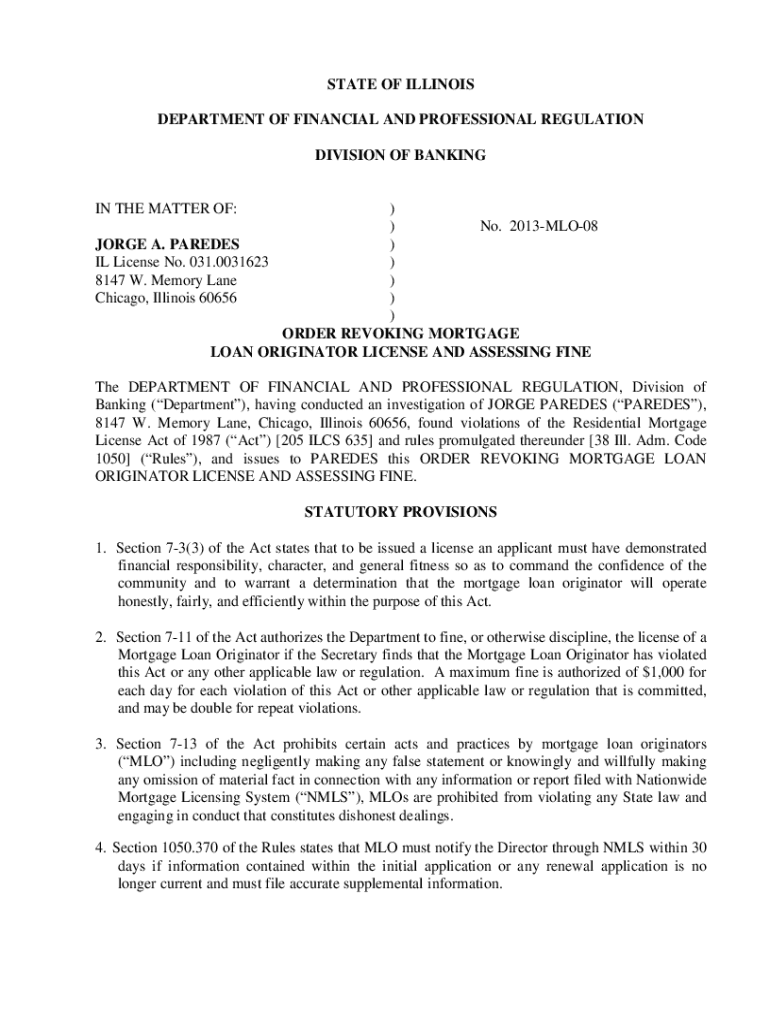

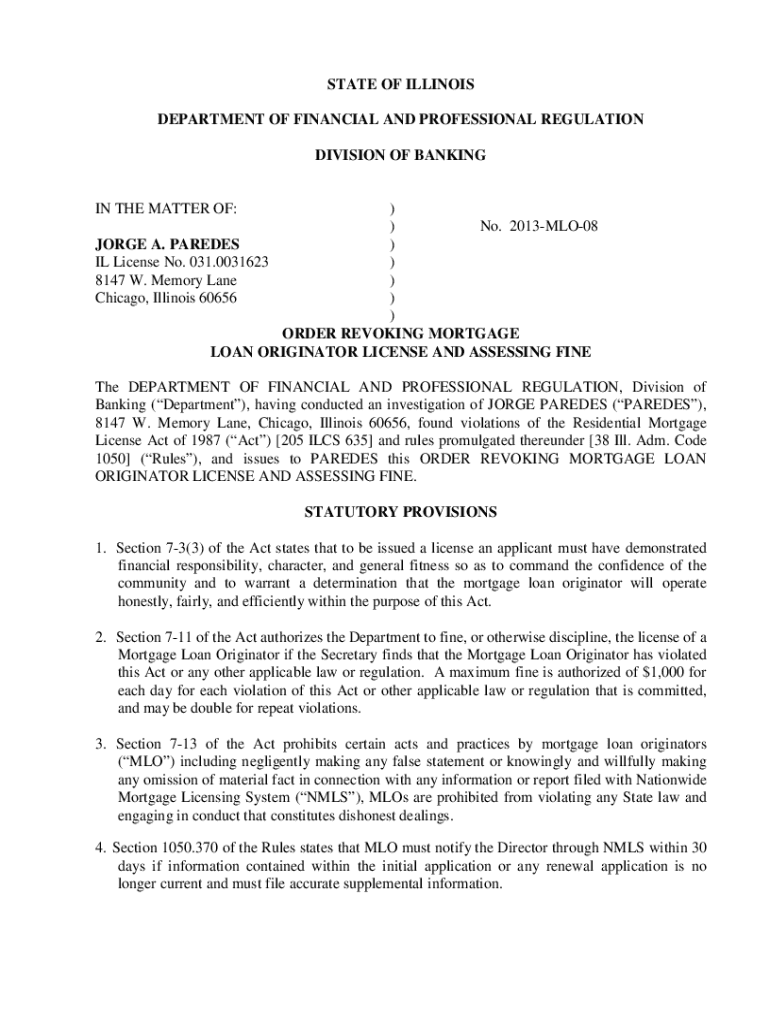

Get the free Order Revoking Mortgage Loan Originator License and Assessing Fine

Get, Create, Make and Sign order revoking mortgage loan

How to edit order revoking mortgage loan online

Uncompromising security for your PDF editing and eSignature needs

How to fill out order revoking mortgage loan

How to fill out order revoking mortgage loan

Who needs order revoking mortgage loan?

