Get the free Ach Authorization Form

Get, Create, Make and Sign ach authorization form

How to edit ach authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ach authorization form

How to fill out ach authorization form

Who needs ach authorization form?

ACH Authorization Form: A Comprehensive How-To Guide

Understanding the ACH Authorization Form

An ACH authorization form is a crucial document that allows individuals or businesses to permit their bank to transfer funds electronically. This transfer occurs through the Automated Clearing House (ACH) network, which facilitates electronic payments and direct deposits securely and efficiently. Without the proper authorization from account holders, banks cannot execute these transactions, ensuring protection against unauthorized charges.

ACH authorizations are essential in various financial landscapes, including payroll systems, vendor payments, and consumer transactions. By providing this authorization, businesses can seamlessly move money, thereby streamlining operations and reducing the time and resources spent on manual checks.

Types of ACH Authorization Formats

ACH authorization forms come in various formats, allowing flexibility depending on the needs of the user and the organization involved.

Electronic authorization forms

Electronic formats enable a speedy and efficient process, often utilizing online services or banking apps. These are particularly beneficial due to their ease of use and lower environmental impact. Users can complete and submit these forms from any device, streamlining the payment process.

Paper authorization forms

Traditional paper forms are also widely used for ACH authorizations, especially in settings where digital signatures aren't practical. These forms can be obtained directly from financial institutions or through online downloads. When utilizing paper authorization forms, ensuring secure handling and timely submissions is paramount to avoid processing delays.

Verbal authorizations

Verbal authorizations carry legal weight in certain situations, primarily when established trust exists between parties, such as long-standing clients. However, documenting these approvals is vital to prevent misunderstandings. Proper notes should be taken during the conversation and saved in a secure location for future reference.

