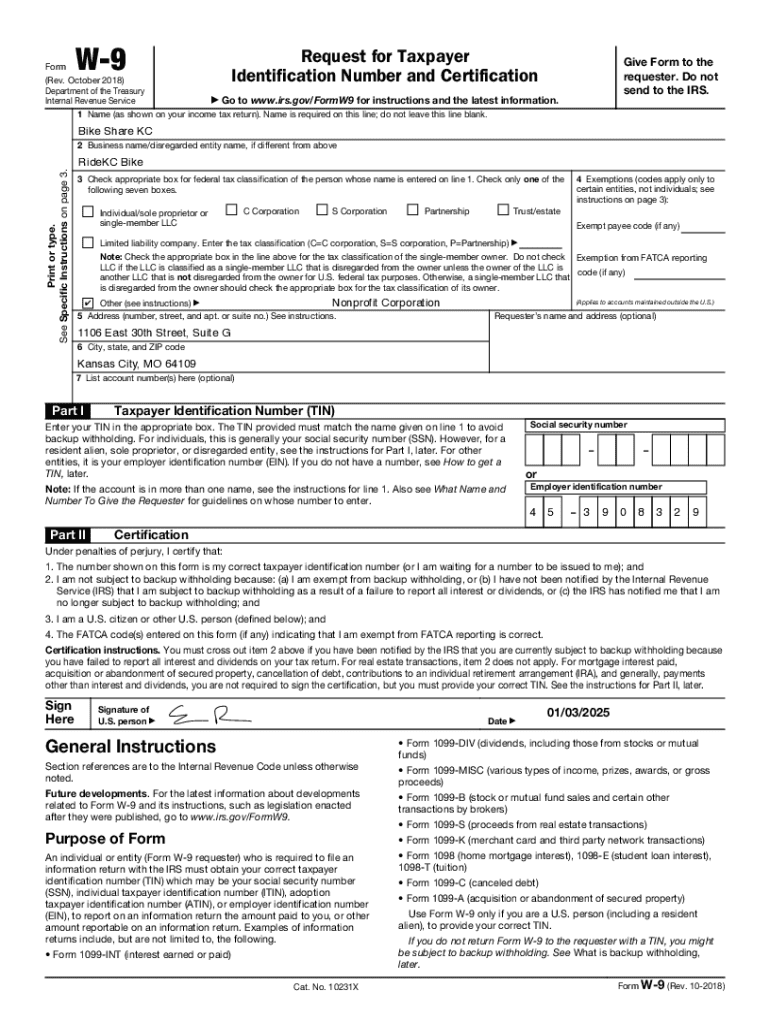

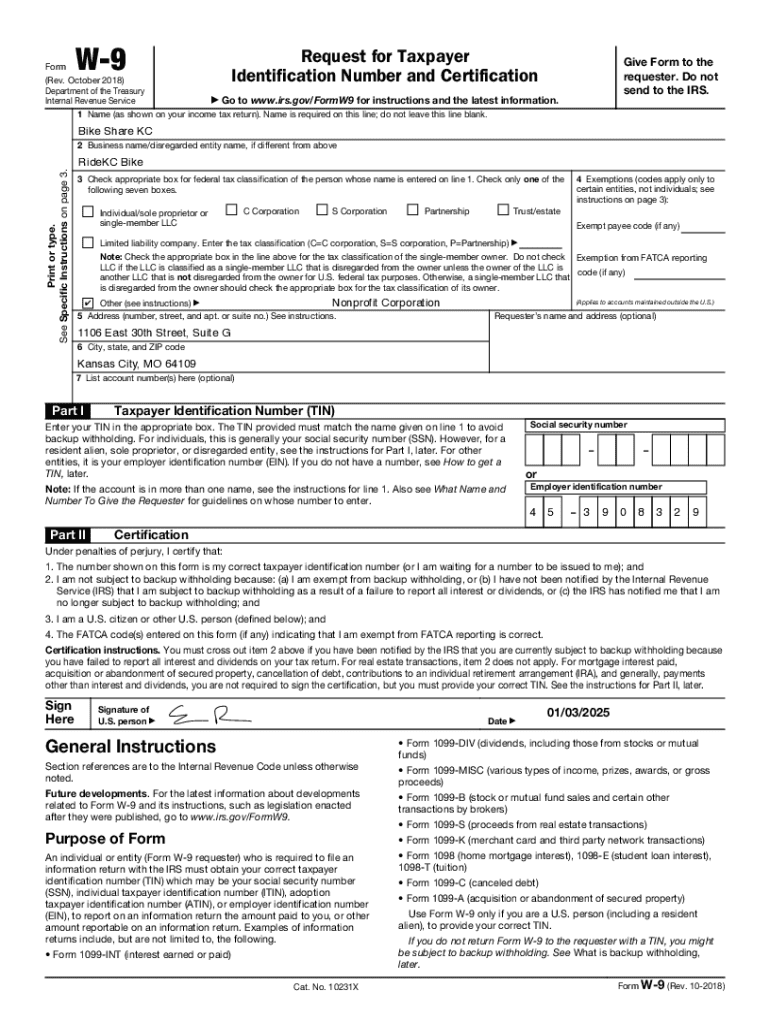

The W-9 form, officially called the 'Request for Taxpayer Identification Number and Certification', is a document required by the Internal Revenue Service (IRS). This form is primarily used by organizations to gather taxpayer identification information from individuals or entities they pay. Its main function revolves around ensuring correct tax reporting and compliance.

