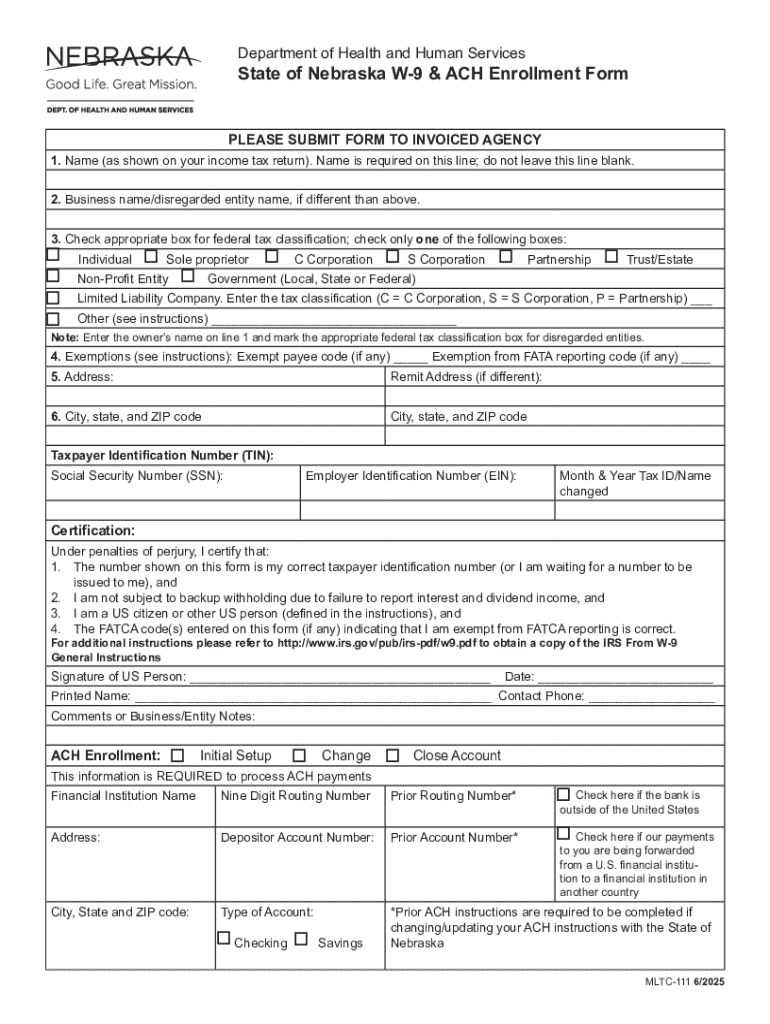

Get the free State of Nebraska W-9 & Ach Enrollment Form - dhhs ne

Get, Create, Make and Sign state of nebraska w-9

How to edit state of nebraska w-9 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out state of nebraska w-9

How to fill out state of nebraska w-9

Who needs state of nebraska w-9?

State of Nebraska W-9 Form: A Comprehensive Guide

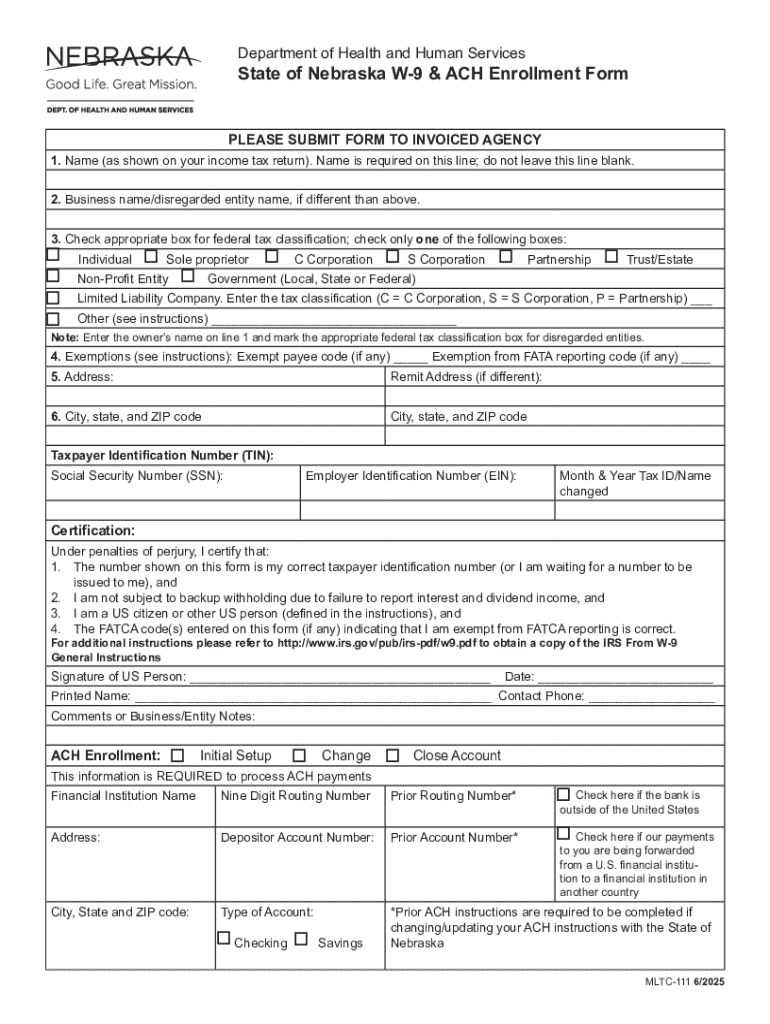

Overview of the W-9 form

The W-9 form is a crucial document used in the United States for tax purposes. It collects necessary taxpayer information from individuals and businesses, allowing payers to report taxable payments to the Internal Revenue Service (IRS) accurately. Its completion is particularly important as it informs the IRS about the type of taxpayer and their identification number.

