Get the free Form No. 60

Get, Create, Make and Sign form no 60

How to edit form no 60 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form no 60

How to fill out form no 60

Who needs form no 60?

Understanding Form No 60: Your Comprehensive Guide

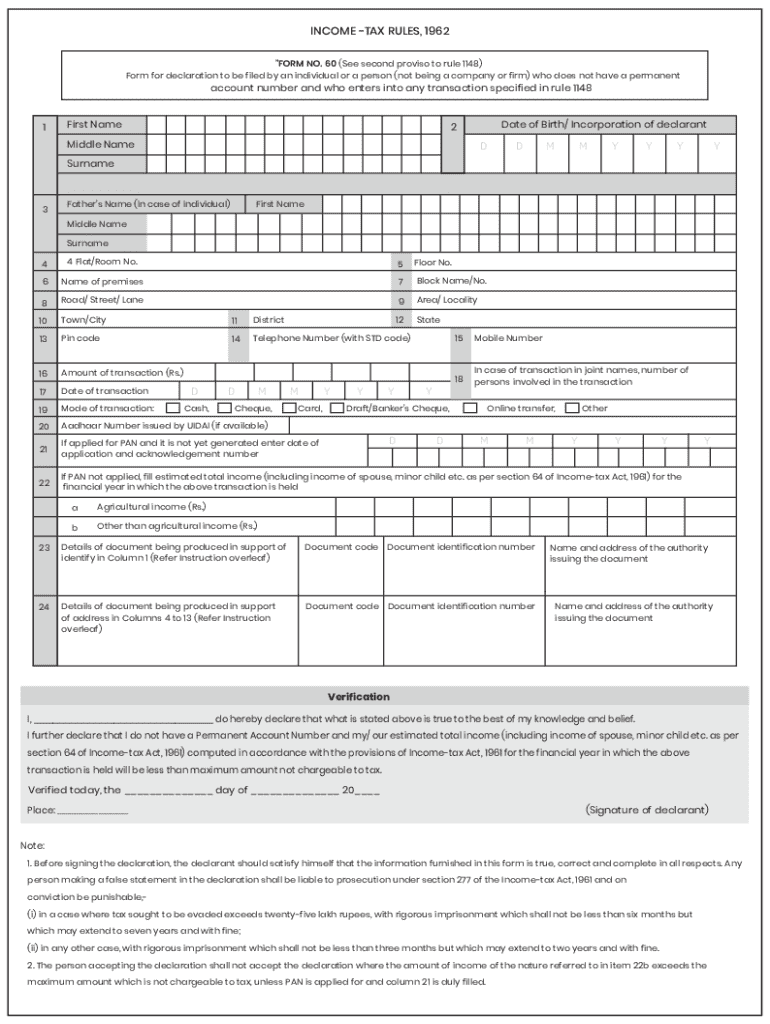

Understanding Form No 60

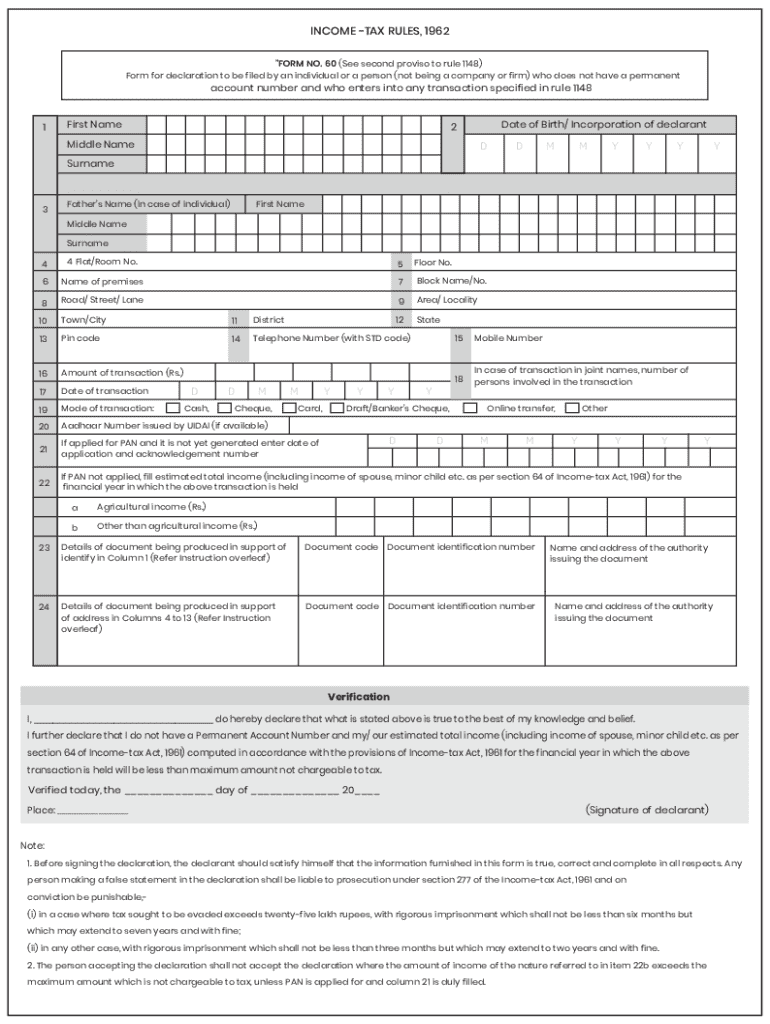

Form No 60 serves a critical function in the realm of finance, particularly within the Indian context. It is a declaration form that is used by individuals who do not possess a Permanent Account Number (PAN) but need to engage in financial transactions that require PAN compliance. As a key document, Form No 60 ensures that individuals can still participate in various monetary activities without facing obstacles due to a lack of a PAN.

The significance of Form No 60 lies in its ability to uphold financial transparency while allowing individuals to perform necessary transactions. It is particularly important for people who may not have a PAN due to various reasons, such as being a non-filer, tax non-residents, or those who are new to economic activities like investing or purchasing real estate.

Key features of Form No 60

Understanding the key features of Form No 60 is essential to ensure proper usage and compliance. The form primarily requires certain mandatory information, such as the details of the transaction being conducted, the declarant's personal information, and their signature. This information is vital for maintaining transparency in financial dealings and assists authorities in tracking potential tax evasion.

In addition to mandatory fields, Form No 60 includes optional sections where users can provide additional details that may support their declarations. This could enhance the legitimacy of their financial activities. Common scenarios for using Form No 60 include significant cash transactions exceeding prescribed limits, property purchases without a PAN, and transactions involving foreign direct investments.

Step-by-step instructions for filling out Form No 60

Filling out Form No 60 accurately is imperative for ensuring transaction compliance. Here’s a step-by-step guide to help you complete the form properly.

Editing and modifying Form No 60

The flexibility to edit and modify Form No 60 can greatly enhance user experience, particularly when utilizing platforms such as pdfFiller. Accessing and filling out Form No 60 online simplifies the process, allowing users to input their details efficiently without the hassle of printed paperwork.

Using pdfFiller’s tools, users can take advantage of various features for easy editing. For example, users can adjust the text in the form directly, adding or removing any necessary details as needed. The signature tools allow for electronic signing, making the submission process even more seamless. Additionally, if revisions are necessary, users can easily modify existing entries without starting from scratch, saving time and effort.