The importance of the W-9 form for tax reporting cannot be overstated. It serves as a crucial tool that helps both the payer and the payee comply with tax regulations. By providing accurate information, individuals and businesses can avoid potential penalties and facilitate smoother tax processes.

Common scenarios where a W-9 form is required include freelance work, contractor engagements, and any situation where a business makes payments to a non-employee for services. It's essential that these forms are filled out correctly to ensure compliance and proper reporting.

Key components of the W-9 form

The W-9 form comprises several key components that must be accurately completed. Below is an overview of the critical fields you'll encounter:

In addition to these required fields, the W-9 form also contains optional fields. While these aren't mandatory, completing them can sometimes facilitate tax reporting or help in better identifying your record for the payers.

How to fill out the W-9 form

Filling out a W-9 form can seem daunting at first, but following these step-by-step instructions can simplify the process significantly:

Common mistakes to avoid during this process include using incorrect names, providing an outdated address, or omitting required fields. Double-checking each entry can help ensure completeness and accuracy.

For best results, take your time and read through the instructions provided with the form. Keeping handy any previous tax documents can also help clarify what information is needed.

Digital and electronic submission of the W-9 form

In today’s digital age, submitting a W-9 form electronically is not only possible but also efficient. Using platforms like pdfFiller allows for easy editing and signing of this document.

Benefits of using electronic signatures include enhanced security, speed of processing, and the ability to store documents digitally, reducing physical paperwork.

While submitting the W-9 electronically, it’s crucial to ensure compliance with IRS regulations. Make sure the document is securely shared and that any required signatures are obtained to validate the form.

Filing and security considerations

Once you’ve completed your W-9 form, submit it to the appropriate requester, typically a business or organization that has hired you. It’s important to follow any specific instructions they provide regarding submission methods.

Handling W-9 information securely is vital since it contains sensitive data. Always store the completed form in a secure location, whether digital or physical, and dispose of any unnecessary copies responsibly.

Understanding privacy and data protection laws can further shield you from unauthorized access to your personal information. Familiarizing yourself with how your data is used and stored can enhance protection.

Frequency of W-9 form submission

You don't need to submit a W-9 form indefinitely. Instances arise when it’s necessary to provide a new W-9 form. Common situations include when there are changes in your name, address, or tax classification.

Contractors and vendors may request updated W-9s periodically to ensure they have accurate information for tax reporting purposes. If you provide services to multiple businesses, keeping an organized record of submitted W-9s can be immensely helpful.

Practical use cases for the W-9 form

The W-9 form is versatile, catering to various relationships and transactions. In employer-employee arrangements, the form helps establish tax obligations and ensures proper reporting for contract work.

In business-contractor relationships, businesses need to collect W-9 forms to report payments made to freelancers and service providers. Financial institutions may also require the W-9 from clients, particularly when opening new accounts.

W-9 form and tax implications

Understanding tax implications related to the W-9 form is crucial for both individuals and organizations. The data provided on the W-9 is used to prepare various tax documents, including Form 1099, which details payments made to non-employees.

Failing to submit a W-9 can lead to serious consequences, such as backup withholding, where 24% of payments are withheld and sent to the IRS. Keeping current with tax obligations and ensuring timely submission of W-9s can alleviate such issues.

Interactive tools and resources

pdfFiller provides a user-friendly template for the W-9 form, enabling users to fill, edit, and sign documents easily. Additionally, the platform includes document management features that help users keep track of different forms, enhancing organization.

Collaboration tools within pdfFiller allow teams to work together on W-9 tasks seamlessly. Users can share documents and add comments, ensuring all parties are on the same page without the hassle of multiple email exchanges.

Need help with the W-9 form?

Common questions about the W-9 form arise, especially for first-time users. Many might wonder about how to update their information or whom to contact in case of discrepancies. Ensuring clear channels of customer support, like those available through pdfFiller, can provide the necessary assistance.

Additional online resources for further assistance, such as IRS guidelines or tax preparation sites, can help clarify any lingering questions about the W-9 form and its use.

External links and further reading

To deepen your understanding of the W-9 form and related requirements, consider visiting the IRS official W-9 form page for the latest updates and information. Additionally, familiarize yourself with other tax forms and guidelines that may complement your use of the W-9.

There are numerous recommended resources available for tax preparation and filing, including software solutions and professional services that can guide you through the complexities of tax reporting.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the w-9 in Gmail?

How do I complete w-9 on an iOS device?

How do I edit w-9 on an Android device?

What is w-9?

Who is required to file w-9?

How to fill out w-9?

What is the purpose of w-9?

What information must be reported on w-9?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.