Get the free Lhusd #1 School Tax Credit

Get, Create, Make and Sign lhusd 1 school tax

Editing lhusd 1 school tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out lhusd 1 school tax

How to fill out lhusd 1 school tax

Who needs lhusd 1 school tax?

A Comprehensive Guide to the LHUSD 1 School Tax Form

Overview of the LHUSD 1 school tax form

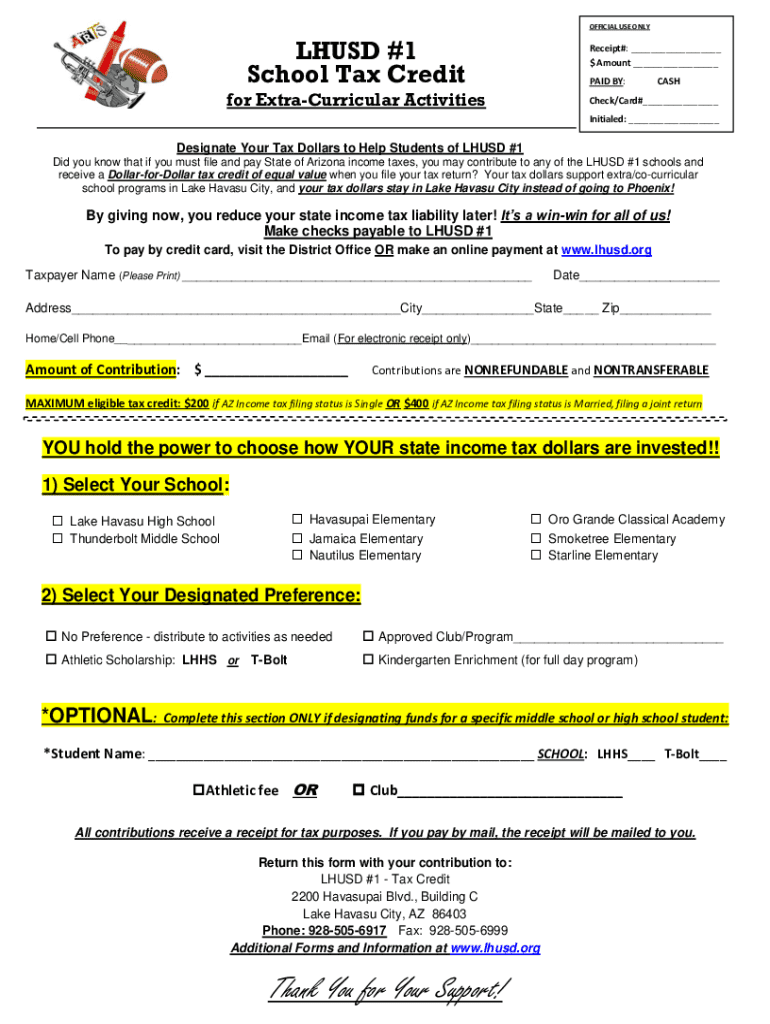

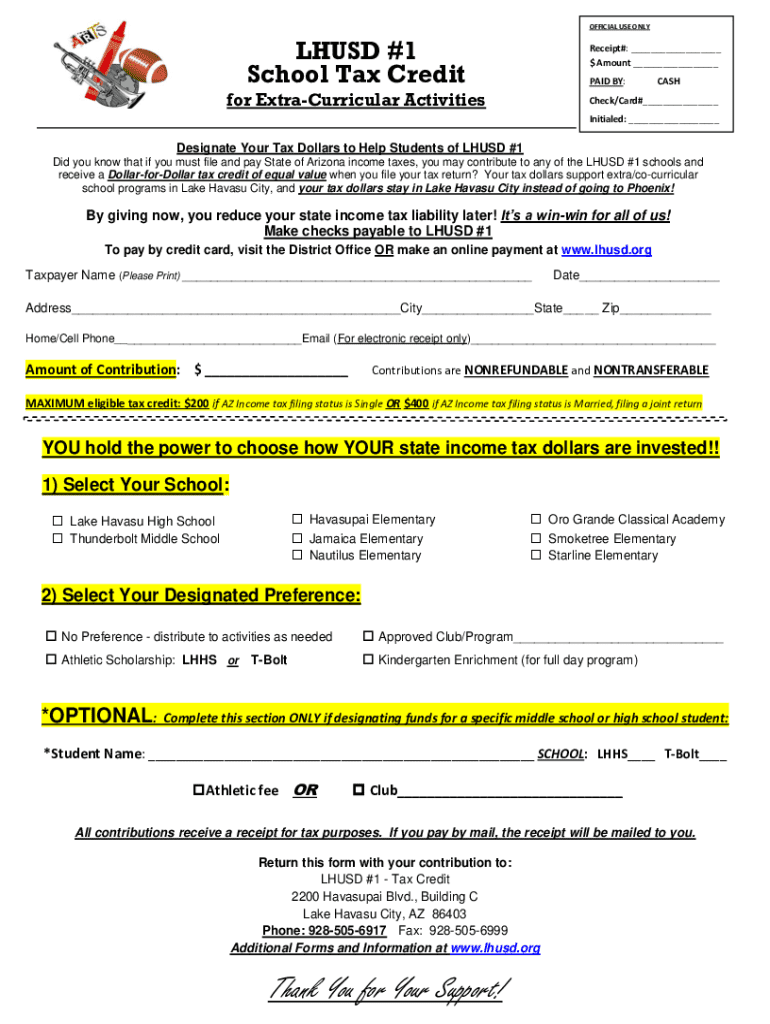

The LHUSD 1 school tax form serves a critical role in the funding of local education initiatives. Designed for residents within the Lake Havasu Unified School District (LHUSD) in Arizona, it ensures that tax revenues support public schools. Understanding this form, its implications, and who it affects can empower taxpayers to make informed decisions.

