Get the free Form 990

Get, Create, Make and Sign form 990

How to edit form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Comprehensive Guide to Form 990 Form

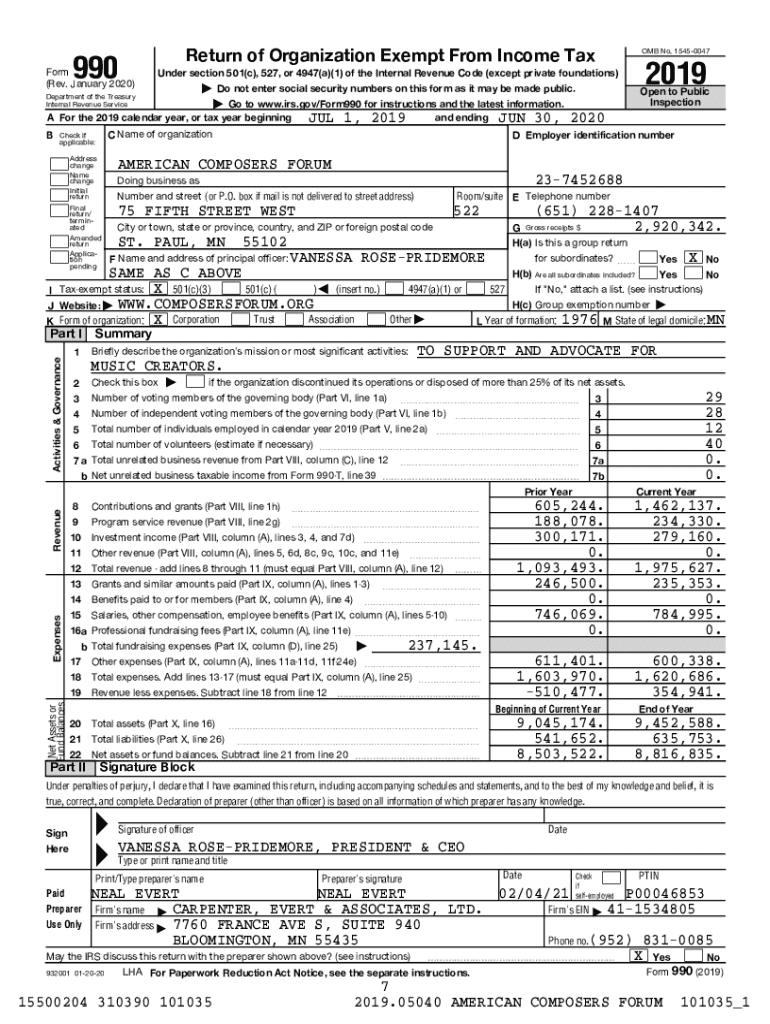

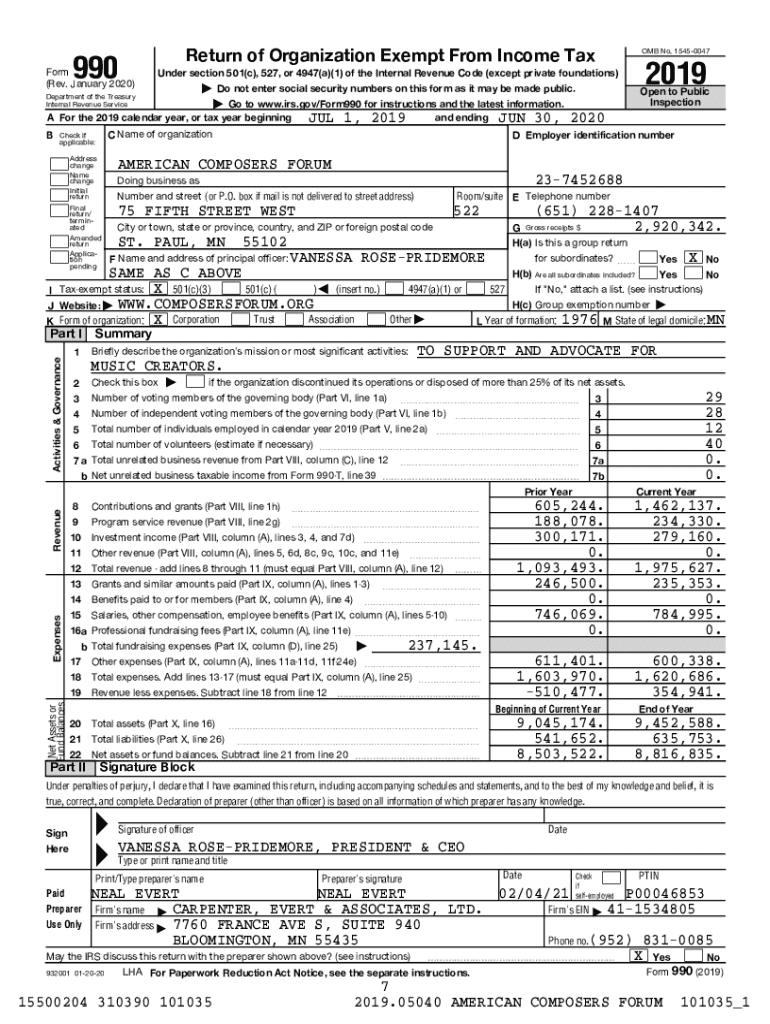

What is Form 990?

Form 990 is a critical document required by the Internal Revenue Service (IRS) from many tax-exempt organizations and nonprofits. This form serves multiple purposes, including providing transparency regarding public charities and ensuring accountability by detailing various financial aspects and operational insights of the organization. The importance of Form 990 cannot be overstated; it is essentially the financial pulse of the nonprofit sector, offering essential information to donors, regulators, and the public.

Who must file Form 990?

Any tax-exempt organization under section 501(c)(3) of the Internal Revenue Code must file Form 990 if their gross receipts exceed $200,000 or total assets exceed $500,000. However, certain types of organizations like churches and their integrated auxiliaries are exempt from filing this form. Small organizations with gross receipts of less than $50,000 can file a shorter version, Form 990-N (e-Postcard). Understanding who needs to file is vital for compliance.

Breakdown of Form 990 sections

Form 990 is segmented into several parts, each serving a specific purpose. By understanding these sections, organizations can provide comprehensive and accurate information leading to a transparent representation of their fiscal activities.

Essential financial statements included in Form 990

Form 990 requires organizations to furnish several key financial statements. These documents provide a transparent view of how the organization manages its funds, which is critical for building trust with stakeholders.

How to fill out Form 990

Filling out Form 990 requires careful organization and attention to detail. Begin by gathering financial records, program descriptions, and previous filings. Use the guidelines provided in the IRS instructions for Form 990 to navigate each section effectively.

Common errors to avoid

Filling out Form 990 comes with its pitfalls. Organizations must be meticulous to avoid inaccuracies, which can lead to penalties or loss of tax-exempt status.

Filing modalities

