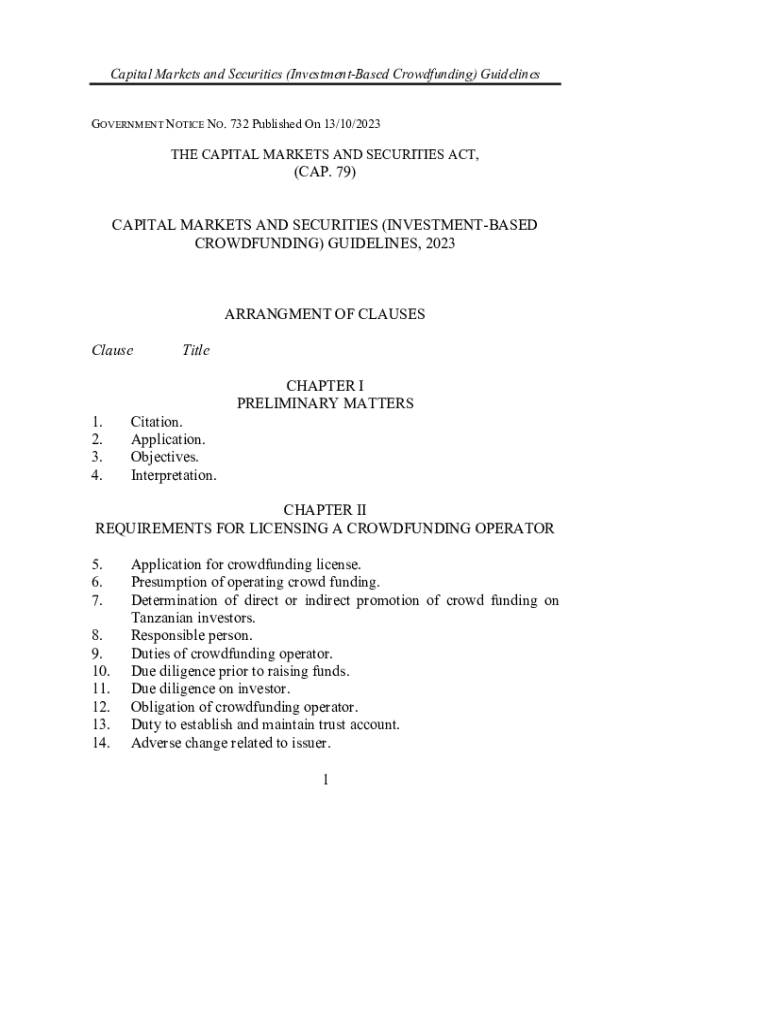

Get the free Capital Markets and Securities (investment-based Crowdfunding) Guidelines

Get, Create, Make and Sign capital markets and securities

How to edit capital markets and securities online

Uncompromising security for your PDF editing and eSignature needs

How to fill out capital markets and securities

How to fill out capital markets and securities

Who needs capital markets and securities?

Capital markets and securities forms: A comprehensive guide

Understanding capital markets and securities forms

Capital markets serve as a vital framework within which individuals and institutions can buy and sell financial instruments. This marketplace directly influences economic growth by allowing businesses to access funding for expansion projects, while enabling investors to put their money to work in various ventures. The interplay between supply and demand in capital markets determines asset prices, influencing everything from interest rates to investment strategies.

Securities, on the other hand, are the instruments that represent ownership or a creditor relationship with entities. Understanding the different types—such as stocks, bonds, and derivatives—is crucial for navigating capital markets. Each type of security has its unique risk-return profile and plays distinct roles, such as raising capital or protecting value.

Key components of capital markets and securities forms

Forms play a crucial role in capital markets, facilitating various processes involved in securities transactions. There are several types of forms used, including registration forms that ensure compliance with laws, transaction forms that document the specifics of trades, and compliance forms needed for auditing and regulatory purposes. Each form must be carefully filled out to ensure accuracy and compliance.

Moreover, essential information is typically required when completing these forms. Personal identification details, such as name and address, financial information such as income and investment history, and transaction-specific details such as the number of shares or bond denominations must be collected to ensure compliance and accuracy.

How to fill out capital markets and securities forms

Filling out capital markets and securities forms accurately is crucial to avoid delays and complications. General guidelines emphasize the importance of being thorough and precise, as errors or omissions can lead to significant issues down the line. Common pitfalls include incorrect personal details, formatting mistakes, and overlooking required signatures.

Editing and managing your capital markets and securities forms

Editing and managing forms efficiently is vital for maintaining accurate records. Utilizing pdfFiller can significantly enhance this experience, offering users tools to make real-time adjustments to their documents. Features such as drag-and-drop editing and field highlighting simplify the process, allowing users to focus on data quality.

eSigning and collaborating on forms

The importance of eSigning in securities transactions cannot be overstated, as electronic signatures are legally valid in many jurisdictions. The shift towards digital signatures has been propelled by the demand for efficiency and accuracy in capital markets transactions. Electronic signatures streamline the signing process and significantly reduce turnaround time.

pdfFiller provides effective collaborative tools, allowing users to share documents with stakeholders effortlessly. With features that enable real-time collaboration, multiple parties can work together to complete forms, ensuring that all inputs are correctly represented.

Compliance and regulatory considerations

Navigating the regulatory landscape is paramount when dealing with capital markets and securities. Understanding the regulations that govern these markets, such as those set forth by entities like the SEC and FINRA, helps in realizing compliance requirements. Accurate form submission plays a significant role in compliance, as inaccuracies can lead to penalties and reputational damage.

Interactive tools and resources

Interactive tools such as calculators and estimators can significantly enhance the process of securities transactions. These tools allow users to perform calculations related to investment returns, tax implications, and transaction costs, thereby making informed decisions before submitting their forms. They add a layer of complexity that can simplify the submission process.

In addition, an FAQ section addressing common queries about securities forms can provide immense value. Common questions range from understanding specific terms to compliance-related ambiguities. Providing clear answers not only enhances user understanding but also fosters confidence in navigating the capital markets.

Case studies and real-life applications

Examining case studies of successful transactions can yield valuable insights into the operational workings of capital markets. By analyzing completed forms, users can identify best practices and spot areas for potential improvement. Learning from both successful and failed attempts provides a wealth of knowledge for individuals and teams alike.

Leveraging pdfFiller for a streamlined document experience

Choosing pdfFiller for managing capital markets forms offers distinct advantages over traditional document handling methods. With its cloud-based platform, users benefit from an organized and accessible approach to document creation and management, enabling them to work more efficiently.

Customer testimonials illustrate the positive impact pdfFiller has on streamlining processes, with users highlighting ease of use and time savings. The clarity of its interface and the breadth of its tools empower users to manage their capital markets transactions confidently.

Frequently encountered challenges and solutions

Common issues when filling out capital markets forms often stem from unfamiliarity with terms or format requirements. Terms specific to securities may confuse users, leading to inaccuracies in submission. Recognizing these challenges is the first step towards overcoming them.

pdfFiller addresses these issues effectively with smart suggestions and on-screen guidance, helping users navigate through complexities. The platform's user-friendly design significantly diminishes the barriers associated with traditional forms, enabling individuals to feel more confident while engaging in capital markets.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit capital markets and securities online?

How do I complete capital markets and securities on an iOS device?

How do I edit capital markets and securities on an Android device?

What is capital markets and securities?

Who is required to file capital markets and securities?

How to fill out capital markets and securities?

What is the purpose of capital markets and securities?

What information must be reported on capital markets and securities?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.