Essentially, the LHUSD 1 school tax form is used for declaring tax obligations relative to local school district funding. Individuals and families with children in public schools or residences in the district will inevitably need to engage with this document. Failing to submit accurate information can affect not only individual tax responsibilities but also the funding levels for local education.

Accessing the LHUSD 1 school tax form

Locating the LHUSD 1 school tax form is straightforward. Start by visiting the official LHUSD website, where it is typically made available under the financial resources section or tax forms area. This step is crucial to ensure you are accessing the most current version of the form, as tax requirements can change annually.

Alternatively, pdfFiller offers robust tools for filling out and managing tax forms online. By accessing pdfFiller's platform, taxpayers can easily find and fill out the school tax form from the comfort of their home. The platform's user-friendly interface makes it easier for individuals who may be less tech-savvy.

Step-by-step instructions for filling out the form

Filling out the LHUSD 1 school tax form requires careful attention to detail. Start with Section 1, which demands personal information. Be sure to include your full name, address, and contact information. Accurate data entry in this section is crucial because inaccuracies can lead to delays or issues with your submission.

Next, in Section 2, taxpayers must provide tax-related details, including income and applicable deductions. This portion often includes complex calculations, so it’s wise to consult a tax professional if you have questions regarding eligibility or rates. To avoid common mistakes, double-check figures and ensure all necessary fields are completed.

In Section 3, ensure you gather all required supporting documents, such as proof of income or previous tax returns. With pdfFiller, users can easily upload these documents directly along with the form, streamlining the process. Lastly, in Section 4, adding your eSignature not only certifies that the information provided is accurate but also enhances the legality of the submission.

Editing and customizing the LHUSD 1 school tax form

Using pdfFiller's tools allows users to modify the LHUSD 1 school tax form readily. An important feature is the ability to enable form fields, making data entry seamless. This means you can easily click into fields instead of manually writing each section, which can reduce errors significantly.

Collaboration is a strong point of pdfFiller, especially for teams that need to work together on tax forms. Users can invite team members to input data, review entries, or make necessary changes, ensuring everyone has input in a transparent manner. This feature is essential during tax season when multiple stakeholders may need to be involved in the process.

Submitting the LHUSD 1 school tax form

Once the LHUSD 1 school tax form is completely filled out, the next critical step is submission. Depending on district guidelines, forms may be submitted online through the LHUSD website or physically at designated tax offices. Be sure to confirm the correct submission channel to ensure efficient processing.

After submission, keep an eye out for confirmation. This may come in the form of an email or a receipt confirming your submission. It’s also essential to understand the follow-up process in case there are any discrepancies or missing information. If challenges arise, knowing common troubleshooting methods can save time and stress.

FAQs about the LHUSD 1 school tax form

Navigating tax forms can be complicated, and questions often arise regarding the LHUSD 1 school tax form. A common concern is what to do if you make a mistake after submission. If discrepancies are found, it's vital to contact the school district office immediately to rectify any issues. They generally have protocols in place for such occurrences.

Another frequent question is how to track the status of your submission. Many districts provide a tracking system, whether through an online portal or via direct contact with a representative. Additionally, for any other inquiries or support needed, it's important to know who to reach out to, ensuring you have access to necessary resources.

Additional links and resources

Being well-informed is crucial, especially regarding tax issues. The official LHUSD 1 website offers a wealth of resources directly related to tax forms, including quick links to essential information. Moreover, pdfFiller provides access to related forms and documentation that can assist taxpayers throughout the entire process.

Community support is also readily available through forums where individuals can engage with others on similar issues, sharing experiences and solutions. Knowing where to find these resources can significantly ease the process during tax season, allowing for a more efficient and effective approach to form submissions.

Spotlight on pdfFiller features for tax season

pdfFiller stands out during tax season, offering users an all-in-one platform for managing tax documents. The benefits of using pdfFiller include easy editing, seamless eSigning, and document collaboration. These features are invaluable as individuals navigate through the complexities of tax forms like the LHUSD 1 school tax form.

User testimonials affirm the platform's effectiveness, with many users reporting significant time savings and reduced stress levels when preparing and submitting their tax documents. Seamless integration with popular tools makes pdfFiller an essential ally for anyone needing an efficient document creation solution.

Stay connected with LHUSD 1 and pdfFiller

Staying updated on tax information is crucial for timely submissions. Signing up for updates from LHUSD 1 can help keep you informed about necessary changes or deadlines regarding the school tax form.

Engaging openly with the community through various platforms is also encouraged. By participating in social media discussions or forums, taxpayers can share their experiences and challenges, creating a more informed and resilient community.

Resources for individuals and teams working on tax forms

Those working with tax forms benefit greatly from comprehensive guides and resources. pdfFiller offers various documents detailing how to navigate several tax forms, allowing individuals to feel more equipped and less overwhelmed.

Collaboration tips are also crucial for teams, as many individuals must work together to compile tax documents correctly. These insights can help ensure that everyone is on the same page and that deadlines are met efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my lhusd 1 school tax in Gmail?

How can I modify lhusd 1 school tax without leaving Google Drive?

Where do I find lhusd 1 school tax?

What is lhusd 1 school tax?

Who is required to file lhusd 1 school tax?

How to fill out lhusd 1 school tax?

What is the purpose of lhusd 1 school tax?

What information must be reported on lhusd 1 school tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.