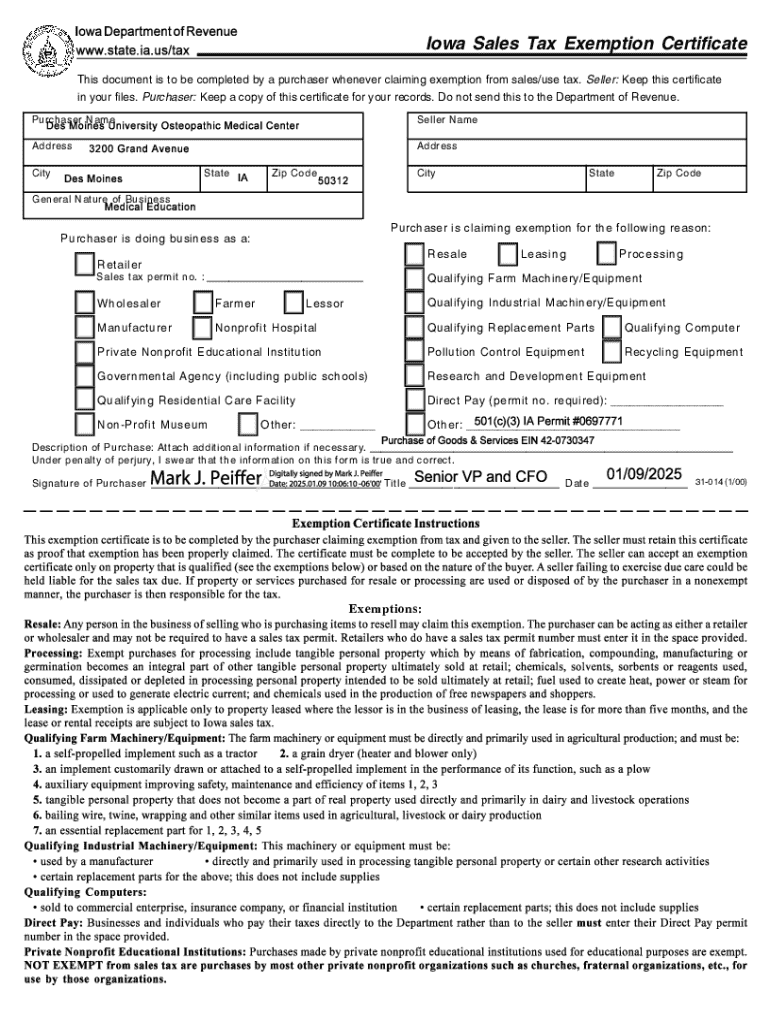

Get the free Iowa Sales Tax Exemption Certificate

Get, Create, Make and Sign iowa sales tax exemption

Editing iowa sales tax exemption online

Uncompromising security for your PDF editing and eSignature needs

How to fill out iowa sales tax exemption

How to fill out iowa sales tax exemption

Who needs iowa sales tax exemption?