Submitting Form No 60

Once Form No 60 is completed, the next step is submission. There are two primary methods of submission, and understanding them can streamline the process.

Tracking the status of your Form No 60 submission

Monitoring the status of your Form No 60 submission is essential to ensure that your financial transactions progress without trouble. Utilizing pdfFiller, users can easily track their submission status through the dashboard.

Key indicators of successful acceptance include confirmation receipts or notifications from the authorities. In instances where there are issues, you may receive alerts requiring additional information or corrections. If needed, contacting the relevant tax authorities can often provide clarity on any outstanding issues.

Managing and storing Form No 60 documentation

After submitting Form No 60, it's prudent to manage and store the documentation efficiently. Using pdfFiller's electronic document management system allows for secure, organized storage of your forms.

Taking advantage of cloud storage solutions simplifies the accessibility of your forms from anywhere at any time. Security is paramount, so employing encryption and secure access controls can help protect your sensitive information from unauthorized access.

Frequently asked questions about Form No 60

Form No 60 can sometimes raise questions among users regarding its eligibility and usage. Addressing common queries can provide clarity and help streamline the process.

Best practices for using Form No 60 effectively

For effective usage of Form No 60, maintaining accurate information is crucial. This includes keeping records of all transactions that necessitate the form and ensuring that data shared is correct and up-to-date.

Compliance with regulations regarding Form No 60 will help avoid potential legal complications. Leveraging tools available through pdfFiller for continuous document management can enhance organization and retention of records, leading to a more streamlined financial process.

Success stories: Real-world applications of Form No 60

Many individuals and organizations have found success through proper usage of Form No 60. Testimonials highlight how easy submission processes facilitated by pdfFiller lead to timely approvals in transactions.

Case studies reveal that accurate form submission significantly impacts the speed and success of financial transactions, encouraging others to adopt similar practices. The clarity offered by online platforms ensures that users can navigate their needs with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form no 60 directly from Gmail?

How do I execute form no 60 online?

Can I sign the form no 60 electronically in Chrome?

What is form no 60?

Who is required to file form no 60?

How to fill out form no 60?

What is the purpose of form no 60?

What information must be reported on form no 60?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.