Organizations have options when submitting Form 990. They can choose between electronic and paper filing. Electronic filing is generally more efficient and allows for quicker processing by the IRS.

Public inspection regulations

Once Form 990 is filed, it must be made available for public inspection. This transparency is crucial for donor confidence and organizational credibility.

How to manage and store your Form 990

Proper management and storage of Form 990 are crucial for ongoing compliance and operational needs. Keeping digital and physical copies organized can save time during audits or inquiries.

Accessing and downloading the Form 990

The latest version of Form 990 can be found directly on the IRS website. It's important to utilize the most current version to avoid compliance issues.

Interactive tools for easier completion

pdfFiller offers a suite of interactive tools designed to simplify the completion of Form 990. These features streamline the process of filling, editing, and signing the document.

Understanding filing requirements and penalties

Noncompliance concerning Form 990 can result in significant penalties. Organizations should be fully aware of the filing requirements and the potential consequences of failing to adhere to them.

The role of Form 990 in charitable evaluation research

Data provided in Form 990 is invaluable for assessing the effectiveness of nonprofits. Researchers, potential donors, and regulatory bodies utilize this data to evaluate where funds are directed and the impact achieved.

Frequently asked questions about Form 990

Many organizations have questions regarding Form 990, and it's beneficial to seek clear answers to these queries. Common inquiries often revolve around filing deadlines, eligibility for exemptions, and troubleshooting errors.

Case studies and examples of Form 990 utilization

Several organizations have effectively used Form 990 to enhance transparency and broaden their donor base. For instance, nonprofits that detail their impact and financial stewardship in Form 990 filings often find greater success in fundraising efforts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form 990?

How do I fill out form 990 using my mobile device?

How do I fill out form 990 on an Android device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.