Comprehensive Guide to Order Revoking Mortgage Loan Form

Understanding the need to revoke a mortgage loan

A mortgage loan revocation is the legal process through which a borrower can cancel their mortgage agreement. This process is crucial for borrowers who realize that the mortgage may not be the best fit for their circumstances after all. There are several common reasons for revoking a mortgage, including financial changes, unfavorable loan terms, or a desire to consolidate or refinance existing debts.

The right of rescission explained

The right of rescission is a critical consumer protection offered under federal law, allowing borrowers a three-day window to cancel a mortgage loan after closing. This right is particularly important as it provides a safety net for unforeseen circumstances or buyer's remorse. Understanding the applicable timeframes is essential since federal regulations offer a standardized period, while individual state laws may vary.

Key steps to order a revoking mortgage loan form

Revoking a mortgage involves a series of important steps that every borrower must follow to ensure a smooth process. The first step is to determine eligibility, which includes reviewing the specific conditions that might warrant revocation, such as timing and the nature of the mortgage.

Once eligibility is established, the next step is to gather all required information. This information typically includes personal identification, mortgage details like the loan number, and supporting documentation that may be needed during the process.

Obtaining the revoking mortgage loan form

Finding the correct revoking mortgage loan form is essential for initiating the revocation process. Borrowers can access these forms through several channels, including official government websites or mortgage lender platforms. pdfFiller provides an excellent resource for obtaining the necessary documentation, ensuring you have instant and direct access.

It's worthwhile to note that different lenders or states may have unique variations of the revocation form. Therefore, understanding the specifics based on your lender's requirements is crucial.

Detailed instructions for filling out the form

Once you have obtained the revoking mortgage loan form, the next step is to complete it correctly. Properly filling out the form is essential to avoid delays or denials. The form typically consists of several sections, including personal information, specifics about the mortgage, and the reason for revocation.

It's also crucial to take special care during this step. Common mistakes can easily occur, especially with personal details or missing documentation. Utilizing pdfFiller’s interactive tools can help streamline the completion process, ensuring accuracy and ease.

Reviewing the form before submission

Before submitting the revoking mortgage loan form, thorough review is imperative. An overlooked error can lead to significant delays or miscommunications. It’s advisable to verify all entered information matches your records and to ensure that all required documentation is included.

Submitting the revoking mortgage loan form

With the form thoroughly reviewed, it’s time to submit it to the lender. There are various methods for submission, including online and traditional mailing options. Each method comes with its pros and cons, so consider which works best for your situation.

After submission, keeping track of your request becomes crucial. Many lenders offer tracking options so you can confirm that your submission was received.

What happens after submission?

After you submit the revoking mortgage loan form, understanding the timeline and next steps is crucial. Typically, lenders will process the request and notify you regarding the decision — whether your revocation has been approved or denied. This period can vary significantly based on lender protocols.

If approved, the lender will provide confirmation, and you will be relieved from the obligations of the original mortgage. If the request is denied, the lender should provide a rationale for the decision, enabling you to take further action if necessary.

Frequently asked questions

Many borrowers have questions regarding mortgage loan revocations. For instance, can one change their mind after signing the loan closing documents? Understanding your rights in this regard is important as many states provide options for loan rescission, making it a topic worth discussing with your lender.

Additionally, if a request to revoke the mortgage is denied, it’s beneficial to know the options available. There may be specific requirements for revocation that were not met. Commonly asked questions can guide borrowers on their journey.

Troubleshooting common issues

Occasionally, borrowers may experience delays in processing their revocation request or run into issues with the paperwork. Proactive measures can be beneficial, such as maintaining frequent communication with the lender and staying organized with documents.

If you encounter problems like lost submissions or disputes about the details, knowing the contact information for support from the lender can provide clarity and resolution.

Additional considerations and legal disclaimers

Before proceeding with a mortgage loan revocation, it's prudent to seek legal advice to fully understand your rights and obligations. The process can be complicated, and having guidance from an expert can help prevent pitfalls that may arise.

Disclaimers related to the mortgage revocation processes should be noted, as every situation is unique and dependent on individual circumstances and lender criteria.

Explore related topics

Understanding the facets of mortgage loans extends beyond revocation. Borrowers might benefit from exploring related topics such as refinancing options or loan modifications. Keeping informed on these subjects can empower borrowers to make educated decisions about their financial future.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete order revoking mortgage loan online?

How do I make edits in order revoking mortgage loan without leaving Chrome?

Can I create an electronic signature for signing my order revoking mortgage loan in Gmail?

What is order revoking mortgage loan?

Who is required to file order revoking mortgage loan?

How to fill out order revoking mortgage loan?

What is the purpose of order revoking mortgage loan?

What information must be reported on order revoking mortgage loan?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.