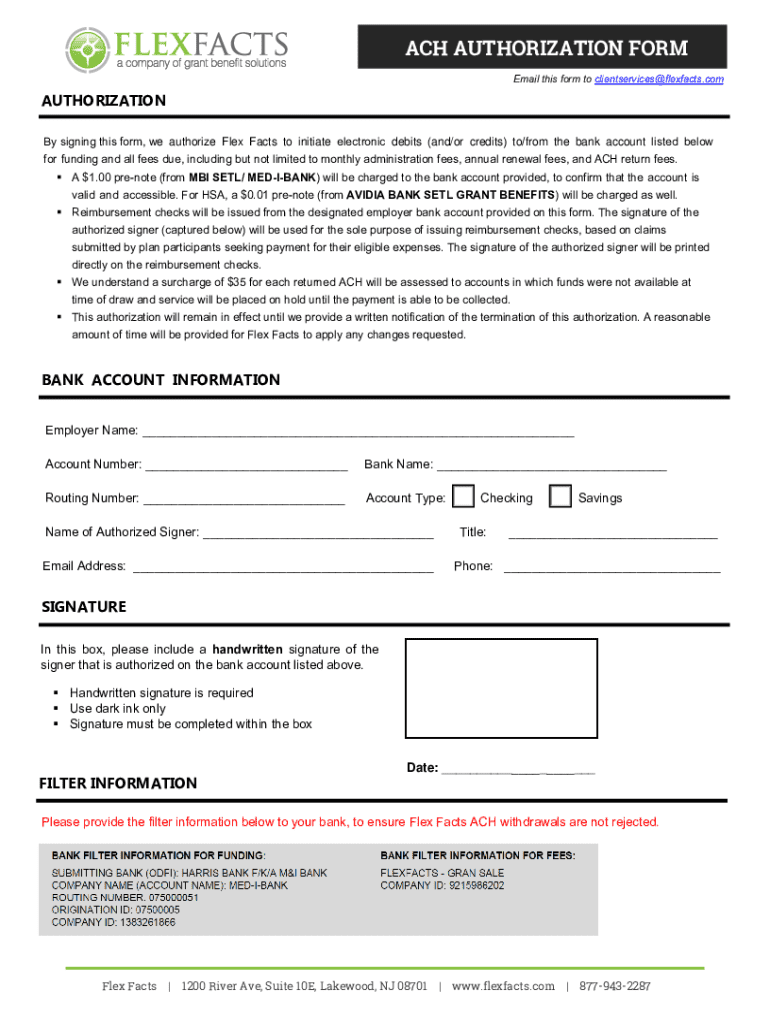

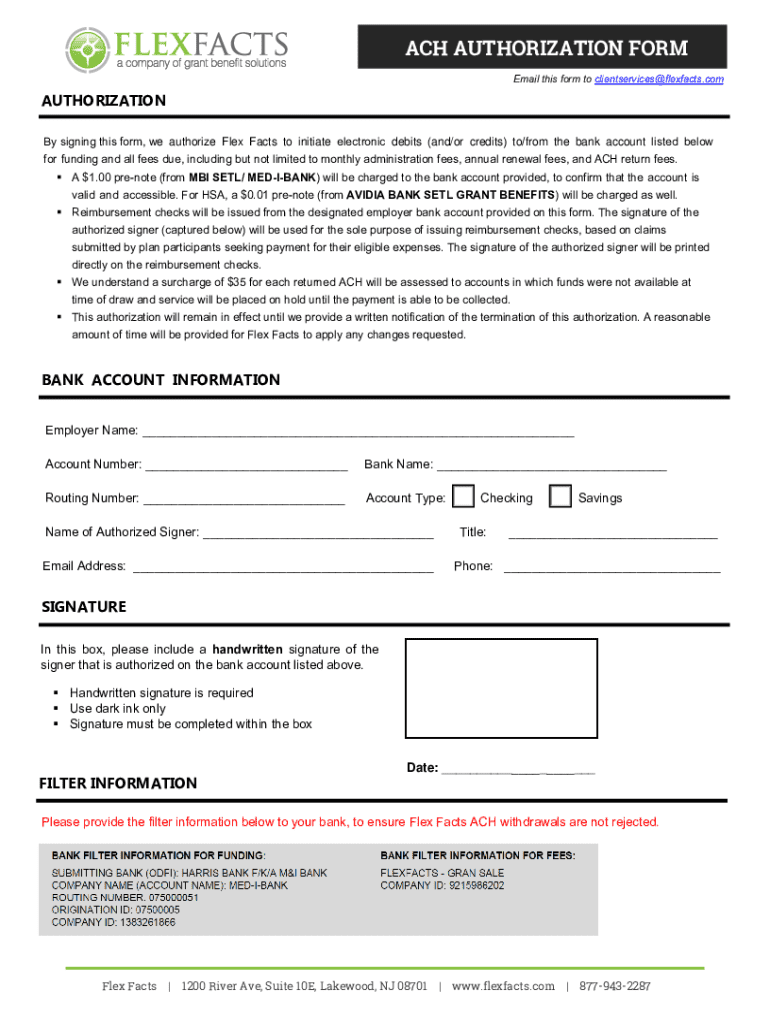

Key components of an ACH authorization form

An effective ACH authorization form must contain specific essential components to ensure compliance and facilitate smooth transactions.

Account holder details

This must include the account holder's name, contact information, and possibly their address. Accuracy is crucial; any discrepancies can lead to processing issues and unauthorized transactions.

Bank account details

Complete banking information, including the bank name, account number, and routing number, must be accurately provided. Double-checking these details is essential, as errors can delay processing or result in funds being transferred incorrectly.

Transaction details

This section should specify the amount to be debited or credited, as well as the frequency of the transactions, whether they are one-time, recurring weekly, or monthly. Clarity here ensures that both parties align their financial expectations.

Authorization statement

A clear statement confirming the authorization allows you to comply with NACHA regulations and best practices. It should explicitly state the authorization’s intention to process ACH transactions.

Signature and date of consent

The account holder's signature is necessary to validate the form. It's also essential to date the authorization; this helps in tracking and managing transactions.

Optional fields

Certain optional fields can enhance the form's utility, such as specifying the purpose of the transaction or including additional contact methods. While these fields aren't mandatory, they can provide insight that facilitates communication.

How to complete an ACH authorization form

Filling out an ACH authorization form is straightforward, yet attention to detail is paramount to avoid potential errors.

Avoid common mistakes such as missing signatures or incorrect routing numbers, which can lead to delays or failures in transaction processing. Taking the time to double-check your entry can save significant hassle down the road.

Additionally, using a platform like pdfFiller allows for efficient completion, as it offers editable templates and guidance throughout the process, minimizing the risk of errors.

Managing and storing ACH authorizations

Once you have filled out and submitted your ACH authorization forms, effective management and storage of these documents become crucial. Proper document management practices ensure easy access for future references and compliance checks.

Employing a document management system like pdfFiller can greatly streamline this process. The platform allows users to securely store, retrieve, and share documents effortlessly, with comprehensive access control and organization methods. It's also essential to periodically audit stored documents to ensure compliance with regulations.

Secure storage practices include using encrypted files, limiting access to authorized personnel, and creating backups to protect against data loss. These practices minimize risks associated with unauthorized access or document manipulation.

Cancelling an ACH authorization

Cancelling an ACH authorization can be necessary for a variety of reasons, such as changing bank accounts or disputing a charge. Follow a clear procedure to ensure your mutual understanding with the involved parties.

How to cancel an ACH authorization

To effectively cancel an ACH authorization, follow these steps:

Is there a deadline for cancelling?

Understanding the deadlines surrounding ACH cancellations can help you navigate this process effectively. Typically, notifying your bank before a scheduled transaction is crucial to ensure any payments can be halted.

Working with your bank for cancellations

When communicating with your bank, be clear and concise regarding your cancellation request. Prepare any documentation requested by the bank's representatives and ask for confirmation that the cancellation has been processed to avoid any misunderstandings.

Differences between ACH debit and credit authorization forms

Understanding the distinctions between ACH debit and credit authorization forms is vital for effective fund management.

Understanding ACH debit authorizations

ACH debit authorizations allow companies to withdraw funds directly from consumers' bank accounts, commonly used in recurring bill payments, subscriptions, and memberships.

Understanding ACH credit authorizations

Conversely, ACH credit authorizations are used when funds are transferred into a bank account, typical in payroll deposits and government benefits. Knowing when to use each type ensures that financial processes flow smoothly.

Compliance and best practices

Staying compliant with regulatory standards when managing ACH authorizations is essential to avoid penalties and maintain trust with clients.

Incorporate best practices such as regularly training staff on proper procedures, maintaining updated documentation, and adhering to NACHA regulations. This proactive approach will help organizations navigate the complexities of electronic payments while safeguarding their interests and those of their clients.

Educating and training teams on the nuances of ACH authorizations can help prevent misunderstandings and enhance operational efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in ach authorization form?

Can I create an eSignature for the ach authorization form in Gmail?

How do I edit ach authorization form on an Android device?

What is ach authorization form?

Who is required to file ach authorization form?

How to fill out ach authorization form?

What is the purpose of ach authorization form?

What information must be reported on ach authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.