Everything You Need to Know About the Iowa Sales Tax Exemption Form

Understanding the Iowa sales tax exemption form

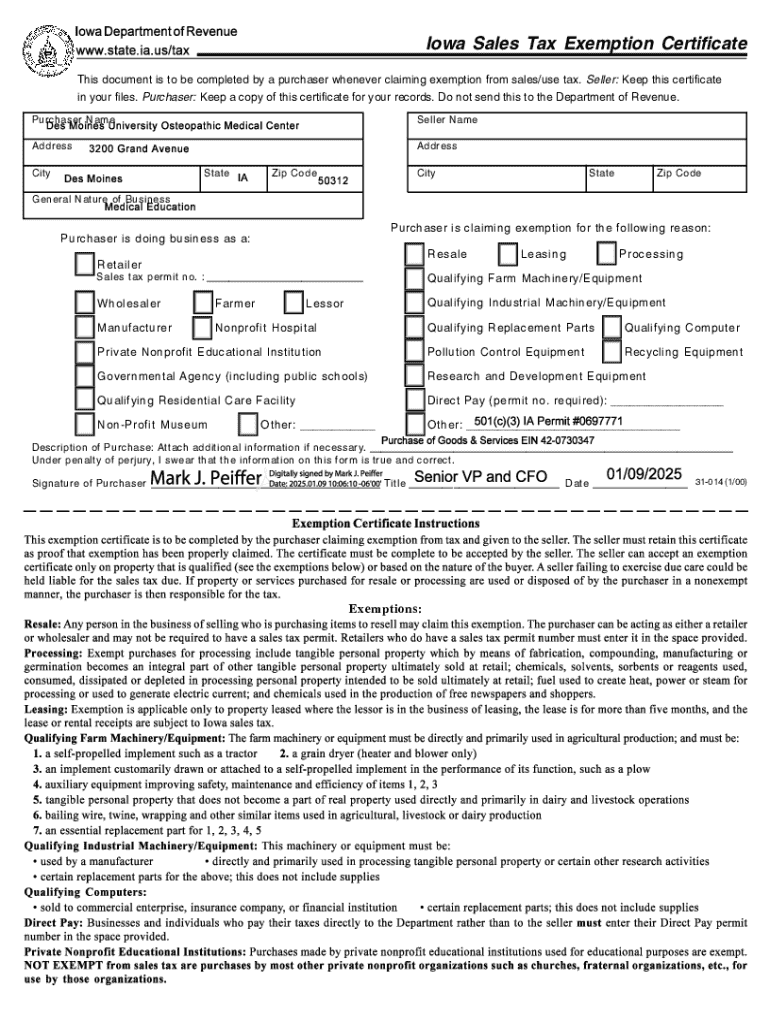

Sales tax in Iowa applies to most goods and services sold in the state. The standard state sales tax rate is 6%, but local jurisdictions may impose additional taxes, leading to varied rates across regions. For certain individuals and organizations, however, the Iowa sales tax exemption form is a crucial document that allows them to make purchases without incurring this tax.

The Iowa sales tax exemption form serves a vital purpose by enabling eligible entities to claim exemptions on their purchases. It is particularly important for nonprofit organizations, educational institutions, and governmental bodies, as it helps them manage costs effectively. This form is not only beneficial but essential for ensuring compliance with Iowa's tax regulations.

Anyone who believes they qualify for a sales tax exemption in Iowa should familiarize themselves with the specific criteria and procedures for filling out the form. This includes various organizations, government agencies, and businesses that meet the eligibility requirements.

Eligibility for sales tax exemption

Eligibility for using the Iowa sales tax exemption form is determined based on specific criteria that apply to various individuals and organizations. In general, those considered eligible may include nonprofit and charitable organizations, government entities, certain businesses, and educational institutions.

Situations that qualify for exemption can vary, but generally include purchases of tangible personal property and services that directly support the exempt functions of the organization. Common exemptions might include items necessary for educational purposes, equipment used by non-profits, or supplies purchased by government agencies.

Detailed steps to complete the Iowa sales tax exemption form

Completing the Iowa sales tax exemption form involves several detailed steps, ensuring that the correct and necessary information is provided to both avoid delays and fulfill the requirements accurately.

Step 1: Gathering necessary information

Before filling out the form, collect all required information. This includes your organization’s name, address, tax ID number, and details about your qualifying purchases. Ensure you have any relevant documentation that may support your claim. For example, a nonprofit verification letter or proof of governmental status may enhance the validity of your submission.

Step 2: Completing the form

Fill out the form by providing accurate data. Pay attention to each section as it clarifies the type of exemption being claimed. Remember to check for common mistakes, such as misentering the organization’s tax ID or leaving sections blank.

Step 3: Reviewing your form

After completing the form, it’s crucial to review it for accuracy and completeness. Prepare a checklist based on the required fields of the form to ensure that no vital information is missing.