In Nebraska, just like in other states, the W-9 form serves as a declaration of the taxpayer's identification number, such as a Social Security number (SSN) or Employer Identification Number (EIN). This information is critical when clients or partners are compensating freelancers, independent contractors, businesses, or corporations.

Requirements for filling out the W-9 form in Nebraska

Understanding who needs to complete the W-9 form is essential for compliance. Generally, any individual or entity receiving payments subject to reporting needs to fill it out. This is especially relevant for freelancers, contractors, and suppliers providing goods or services to clients in Nebraska.

For Nebraska residents, particular considerations apply. For instance, some state-specific regulations might affect how tax identification is handled. Additionally, individuals should be aware of the privacy concerns associated with sharing their TIN, especially when dealing with unfamiliar companies.

Detailed breakdown of the W-9 form sections

The W-9 form is divided into several key sections, which include personal information, certification, and signature fields. Let's break these down further.

The personal information section includes fields 1 to 4, where you fill out your name, business name (if applicable), and address details. It's vital to ensure this information is accurate to avoid complications during tax reporting.

The certification section (Boxes 5-6) requires you to certify the accuracy of the information provided and whether you're subject to backup withholding. Common mistakes include incorrect entries and failing to sign the form, which can delay processing.

Step-by-step guide to completing the W-9 form

Completing the W-9 form can be done easily through various methods; however, accessing it online is the most streamlined approach. Here’s a step-by-step guide on filling out the form accurately.

Step 1: Enter your name and business name (if applicable). Ensure that your name matches the information on your tax documents.

Step 2: Select the appropriate tax classification. This step is crucial as it determines how your income will be taxed.

Step 3: Provide your complete address information, ensuring it’s accurate to avoid discrepancies.

Step 4: Enter your Taxpayer Identification Number (TIN), either as your SSN or EIN, as this is critical for IRS reporting.

Step 5: Certify the information by signing and dating the form, confirming everything you’ve provided is accurate.

eSigning and submitting the W-9 form

Once you've completed the W-9 form, the next step is eSigning it for submission. This is especially convenient for Nebraska residents as it helps maintain flexibility in document management.

Preparing to eSign is straightforward. Many platforms, including pdfFiller, offer integrated eSigning options that simplify the process significantly.

After eSigning, ensure to submit your completed W-9 form to the requester promptly. This is vital for timely and accurate tax processing on their end.

Scenarios requiring a W-9 form in Nebraska

Several situations may necessitate the completion of a W-9 form in Nebraska. Freelancers and independent contractors are some of the most common examples, as they typically work with multiple clients who need their taxpayer information for reporting.

Moreover, businesses providing services in Nebraska must also complete this form to ensure compliance with tax regulations. Partnerships and corporations often use the W-9 form for agreements involving payments to individuals that require thorough documentation and reporting.

Backup withholding and its implications

Backup withholding is a critical process where the IRS requires withholding on certain payments to ensure tax compliance. This is triggered in cases where taxpayers have not provided a valid taxpayer identification number (TIN) or are subject to backup withholding.

Nebraska residents need to be aware of the exemptions as well. For certain income categories, including interest payments and other pass-through income, backup withholding may not apply if the taxpayer meets specific criteria.

Common issues and solutions

Misplacing your W-9 form can be a common occurrence, particularly for those handling multiple documents. If you lose your form, it's recommended to reach out to the requester for a replacement promptly.

If you find that the information provided on your submitted W-9 form is incorrect, you'll need to submit a new form with the correct details. It's also essential to inform the requester of any changes to ensure they are aware of your updated information.

New updates for the W-9 form in 2024

Staying updated on the W-9 form is crucial, especially with upcoming changes for 2024. Tax law adjustments may affect how information is reported, including new fields or requirements that Nebraska residents must accommodate.

It’s essential to consult the IRS updates and local tax laws to ensure compliance, as these changes might influence how independent contractors and businesses operate financially.

Resources for additional assistance

For those managing the W-9 form or seeking additional guidance, various online tools can simplify this process. Platforms like pdfFiller provide resources to help users manage their W-9 forms efficiently.

Contacting the IRS or your local state tax office can also provide clarification on any questions regarding the W-9 form. Many users find webinars and live support helpful in navigating more complex scenarios.

Related topics

Understanding various tax identification requirements is critical when handling forms like the W-9. Additionally, as different reporting obligations come into play, such as FATCA reporting, remaining informed is vital.

Interactive tools

pdfFiller offers several interactive tools aimed at simplifying the W-9 form process. Users can easily edit PDFs and utilize the eSigning features through the platform, streamlining the document management experience.

Exploring these tools can enhance the way you handle documents, making it easier to stay compliant with IRS requirements while managing your taxpayer information securely.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find state of nebraska w-9?

How do I make changes in state of nebraska w-9?

Can I edit state of nebraska w-9 on an Android device?

What is state of nebraska w-9?

Who is required to file state of nebraska w-9?

How to fill out state of nebraska w-9?

What is the purpose of state of nebraska w-9?

What information must be reported on state of nebraska w-9?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.