Step 4: Submitting your form

There are various accepted methods for submission, including faxing, mailing, or submitting online via platforms like pdfFiller. Consult specific guidelines to determine the best method for your situation, and note the timeline for processing exemptions, which may vary.

Frequently asked questions (FAQs)

Understanding common questions surrounding the Iowa sales tax exemption form can ease concerns and clarify the process further.

Interactive tools and resources

Utilizing digital solutions can streamline your experience with the Iowa sales tax exemption form. Platforms like pdfFiller offer powerful features.

Accessing the online form through pdfFiller

You can easily find and fill out the Iowa sales tax exemption form directly on pdfFiller. The site provides a user-friendly interface for completing documents seamlessly.

Tools for collaboration: sharing your form

Collaboration tools on pdfFiller allow you to share forms easily with your team or other stakeholders, facilitating collective input and review.

Utilizing pdfFiller's cloud-based features

pdfFiller's cloud-based features enable users to manage documents from anywhere, providing you with flexibility when dealing with the Iowa sales tax exemption form and other necessary paperwork.

Alternatives to the Iowa sales tax exemption form

While the Iowa sales tax exemption form is the primary document for claiming tax exemptions, there are alternative forms and documentation used for specific situations and sectors. Understanding these alternatives can facilitate compliance with Iowa tax laws.

Other forms used in Iowa for sales tax purposes

There are varying forms depending on the type of exemption or documentation needed, such as forms related to agricultural exemptions or manufacturer’s tax exemptions. Knowing which form to use prevents delays and confusion regarding tax compliance.

Common forms and documents related to sales tax

Familiarizing yourself with frequently used tax forms in Iowa can help ensure all necessary documentation is accounted for. This includes letters of exemption, resale certificates, or other relevant forms.

Links to download related forms directly from pdfFiller

pdfFiller provides easy access to download various related forms directly from their platform, allowing you to stay organized and compliant effortlessly.

Contact support & assistance

When dealing with the Iowa sales tax exemption form, having access to support can be beneficial. pdfFiller offers dedicated assistance related to Iowa forms to ensure users have the help they need.

How pdfFiller can help

pdfFiller equips users with necessary tools and assistance, simplifying the document management process when filling out the Iowa sales tax exemption form.

Contact information for assistance

For assistance, pdfFiller provides multiple ways to reach their support team including email, phone, and live chat options, ensuring help is accessible.

Legal considerations and compliance

Navigating tax exemptions in Iowa requires an understanding of the relevant tax laws. Mismanaging your exemption claims can lead to serious consequences, including penalties for improperly filing or claiming an exemption incorrectly.

Organizations must be diligent to avoid these issues, ensuring they are compliant with current Iowa tax regulations. Regular training and updates on tax laws can mitigate the risk of non-compliance.

News & updates

Staying informed of recent changes in Iowa's sales tax legislation is crucial as these developments can affect the exemption process. Regular review of tax guidelines can help your organization maintain compliance.

Keep an eye on local government announcements or updates from tax advisory services for information on how proposed changes could influence existing tax exemption practices.

Footer section for additional information

To further assist with navigating document management, pdfFiller offers links to related articles and templates relevant to the Iowa sales tax exemption form, supporting users in their documentation journey.

Moreover, follow pdfFiller on social media for timely updates and additional resources concerning tax forms and document management.

Getting started with document management using pdfFiller

pdfFiller provides a comprehensive guide to document creation and management. Utilize their platform to enhance your workflow, ensuring you complete tasks efficiently and effectively.

Whether you are preparing the Iowa sales tax exemption form or other necessary documentation, pdfFiller empowers users to streamline the entire process, all from a single, cloud-based platform.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my iowa sales tax exemption in Gmail?

How do I make changes in iowa sales tax exemption?

Can I edit iowa sales tax exemption on an Android device?

What is iowa sales tax exemption?

Who is required to file iowa sales tax exemption?

How to fill out iowa sales tax exemption?

What is the purpose of iowa sales tax exemption?

What information must be reported on iowa sales tax exemption?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.